|

市场调查报告书

商品编码

1444430

HVAC 服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

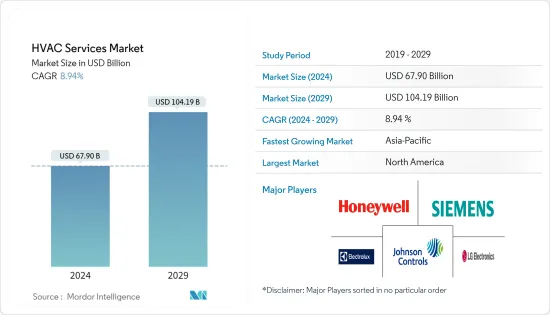

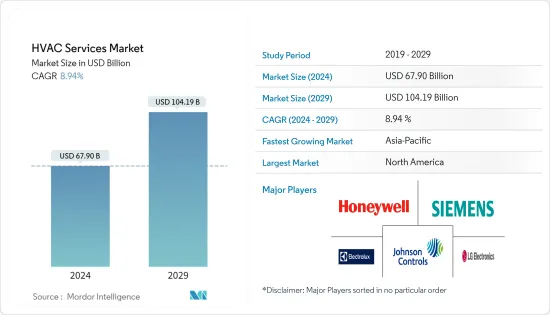

2024年暖通空调服务市场规模预估为6,79亿美元,预估至2029年将达1,041.9亿美元,预测期内(2024-2029年)CAGR为8.94%。

家庭和办公室越来越多地使用空调是强调暖通空调服务需求的重要驱动因素之一。

主要亮点

- 技术创新和气候变迁增加了暖通空调设备的采用。例如,2022年10月,75F Smart Innovations India与塔塔电力贸易公司(TPTCL)签署了一份合同,共同推广自动化和节能建筑解决方案。透过此次合作,TPTCL 和 75F 将合作提供由物联网、云端和 AI/ML 等先进技术支援的智慧楼宇自动化和 HVAC(暖气、通风和空调)优化解决方案。

- 此外,发展中国家建筑业的成长和可支配收入的增加增加了暖通空调设备对更广泛消费者群体的可用性。例如,根据美国劳工统计局的数据,到2028 年,美国建筑业的产值预计将达到约1.58 兆美元。暖通空调服务预计将出现显着的市场成长,主要是由于安装和安装的需求增加.保持现有系统的能源效率。

- 主要新兴经济体建筑业的成长以及资讯中心市场等终端用户市场的扩张是预测期内推动暖通空调服务市场发展的影响因素。使用 HVAC 系统的优点是能源效率、改善效果和更长的使用寿命。根据英国石油公司 (BP) PLC 的数据,印度的一次能源消耗到 2022 年将增加 10%,从 32 艾焦耳增加到 35 艾焦耳。

- 此外,复杂的全球气候环境和维持建筑物周围环境的迫切需求是在预测期内对市场产生积极影响的关键原因。近年来,智慧功能和更高的能源效率已成为大多数客户的关键购买标准。预计这一趋势将在未来几年内获得关注。根据欧盟智慧能源欧洲计画共同创立的Stratego称,2010年至2050年投资500亿欧元(约524.3亿美元)将节省足够的燃料以降低能源系统的成本。作为此项投资的一部分,区域供暖所占份额为 50 亿欧元(约 52.4 亿美元),个人热泵份额为 150 亿欧元(约 157.3 亿美元)。

- 此外,设备需求的任何变化都将进一步对服务市场产生积极影响,因为对新设备的更高需求会导致更多的安装或改造服务。暖通空调公司为非商业和商业业主提供各种服务。这些服务不仅着重于提高设备效能,还可以降低能源成本。

- 此外,欧盟也聚焦在《欧洲绿色协议》,该指令旨在到2030 年将能源消耗减少9%。这种情况有利于暖通空调製造商,因为欧洲各国政府一直在启动针对节能家居改善的税收抵免计划。例如,义大利税务局最近为 Suberbonus 提供住宅区翻修 110% 的税收减免,以提高能源效率。这增加了住宅领域以新的 HVAC 设备取代旧的 HVAC 设备的需求。

- 随着COVID-19的爆发,大多数商业和工业建设项目的开工进度放缓,有些项目被取消。一些暖通空调製造商的生产线不得不暂停数週,安装人员发现他们的新安装项目受到卫生准则的限制。然而,在义大利等欧洲国家,AHU 销售受益于 COVID-19 导致的通风需求增加。

暖通空调市场趋势

住宅领域预计将显着成长

- 住宅领域对暖通空调服务的需求主要是由于世界人口的增长,从而导致了新的安装。欧洲、北美等已开发地区的市场主要来自维修和更换服务。此外,截至2022年10月,中国人口为14.5亿,其次是印度,人口为13.8亿。

