|

市场调查报告书

商品编码

1444450

全球锚固水泥浆市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Anchors and Grouts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

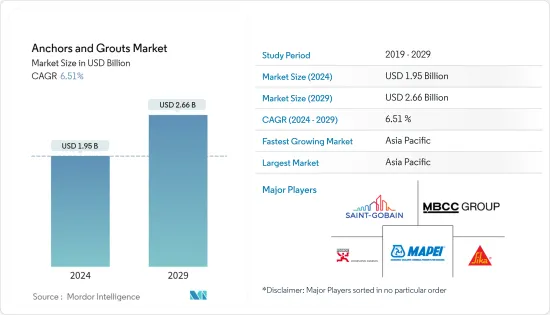

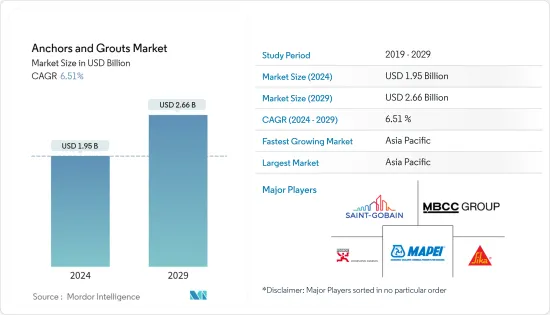

全球锚固水泥浆市场规模预计在2024年达到19.5亿美元,并在2024-2029年预测期内以6.51%的复合年增长率增长,到2029年将达到26.6亿美元。这一目标已经实现。

主要亮点

- COVID-19 大流行对全球经济产生了负面影响,扰乱了 2020 年的工业投资和活动。然而,从2021年开始,产业开始再次回归稳定状态。

- 石化厂扩建的成长和建筑业的强劲成长预计将推动锚固水泥浆的需求。

- 另一方面,挥发性排放法规和技术纯熟劳工的缺乏预计将阻碍市场成长。

- 然而,锚固水泥浆系统技术进步带来的巨大成长潜力可能为所研究的市场创造利润丰厚的成长机会。

- 亚太地区主导全球市场,其中消费量最高的国家是中国和日本等。

锚固灌浆水泥浆市场趋势

基础设施领域需求扩大

- 锚固水泥浆用于道路和桥樑、机场、铁路网和造船厂等基础设施部门。基础设施领域计划数量的增加预计将在预测期内推动市场。

- 锚固水泥浆经常用于铁轨上以连接和支撑地面和轨道。锚固水泥浆也用于电轨、铁路桥樑和隧道的支撑结构。这种支撑结构必须非常坚固且耐用,因为它们需要立即转移大量的重量。

- 水水泥浆由于其不收缩、高流动性和长期性能等特性,主要用于桥樑、水坝、岩锚和类似基础设施的结构修復和加固。

- 2021 年最后一个季度,印度铁路公司将根据「PM Gati Shakti」计划,在 4-5 年内开发约 500 个多式联运货运站和约 102 条半高速 Vande Bharat Express,价值 66.8 亿美元。到 2024 年,大约 40 个城市将实现连网。

- 2021 年 6 月,Webuild Group 及其子公司兼合资伙伴 Lane Construction 与 Texas Central LCC 签订了价值 160 亿美元的最终协议,在休士顿和达拉斯之间建造美国第一条全面的高铁线路。

- 预计亚太地区机场基础设施在未来几年将显着成长。中国的长期计画是到2035年将机场数量增加到450个,印度的目标是透过UDAN计画在2025年增加100个新机场。

- 所有上述发展预计将在未来几年推动基础设施领域锚固水泥浆市场的需求。

亚太地区主导市场

- 亚太地区的建筑业是世界上最大的,并且由于人口增长、中阶收入增加和都市化稳步增长。

- 中国、印度、印尼、越南和菲律宾等亚太新兴经济体的建设活动正在强劲成长。强劲的经济状况预计将进一步加速该地区住宅建设活动的扩张。

- 中国正处于建设热潮之中。中国政府正在推出一项大规模建设计画,包括为未来十年内2.5亿人搬入新大都市做准备。因此,在建筑工程过程中的各种应用中可能会出现对锚固水泥浆的需求,以增强建筑物的性能。

- 根据中国国家统计局的数据,2021年中国建筑业产值约为4.1兆美元,可能会为调查市场带来巨大的需求。

- 印度政府高度重视基础建设以促进经济成长,并计划于2025年在基础建设上投入1.4兆美元。印度房地产业预计到2030年将达到1兆美元,预计占GDP比率%。

- 建筑业是印度第二大产业,预计2022年将成长10.7%。印度建筑业将成为全球第三大市场,预计其规模在预测期内最终将达到近1兆美元。

- 日本拥有各种高层建筑(约 290 座),东京是此类建筑的主要中心。日本此类建筑的规划和建设正在经历短期成长。

- 所有上述因素预计将在预测期内推动该地区调查的市场需求。

锚固水泥浆产业概况

锚固水泥浆市场本质上是分散的。研究市场中的主要企业包括圣戈班、Fosroc Inc.、西卡股份公司、MBCC 集团和马贝公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业需求增加

