|

市场调查报告书

商品编码

1444429

半导体硅片:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Semiconductor Silicon Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

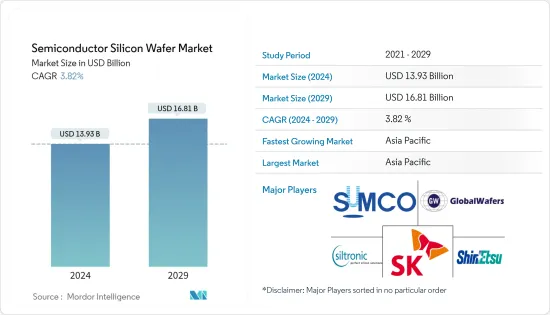

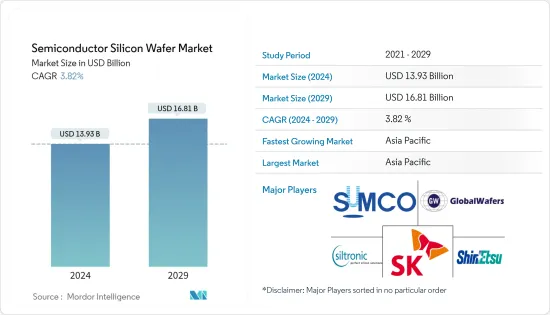

2024年半导体硅晶圆市场规模预估为139.3亿美元,预计2029年将达到168.1亿美元,在预测期间(2024-2029年)成长3.82%,以复合年增长率成长。

主要亮点

- 半导体硅晶圆仍然是许多微电子元件的核心元件,并构成电子工业的基础。由于数位化和电子移动性是当前技术形势的趋势,因此这些产品应用于许多设备。此外,对小型设备的需求增加了对单一设备具有更多功能的需求。这意味着IC晶片需要有更多的电晶体来支援更多的功能。

- 据国际半导体设备与材料协会 (SEMI) 称,由于 COVID-19 影响的不确定性加剧,硅晶圆市场的销售量可能会下降。然而,由于晶片销售的復苏,需求增加。 SEMI也预测,2022年全球硅晶圆出出货将创下历史新高。中国首次感染疾病的 COVID-19 疫情扰乱了该国的供应链和生产。过去20-30年,中国成为世界製造中心,对各大半导体製造业产生了重大影响。

- 半导体产业是电子、汽车和自动化等关键领域重大创新背后的关键驱动力,而半导体技术正成为所有现代技术的基石。该领域的进步和创新正在对所有下游技术产生直接影响。

- 晶圆代工厂正在增加对新的先进封装技术的投资,特别是基于硅晶圆的技术。晶圆代工厂供应商正在进行研究,利用诸如利用 2D 材料代替硅作为通道来开发单片 3D 积体电路等技术来提高电晶体密度。例如,台积电的晶圆上基板技术已开发出世界上最大的硅中介层,其封装内可容纳两个巨型处理器和八个 HBM 记忆体。

- 穿戴式装置的进步为市场供应商带来了巨大的成长机会。西门子表示,工业穿戴设备有潜力成为一个巨大的市场,因为它们可以提高加工行业的品质和安全性。据 Zebra Technologies Corporation 称,预计到 2022 年,全球 40-50% 的製造商将采用穿戴式装置。对小型设备的需求也增加了对单一设备提供更多功能的需求。这表明IC晶片需要有更多的电晶体来支援更多的功能。

- 中国等新兴国家的有利政府政策为半导体产业创造了巨大机会,预计将在预测期内扩大半导体硅片市场。例如,中华人民共和国国务院发布的政策框架旨在使先进半导体封装解决方案成为整个半导体产业的技术重点。

半导体硅片市场趋势

电器产品产业预计将占据重要市场占有率

- 在当前的市场情况下,包括笔记型电脑、智慧型手机、电脑等在内的许多电子设备仍然使用由硅材料製造的IC和其他半导体装置。硅仍然在消费性电器产品市场占据主导地位,但在某些应用中新材料已经取代了旧的基板和封装。

- 根据消费者技术协会 (CTA) 的美国消费者技术销售和预测研究,CTA 预计支援5G 的智慧型手机设备将达到210 万台,销售额将超过19 亿美元,到2021 年将实现三位数成长。我预计这一结果会显示出来。苹果承诺在 2023 年为美国经济贡献 3,500 亿美元,并在未来五年内创造 240 万个就业机会,其中包括新投资以及与国内公司进行供应和製造的机会,也包括现有支出。该公司是消费电器产品产业的知名公司。因此,这项公告预计将带动半导体硅片的需求。