- 随着全球气温上升和生活水平提高,空调系统的市场渗透率预计将在发展中国家目前的水平上大幅增长。此外,在全球金融危机和房地产市场崩溃的背景下,许多成熟经济体的房屋过剩导致现有住房成本下降,并抑制了最新的住宅建设支出。

- 根据JRAIA统计,近年来全球房间空调需求量已增加至9,516万台。此外,Motilal Oswal Group表示,不断成长的家用电器需求和相当低的普及率使得印度空调市场有很大的成长空间,预计2023财年将达到970万台。

- 此外,政府部门对新建筑和智慧基础设施的投资也可以推动对暖通空调服务的需求。根据美国人口普查局的数据,2022 年3 月美国新屋开工量约为68,000 套,比2021 年3 月增长3.9%。此外,美国2021 年共发放了622,000 张多户住宅建筑许可证,而2021 年美国共发放了492,000 套多户住宅建筑许可证。前十二个月。

- 例如,2022 年 4 月,大金宣布支持 REPowerEU,该计画设定了目标,将热泵的部署量从 2027 年的 1,000 万台增加到 2030 年的 3,000 万台。这进一步与住宅脱碳运动相关。可以帮助欧盟在2050年实现住宅领域的脱碳目标。各种暖通空调服务供应商正在进一步支持此类措施。

- 根据 Aeroseal 的报告,不规则速度热泵可将房主每月的成本降低高达 40%。就其本身而言,适当的建筑或家庭隔热可以将 HVAC 效率提高高达 30%。

美国将经历显着的市场成长

- 政府以增加预算拨款的形式不断增加支持,旨在增加住房拥有率和永续社区发展,以及提高该国的住房负担能力,可能有助于住宅建筑业的不断增长。此外,建筑活动的增加、快速城市化、基础设施改革和暖通空调设备更换是支持该国暖通空调服务市场成长的一些主要因素。

- IEA 的数据显示,美国 90% 以上的家庭拥有空调设备,而居住在世界最热地区的 28 亿人口中只有 8% 拥有空调设备。美国各地家庭和办公室越来越多地使用空调,这将是强调该地区对暖通空调服务需求的主要驱动因素之一。

- 此外,预计新建和现有建筑存量的棕地和绿地机会也将在预测期内显着促进市场成长。此外,拜登计划建立现代化、可持续的基础设施和公平的清洁能源未来,使美国走上一条不可逆转的道路,最迟到2050 年在整个经济范围内实现净零排放。拜登整体计划的很大一部分计划是使商业建筑(特别是老化建筑)更加节能。该计画要求对美国400万处商业设施进行升级改造。作为其计划的一部分,拜登政府宣传的能源效率措施包括安装 LED 照明、电器以及先进的加热和冷却系统。该计划还包括对家庭、办公室、仓库和公共建筑的「能源升级」的投资。

- 美国的暖通空调产业正在向智慧技术发展,因为该地区正在见证高水准的物联网整合。国家政策和法规也管理该国对暖通空调服务的需求。例如,根据 Aeroseal, LLC 的说法,在美国北部,熔炉必须具有 90% 的效率等级,但在南部各州,只需要 80% 的效率等级。这显示暖通空调服务产业往往受到地方和地区法规的推动。

- 根据美国EIA住宅能源消耗调查(RECS),7,600万美国家庭(占总数的64%)使用中央空调设备。大约有 1,300 万户家庭 (11%) 使用热泵来供暖或冷气。到2023年,所有在美国销售的新住宅中央空调和空气源热泵系统都将被要求满足新的能源效率标准,从而推动暖通空调服务的成长。

暖通空调产业概况

暖通空调服务市场竞争十分激烈,由多家知名企业组成。市场参与者正专注于扩大在国外的消费者基础。这些企业利用策略合作措施来提高市场占有率和获利能力。市场上的公司也正在收购从事暖通空调服务技术的新创企业,以增强其生产能力。

- 2022 年 1 月:大金应用材料公司推出了 SiteLineBuilding Controls,这是一种可扩展的基于云端的技术,可连接、管理和监控单个 HVAC 设备和整合建筑系统。透过 SiteLineBuilding Controls,商业建筑业主和营运商可以获得优化性能、改善室内空气品质以及减少能源使用和碳排放的工具和见解。

- 2022 年 1 月:艾默生宣布推出下一代谷轮 ZPK7 单(定)速涡旋压缩机,适用于住宅和轻型商业 HVAC 应用,包括热泵、分离式空调、成套系统、屋顶和地热系统。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 主要新兴经济体建筑业务不断成长

- 不断成长的资料中心市场

- 市场限制

- 劳力短缺/熟练劳动成本高

第 6 章:市场细分

- 依实施类型

- 新建筑

- 改造建筑

- 按最终用户

- 住宅

- 商业的

- 工业的

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 比荷卢经济联盟

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- Siemens AG

- Honeywell International Inc.

