|

市场调查报告书

商品编码

1444434

託管IT基础设施服务:市场占有率分析、产业趋势与统计、成长预测 (2024-2029)Managed IT Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

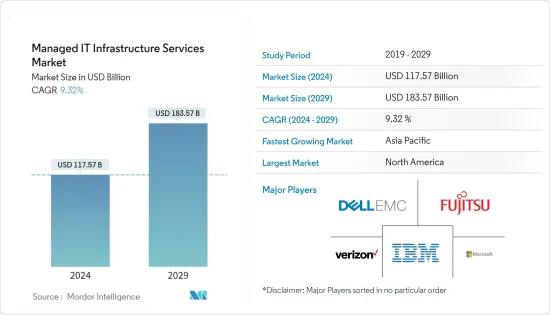

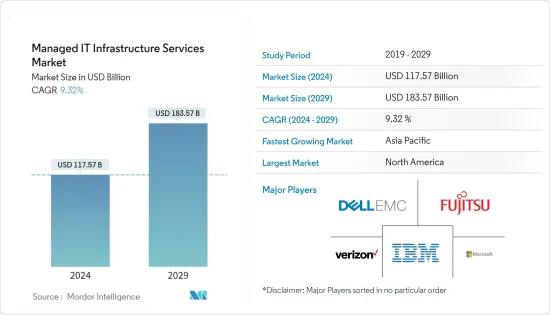

託管IT基础设施服务市场规模预计到2024年为1175.7亿美元,预计到2029年将达到1835.7亿美元,在预测期内(2024-2029年)增长9.32%。复合年增长率为

主要亮点

- 越来越多的企业在努力平衡确保IT基础设施以最佳效能水准运作的同时管理相关成本,因此转向提供基础架构服务的供应商。託管基础设施服务可协助各行业仅专注于其核心业务。

- 这些服务主要由IT产业采用,成本优化、关注核心能力和资料安全仍然是主要关注点。然而,最近云端基础的技术的普及和技术进步极大地促进了这一趋势。

- 巨量资料等技术的普及进一步增加了外包IT服务的需求。公司可以结合利用巨量资料和云端来提供可扩展且经济高效的解决方案。例如,亚马逊的 Elastic Map Reduce 展示瞭如何利用云端的弹性运算能力进行巨量资料处理。

- 此外,更新过时硬体的需求也是市场的主要驱动因素。 Spice Works Inc. 进行的一项研究显示,接受调查的 700 家公司中有 64% 表示,更新过时的信息技术 (IT) 基础设施的需要和安全问题是 IT 预算过高的主要原因。 。

託管IT基础设施服务市场趋势

技术普及和云端基础技术进步补充了需求

- 在当前市场情况下,对云端服务和基础设施升级活动的依赖日益增加是推动託管IT基础设施服务需求的主要因素。事实上,未来几年的大部分基础设施开发将致力于支援不断增长的云端服务需求。

- IT基础设施本身的形势正在快速改变。随着越来越多的公司将大部分或全部 IT 服务和应用程式迁移到云端,传统的笼式伺服器机架正在迅速消失。因此,随着企业增加对先进云端基础设施的投资,即使是传统IT基础设施的投资预计也会在预测期内下降。

- 此外,根据思科全球云端指数报告,到今年,超过 90% 的工作负载将云端基础。全球云端流量将占所有资料中心流量的95%。同时,传统资料中心工作负载和计算实例预计将在同一时期下降。以前,一台伺服器运行一个工作负载和计算实例。然而,随着伺服器运算能力和虚拟的提高,每个实体伺服器的多个工作负载和运算实例在云端架构中变得非常常见。

北美地区占据最大市场占有率

- 由于早期的技术采用和大量的 IT资料中心,北美仍然是託管IT基础设施服务的最大市场。

- 近年来,北美地区的云端迁移急剧增加。这主要归功于该地区强大的IT基础设施、法律、标准和技术经验等因素。此外,亚马逊网路服务、IBM公司、微软公司、谷歌和思科系统等着名云端公司的存在也推动了北美云端迁移服务市场的扩张。

