|

市场调查报告书

商品编码

1444289

光学镀膜 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Optical Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

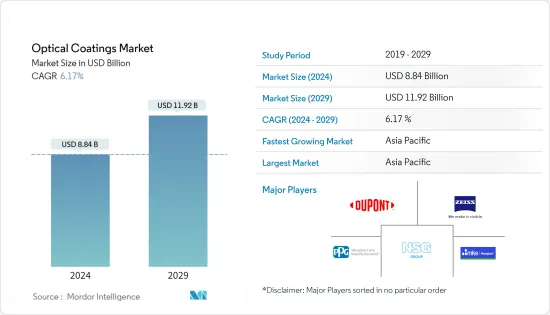

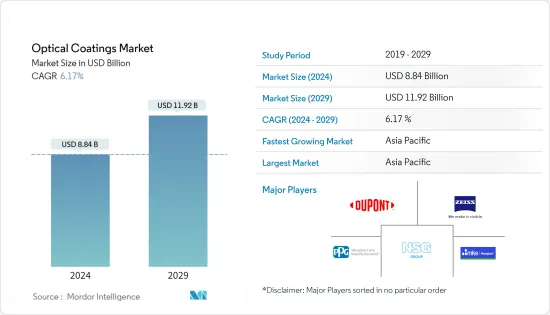

2024年光学涂料市场规模预估为88.4亿美元,预估至2029年将达119.2亿美元,预测期间(2024-2029年)复合年增长率为6.17%。

2020年,市场受到COVID-19的显着影响。由于供应炼和市场中断,COVID-19 大流行对光学涂料市场产生了影响。然而,2021年至2022年市场开始復苏。

主要亮点

- 短期内,光伏产业对光学镀膜的需求增加预计将推动市场。

- 光学镀膜的高成本和一些限制特性预计将阻碍市场成长。

- 即将到来的电动车需求预计将在未来几年创造市场机会。

- 预计亚太地区将主导市场,并可能在预测期内呈现最高的复合年增长率。

光学镀膜市场趋势

电子和半导体领域预计将主导市场

- 光学涂层用于光必须穿过光学表面的各种电子应用。行动电话和平板电脑萤幕使用光学抗反射膜,具有多种优点,包括使它们在阳光下更容易阅读。它也用于消费性萤幕的防眩光应用。

- 透明导电涂层也用于电子显示器。所研究的市场是由电器产品需求的持续成长所推动的。行动电话、可携式运算设备、游戏系统和其他个人电子产品的製造预计将继续推动对半导体、显示器和其他电子元件的需求。

- 光学涂层用于半导体应用。这些涂层涂布半导体雷射的端面。由于物联网在许多行业的普及不断提高,半导体的需求在过去几年中呈现出非常高的成长,这正在推动光学镀膜市场的需求。

- 例如,根据电子情报技术产业协会(JEITA)2021年12月发布的与前一年同期比较,2021年全球电子资讯科技产业产值预计为3.36兆美元,年成长11%。美元的成长率为%。此外,预计到2022年该产业将达到3.54兆美元,与前一年同期比较成长率为5%。

- 根据世界半导体贸易统计数据,2021年全球半导体市场规模为5,558.9亿美元,较2020年的4,403.9亿美元成长26.23%。此外,预计2022年全球半导体市场将成长13.9%。 ,相当于销售额 6,330 亿美元。预计2023年全球半导体市场将成长4.6%,达到6,620亿美元。

- 根据ZVEI统计,2021年德国电子和数位产业销售额达1,998亿欧元(约2,363.6亿美元),较2020年成长9.8%。此外,从产量来看,2021年电子业和数位产业较2020年成长8.8%。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区预计将主导市场

- 预计亚太地区在预测期内将主导光学涂料市场。中国、印度、日本和韩国等国家的电子、半导体、航太、国防部门和其他产业对光学涂层的需求不断增长,预计将推动市场成长。

- 中国民用航空局(CAAC)预计,航空业国内运输量将恢復至疫情前水准的85%左右。此外,中国航空公司计划在未来20年购买约7,690架新飞机,金额约1.2兆美元。这预计将进一步增加光学镀膜的市场需求。

