|

市场调查报告书

商品编码

1687142

防护涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Protective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

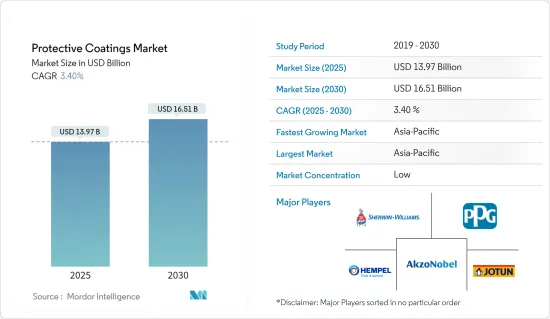

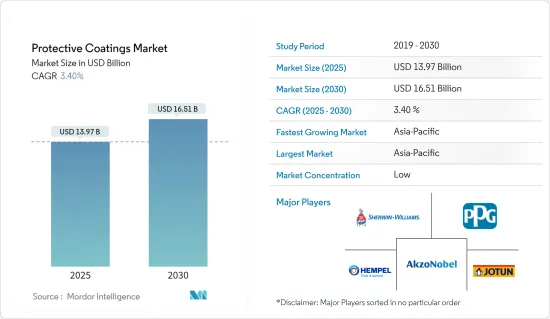

防护涂料市场规模预计在 2025 年为 139.7 亿美元,预计到 2030 年将达到 165.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.4%。

2020 年,新冠疫情对市场产生了负面影响。然而,随着封锁措施的放鬆,这些终端用户产业开始蓬勃发展,达到了新冠疫情之前的水平。

主要亮点

- 短期内,亚太地区基础设施的发展、工业化进程的加速以及对绿色涂料的需求不断增长将推动市场成长。

- 另一方面,有关 VOC排放的规定预计会阻碍防护涂料市场的成长。

- 粉末涂料被取代的可能性可能会在预测期内及以后为市场带来机会。

- 由于中国和印度等国家的消费量高,预计亚太地区将主导市场。

防护涂料市场趋势

基础建设产业需求增加

- 基础设施产业是防护涂料市场的主要消费者。在基础设施产业,结构表面劣化是一个主要问题。表面劣化会因覆盖层的损失和表面钢筋的腐蚀而引发结构问题。使用保护涂层可以最大程度地减少劣化。涂层材料必须耐用、能很好地黏附在基材表面,并且能够适应因温度变化而产生的膨胀和收缩。

- 100% 固体/刚性结构聚氨酯涂料可能是恶劣环境下基础设施保护的首选技术。 100% 固体/刚性结构聚氨酯涂料也是适用于几乎所有类型钢骨的防腐蚀涂料。

- 印度、德国、美国和中国等国家在基础设施领域的计划和投资正在增加。这导致保护涂层的消耗增加。

- 在印度,基础设施是促进和维持经济成长的关键因素之一,因为它对于提高和维持该国製造业的竞争力以及实现高成长至关重要。

- 印度基础设施领域面临的主要挑战是土地征用政策、实施缓慢以及由于官僚主义拖延而导致计划超支的风险。然而,现任政府正在努力透过减少延误、降低复杂性和提高计划透明度来加快计划的进程。

- 印度政府已推出2019-25年国家基础建设管道(NIP)。这是一套投资 111,000 亿卢比(约 1.5 兆美元)的基础设施计划,旨在改善宜居和商业环境。

- 最初计划的计划有 6,835 个,但到 2021 年将扩大到 7,400计划。道路、住宅、城市发展、铁路、传统型电力、可再生能源和灌溉占计划金额的大部分。

- 目前,北美正在进行重大计划,预计2022年第一季计划,包括耗资85.6亿美元的安大略线地铁计划、耗资30亿美元的钢铁短流程钢厂计划和耗资30亿美元的奥西奥拉钢铁厂计划。

- 2022年8月,沙乌地也开工兴建吉达中央开发计划。这个耗资 200 亿美元的基础设施计划将打造四个地标,包括一座博物馆、一座体育场、一个珊瑚农场和一座歌剧院。此外,还计划建造至少17,000套居民住宅以及3,000多座饭店和旅游设施。