- 另一个因素是IT应用在多个最终用户产业的高度自动化和显着渗透,为该地区的IT基础设施服务创造了持续的需求。

託管IT基础设施服务产业概述

由于存在各种规模的参与者,託管IT基础设施服务市场竞争非常激烈。市场的分散性导致人们更加关注收购和利基领域作为扩大策略。随着服务产品的不断发展,所有参与者都必须继续投资于新时代的技能和技术,以在竞争中保持领先。这只能透过僱用合适的研发人才或收购有潜力颠覆该行业的有趣的新兴企业来实现。小公司相对于大公司的主要优势是他们的资料中心位于本地,因此可以更好地服务本地市场。这迫使大公司进行积极收购,以扩大其全球足迹。

2022 年 8 月,戴尔科技集团宣布推出与 VMware 共同设计的新基础架构解决方案。这些新的基础设施解决方案提高了采用多重云端和边缘策略的企业的自动化和效能。

2022年3月,Verizon Communications Inc.宣布将在年终前将其5G超宽频网路扩展到1.75亿人口。该公司正致力于将 5G 行动、国家宽频、行动边缘运算(MEC)、业务解决方案、价值市场和网路货币收益,预计将有助于增加公司的服务和其他收益。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件和定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场动态介绍

- 市场驱动因素

- 透过实施託管服务优化成本

- 由广泛的技术和云端基础的技术的进步普及

- 市场限制因素

- 安全和隐私问题是限制因素

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按服务类别

- 虚拟

- 联网

- 贮存

- 伺服器

- 按公司规模

- 中小企业

- 大公司

- 按配置

- 本地

- 云

- 按最终用户

- 资讯科技和通讯

- 零售

- 运输和物流

- BFSI

- 製造业

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Fujitsu Ltd.

- CSS Corp Pvt Ltd.

- Dell EMC(EMC Corporation)

- IBM Corporation

- Alcatel-Lucent SA(Nokia Corporation)

- Microsoft Corporation

- Verizon Communications Inc.

- Citrix Systems Inc.

- Tata Consultancy Services Limited

- Deutsche Telekom AG

第七章 投资分析

第八章市场机会及未来趋势

The Managed IT Infrastructure Services Market size is estimated at USD 117.57 billion in 2024, and is expected to reach USD 183.57 billion by 2029, growing at a CAGR of 9.32% during the forecast period (2024-2029).

Key Highlights

- Companies struggling to strike a balance between ensuring their IT infrastructure functions at optimal performance levels and simultaneously managing the associated costs are increasingly hiring vendors offering infrastructure services. Managed infrastructure services help different industry verticals to focus only on their core business.

- These services are mostly being adopted in the IT industry, where cost optimization, emphasis on core competencies, and data security remain significant concerns. However, the recent proliferation of cloud-based technology and technological advancements is the major contributor to this trend.

- The proliferation of technologies like big data has further added to the need for outsourcing IT services. Companies can leverage the combination of both Big Data and the Cloud to provide scalable and cost-effective solutions. For example, Amazon's "Elastic Map Reduce" demonstrates how the power of cloud elastic computes is leveraged for big data processing.

- Further, the need to update outdated hardware is another major market driver. According to a survey conducted by Spice works Inc., 64% of the 700 companies involved in the study reported that the need to update outdated information technology (IT) infrastructure and security concerns are the major factors leading to high IT budgets.

Managed IT Infrastructure Services Market Trends

Technological Proliferation and Advancement of Cloud Based Technology Complement the Demand

- In the current market scenario, the increasing dependency on cloud services and infrastructure upgrading activities are the major factors driving the demand for managed IT infrastructure services. In fact, most of the infrastructure developments in the next few years are dedicated to supporting the increasing demand for cloud services.