- 最近,新加坡麻省理工学院研究与技术联盟(SMART)(新加坡麻省理工学院的一家研究公司)开发了一种商业性可行的方法来製造整合硅III-V 晶片,该方法可以将强大的性能III-V 装置插入到设计中。他们已经成功开发了。

- 在目前的大多数设备中,硅基 CMOS 晶片主要用于计算,但它们对于通讯或照明效率不高,导致效率低并产生热量。因此,目前市面上的5G行动装置在使用过程中会很热,用一段时间后就会关机。然而,以商业性可行的方式将 III-V 半导体元件与硅结合是半导体产业面临的最复杂的挑战之一。

北美预计将占据很大份额

- 由于无晶圆厂半导体公司是半导体代晶圆代工厂和晶圆厂商的主要客户,预计到 2021 年,北美将对该市场的收益做出重大贡献。无厂半导体公司专门设计晶片并在没有製造工厂的情况下销售它们。

- 该地区的主要无厂半导体公司包括 AMD、博通、苹果、高通、Marvell、NVIDIA 和 Xilinx。北美在先进半导体系统的设计和製造方面发挥了重要作用。在该地区,建立半导体晶圆製造的活动正在增加。台积电宣布,2021年至2029年将斥资120亿美元兴建12吋晶圆厂,采用先进的5奈米製程製造晶片。此外,即使乔·拜登背叛唐纳德·川普之后,高科技供应链也可能会继续发生变化,而唐纳德·川普推动外国公司在美国投资和创造就业机会。

- 该地区的电子产业正在稳步成长,并在设计和无晶圆厂领域的多家公司中占有重要份额。根据美国人口普查局统计,2019年美国半导体及其他电子元件产业收益为1,000.8亿美元,预计2023年将达到1,051.6亿美元。智慧型手机是半导体消费的最大贡献者之一。在电器产品领域。近年来,该地区的智慧型手机销量持续成长。

- 此外,美国是世界主要汽车公司的所在地,这些公司正在投资电动车和自动驾驶汽车的潜力,这需要高性能积体电路。这是拉动半导体硅片市场需求的关键因素之一。

半导体硅片行业概况

半导体硅片市场竞争激烈。从市场占有率来看,市场相当集中,目前市场上只有少数几家企业占据主导地位。然而,参与者即将推出的技术和所进行的创新是半导体硅晶圆市场大幅成长的原因。市场上也出现了一些公司为了扩大其地理影响力而进行的合併和联盟。

- 2022 年 3 月 - SK Siltron 宣布决定在未来三年投资 1.5 兆韩元,扩建位于龟尾国立工业园区 3 的 300 毫米晶圆工厂。该公司计划于2022年开始扩建工作,并于2024年开始量产。

- 2022 年 1 月 - 全球领先的硅晶圆供应商之一 GlobalWafers Co. 每月从其当地工厂新增约 20,000 片先进 12 吋晶圆。 World Wafers预计,为满足强劲需求,其位于韩国、日本、台湾和义大利的工厂扩建后产能将增加10-15%。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第 2 章执行摘要

第三章调查方法

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 市场驱动因素

- 非传统终端用户产业需求不断成长,穿戴式装置销量稳定成长

- 市场挑战

- 由于高成本和最终用户需求的动态性,生产商面临营运挑战

- 硅晶圆成本的关键考量因素

- COVID-19对半导体硅晶片产业的影响

第五章市场区隔

- 依直径

- 小于150mm

- 200mm

- 300mm以上(450mm等)

- 副产品

- 逻辑

- 记忆

- 模拟

- 其他产品

- 按用途

- 家用电器

- 行动智慧型手机

- 桌上型电脑、笔记型电脑、伺服器 PC

- 产业

- 通讯

- 车

- 其他用途

- 家用电器

- 按地区

- 北美洲

- 欧洲

- 亚太地区

第六章 竞争形势

- 公司简介

- Shin-Etsu Handotai

- Siltronic AG

- SUMCO Corporation

- SK Siltron Co. Ltd

- Globalwafers Co.Ltd

- SOITEC SA

- Okmetic Inc.

- Wafer Works Corporation

- Episil-Precision Inc.