- 考虑到以上所有因素,基础设施产业预计将主导市场。

亚太地区占市场主导地位

- 亚太地区占据全球市场主导地位。据估计,中国占全球最大的市场占有率。

- 中国是全球最大的建筑市场,占全球整体建筑投资的20%。 2020年中国建筑业蓬勃发展,但疫情限制了成长。每当经济出现大幅放缓时,建筑业总能支撑起国家经济成长。

- 据估计,中国基础设施产业占据受调查市场的最大份额。中国是全球最大的建筑市场,占全球整体建筑投资的20%。

- 中国是化学加工中心,占全球化学品产量的大部分。由于全球对各种化学品的需求不断增加,预计预测期内该行业对防护涂料的需求将会增加。

- 在中国,2021 年第四季有多个项目破土动工,包括位于湖北武汉、投资 72 亿美元的武汉长泰福金融中心、投资 42 亿美元的 2,000 兆瓦青岛深远海上风电场,以及计划181 亿元人民币(约合 28 亿美元)的六横跨海上跨海大桥计划。

- 此外,印度的基础设施部门是该国经济的重要支柱。政府正在采取各种倡议,确保及时提供良好的基础设施。

- 印度国家基础设施计画(NIP)最初包含6,835个计划,目前已扩展至9,335个计划,预计2020财年至2025财年期间总投资额约为108兆日圆。

- 印度生产约 95 种矿产,其中包括 10 种金属矿产、3 种原子矿产、4 种燃料相关矿产、23 种非金属矿产和 55 种小型矿产。这使得印度成为亚太地区领先的采矿国家之一。许多私人企业正在积极投资推动采矿业的发展。

- 所有上述因素使得亚太地区在全球市场占据主导地位。

防护涂料产业概况

全球防护涂料市场比较分散,2021 年五大公司占了全球产量的很大份额。市场的主要企业(不分先后顺序)包括阿克苏诺贝尔公司 (Akzo Nobel NV)、宣威威廉姆斯公司 (The Sherwin-Williams Company)、PPG 工业公司 (PPG Industries Inc.)、佐敦 (Jotun) 和 Hempel AS。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区基础建设发展与工业化

- 绿色涂料需求不断增加

- 限制因素

- VOC排放法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 环氧树脂

- 聚氨酯

- 乙烯基酯

- 聚酯纤维

- 其他产品类型

- 依技术分类

- 水性

- 溶剂型

- 粉末

- 其他技术

- 按最终用户产业

- 石油和天然气

- 矿业

- 力量

- 基础设施

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems LLC

- Hempel AS

- Jotun A/S

- Kansai Paint Co. Ltd

- Nippon Paints

- PPG Industries Inc.

- RPM International

- The Sherwin Williams Company

- Asian Paints PPG Pvt. Limited

- Sika AG

第七章 市场机会与未来趋势

- 粉末涂料作为替代品的可能性

The Protective Coatings Market size is estimated at USD 13.97 billion in 2025, and is expected to reach USD 16.51 billion by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. However, as the lockdowns were lifted, these end-user sectors started to grow rapidly to reach the pre-COVID level, which is expected to enhance demand for the market studied through the years to come.

Key Highlights

- Over the short term, growing infrastructure and industrialization in the Asia-Pacific region and increasing green coatings demand will likely drive the market's growth.

- On the flip side, regulations related to VOC emissions are expected to hinder the growth of the protective coatings market.

- Potential replacement by powder coatings is likely to act as an opportunity for the market beyond the forecast period.

- The Asia-Pacific is expected to dominate the market due to high consumption in countries such as China and India.

Protective Coatings Market Trends

Increasing Demand from the Infrastructure Sector

- The infrastructure industry is the key consumer for the protective coatings market. Surface deterioration of a structure is a major problem in the infrastructure industry. Surface deterioration may lead to structural problems due to the loss of cover and corrosion of surface reinforcements. To minimize the deterioration, protective coatings are used. The coating material should be durable, bond well to the surface of the substrate, and be compatible if there is an expansion or a contraction during temperature changes.

- A 100% solid/rigid structural polyurethane coating is likely the technology of choice for infrastructure protection in harsh environments. 100% solid/rigid structural polyurethane coating is also an anti-corrosive coating for virtually any type of steel structure.

- Countries such as India, Germany, the United States, and China, among others, are witnessing increasing projects and investments in the infrastructure sector. Hence, witnessing the consumption of protective coatings.