- The landscape of IT infrastructure itself is changing rapidly. Traditional racks of servers stored in cages are quickly disappearing as more companies migrate most or all of their IT services and applications to the cloud. As a result, even investments in traditional IT infrastructure are expected to decline over the forecast period as companies increasingly invest in advanced cloud infrastructure.

- Moreover, according to the Cisco Global Cloud Index Report, more than 90 percent of all workloads will be cloud-based by this year. Global cloud traffic will represent 95 percent of total data center traffic. Whereas traditional data center workloads and compute instances are expected to decline during the same period. Historically, one server carried one workload and computed instance. But with increasing server computing capacity and virtualization, multiple workloads and compute instances per physical server are common in cloud architectures.

North America Region to Hold the Largest Market Share

- North America remains the largest market for managed IT infrastructure services because of the early adoption of technology and numerous IT data centers.

- North America has seen a dramatic increase in cloud migration over the years, mostly because of the region's strong IT infrastructure, laws, standards, and access to technological experience, among other factors. Additionally, the expansion of the cloud migration services market in North America has been aided by the existence of illustrious cloud firms like Amazon Web Services, IBM Corporations, Microsoft Corporation, Google, and Cisco Systems.

- The other factor is the high degree of automation and immense penetration of IT applications in several end-user industries, creating a constant demand for IT infrastructure services in the region.

Managed IT Infrastructure Services Industry Overview

The managed IT infrastructure services market is highly competitive due to the presence of many large and small players. The fragmented nature of the market is leading to acquisitions or a growing focus on niche segments as strategies to scale up. The continuously evolving nature of the services offered has made it imperative for all players to keep investing in new-age skills and technologies to stay relevant and ahead of the competition. This can only be achieved by hiring the right R&D talent and/or by acquiring any interesting start-ups that have the potential to disrupt the space. The major advantage that the smaller players have over the bigger ones is their ability to serve the local markets better because of the presence of their data centers locally. This forces bigger players to go for aggressive acquisitions to enhance their global footprint.

In August 2022, Dell Technology announced the launch of new infrastructure solutions, co-engineered with VMware, these new infrastructure solutions increase automation and performance for businesses adopting multi-cloud and edge strategies.

In March 2022, Verizon Communications Inc. announced the expansion of its 5G Ultra Wideband network to an expected 175 million people by year-end 2022. The company outlined several growth avenues, including 5G mobility, nationwide broadband, mobile edge computing (MEC), business solutions, the value market, and network monetization, with the expectation that these will help the company achieve service and other revenue growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

- 4.3 Market Drivers

- 4.3.1 Cost Optimization with the Adoption of Managed Services

- 4.3.2 Technological Proliferation and Advancement of Cloud Based Technology will Act as a Driver

- 4.4 Market Restraints

- 4.4.1 Concerns Over Security and Privacy will Act as a Restraint

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Category

- 5.1.1 Virtualization

- 5.1.2 Networking

- 5.1.3 Storage

- 5.1.4 Servers

- 5.2 By Enterprise Size

- 5.2.1 Small & Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Deployment

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.4 By End-User

- 5.4.1 IT & Telecommunication

- 5.4.2 Retail

- 5.4.3 Transportation & Logistics

- 5.4.4 BFSI

- 5.4.5 Manufacturing

- 5.4.6 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujitsu Ltd.

- 6.1.2 CSS Corp Pvt Ltd.

- 6.1.3 Dell EMC (EMC Corporation)

- 6.1.4 IBM Corporation

- 6.1.5 Alcatel-Lucent SA (Nokia Corporation)

- 6.1.6 Microsoft Corporation

- 6.1.7 Verizon Communications Inc.

- 6.1.8 Citrix Systems Inc.

- 6.1.9 Tata Consultancy Services Limited

- 6.1.10 Deutsche Telekom AG