- 根据印度品牌股权基金会(IBEF)的数据,印度的可再生能源和风力发电能力在全球排名第四,太阳能发电能力在全球排名第五。根据2021年印度太阳能市场年度更新,截至2021年12月底,印度太阳能累积装置容量约49吉瓦。

- 此外,印度在 2021 年增加了创纪录的 10 吉瓦太阳能发电量。太阳能发电占2021年新增发电容量的62%,成为有史以来最大的发电容量份额。 2021年,大型太阳能发电工程占装机量的83%,每年成长230%。

- 据电子情报技术产业协会(JEITA)称,截至 2021 年 12 月,日本电子和 IT 产业(包括电子设备、零件、装置等)的全球产量预计将增加。 2021年工业产值将以每年8%的速度成长,达到37.32兆日圆(约3,405.4亿美元),2022年工业产值将为38.2兆日圆(约3,468.9亿美元),预计将成长每年增加2%。

- 由于所有这些因素,预计该地区的光学涂料市场在预测期内将稳定成长。

光学镀膜产业概况

光学涂料市场本质上高度分散。市场主要企业包括杜邦、蔡司国际、纽波特公司、PPG工业公司、日本板硝子等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 太阳能产业需求不断成长

- 光学镀膜製程的技术进步

- 抑制因素

- 光学镀膜高成本且性能有限

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 产品类别

- 光学滤光片涂层

- 抗反射膜

- 透明导电涂层

- 镜面镀膜(高反射)

- 分束器涂层

- 其他产品类型

- 科技

- 化学沉淀

- 离子束溅镀

- 等离子溅镀

- 原子层沉积

- 亚波长结构化表面

- 最终用户产业

- 航太和国防

- 电子和半导体

- 电讯

- 卫生保健

- 太阳

- 车

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- 3M

- Abrisa Technologies

- Accucoat Inc.

- Artemis Optical Ltd

- Edmund Optics Inc.

- DuPont

- Inrad Optics

- Materion Corporation

- Newport Corporation

- Nippon Sheet Glass Co. Ltd

- Optical Coatings Technologies

- PPG Industries Inc.

- Quantum Coating

- Reynard Corporation

- Sigmakoki Co. Ltd

- Schott AG

- Zeiss International

- Zygo Corporation

第七章市场机会与未来趋势

- 未来电动车的需求

The Optical Coatings Market size is estimated at USD 8.84 billion in 2024, and is expected to reach USD 11.92 billion by 2029, growing at a CAGR of 6.17% during the forecast period (2024-2029).

The market was highly impacted by COVID-19 in 2020. The COVID-19 pandemic affected the optical coatings market because of supply chain and market disruption. However, the market rebounded back in 2021-2022.

Key Highlights

- Over the short term, increasing demand for optical coatings from the solar industry is expected to drive the market.

- High costs and some limiting properties of optical coatings are expected to hinder the market's growth.

- The upcoming demand for electric vehicles is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Optical Coatings Market Trends

The Electronics and Semiconductors Segment is Expected to Dominate the Market

- Optical coatings are used in various electronic applications where light must pass through optical surfaces. In cell phones and tablet screens, optical anti-reflective coatings are used for various effects, such as making it easier to read under sunlight. They are also used for anti-glare applications on consumer screens.

- Transparent conductive coatings are also used in an electronic display. The market studied is being driven by the continuous growth of the demand for consumer electronics. The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices is anticipated to continue to spark the demand for semiconductors, displays, and other electronic components.

- Optical coatings are used in semiconductor applications. These coatings are applied to the facets of the semiconductor diode lasers. The demand for semiconductors has shown very high growth in the past few years owing to the increasing penetration of IoT in many industries, which, in turn, is driving the demand for the optical coatings market.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA) - December 2021 release, the production by the global electronics and IT industry was estimated at USD 3.36 trillion in 2021, registering a growth rate of 11% Y-o-Y compared to USD 3.03 trillion in 2020. Moreover, the industry was expected to reach USD 3.54 trillion, with a growth rate of 5% Y-o-Y by 2022.

