|

市场调查报告书

商品编码

1444391

风力发电机 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

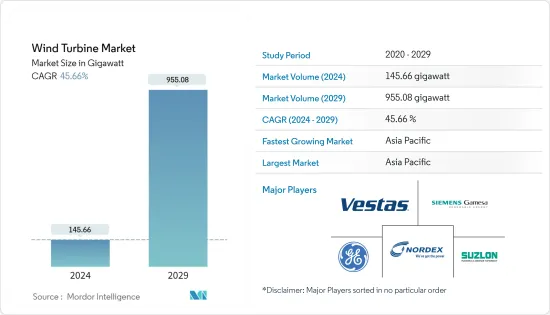

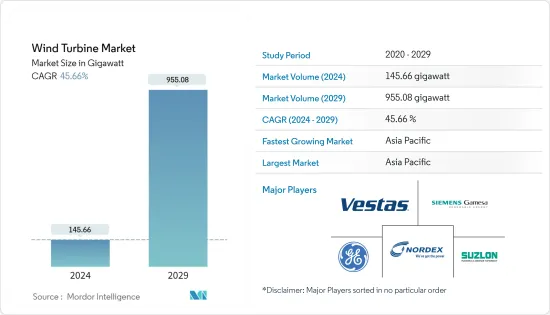

预计2024年风电机组市场规模为145.66吉瓦,预计2029年将达到955.08吉瓦,在预测期(2024-2029年)CAGR为45.66%。

2020年,COVID-19对市场产生了不利影响。目前,市场已达到疫情前水准。

主要亮点

- 中期来看,发电结构中对再生能源(尤其是风电)的需求不断增加、减少对化石燃料发电依赖的努力以及能源效率法规等因素预计将推动风力涡轮机的发展预测期内的市场。

- 另一方面,采用太阳能和其他替代能源等替代清洁能源可能会阻碍市场的成长。

- 儘管如此,全球风能理事会承诺到2030年实现全球离岸风电装置容量380吉瓦,到2050年实现2000吉瓦,这可能很快为风力涡轮机的部署提供重大机会。

- 由于风力发电所占比重最大,且中国、印度、日本等国家拥有製造和技术中心,亚太地区预计将成为最大、成长最快的市场。

主要市场趋势

海上风力发电机将显着成长

- 随着能源需求的不断增长,主要国家和公司都转向采用再生能源,特别是风能,因为它们可以提供清洁能源。技术先进的海上风能吸引了许多国家和企业的高额投资。

- 根据部署地点,由于成本下降、技术改进以及全球离岸风能专案的开发和投资增加,预计在预测期内,全球风力涡轮机产业投资将大幅成长。

- 为了大幅增加英国负担得起的能源供应,同时减少碳排放,英国政府制定了一项长期策略,作为离岸风电产业与政府之间部门协议的一部分,透过离岸风电提供至少三分之一的电力。英国气候变迁委员会的一份报告表明,该国可能成为第一个立法制定 2050 年「净零」排放目标的大型经济体。

- 2022 年 5 月,英国浮动式离岸风电製造投资计画 (FLOWMIS) 在最近的公告中宣布,将向政府提供 1.6 亿英镑,用于提高英国各地苏格兰、威尔斯、和其他地方。透过支持製造商并为私人投资者提供投资这个预计未来将过度成长的新兴产业的信心,政府将为这些项目提供资金。

- 2022年5月,挪威政府启动投资计划,到2040年分配海域用于离岸风电开发,目标装置容量30吉瓦。

- 根据再生能源法案(EEG),德国计划大规模发展离岸风能。作为联盟协议的一部分,德国表示将到 2030 年将离岸风电目标提高到 30 吉瓦。

- 根据全球风能理事会(GWEC)统计,2022年,全球离岸风电装置容量达64.3吉瓦,2022年新增装置容量8.8吉瓦。

- 除此之外,由于风力涡轮机所用材料的改进,这些公司已经能够安装更高的风力涡轮机,这使得涡轮机能够利用更高海拔的风力。此外,这些新型涡轮机具有更大的叶片,因此可以比小型涡轮机扫过更大的区域。风力涡轮机尺寸的不断增大有助于降低风能的成本,这表明在美国、德国、法国等一些地区,风能与化石燃料替代品相比在经济上具有竞争力。因此,这些近期趋势预计将推动风能的发展。预测期内的海上风力涡轮机市场。

