|

市场调查报告书

商品编码

1444300

工业气体 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Industrial Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

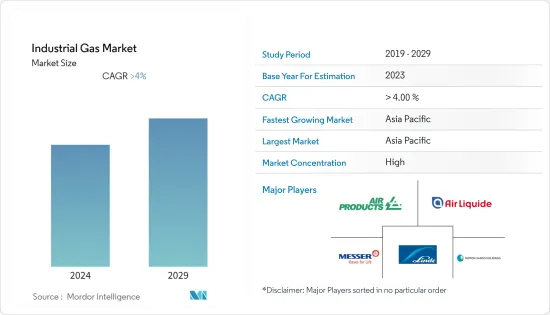

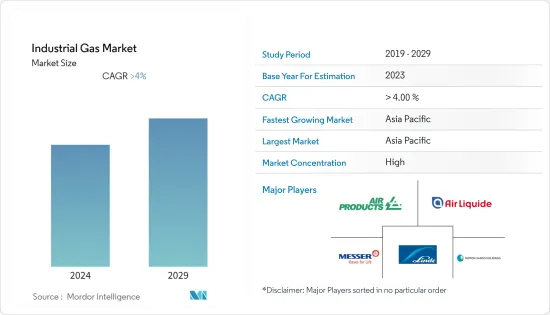

2024年工业气体市场规模预估为16.7亿吨,预估至2029年将达20.7亿吨,在预测期间(2024-2029年)CAGR为4.35%。

COVID-19 对 2020 年市场产生了负面影响。二氧化碳用于生产碳酸软性饮料和苏打水,由于大流行情况而受到影响。然而,疫情期间医疗产业对復苏和吸入治疗用氧气的需求增加,刺激了市场的成长。

主要亮点

- 短期内,对替代能源的需求不断增长以及医疗保健行业不断增长的需求预计将推动工业气体市场的成长。

- 环境法规和安全问题预计将推动市场的成长。

- 亚太和非洲的工业成长可能会在未来几年创造市场机会。

- 预计亚太地区将主导市场,并可能在预测期内实现最高的CAGR。

工业气体市场趋势

医疗和製药业的需求不断增长

- 工业气体,例如氧气、氮气、二氧化碳、氢气、甲烷和丙烷,是化学生产链中各个製程步骤所需的反应剂的重要分子。

- 工业气体为惰化、反应器冷却和 pH 控制提供解决方案。石化产品是从石油和天然气的精炼和加工中获得的物质。它们需要惰性气氛来运输和储存,而惰性气氛由氮气提供。

- 在炼油厂中,氧气用于富集催化裂解再生器的空气进料,从而提高装置的产能。它用于硫磺回收装置以实现类似的优点。氧气也用于再生催化剂。

- 大量二氧化碳被用作化学程序工业的原料,特别是用于甲醇和尿素的生产。

- 氢气主要用于炼油和化学製造。氢气用作生产两种工业化学品氨和甲醇的原料。在炼油厂中,它用于各种加氢脱硫 (HDS) 和加氢裂解程序。

- 甲烷在化学工业中用作製造甲醇、合成氨、乙炔和二氯甲烷等的原料。此外,丙烷用于生产乙烯和丙烯。

- 由于消费的增加、出口需求的增加以及政府措施的支持,预计世界各地的化学工业将出现成长。

- 亚太地区已发展成为全球化学加工中心。中国、印度、日本等国的化学工业发展迅速。迄今为止,亚洲占据全球化学品市场最大份额。自2012年以来,连续占据全球化学品市场一半以上的份额。

- 2022 年,亚洲化学品产量整体成长 4.2%。然而,各国的情况差异很大。印度产量显着增加(+4.6%)。相较之下,日本、韩国和台湾的产量分别下降了3.0%、7.4%和12.9%。

- 在欧盟(EU),由于天然气价格大幅上涨,化学品产量大幅下降5.8%。在德国,随着天然气密集型基础化学品的生产停止,这一数字下降了约 12%。英国的化学品产量也大幅下降。

- 相较之下,2022年美国化学品产量增加了2.3%。然而,2021年天气相关产量损失的潜在影响发挥了主要作用。同时,2022 年南美洲产量成长 2.6%,略低于上年(+3.6%)。

- 因此,预计上述因素将影响化学工业对工业气体的需求。

亚太地区将主导工业气体市场

- 亚太地区是最大的工业气体市场。中国占该地区消费的主要部分。然而,印度预计将成为该地区成长最快的国家。

- 中国航空航太业在经历前几年的大幅下滑后,预计将于 2022 年恢復盈利。中国民用航空局(CAAC)预计,航空业国内运输量将恢復至疫情前水准的 85% 左右。

- 工业气体也应用于交通运输,包括使用加压氮气、用于安全气囊的高压氩气以及用于精确安全焊接的二氧化碳和氮气来製造轮胎。根据IATA(国际航空运输协会)的报告,印度预计在2030年底成为世界第三大航空市场。