- According to the World Semiconductor Trade Statistics, the global semiconductor market size accounted for USD 555.89 billion in 2021, registering a growth of 26.23% compared to USD 440.39 billion in 2020. Moreover, the global semiconductor market was expected to increase by 13.9% in 2022, which corresponds to sales of USD 633 billion. In 2023, the global semiconductor market is projected to grow by 4.6% to USD 662 billion.

- According to ZVEI, the electronic and digital industry turnover in Germany accounted for EUR 199.8 billion (~USD 236.36 billion) in the full-year 2021, witnessing a growth rate of 9.8% compared to 2020. Furthermore, in terms of production, the electro and digital industry registered a growth rate of 8.8% in 2021 compared to 2020.

- Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is estimated to dominate the optical coatings market during the forecast period. Increasing demand for optical coatings from electronics and semiconductors, and aerospace and defense sector, and other sectors in countries like China, India, Japan, and South Korea is expected to drive the market's growth.

- The Civil Aviation Administration of China (CAAC) has estimated the aviation sector to recover domestic traffic to around 85% of pre-pandemic levels. In addition, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, which were valued at approximately USD 1.2 trillion. This is further expected to raise the market demand for optical coatings.

- According to the India Brand Equity Foundation (IBEF), globally, India ranks fourth in renewable energy and wind power capacity and fifth in solar power capacity. According to the Annual 2021 India Solar Market Update, as of the end of December 2021, the cumulative solar capacity installed in India was around 49 GW.

- In addition, India added a record 10 GW of solar power in 2021. Solar power accounted for 62% of newly added power capacity in 2021, the largest share of power capacity to date. For 2021, large-scale solar PV projects accounted for 83% of installations, an increase of 230% annually.

- In Japan, according to the Japan Electronics and Information Technology Industries Association (JEITA), as of December 2021, the global production by the Japanese electronics and IT industry, including electronic equipment, components, devices, and others, was estimated to register a growth of 8% annually in 2021 to JPY 37.32 trillion (~USD 340.54 billion) and the industrial production was forecasted to JPY 38.02 trillion (~USD 346.89 billion) in 2022, with an estimated growth of 2% annually.

- Due to all such factors, the market for Optical coatings in the region is expected to have a steady growth during the forecast period.

Optical Coatings Industry Overview

The optical coatings market is highly fragmented in nature. Some of the key players in the market include DuPont, ZEISS International, Newport Corporation, PPG Industries Inc., and Nippon Sheet Glass Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Solar Industry

- 4.1.2 Technological Advancements in the Optical Coatings Process

- 4.2 Restraints

- 4.2.1 High Costs and Some Limiting Properties of Optical Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Optical Filter Coatings

- 5.1.2 Anti-reflective Coatings

- 5.1.3 Transparent Conductive Coatings

- 5.1.4 Mirror Coatings (High Reflective)

- 5.1.5 Beam Splitter Coatings

- 5.1.6 Other Product Types

- 5.2 Technology

- 5.2.1 Chemical Vapor Deposition

- 5.2.2 Ion-beam Sputtering

- 5.2.3 Plasma Sputtering

- 5.2.4 Atomic Layer Deposition

- 5.2.5 Sub-wavelength Structured Surfaces

- 5.3 End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Electronics and Semiconductors

- 5.3.3 Telecommunications

- 5.3.4 Healthcare

- 5.3.5 Solar

- 5.3.6 Automotive

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Abrisa Technologies

- 6.4.3 Accucoat Inc.

- 6.4.4 Artemis Optical Ltd

- 6.4.5 Edmund Optics Inc.

- 6.4.6 DuPont

- 6.4.7 Inrad Optics

- 6.4.8 Materion Corporation

- 6.4.9 Newport Corporation

- 6.4.10 Nippon Sheet Glass Co. Ltd

- 6.4.11 Optical Coatings Technologies

- 6.4.12 PPG Industries Inc.

- 6.4.13 Quantum Coating

- 6.4.14 Reynard Corporation

- 6.4.15 Sigmakoki Co. Ltd

- 6.4.16 Schott AG

- 6.4.17 Zeiss International

- 6.4.18 Zygo Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Demand from Electric Vehicles