亚太地区将主导市场

- 在亚太地区,风能是最丰富的能源之一,是满足该地区能源需求的理想来源。鑑于风能巨大的成长潜力,包括中国、印度、日本等在内的亚洲国家目前正致力于广泛部署这种能源。

- 由于人们日益关注永续发展和减少温室气体排放的承诺,海上风能已成为一种流行的能源。离岸风能作为主流发电能源,已经从替代能源发生了巨大转变。亚洲国家的离岸风能技术正在快速发展,由于涡轮机技术的最新进步和政府的激励措施,这导致了对风能的日益依赖。

- 根据中国风能协会(CWEA)统计,2022年陆上风电装置容量为44.7吉瓦。但国家能源局(NEA)最新发布的统计数据显示,2022年陆上风电新增併网容量仅32.6吉瓦。同年连接。

- 根据GWEC统计,2022年全球离岸风电新增装置容量为8.7吉瓦。中国新增装置容量连续领先全球,2022年离岸风电併网容量超过5吉瓦。

- 2022年,印度新增风电装置量约1.8吉瓦,截至同年底总装置容量达41.9吉瓦。这些项目主要分布在该国的北部、南部和西部地区。

- 2022年5月,印度政府宣布了离岸风电开发的第一步,并概述了启动拍卖的策略和时间表。首次拍卖概述了建造至少 10 至 12 吉瓦海上风力涡轮机的初步策略,预计将在未来几个月内进行。在最近发布的计划中,将有两个地区作为首次拍卖的目标。其中之一是泰米尔纳德邦和古吉拉特邦。该领域的首次拍卖目标容量为 4 吉瓦。

- 根据世界银行集团的数据,菲律宾专属经济区拥有约 178 吉瓦的离岸风电技术资源潜力,主要是浮动风电和 18 吉瓦固定底部离岸风电。考虑到这是该国总发电装置容量的七倍多,实现脱碳和能源安全目标的机会非常重大。

- 菲律宾能源部与世界银行集团的 ESMAP-IFC 离岸风电开发计画合作,正在製定离岸风电路线图。路线图草案确定了六个不同的离岸风电开发区域,到2030年总计2.8吉瓦,到2050年总计58吉瓦,其中大部分是浮动离岸风电计画。

- 反过来,预计这将使亚太地区成为预测期内参与风力涡轮机业务的市场参与者的绝佳商业目的地。

竞争格局

风力涡轮机市场适度分散。市场上一些主要的参与者(排名不分先后)包括维斯塔斯风力系统公司、西门子歌美飒再生能源公司、通用电气公司、Nordex SE 和苏司兰能源有限公司。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究范围

- 市场定义

- 研究假设

第 2 章:执行摘要

第 3 章:研究方法

第 4 章:市场概览

- 介绍

- 到 2028 年风力涡轮机装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 司机

- 限制

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 部署地点

- 陆上

- 离岸

- 容量

- 小的

- 中等的

- 大的

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 领先企业采取的策略

- 公司简介

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Nordex SE

- Suzlon Energy Limited

- Xinjiang Goldwind Science & Technology Co. Ltd.

- Eaton Corporation PLC

- Enercon GmbH

- Hitachi Ltd.

- Vergnet

第 7 章:市场机会与未来趋势

The Wind Turbine Market size is estimated at 145.66 gigawatt in 2024, and is expected to reach 955.08 gigawatt by 2029, growing at a CAGR of 45.66% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium period, factors such as increasing demand for renewable energy sources, especially wind power, in the power generation mix, efforts to reduce the reliance on fossil fuel-based power generation, and regulations on energy efficiency are expected to drive the wind turbine market during the forecast period.

- On the other hand, the adoption of alternative clean energy sources like solar and other alternatives is likely to hinder the market's growth.

- Nevertheless, the global wind energy council committed to achieving 380 GW of offshore wind by 2030 and 2,000 GW by 2050 worldwide, which is likely to provide significant opportunities for the deployment of wind turbines soon.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the largest share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Key Market Trends

Offshore Wind Turbine to Witness a Significant Growth

- As energy demand is rising, major countries and companies are turning toward the adoption of renewable energy sources, especially wind energy, as they can provide clean energy. The adoption of offshore wind energy with advanced technologies has attracted many countries and companies with high investments.

- By location of deployment, the offshore industry is expected to witness significant growth in global wind turbine industry investments during the forecast period, owing to declining costs, improved technology, and increased developments and investments in offshore wind energy projects worldwide.