- LG Electronics Inc.

- Electrolux AB

- Johnson Controls International PLC

- Lennox International Inc.

- Fujitsu General Ltd

- Robert Bosch GmbH

- Ingersoll-Rand PLC

- Carrier Corporation

- Daikin Industries Ltd.

- Nortek Global HVAC

第 8 章:投资分析

第 9 章:市场的未来

The HVAC Services Market size is estimated at USD 67.90 billion in 2024, and is expected to reach USD 104.19 billion by 2029, growing at a CAGR of 8.94% during the forecast period (2024-2029).

The growing use of air conditioners in homes and offices is one of the significant drivers stressing the need for HVAC services.

Key Highlights

- Technological innovations and climate changes have increased the adoption of HVAC equipment. For instance, in October 2022, 75F Smart Innovations India and Tata Power Trading Company (TPTCL) inked a contract to jointly promote automation and energy-efficient building solutions. Through this partnership, TPTCL and 75F will collaborate to provide solutions for smart building automation and HVAC (heating, ventilation, and air conditioning) optimization powered by advanced technologies like IoT, cloud, and AI/ML.

- Furthermore, the growth in the construction industry and the rising disposable income in developing countries have increased the availability of HVAC equipment for a broader consumer base. For instance, According to the Bureau of Labor Statistics, the construction sector's output in the United States is expected to amount to approximately USD 1.58 trillion by 2028. HVAC services are expected to witness significant market growth, majorly due to the increased need to install and maintain the energy efficiency of the existing systems.

- The growing construction industry in major emerging economies and the expansion of end-user markets, such as the information center market, are influential factors driving the evolution of the HVAC services market over the forecast period. The advantages of using HVAC systems are energy efficiency, improved results, and a longer lifespan. According to British Petroleum (BP) PLC, primary energy consumption in India increased by 10% in 2022, from 32 to 35 exajoule.

- Further, the mixed global climatic circumstances and the vital need to maintain an ambient environment in a building are the key reasons that will positively impact the market over the forecast period. In recent times, intelligent features and higher energy efficiency have been the critical purchase criteria for most customers. The trend is expected to gain traction over the next few years. According to Stratego, co-founded by the Intelligent Energy Europe Programme of the EU, an investment of EUR 50 billion ( ~USD 52.43 billion) from 2010 to 2050 will save enough fuel to reduce the costs of the energy system. As part of this investment, district heating's share stood at EUR 5 billion (~USD 5.24 billion), and individual heat pumps at EUR 15 billion (~USD 15.73 billion).

- Furthermore, any changes in demand for the equipment will further impact the service market positively, as higher demand for new equipment leads to higher installation or retrofitting services. HVAC companies offer a variety of services for both non-commercial and commercial property owners. These services not only give attention to improving the equipment's performance but can also reduce energy costs.

- Furthermore, the European Union is focused on the European green Deal, a directive that aims to reduce energy consumption by 9% by 2030. Such instances favor HVAC manufacturers as governments across Europe have been initiating Tax Credit programs for energy-efficient home improvements. For example, the Italian Revenue agency recently offered Suberbonus a 110% tax deduction for renovations in residential sectors to improve energy efficiencies. This increases the demand for replacing older HVAC equipment with new HVAC equipment in the residential sector.

- With the outbreak of COVID-19, most commercial and industrial construction projects started carried on at a slower pace while some were canceled. Production lines at some HVAC manufacturers had to be put on hold for several weeks, and installers saw their new installation projects limited by sanitary guidelines. However, in European countries such as Italy, AHU sales benefitted from the increased ventilation demand due to COVID-19.

HVAC Market Trends

Residential Segment is Expected to Register Significant Growth

- The HVAC services need in the residential sector are mainly due to the growing population in the world, thereby leading to new installations. The market in developed regions, like Europe and North America, is primarily from the maintenance and replacement services. Further, as of October 2022, China's population stood at 1.45 billion, followed by India, with residents of 1.38 billion.

- With rising global temperatures and enhancing living standards, market penetration for A/C systems is expected to grow substantially from current levels in developing nations. Also, amidst the global financial crisis and housing market collapse, an overhang of housing in many mature economies led to a breakdown in the costs of existing homes and stifled the latest residential construction spending.

- According to JRAIA, the global demand for room air conditioners has increased to 95.16 million in recent years. Furthermore, according to Motilal Oswal Group, increasing demand for home appliances and a reasonably low penetration rate has left the Indian air conditioner market with plenty of room to grow and is estimated to reach 9.7 million units in the financial year 2023.

