|

市场调查报告书

商品编码

1444301

热塑性聚氨酯 (TPU) -市场占有率分析、行业趋势和统计、成长预测 (2024-2029)Thermoplastic Polyurethane (TPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

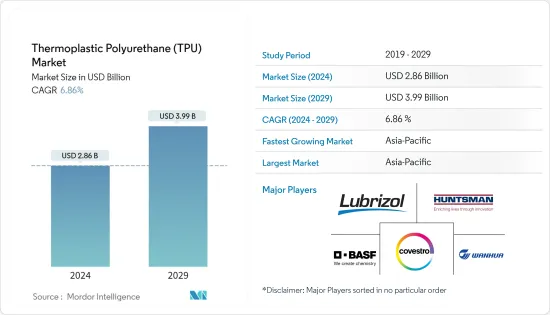

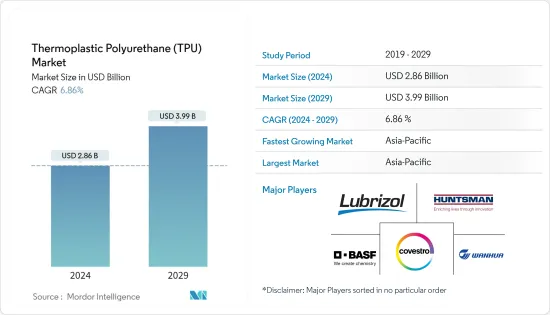

热塑性聚氨酯市场规模预计到2024年为28.6亿美元,预计到2029年将达到39.9亿美元,在预测期内(2024-2029年)增长6.86%,复合年增长率为

在COVID-19感染疾病期间,TPU的需求大幅下降,因为它主要用于消费品。不利的宏观经济影响了人们的财务状况,降低了他们的购买力,并对TPU的需求产生了负面影响。供应链限制进一步加剧了下滑。然而,一旦限制放鬆,需求将在 2021 年恢復到大流行前的水平。

主要亮点

- 研究市场的主要驱动因素是 TPU 在鞋类和服装行业中的使用不断增加。

- 相反,原物料价格上涨正在阻碍所研究市场的成长。

- 在预测期内,生物基 TPU 薄膜可能会为接受调查的市场提供成长机会。

- 亚太地区是各种应用领域 TPU 的最大消费国,预计这项需求在预测期内将快速成长。

热塑性聚氨酯(TPU)市场趋势

TPU 在鞋类和服装产业的使用不断增加

- 由于人口的快速增长和许多经济体的持续扩张,对皮革的需求正在稳步增长。传统皮革产业消费量大、污染大。大众对环境议题的关注给皮革产业带来了重大挑战。

- TPU薄膜具有其他塑胶和橡胶所需的性能,使其广泛应用于鞋类和服装类领域。

- 随着科学技术的进步,TPU薄膜及其复合製品的製造技术有了很大的进步,为采用TPU薄膜及其复合製品创造了理想的条件。生产商最近在鞋类和服装行业推出了许多创新产品。

- 例如,路博润推出了一款完全由 TPU 製成的原型鞋。这款 100% TPU 原型鞋可以提供改进的「循环」解决方案。鞋类製造商在製造过程中重复利用 TPU废弃物,促进消费后回收过程。

- 亨斯迈的特殊合成橡胶专业知识创造了一种新型热塑性聚氨酯 (TPU) 牌号 IROGRAN A 85 P 4394 HR。非常适合为要求性能的服装类(包括手套和鞋类)提供防水和透气层。

- 全球大部分鞋类生产集中在亚太地区,占产量份额的85%以上。除亚洲国家和墨西哥外,巴西是世界主要鞋类製造国之一。根据巴西鞋业工业协会(Avicarcados)统计,2022年巴西鞋类产量达8.63亿双。

- 由于鞋类和服装产量的激增以及技术进步使 TPU 成为鞋类和服装行业更灵活和首选的材料,预计预测期内对 TPU 薄膜的需求将大幅增加。

亚太地区主导市场

- 亚太地区占据了最大的区域热塑性聚氨酯市场。由于汽车需求以及纺织品和鞋类需求的增加,TPU 基黏剂和密封剂预计将在该地区呈现健康的成长速度。

- 中国的製鞋业是世界上最大的,拥有强大的国内销售和向主要国家出口的网路。与世界其他地区相比,中国对 TPU黏剂的需求预计最为强劲,因为皮鞋在中国製鞋业中占据最大份额。