- 根据住房和城乡建设部的预测,到 2025 年,中国建筑业占国内生产总值的比重预计将保持在 6%。考虑到这一预测,中国政府于 2025 年公布了一项五年计划。2022年1 月,使建筑业更加永续和品质驱动。

- 2023 年 3 月,主要工业气体生产商液化空气集团宣布投资约 6,000 万欧元(约 6,564 万美元)改造集团在中国天津工业盆地营运的两台空气分离装置 (ASU)。本公告是在与博化集团子公司天津博化永利化工(「YLC」)续签长期工业气体供应合约的背景下发布的。

- 印度是亚太地区第二大钢铁生产国,产量每年快速成长。

- 根据印度政府 2022 年 12 月的报告,印度的钢铁产量达到每年约 1.2 亿吨的历史水平,成为世界第二大钢铁生产国。该国每年的钢铁产量约占全球的 4.8%。

- 根据世界钢铁协会的资料,2022 年印度粗钢产量增加约 5.80%,达到 1.244 亿吨,而 2021 年为 118.2 吨。根据世界钢铁协会的资料,2023 年 1 月至 2 月期间,印度生产了约 10.9 吨钢材,较 2022 年同期下降约 0.2%。

- 各产业对钢铁的需求不断增长,加上政府推动製造业发展的倡议,预计将增加机械天然气生产装置的使用,以满足现代天然气的大量先决条件。

- 因此,预计上述因素将在未来几年推动该地区的市场成长。

工业气体产业概况

工业气体市场本质上是整合的。该市场的一些主要参与者(排名不分先后)包括液化空气集团、梅塞尔集团有限公司、日本酸素控股公司、林德集团和空气产品公司。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 对替代能源的需求不断增长

- 对冷冻和储存食品的需求不断增加

- 医疗保健产业的需求不断增加

- 限制

- 环境法规和安全问题

- 其他限制

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争程度

第 5 章:市场区隔(按数量分類的市场规模)

- 产品类别

- 氮

- 氧

- 二氧化碳

- 氢

- 氦

- 氩气

- 氨

- 甲烷

- 丙烷

- 丁烷

- 其他产品类型

- 最终用户产业

- 化学加工和精炼

- 电子产品

- 食品与饮品

- 油和气

- 金属製造和加工

- 医疗与製药

- 汽车和交通

- 能源与电力

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 东协国家

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Air Liquide

- Air Products and Chemicals Inc.

- Asia Technical Gas Co Pte Ltd.

- BASF SE

- Bhuruka Gases Limited

- Ellenbarrie industrial Gases

- Gruppo SIAD

- Iwatani Corporation

- Linde PLC

- Messer Group GmbH

- Nippon Sanso Holdings Corporation

- PT Samator Indo Gas TBK

- Sapio Group

- SOL SPA

- Yingde Gases Group

第 7 章:市场机会与未来趋势

- 未来几年对低碳气体的需求不断增长

The Industrial Gas Market size is estimated at 1.67 Billion tons in 2024, and is expected to reach 2.07 Billion tons by 2029, growing at a CAGR of 4.35% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. Carbon dioxide is used to produce carbonated soft drinks and soda water, which was affected owing to the pandemic scenario. However, the medical industry's demand for oxygen for resuscitation and inhalation therapy increased during the pandemic, stimulating the market's growth.

Key Highlights

- Over the short term, the growing need for alternate energy sources and increasing demand from the healthcare sector are expected to drive the growth of the industrial gas market.

- Environmental regulations and safety issues are projected for the market's growth.

- Industrial growth in Asia-Pacific and Africa will likely create market opportunities in the coming years.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Industrial Gases Market Trends

Increasing Demand from the Medical and Pharmaceutical Sector

- Industrial gases, such as oxygen, nitrogen, carbon dioxide, hydrogen, methane, and propane, are essential molecules required as reaction agents for various process steps in the chemical production chain.

- Industrial gases provide solutions for inerting, reactor cooling, and pH control. Petrochemicals are substances obtained from the refining and processing of petroleum and natural gases. They require inert atmospheres for transportation and storage, which is provided by nitrogen.

- In refineries, oxygen is used to enrich the air feed to catalytic cracking regenerators, increasing the units' capacity. It is used in sulfur recovery units to achieve similar benefits. Oxygen is also used to regenerate catalysts.

- Large quantities of carbon dioxide are used as a raw material in the chemical process industry, especially for methanol and urea production.

- Hydrogen is mostly used in oil refining and chemical manufacturing. Hydrogen is used as a feedstock in the production of two industrial chemicals, ammonia and methanol. In refineries, it is used in various hydro-desulfurization (HDS) and hydrocracking procedures.

- Methane is used as a raw material in the chemical industry to make methanol, synthetic ammonia, acetylene, and methylene chloride, among others. Further, propane is used in the production of ethylene and propylene.

- The chemical industry across the world is projected to witness growth, owing to the increasing consumption, increasing export demand, and enabling government initiatives.

- Asia-Pacific has grown to be the hub for chemical processing globally. The chemical industry in countries such as China, India, and Japan has been growing rapidly. The largest proportion of the global chemicals market is held by Asia by far. Since 2012, it has continuously accounted for more than half of the global chemicals market.

