|

市场调查报告书

商品编码

1687169

电子纸显示器-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Electronic Paper Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

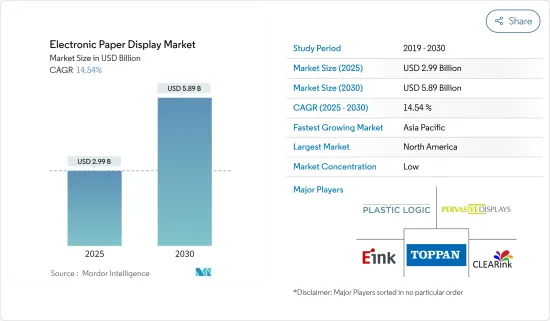

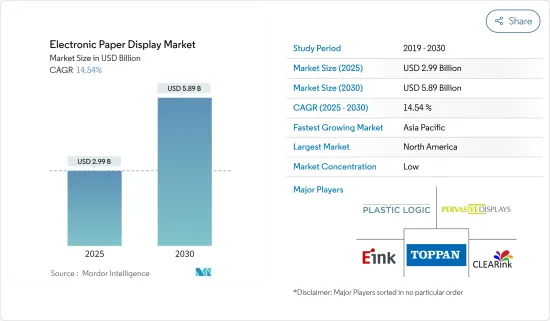

电子纸显示器(EPD) 市场规模预计在 2025 年为 29.9 亿美元,预计到 2030 年将达到 58.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.54%。

行动资讯需求的不断增长、电子阅读器新兴市场的开发以及易于使用的显示设备的开发是推动电子纸显示器市场需求的一些关键因素。

关键亮点

- 目前,EPD 已应用于零售和交通运输等许多领域,例如公车站和铁路资讯板。例如,在日本,E Ink Holdings 和 Papercast 为智慧公车站计划生产了太阳能电子纸乘客资讯显示技术。耶路撒冷交通总体规划团队(JTMT)利用太阳能电子纸显示器增强了公车站乘客资讯系统。

- 电子纸显示器广泛应用于电子阅读器和蓬勃发展的电子货架标籤(ESL)领域。零售商必须花费大量时间为每种产品和 SKU 列印、贴上和更换店内货架上的传统纸质标籤。安装小型电子纸显示器标籤,实现动态定价,让您的员工专注于为客户提供服务。

- 除了电子书阅读器和电子货架标籤 (ESL) 之外,电子纸显示器还用于活动场所、医院、饭店等室内标誌。它重量轻、由电池供电、几乎可以放置在任何地方、易于移动,甚至可以与您的日历系统整合以自动更新。正在尝试的电子纸的其他新应用包括菜单板、公共运输标誌和行李标籤。

- 与全彩显示器相比,单色显示器具有功耗低、软体设计更简单、体积小、成本更低等特性。彩色显示器通常更昂贵,但它们提供Sharp Corporation、更丰富多彩的图像和更好的图形。根据成本和功耗等因素,彩色图形显示器是提高感知价值和让自己在竞争中脱颖而出的理想选择,但以可承受的成本提供彩色显示器是一个市场挑战。

电子纸显示器市场趋势

消费性电子产业可望占据主要市场占有率

- EPD 是家用电子电器产品和穿戴式装置的重要组成部分。由于对显示技术的不断需求,预测期内对消费性电子产品的需求不断增加,对市场成长做出了重大贡献。此外,行动电话、平板电脑和智慧型手机的普及正在推动消费性电子产业的成长,需要更有效的显示技术。此外,E Ink 技术被应用于大多数家用电子电器产品,因为它可以减轻眼睛疲劳并延长电池寿命。根据 GSMA 预测,2020 年至 2025 年间,拉丁美洲将新增 5.13 亿个物联网 (IoT) 连线。其中,智慧家居领域预计将占据超过 1 亿个连线。

- 网路上免费电子书的出现以及技术娴熟的偏好从传统书籍转向携带式电子阅读设备的转变预计将推动 EPD 市场的发展。大多数美国成年人拥有平板电脑、智慧型手机和电子阅读器,他们使用平板电脑阅读电子书。电子墨水技术可生产低功耗纸张类显示器,主要用于亚马逊 Kindle 等电子阅读器。