- 家庭收入水准的提高和农村人口向都市区的迁移预计将继续推动对中国所研究市场的需求。

- 亚太地区是世界上一些最有价值的汽车製造商的所在地。中国、印度、日本和韩国等新兴国家正努力加强製造基础,建立高效的供应链,以提高盈利。

- 根据中国工业协会统计,中国是全球最大的汽车生产基地,预计2022年汽车产量将达到2700万辆,比去年的2600万辆增长3.4%。记录下来了。此外,2022年1-7月,全国汽车产量1,457万辆,与前一年同期比较成长31.5%。此外,2022年7月,电池驱动的电动车数量比2021年1月至7月增加了117.2%。预计2022年7月国内电动车销量约61.7万辆。

- 此外,根据印度汽车工业协会(SIAM)的数据,该国汽车工业在2021-22财年(2021年4月至2022年3月)总合生产了2,293万辆汽车,而2021-22财年总合销售了2293万辆汽车。相较之下,2020 年 4 月至 2022 年 3 月印度的销量为 2266 万台。此外,根据印度经济监测中心 (CMIE) 的数据,汽车产量从 2022 年 6 月的 169,520 辆增加到 2022 年 7 月的 193,630 辆。这些因素可能会增加所研究市场的需求。

- 印度政府制定的1,205亿美元投资目标,发展27个产业丛集,预计将推动该国商业建设。

- 所有这些因素预计将在预测期内推动该地区热塑性聚氨酯市场的发展。

热塑性聚氨酯(TPU)产业概况

全球热塑性聚氨酯市场正在整合,排名前五的公司占据了研究市场的主要份额。该市场的主要企业包括BASF股份公司、科思创股份公司、路博润公司、亨斯曼国际有限责任公司和万华化学集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗产业应用不断增加

- 工业应用中的使用增加

- 其他司机

- 抑制因素

- 原物料价格上涨

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 目的

- 挤出成型品

- 射出成型产品

- 黏剂

- 其他用途

- 最终用户产业

- 建造

- 车

- 鞋类

- 医疗保健

- 电力/电子

- 重工业

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Trinseo

- Avient Corporation(Formerly PolyOne Corporation)

- Epaflex Polyurethanes SpA

- BASF SE

- Covestro AG

- Coim Group

- Miracll Chemicals Co. Ltd

- Huafeng Group

- Huntsman International LLC

- Dongsung Corporation

- Sumei Chemical Co. Ltd

- Suzhou New Mstar Technology Ltd

- The Lubrizol Corporation

- Tosoh Corporation

- Wanhua Chemical Group Co. Ltd

- Hexpol AB

第七章市场机会与未来趋势

- 将重点转向生物基产品开发

- 增加研发活动

The Thermoplastic Polyurethane Market size is estimated at USD 2.86 billion in 2024, and is expected to reach USD 3.99 billion by 2029, growing at a CAGR of 6.86% during the forecast period (2024-2029).

During the Covid-19 pandemic, the demand for TPU declined heavily as TPU is majorly used in consumer products. The unfavorable macroeconomics affected people's finances and reduced purchasing power, negatively affecting the TPU demand. The supply chain restrictions further compounded the decline. However, as the restrictions eased, the demand returned to pre-pandemic levels in 2021.

Key Highlights

- The major driving factor of the market studied is TPU's increasing usage in the footwear and apparel industries.

- On the flip side, the rising prices of raw materials are hindering the studied market's growth.

- Bio-based TPU films will likely offer growth opportunities for the market studied over the forecast period.

- Asia-Pacific is the largest consumer of TPU for various applications, and this demand is expected to grow rapidly during the forecast period.

Thermoplastic Polyurethane (TPU) Market Trends

Increasing TPU Usage in the Footwear and Apparel Industries

- With the fast rise of the population and the ongoing expansion of many economies, the demand for leather is growing at a healthy rate. The conventional leather sector includes high consumption and causes pollution. The public's attention to environmental concerns poses significant difficulties for the leather business.