第七章 中国主要供应商及相关人员分析

- Zing Semiconductor Corporation (Shanghai)

- MCL Electronic Material Limited

- GrinM Semiconductor Materials Limited

- Shanghai Simgui Technology Co. Limited

- Ferrotec (Hangzhou & Shenhe FTS)

- Zhonghuan Semiconductor Corporation

第八章投资分析

第9章市场的未来

The Semiconductor Silicon Wafer Market size is estimated at USD 13.93 billion in 2024, and is expected to reach USD 16.81 billion by 2029, growing at a CAGR of 3.82% during the forecast period (2024-2029).

Key Highlights

- Semiconductor silicon wafer remains the core component of many microelectronic devices and forms the cornerstone of the electronics industry. With digitization and electronic mobility being the current trends in the technology landscape, these products are finding applications in many devices. Also, the demand for small-sized gadgets has increased the need for more functionalities from a single device. This means that an IC chip should now house more transistors to support more features.

- According to the Semiconductor Equipment and Materials International (SEMI), silicon wafer market sales could witness a dip amidst the looming uncertainty surrounding the impact of COVID-19. However, the demand climbed on the strength of rebounding chip sales. SEMI also estimates that silicon wafer shipments globally will reach a record high in 2022. The initial outbreak of COVID-19 in China disrupted the country's supply chain and production. Major semiconductor manufacturing industries have been significantly affected due to China becoming a world production center over the past two to three decades.

- The semiconductor industry has been a significant driver behind critical innovations in significant sectors like electronics, automobiles, and automation, with semiconductor technology emerging as the building block of all modern technologies. The advancements and innovations in this field are immediately impacting all downstream technologies.

- Foundries are increasingly investing in new advanced packaging techniques, especially silicon wafer-based. Foundry vendors are researching improving transistor density with techniques like utilizing two-dimensional materials instead of silicon as the channel to develop Monolithic 3D Integrated Circuits. For instance, TSMC's chip on wafer on Substrate technology developed the world's largest silicon interposer that featuring room for two massive processors combined with 8 HBM memory devices in a package.

- Advancements in wearable devices will create massive growth opportunities for market vendors. According to Siemens, industrial wearables could be a massive market as these devices enhance quality and safety in the processing industry. According to Zebra Technologies Corporation, 40-50% of manufacturers globally are expected to adopt wearables by 2022. Also, the demand for small-sized gadgets has raised the need for more functionalities from a single device. This indicates that an IC chip should now house more transistors to support more functionalities.

- Favorable government policies across emerging economies like China created enormous opportunities for the semiconductor industry, which is expected to expand the semiconductor silicon wafer market during the forecast period. For instance, the policy framework published by the State Council of the People's Republic of China aims to make advanced semiconductor packaging solutions a technology priority across the semiconductor industry.

Semiconductor Silicon Wafer Market Trends

The Consumer Electronics Segment is Expected to Occupy a Significant Market Share

- In the current market scenario, many electronic devices, including laptops, smartphones, computers, etc., still use ICs and other semiconductor devices manufactured from silicon substances. Although silicon is still dominating primary applications in the consumer electronics market, new materials have replaced the previous substrates and packaging for a few uses.

- According to the Consumer Technology Association's (CTA) 'US Consumer Technology Sales and Forecast' study, CTA expects that 5G-enabled smartphone devices will reach 2.1 million units and cross USD 1.9 billion in revenue with triple-digit increases through 2021. Apple announced a contribution of USD 350 billion to the US economy by 2023 and promised 2.4 million jobs over the next five years, which comprises new investments and its existing spending with domestic companies for supply and manufacturing. The company is a prominent player in the consumer electronics industry. Hence, the announcement is expected to propel the demand for semiconductor silicon wafers.

- Recently, the Singapore-MIT Alliance for Research and Technology (SMART), MIT's research enterprise in Singapore, announced the successful development of a commercially viable way to manufacture integrated silicon III-V chips with powerful performance III-V devices inserted into their design.

- In most devices nowadays, silicon-based CMOS chips are primarily used for computing, but they are not efficient for communications and illumination, resulting in low efficiency and heat generation. Thus, current 5G mobile devices on the market get very hot upon use and shut down after a short time. However, combining III-V semiconductor devices with silicon in a commercially viable way is one of the most complex challenges the semiconductor industry faces.

North America is Expected to Hold a Significant Share

- North America is expected to be a significant revenue contributor to the market by 2021, as fabless semiconductor companies are the prominent customers for semiconductor foundries and wafer players. Fabless companies make chip designs exclusively and market them without a fabrication plant.