- 电子纸显示器在穿戴式装置产业中已广泛应用。随着消费者整体健身趋势的日益增长,健身追踪器等穿戴式装置也越来越受欢迎。 Plastic Logic 的超薄柔性电子纸显示器正在被製造商采用,因为它们为手錶和行动行动医疗监测设备等穿戴式装置应用提供了巨大的机会。

- EPD 正被智慧家庭设备(例如智慧恆温器和智慧显示器)所采用,这些设备要求低功耗和易读性。 EPD 可以显示温度和天气更新等信息,也可以充当数位便籤。此外,EPD 因其低功耗要求和在各种照明条件下的可见性而被应用于各种物联网 (IoT) 设备。

- EPD 正被纳入消费品的智慧包装和标籤中。这些标籤可以显示动态讯息,例如产品详细资讯、有效期限和促销讯息。 EPD 包含与消费者沟通并改善其产品体验的互动、引人注目的方式。

预计北美将占据较大的市场占有率

- 北美占据全球 EPD 市场的大部分份额。由于电子阅读器、零售、指示牌和穿戴式装置等各个领域对 EPD 的需求不断增长,该地区正在经历稳定成长。电子书日益普及、对节能显示解决方案的需求以及智慧型设备的日益普及等因素正在推动市场的发展。

- 北美是电子阅读器的重要市场,EPD 在这一领域发挥关键作用。由于电子书的流行和主要电子阅读器製造商的存在,EPD 在北美获得了大量追随者。电子阅读器之所以青睐 EPD,是因为它们能提供舒适的阅读体验、较长的电池寿命和极佳的可视性。

- 北美零售业对电子纸显示器,尤其是电子货架标籤(ESL)的采用率正在不断提高。 EPD 简化了价格和资讯更新,减少了人工工作和成本。此外,在北美,店内显示器和户外广告看板等数位电子看板应用程式正在利用 EPD,它节能且提供易于阅读的内容。

- 北美市场以穿戴式装置和智慧型手錶的普及率高而闻名。这些设备越来越多地采用 EPD,以提供始终开启的显示、出色的可视性和低功耗。北美对智慧型手錶和健身追踪器的需求正在推动该领域 EPD 的成长。

- 北美是 EPD 市场技术进步和创新的中心。该地区的公司正积极致力于研发,以改善 EPD 技术,包括提高色彩再现、刷新率和灵活性。这些进步促进了北美 EPD 市场的成长。

电子纸显示器产业概况

电子纸显示器市场较为分散,主要企业包括 Plastic Logic GmbH、E-Ink Holdings Inc.、Clear Ink Displays、Pervasive Displays Inc. 和 Toppan Printing。该市场的参与企业正在采取合作伙伴关係、协作和收购等策略来加强其产品供应并获得可持续的竞争优势。

2022年9月:显示器领域的主要企业之一Sharp Corporation显示技术有限公司(SDTC)和数位纸技术的发起者和先驱以及全球商业性领导者之一 E Ink Holdings Inc.(E Ink)宣布合作并采用 SDTC 的铟镓锌氧化物(IGZO*2)背板,用于电子阅读器和笔记本产品中使用的电子纸模组。近十年来,E Ink 一直在研究氧化物薄膜电晶体 (TFT) 在电泳技术中的应用,并计划使用氧化物 TFT 扩大其电子纸产品范围。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 主要相关人员分析(涵盖製造商、技术提供者、零售商/经销商和最终用户)

- 主要监管格局(环境法规、能源效率标准、智慧财产权、消费者安全法规、材料安全标准等分析)

- 评估市场的宏观经济因素

第五章市场动态

- 市场驱动因素

- 电子显示领域的技术创新

- 扩大 E-displays 在各个终端用户产业的应用

- 市场问题

- 电子纸显示器性能极限的挑战

- 电子纸显示器的关键要求

- 单色与彩色显示器

- 显示屏尺寸比较

- 显示解析度比较

第六章市场区隔

- 按产品

- 电子阅读器

- 电子货架展示架(ESD)

- 辅助显示

- 其他(行动装置、智慧卡、海报、指示牌)

- 按类型

- 平板式 EPD

- 曲面EPD/软性EPD

- 依技术

- 电泳显示(EPD)

- 电致变色显示器

- 胆固醇液晶显示器(ChLCD)

- 电润湿显示器

- 电流体显示器

- 其他的

- 按最终用户

- 消费性电子产品

- 设施

- 零售

- 其他终端使用者(媒体娱乐、交通运输、医疗、工业智慧包装、建筑应用)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 瑞士

- 亚洲

- 中国

- 印度

- 日本

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Plastic Logic GmbH

- E-Ink Holdings Inc.