- TPU film possesses the essential properties of other plastics and rubbers, making it widely utilized in footwear and clothes.

- The production technology of TPU film and its composite products saw significant growth with the advancement of science and technology, generating ideal conditions for adopting TPU film and its composite products. Producers introduced numerous innovations lately in the footwear and apparel industries.

- For instance, Lubrizol unveiled a prototype shoe made entirely of TPU. This 100% TPU prototype shoe can deliver improved "circularity" solutions. TPU waste can be reused by shoemakers during manufacturing and ease the post-consumer recycling process.

- Huntsman's Specialty Elastomers' expertise led to the creation of IROGRAN A 85 P 4394 HR, a novel thermoplastic polyurethane (TPU) grade. It is ideal for providing a waterproof, breathable layer in demanding performance garments (including gloves and footwear).

- Most of the global footwear production is concentrated in the Asia-Pacific region and occupies a share of over 85% in production volume. Apart from Asian countries, Mexico, brazil is among the major footwear manufacturers in the world. According to the Brazilian Footwear Industries Association (Abicalcados), Brazil's footwear production volume reached 863 million pairs in 2022.

- With a surge in footwear and apparel production and technological advancements making TPU a more flexible and preferable material for the footwear and apparel sectors, the demand for TPU films is expected to grow considerably during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounted for the largest regional thermoplastic polyurethane market. Due to the increasing automotive demand and demand for textile and footwear, TPU-based adhesives and sealants are expected to witness a healthy growth rate in the region.

- The Chinese footwear industry is the largest in the world, with a robust network of domestic sales and exports to major countries. As leather footwear accounts for the largest share of the footwear industry in China, the demand for TPU adhesives is estimated to be the strongest in China compared to other parts of the world.

- The rising household income levels and the population migrating from rural to urban areas are expected to continue to drive the demand for the market studied in China.

- The Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea are working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year. Further, in the first 7 months of 2022, the country produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year. Furthermore, in July 2022, the number of battery-powered electric vehicles increased by 117.2% compared to January-July in 2021. In July 2022, the country's electric vehicle sales were estimated at around 617,000 units.

- Moreover, in India, during FY 2021-22 (April 2021 to March 2022), according to the Society of Indian Automobile Manufacturers (SIAM), the country's automotive industry produced a total of 22.93 million vehicles compared to 22.66 million units during April 2020 to March 2021. Further, according to the Centre for Monitoring Indian Economy (CMIE), car production increased to 193.63 thousand units in July 2022 from 169.52 thousand units in June 2022. Such factors are likely to increase the demand for the studied market.

- In India, the government's investment target of USD 120.5 billion for developing 27 industrial clusters is expected to boost commercial construction in the country.

- All these factors are expected to boost the region's thermoplastic polyurethane market during the forecast period.

Thermoplastic Polyurethane (TPU) Industry Overview

The global thermoplastic polyurethane market is consolidated, with the top five players accounting for major shares of the market studied. Some major players in the market include BASF SE, Covestro AG, The Lubrizol Corporation, Huntsman International LLC, and Wanhua Chemical Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in the Medical Industry

- 4.1.2 Rising Usage in Industrial Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Extruded Products

- 5.1.2 Injection Molded Products

- 5.1.3 Adhesives

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Footwear

- 5.2.4 Medical

- 5.2.5 Electrical and Electronics

- 5.2.6 Heavy Engineering

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Trinseo

- 6.4.2 Avient Corporation (Formerly PolyOne Corporation)

- 6.4.3 Epaflex Polyurethanes SpA

- 6.4.4 BASF SE

- 6.4.5 Covestro AG

- 6.4.6 Coim Group

- 6.4.7 Miracll Chemicals Co. Ltd

- 6.4.8 Huafeng Group

- 6.4.9 Huntsman International LLC

- 6.4.10 Dongsung Corporation

- 6.4.11 Sumei Chemical Co. Ltd

- 6.4.12 Suzhou New Mstar Technology Ltd

- 6.4.13 The Lubrizol Corporation

- 6.4.14 Tosoh Corporation

- 6.4.15 Wanhua Chemical Group Co. Ltd

- 6.4.16 Hexpol AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward the Development of Bio-based Products

- 7.2 Increasing R&D Activities