- The major fabless companies in the region are AMD, Broadcom, Apple, Qualcomm, Marvell, NVIDIA, and Xilinx. North America has presented a crucial role in advanced semiconductor system design and manufacturing. The region has been witnessing increased activity in establishing semiconductor wafer foundries. TSMC announced that it would spend a total of USD 12 billion from 2021 to 2029 to build a 12-inch wafer plant to manufacture chips using the advanced 5 nm process. Moreover, tech supply chains will continue to shift even after Donald Trump, who pressed foreign companies to invest and create jobs in America, was defected by Joe Biden.

- The electronics industry in the region has been growing steadily and holds a prominent share in several enterprises operating in the design and fabless space. According to the US Census Bureau, the industry revenue of semiconductors and other electronic components in the United States during 2019 stood at USD 100.08 billion, and it is expected to reach USD 105.16 billion by 2023. Smartphones are among the most significant contributors to semiconductor consumption in the consumer electronics sector. In recent years, the region has witnessed consistent growth in smartphone sales.

- Moreover, the United States is home to some of the world's major automotive players, which are investing in electric vehicles and the self-driving potential of cars, which demand high-performance ICs. This is one of the major factors driving the demand for the semiconductor silicon wafers market.

Semiconductor Silicon Wafer Industry Overview

The Semiconductor Silicon Wafer Market is quite competitive. In terms of market share, only a few players dominate the current market, due to which the market is quite consolidated. However, players' upcoming technologies and the innovations carried out are the reason behind the significant boost in the semiconductor silicon wafers market. The market is even witnessing multiple mergers and partnerships so that the companies expand their geographical presence.

- March 2022 - SK Siltron Co. announced that it has decided to invest won 1.05 trillion over the next three years to expand its facilities for 300 mm wafers, which are located in Gumi National Industrial Complex 3. The company will begin the expansion work in 2022 to start mass production in 2024.

- January 2022 - GlobalWafers Co., one of the global leading silicon wafer suppliers, added around 20,000 advanced 12-inch wafers each month from local fabs. GlobalWafers estimates capacity to rise 10-15% at plants in South Korea, Japan, Taiwan, and Italy as a result of the expansions to satisfy strong demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Demand from Non-Traditional End-User Verticals and Steady Rise in Wearable Sales

- 4.5 Market Challenges

- 4.5.1 Operational Challenges Faced by the Producers Owing to High Cost and Dynamic Nature of End-User Demand

- 4.6 Key Cost Considerations for Silicon Wafer

- 4.7 Impact of COVID-19 on the Semiconductor Silicon Wafer Industry

5 MARKET SEGMENTATION

- 5.1 By Diameter

- 5.1.1 Less than 150 mm

- 5.1.1.1 By Product (Logic, Memory, Analog, and Other Products)

- 5.1.1.2 Vendor Ranking Analysis

- 5.1.2 200 mm

- 5.1.3 300 mm and above (450mm, etc.)

- 5.1.1 Less than 150 mm

- 5.2 By Product

- 5.2.1 Logic

- 5.2.2 Memory

- 5.2.3 Analog

- 5.2.4 Other Products

- 5.3 By Application

- 5.3.1 Consumer Electronics

- 5.3.1.1 Mobile/Smartphones

- 5.3.1.2 Desktop, Notebook, and Server PCs

- 5.3.2 Industrial

- 5.3.3 Telecommunication

- 5.3.4 Automotive

- 5.3.5 Other Applications

- 5.3.1 Consumer Electronics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Shin-Etsu Handotai

- 6.1.2 Siltronic AG

- 6.1.3 SUMCO Corporation

- 6.1.4 SK Siltron Co. Ltd

- 6.1.5 Globalwafers Co.Ltd

- 6.1.6 SOITEC SA

- 6.1.7 Okmetic Inc.

- 6.1.8 Wafer Works Corporation

- 6.1.9 Episil-Precision Inc.

7 ANALYSIS OF KEY CHINESE VENDORS AND STAKEHOLDERS

- 7.1 Zing Semiconductor Corporation (Shanghai)

- 7.2 MCL Electronic Material Limited

- 7.3 GrinM Semiconductor Materials Limited

- 7.4 Shanghai Simgui Technology Co. Limited

- 7.5 Ferrotec (Hangzhou & Shenhe FTS)

- 7.6 Zhonghuan Semiconductor Corporation