- Clear Ink Displays

- Pervasive Displays Inc.

- Toppan Printing Co. Ltd

- LANCOM Systems GmbH

- Adafruit Industries

- Guangzhou Oed Technologies Co. Ltd

- Microtips Technology

- GDS Holding Srl

- Mpicosys Solutions Pvt

- Visionect

第八章投资分析

第九章:市场的未来

The Electronic Paper Display Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 5.89 billion by 2030, at a CAGR of 14.54% during the forecast period (2025-2030).

The rising demand for on-the-move information, along with the growing number of electronic readers, and the development of easy-to-use display devices, are among some of the significant factors driving the demand for the electronic paper display market.

Key Highlights

- EPDs are currently being deployed for many applications, including retail and transport, such as bus stops and rail information boards. For instance, in Japan, E Ink Holdings and Papercast have produced a solar-powered electronic paper passenger information display technology for a smart bus stop project. The Jerusalem Transportation Master Plan Team (JTMT) has advanced passenger information systems at bus stops with solar-powered e-paper displays.

- E-paper displays are widely used in e-readers and the booming Electronic Shelf Label (ESL) segment. Retail stores must dedicate long hours of employee time to print, stick, and replace traditional paper labels on store shelves for every single product and SKU. Installing miniature e-paper display labels enables dynamic pricing and frees employees to focus on helping customers.

- In addition to e-readers and ESLs, e-paper displays have been used for indoor signage, for instance, at event venues, hospitals, and hotels. They are lightweight, battery-powered, can be mounted virtually anywhere, moved around easily, and can be integrated with calendaring systems to update automatically. Other new e-paper applications being tried include menu boards, public transit signs, and baggage tags.

- The monochrome display boasts low power consumption, easy software design, small form factors, and low cost relative to full-color alternatives. Color display alternatives are generally more expensive but provide sharp, colorful images and high-performing graphics. Depending on factors such as cost and power consumption, a color graphical display is the best way to increase the perceived value and stay ahead of the competitors but providing a colorful display at an affordable cost is a challenge for the market.

E-Paper Display Market Trends

The Consumer Electronics Industry is Expected to Hold Significant Market Share

- EPD is an integral part of consumer electronics as well as wearable. Growing demand for consumer electronics over the forecast period majorly contributes to the market growth owing to the constant need for display technologies. Furthermore, the intense penetration of mobile phones, tablets, and smartphones fuels growth in the consumer electronics industry, which demands more effective display technologies. Additionally, E-ink technology is used for most consumer electronics to provide low eye strain and enhanced battery life. According to GSMA, Latin America is poised to witness a surge of 513 million new Internet of Things (IoT) connections from 2020 to 2025. Notably, the smart home sector is projected to account for over 100 million of these connections.

- The rising availability of free e-books on the internet and a shift in preference among tech-savvy users from traditional books toward portable electronic reading devices are expected to drive the EPD market. Most American adults own a tablet, smartphone, or e-reader device, with the majority using tablets for reading eBooks. Electronic ink technology produces low-power paper, like a display used primarily in e-book readers, such as Amazon's Kindle.

- Electronic paper displays are widely adopted in the wearables industry. Wearables, such as fitness trackers, have gained significant traction owing to increased fitness trends across consumers. Plastic Logic's ultra-thin and flexible e-paper displays have been gaining adoption, given the enormous opportunities they open up in wearable device applications, such as watches and devices, for mobile health monitoring.

- EPDs are employed in smart home devices, such as smart thermostats or smart displays, where low power consumption and easy readability are important. EPDs can display information like temperature and weather updates or even act as digital sticky notes. In addition, EPDs find applications in various Internet of Things (IoT) devices, where their low power requirements and visibility in different lighting conditions are advantageous.

- EPDs are integrated into smart packaging and labels for consumer products. These labels can display dynamic information, such as product details, expiration dates, or promotional messages. EPDs provide an interactive and eye-catching way to communicate with consumers and enhance the product experience.

North America is Expected to Hold Significant Market Share

- North America holds a considerable share of the global EPD market. The region has witnessed steady growth due to the increasing demand for EPDs in various sectors, such as e-readers, retail, signage, and wearables. Factors like the popularity of e-books, the need for energy-efficient display solutions, and the growing adoption of smart devices drive the market.