- Chemical production in Asia overall increased by 4.2% in 2022. However, this varies greatly from country to country. India saw a significant increase in production (+4.6%). In contrast, production in Japan, South Korea, and Taiwan fell by 3.0%, 7.4%, and 12.9%, respectively.

- In the European Union (EU), chemical production fell sharply by 5.8% due to a sharp rise in natural gas prices. In Germany, this fell by around 12% as the production of gas-intensive basic chemicals ceased. The United Kingdom also experienced a significant decline in chemical production.

- In contrast, US chemical production increased by 2.3% in 2022. However, the underlying impact of weather-related production losses in 2021 played a major role. Meanwhile, production in South America grew at 2.6% in 2022, slightly slower than the previous year (+3.6%).

- Thus, the abovementioned factors are expected to influence the demand for industrial gases used in the chemical industry.

Asia-Pacific to Dominate the Industrial Gas Market

- Asia-Pacific is the largest market for industrial gases. China accounted for a major chunk of the consumption in the region. However, India is expected to witness the fastest growth in the region.

- China's aerospace industry is projected to return to profitability in 2022 after facing a significant decline in the previous years. The Civil Aviation Administration of China (CAAC) estimated the aviation sector to recover domestic traffic to around 85% of pre-pandemic levels.

- Industrial gases also find their application in transportation, including tire manufacturing using pressurized nitrogen, high-pressure argon for airbags, and carbon dioxide and nitrogen for precise and secure welding. According to the IATA (International Air Transport Association) report, India is poised to become the third-largest aviation market in the world by the end of 2030.

- As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025. Considering the given forecasts, the Chinese government unveiled a five-year plan in January 2022 to make the construction sector more sustainable and quality-driven.

- In March of 2023, Air Liquide, a major industrial gas player, announced investing around EUR 60 million (~USD 65.64 million) to revamp two Air Separation Units (ASUs), which the Group operates in the Tianjin industrial basin in China. This announcement comes within the context of the renewal of a long-term industrial gases supply contract with Tianjin Bohua YongliChemical Industry Co., Ltd ('YLC'), a subsidiary of the BohuaGroup.

- India is the Asia-Pacific's second-largest iron and steel producer, and production is increasing rapidly yearly.

- Steel production in India reached a historic level of around 120 million tons per annum, making it the world's second-largest steel producer, as per the Indian government report in December 2022. The country accounts for around 4.8% of global steel production annually.

- The crude steel production in India rose by around 5.80% to 124.4 million tons (MT) in 2022, compared to 118.2 MT in 2021, according to World Steel Association data. India produced around 10.9 MT of steel between January-February 2023, down by around 0.2% compared to the same period in 2022, as per the World Steel Association data.

- Growing demand for iron and steel from various industries and the upcoming steel ventures, coupled with government initiatives to boost the manufacturing sector, is expected to boost the usage of mechanical gas creation units to address the mass prerequisites for modern gases.

- Therefore, the abovementioned factors are expected to drive market growth in th region in the coming years.

Industrial Gases Industry Overview

The industrial gas market is consolidated in nature. Some of the market's major players (not in any particular order) include Air Liquide, Messer Group GmbH, Nippon Sanso Holdings Corporation, Linde PLC, and Air Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Need for Alternate Energy Sources

- 4.1.2 Increasing Demand For Frozen and Stored Food

- 4.1.3 Increasing Demand from the Healthcare Sector

- 4.2 Restraints

- 4.2.1 Environmental Regulations and Safety Issues

- 4.2.2 Other Restraints

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Nitrogen

- 5.1.2 Oxygen

- 5.1.3 Carbon dioxide

- 5.1.4 Hydrogen

- 5.1.5 Helium

- 5.1.6 Argon

- 5.1.7 Ammonia

- 5.1.8 Methane

- 5.1.9 Propane

- 5.1.10 Butane

- 5.1.11 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Chemical Processing and Refining

- 5.2.2 Electronics

- 5.2.3 Food and Beverage

- 5.2.4 Oil and Gas

- 5.2.5 Metal Manufacturing and Fabrication

- 5.2.6 Medical and Pharmaceutical

- 5.2.7 Automotive and Transportation

- 5.2.8 Energy and Power

- 5.2.9 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 NORDIC Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals Inc.

- 6.4.3 Asia Technical Gas Co Pte Ltd.

- 6.4.4 BASF SE

- 6.4.5 Bhuruka Gases Limited

- 6.4.6 Ellenbarrie industrial Gases

- 6.4.7 Gruppo SIAD

- 6.4.8 Iwatani Corporation

- 6.4.9 Linde PLC

- 6.4.10 Messer Group GmbH

- 6.4.11 Nippon Sanso Holdings Corporation

- 6.4.12 PT Samator Indo Gas TBK

- 6.4.13 Sapio Group

- 6.4.14 SOL SPA

- 6.4.15 Yingde Gases Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Low-Carbon Gases in the Coming Years