- In India, one of the crucial components that drive and sustain economic growth is infrastructure, as it is critical to improve and maintain the country's manufacturing competitiveness leading to higher growth.

- Key challenges in India's infrastructure sector are land acquisition policies, implementation delays, and the risk of project overruns caused by bureaucratic delays. However, the current government ensures minimizing such delays, reducing complexities, and improving project transparency to increase the pace of infrastructure projects.

- The government launched the National Infrastructure Pipeline (NIP) for FY 2019-25, an INR 111-lakh-crore (~USD 1.5 trillion) group of infrastructure projects aimed at improving the ease of living and business environment.

- Initially, it was earmarked for 6,835 projects and expanded to 7,400 projects in 2021. Roads, housing, urban development, railways, conventional power, renewable energy, and irrigation account for most of the project value.

- Currently, North America has started significant projects in the first quarter of 2022; the projects include the USD 8,560 million Ontario Line Subway project, the USD 3,000 Million Steel Mini Mill project, the USD 3,000 million Osceola Steel Plant project, and other projects.

- In August 2022, Saudi Arabia also started constructing the Jeddah Central development project. The USD 20 billion infrastructure project involves the construction of four landmarks, including a museum, a sports stadium, a coral farm, and an opera house. Moreover, at least 17,000 houses for citizens and over 3,000 hotels and tourism sites are also to be built.

- Based on the aspects above, the infrastructure segment is expected to dominate the market.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market. China is estimated to hold the largest market share globally.

- China has the largest construction market in the world, encompassing 20% of all construction investments globally. In China, the construction industry grew rapidly in 2020, but the growth was restricted due to the pandemic. The construction sector supported the economic growth in the country whenever major slowdowns occurred.

- The Chinese infrastructure sector is estimated to hold the largest share in the country of the market studied. The country has the largest construction market in the world, encompassing 20% of all construction investments globally.

- China is a hub for chemical processing, accounting for a major chunk of chemicals produced globally. With the rising demand for various chemicals globally, this sector's demand for protective coating is projected to increase during the forecast period.

- In China, several projects commenced construction in the fourth quarter of 2021, including the USD 7.2 billion Wuhan Chow Tai Fook Financial Center in Wuhan, Hubei, the USD 4.2 billion 2,000MW Qingdao Shenyuanhai Offshore Wind Farm and the CNY 18.1 billion (~USD 2.8 billion) Liuheng Sea-Crossing Bridge project.

- Furthermore, the infrastructure sector in India is an important pillar of the country's economy. The government is taking various initiatives to ensure the timely creation of excellent infrastructure.

- In India, The National Infrastructure Pipeline (NIP), which was launched with 6,835 projects, has been expanded to 9,335 projects with total envisaged investments of almost 108 trillion between FY20 and FY25.

- India produces about 95 minerals, including ten metallic minerals, three atomic minerals, four fuel-related minerals, 23 non-metallic minerals, and 55 minor minerals. This makes India one of the major mining countries in the Asia-Pacific region. Many private players are investing actively to boost the mining sector.

- All the aforementioned factors make the Asia-Pacific region dominant in the global market.

Protective Coatings Industry Overview

The global protective coatings market is fragmented in nature, and the top five players dominated global production with a significant share in 2021. Some of the key players (not in any particular order) in the market include Akzo Nobel NV, The Sherwin-Williams Company, PPG Industries Inc., Jotun, and Hempel AS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Infrastructure and Industrialization in the Asia-Pacific Region

- 4.1.2 Growing Green Coatings Demand

- 4.2 Restraints

- 4.2.1 Regulations Related to VOC Emissions

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Vinyl Ester

- 5.1.4 Polyester

- 5.1.5 Other Product Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder

- 5.2.4 Other Technologies

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Mining

- 5.3.3 Power

- 5.3.4 Infrastructure

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by the Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems LLC

- 6.4.3 Hempel AS

- 6.4.4 Jotun A/S

- 6.4.5 Kansai Paint Co. Ltd

- 6.4.6 Nippon Paints

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International

- 6.4.9 The Sherwin Williams Company

- 6.4.10 Asian Paints PPG Pvt. Limited

- 6.4.11 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Replacement by Powder Coatings