- North America has been a significant market for e-readers, and EPDs play a crucial role in this segment. With the popularity of e-books and the presence of major e-reader manufacturers, EPDs have gained significant traction in North America. EPDs offer a comfortable reading experience, long battery life, and excellent visibility, making them a preferred choice for e-readers.

- The retail sector in North America has embraced electronic paper displays, particularly for electronic shelf labels (ESLs). EPDs provide efficient pricing and information updates, reducing manual labor and costs. Moreover, digital signage applications in North America, such as in-store displays and outdoor billboards, leverage the benefits of EPDs for energy-efficient and easily readable content.

- The North American market is known for its high adoption of wearable devices and smartwatches. EPDs are increasingly incorporated into these devices, offering always-on displays, excellent visibility, and low power consumption. The demand for smartwatches and fitness trackers in North America has propelled the growth of EPDs in this segment.

- North America is a hub for technological advancements and innovation in the EPD market. Companies in the region are actively involved in research and development efforts to improve EPD technology, such as enhancing color reproduction, refresh rates, and flexibility. These advancements contribute to the growth of the EPD market in North America.

E-Paper Display Industry Overview

The Electronic Paper Display Market isfragmented, with the presence of major players like Plastic Logic GmbH, E-Ink Holdings Inc., Clear Ink Displays, Pervasive Displays Inc., and Toppan Printing Co. Ltd. Players in the market are adopting strategies such as partnerships, collaboration, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

September 2022: Sharp Display Technology Corporation (SDTC), one of the leading companies in the field of displays, and E Ink Holdings Inc. (E Ink), the originator, pioneer, and one of the global commercial leaders in digital paper technology, announced their collaboration and adoption of SDTC's indium gallium zinc oxide (IGZO*2) backplanes for ePaper modules used in eReader and eNote products. For almost ten years, E Ink has been researching the use of oxide thin film transistors (TFTs) for electrophoretic technology, and it plans to extend its ePaper product range utilizing oxide TFTs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Stakeholder Analysis (Coverage on manufacturers, technology providers, retail and distributors, end users)

- 4.3 Key Regulatory Landscape (Analysis on Environment Regulations, Energy Efficient Standards, Intellectual Property Rights, Consumer Safety Regulations, Material Safety Standards among Others)

- 4.4 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Innovations in the Field of E-displays

- 5.1.2 Growing Applications of E-display Across Various End-user Industries

- 5.2 Market Challenges

- 5.2.1 Challenges in Performance Limitations of E-paper Displays

- 5.3 Key E-paper Display Requirements

- 5.3.1 Comparison Between Monochrome and Color Display

- 5.3.2 Comparison Between Display Sizes

- 5.3.3 Comparison Between Display Resolutions

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 E-Readers

- 6.1.2 Electronic Shelf Displays (ESD)

- 6.1.3 Auxiliary Displays

- 6.1.4 Others (Mobile Devices, Smart Cards, Poster and Signage)

- 6.2 By Type

- 6.2.1 Flat EPDs

- 6.2.2 Curved EPDs/Flexible EPDs

- 6.3 By Technology

- 6.3.1 Electrophoretic Displays (EPD)

- 6.3.2 Electrochromic Displays

- 6.3.3 Cholesteric Liquid Crystal Displays (ChLCD)

- 6.3.4 Electro-wetting Displays

- 6.3.5 Electro-fluidic Displays

- 6.3.6 Others

- 6.4 By End User

- 6.4.1 Consumer Electronics

- 6.4.2 Institutional

- 6.4.3 Retail

- 6.4.4 Other End Users (Media and Entertainment, Transportation, Healthcare, Industrial/Smart Packaging, and Architectural Applications)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Netherlands

- 6.5.2.6 Switzerland

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Plastic Logic GmbH

- 7.1.2 E-Ink Holdings Inc.

- 7.1.3 Clear Ink Displays

- 7.1.4 Pervasive Displays Inc.

- 7.1.5 Toppan Printing Co. Ltd

- 7.1.6 LANCOM Systems GmbH

- 7.1.7 Adafruit Industries

- 7.1.8 Guangzhou Oed Technologies Co. Ltd

- 7.1.9 Microtips Technology

- 7.1.10 GDS Holding S.r.l

- 7.1.11 Mpicosys Solutions Pvt

- 7.1.12 Visionect