- To significantly increase the United Kingdom's affordable energy supply while reducing carbon emissions, the UK government developed a long-term strategy to deliver at least one-third of its electricity from offshore wind as part of a sector deal between the offshore wind industry and the government. A report by the UK's Committee on Climate Change indicates the country could become the first large economy to legislate a "net zero" emissions target for 2050.

- In May 2022, in a recent announcement, the Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) of the United Kingdom announced that it would provide the government with GBP 160 million to boost floating offshore wind capability around the UK at locations in Scotland, Wales, and elsewhere. By supporting manufacturers and providing private investors with the confidence to invest in this emerging sector, which is expected to overgrow in the future, the government is going to provide funding for these projects.

- In May 2022, the Government of Norway launched an investment plan to allocate sea areas for offshore wind development by 2040, targeting 30 GW of capacity.

- Following the Renewable Energy Act (EEG), Germany plans to boost offshore wind energy massively. As part of the Coalition Agreement, Germany stated it would increase its offshore wind target to 30 GW by 2030.

- According to Global Wind Energy Council (GWEC) statistics, in 2022, the global offshore wind capacity reached 64.3 GW and the new 8.8 GW of capacity was added in 2022.

- Besides this, the companies have been able to install taller wind turbines due to improvements in the wind turbine materials used, which allow the turbines to exploit higher-altitude winds. Also, these new turbines have larger blades and, hence, can sweep a larger area than the smaller turbines. The growing size of the wind turbines helped lower the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives in some locations such as the United States, Germany, France, etc. Therefore, these recent trends are expected to drive the offshore wind turbine market during the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, wind energy is one of the most abundant energy resources, making it an ideal source for fulfilling the region's energy needs. In view of wind energy's tremendous growth potential, Asian countries, including China, India, Japan, and others, are currently focusing on implementing a widespread deployment of this energy resource.

- As a result of an increasing focus on sustainable development and a commitment to reducing greenhouse gas emissions, offshore wind energy has become a popular source of energy. As a mainstream energy source for power generation, offshore wind energy has significantly changed from being a source of alternative energy. Offshore wind energy technology is being developed at a rapid pace in Asian countries, which has contributed to the growing reliance on wind energy due to recent advancements in turbine technology and government incentives.

- According to the Chinese Wind Energy Association (CWEA), 44.7 GW of onshore wind capacity was installed in 2022. However, the most recent statistics released by the National Energy Administration (NEA) indicate that only 32.6 GW of new onshore wind capacity was grid-connected in the same year.

- According to GWEC, the global offshore wind industry installed a new capacity of 8.7 GW in 2022. China consecutively led the world in new installations, with more than 5 GW of offshore wind grid-connected in 2022.

- During 2022, India installed around 1.8 GW of new wind power, making 41.9 GW of total installed capcity by end of the same year. These projects are mostly spread in the northern, southern, and western parts of the country.

- In May 2022, the Indian government announced the first steps in offshore wind power development and outlined a strategy and timetable for starting auctions. An initial strategy of building at least 10 to 12 GW of offshore wind turbines is outlined for the first auctions, which are expected to take place in the coming months. There are going to be two regions targeted for the first auctions in the recently released plan. One is going to be Tamil Nadu and Gujarat. The first auctions in this area will target 4 GW of capacity.

- According to the World Bank Group, the Philippines' EEZ has around 178 GW of technical resource potential for offshore wind, primarily floating wind with 18 GW of fixed-bottom offshore wind. Considering that this is more than seven times the country's total installed electricity generation capacity, the opportunity to meet decarbonization and energy security goals is significant.

- In partnership with the World Bank Group's ESMAP-IFC Offshore Wind Development Program, the Philippine Department of Energy is developing an offshore wind roadmap. A draft roadmap identifies six different zones for offshore wind development, totaling 2.8 GW by 2030 and 58 GW by 2050, with mostly floating offshore wind projects.

- This, in turn, is expected to present Asia-Pacific as an excellent business destination for market players involved in the wind turbine business during the forecast period.

Competitive Landscape

The wind turbine market is moderately fragmented. Some of the major players in the market (in no particular order) include Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, General Electric Company, Nordex SE, and Suzlon Energy Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Turbine Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Capacity

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 General Electric Company

- 6.3.4 Nordex SE

- 6.3.5 Suzlon Energy Limited

- 6.3.6 Xinjiang Goldwind Science & Technology Co. Ltd.

- 6.3.7 Eaton Corporation PLC

- 6.3.8 Enercon GmbH

- 6.3.9 Hitachi Ltd.

- 6.3.10 Vergnet