- Moreover, investments by the government sector in new building construction and smart infrastructure can also drive the demand for HVAC services. According to the U.S. census bureau, US new home construction in March 2022 was around 68,000 units, or 3.9% higher than in March 2021. Further, 622,000 building permits for multifamily housing units were granted in the United States in 2021, compared with 492,000 over the previous twelve months.

- For instance, in April 2022, Daikin announced its support for the REPowerEU, which has set a goal to boost the rollout of heat pumps from 10 million units in 2027 to 30 million units in 2030. This is further associated with residential decarbonization as the movement can help the European Union achieve the residential sector's decarbonization goals by 2050. Various HVAC services vendors are further supporting such initiatives.

- According to an Aeroseal report, irregular speed heat pumps can reduce monthly homeowner costs by up to 40%. On its own, proper building or home insulation can improve HVAC efficiencies by up to 30%.

United States\sto Experience Significant Market Growth

- Growing government support, in the form of higher budget allocations, designed to increase homeownership and sustainable community development, and the increasing housing affordability in the country, may contribute to the ever-growing residential construction sector. In addition, increased construction activities, rapid urbanization, infrastructural reforms, and HVAC unit replacements are some of the major factors supporting the growth of the HVAC services market in the country.

- According to IEA, more than 90% of households in the United States have air conditioning equipment, compared to just 8% of the 2.8 billion people living in the hottest parts of the world. The growing use of air conditioners in homes and offices around the U.S. will be one of the top drivers stressing the need for HVAC services in the region.

- Furthermore, brownfield and greenfield opportunities for the new and existing building stock are also anticipated to significantly aid the market growth during the forecast period. Further, the Biden plan to build modern, sustainable infrastructure and an equitable clean energy future to put the United States on an irreversible path to achieve net-zero emissions, economy-wide, by no later than 2050. A large part of the overall Biden plan is to make commercial buildings (especially aging buildings) more energy efficient. The plan calls for an upgrade of 4 million commercial facilities in the United States. Energy efficiency measures touted by the Biden administration as part of their plan include installing LED lighting, electrical appliances, and advanced heating and cooling systems. The plan also comprises investment in 'energy upgrades' for homes, offices, warehouses, and public buildings.

- The HVAC Industry is moving towards smart technologies in the United States, as the region is witnessing a high level of IoT integrations. State policies and regulations also govern the demand for HVAC services in the country. For instance, according to Aeroseal, LLC, in the northern U.S., furnaces must have a 90% efficiency rating, but in southern states, only an 80% efficiency rating is required. This indicates that the HVAC services industry tends to be fueled by local and regional regulations.

- According to the US EIA Residential Energy Consumption Survey (RECS), 76 million primarily occupied US homes (64% of the total) use central air-conditioning equipment. Heat pumps are used for heating or cooling in approximately 13 million homes (11%). By 2023, all new residential central air-conditioning and air-source heat pump systems sold in the United States will be demanded to meet new energy efficiency standards, fueling the growth of HVAC services.

HVAC Industry Overview

The HVAC services market is favorably competitive and consists of several prominent players. The market performers are focusing on expanding their consumer base across foreign countries. These enterprises leverage strategic collaborative initiatives to boost their market share and profitability. The companies performing in the market are also acquiring start-ups working on HVAC services technologies to strengthen their production capacities.

- January 2022: Daikin Applied introduced SiteLineBuilding Controls, a scalable, cloud-based technology that connects, manages, and monitors individual HVAC equipment and integrated building systems. With the SiteLineBuilding Controls, commercial building owners and operators have the tools and insights to optimize performance, improve indoor air quality, and trim energy use and carbon emissions.

- January 2022: Emerson announced the launch of the next generation of Copeland ZPK7 single (fixed) speed scroll compressors for residential and light commercial HVAC applications, including heat pumps, split air conditioning, packaged systems, rooftops, and geothermal systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Construction Business in Major Emerging Economies

- 5.1.2 Growing Data Center Market

- 5.2 Market Restraints

- 5.2.1 Labor Shortage/High Costs of Skilled Labor

6 MARKET SEGMENTATION

- 6.1 By Implementation Type

- 6.1.1 New Construction

- 6.1.2 Retrofit Buildings

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Benelux

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Siemens AG

- 7.1.2 Honeywell International Inc.

- 7.1.3 LG Electronics Inc.

- 7.1.4 Electrolux AB

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Lennox International Inc.

- 7.1.7 Fujitsu General Ltd

- 7.1.8 Robert Bosch GmbH

- 7.1.9 Ingersoll-Rand PLC

- 7.1.10 Carrier Corporation

- 7.1.11 Daikin Industries Ltd.

- 7.1.12 Nortek Global HVAC