- 石化厂扩建的成长

- 抑制因素

- VOC排放法规和熟练劳动力短缺

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔:市场规模(以金额为准)

- 产品类别

- 水泥固定材料

- 树脂固定材料

- 环氧水泥浆

- 聚氨酯水泥浆

- 其他产品类型

- 部门

- 住宅

- 商业的

- 产业

- 基础设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Bayshield International IBM

- Bostik(Arkema)

- Elmrr

- Five Star Products Inc.

- Fosroc Inc.

- Gantrex

- GCP Applied Technologies Inc.

- GRUPA SELENA

- Henkel AG &Co. KGaA

- LATICRETE International Inc.

- MAPEI SPA

- MBCC Group

- Nano Vision(PVT)Ltd

- Saint-Gobain

- Sika AG

- Thermax Limited

第七章市场机会与未来趋势

第8章锚固水泥浆系统的技术进步

简介目录

Product Code: 60918

The Anchors and Grouts Market size is estimated at USD 1.95 billion in 2024, and is expected to reach USD 2.66 billion by 2029, growing at a CAGR of 6.51% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had an adverse impact on the global economy, which interrupted industrial investments and activity in 2020. However, since 2021, the industry has started to bounce back to its steady state once again.

- Growth in the petrochemical plant expansions and robust growth of the construction sector are the factors expected to drive the demand for anchors and grouts.

- On the other hand, regulations for VOC emissions and the inadequacy of skilled labor are expected to hinder the growth of the market.

- However, the huge growth potential from the technological advancements in the anchor grout system is likely to create a lucrative growth opportunity for the market studied.

- The Asia-Pacific dominated the market across the world with the most substantial consumption from countries like China and Japan.

Anchors and Grouts Market Trends

Growing Demand in the Infrastructure Sector

- Anchors and grouts are used in the infrastructure sector in roads and bridges, airports, railway networks, dockyards, etc. The growing number of projects in the infrastructure sector is expected to drive the market during the forecast period.

- Grouts and anchors are used a lot in railway tracks in order to bind the ground and track and provide support. Grouts and anchors are also used in support structures for electric rails, railway bridges, and tunnels. Such support structures should be very strong and durable, as they are supposed to allow the commutation of a huge amount of weight at a time.

- Cementitious grouts are primarily used for structural repairs and strength impartation in like infrastructures like bridges, dams, and rock anchors due to the offered properties like non-shrinkage, high fluidity, and long-lasting performance.

- During the last quarter of 2021, Indian Railways announced its plan to develop about 500 multi-modal cargo terminals worth USD 6.68 billion under the 'PM Gati Shakti' program in 4-5 years and about 102 semi-high-speed Vande Bharat Expresses by 2024 connecting about 40 cities.

- In June 2021, Webuild Group, with its subsidiary and joint venture partner Lane Construction, signed a final agreement worth USD 16 billion with Texas Central LCC for the construction of the first true high-speed railway in the United States between Houston and Dallas.

- The Asia-Pacific is expected to witness strong growth in airport infrastructure in the coming years. China holds a long-term plan to increase the number of airports to 450 by 2035, while India aims to add 100 new airports by 2025 through its UDAN scheme.

- All such aforementioned developments are expected to drive the demand for the anchors and grouts market in the infrastructure sector in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific construction sector is the largest in the world, and it is increasing at a healthy rate, owing to the rising population, increasing middle-class income, and urbanization.

- The emerging economies in the Asia-Pacific region, such as China, India, Indonesia, Vietnam, and the Philippines, have been witnessing robust growth in construction activities. The robust economic performance is expected to further accelerate the expansion of housing construction activities in the region.

- China is amid a construction mega-boom. The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next 10 years. Thus, this may create a demand for anchors and grouts in various applications during building construction as it enhances the building's properties.

- According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately USD 4.10 trillion, which would likely provide huge demand for the market studied.

- The Government of India is strongly focused on infrastructure development to boost economic growth and has plans to spend USD 1.4 trillion on infrastructure by 2025. The real estate industry in India is expected to reach USD 1 trillion by 2030, and it is anticipated to contribute approximately 13% to the GDP.

- The construction industry is the second-largest industry in India and is estimated to grow at 10.7% in 2022. India's construction industry is predicted to emerge as the third-largest market in the world, with a size of almost USD 1 trillion by the end of forecast period.

- Japan hosts various high-rise buildings (nearly 290), with Tokyo being a major hub for such buildings. The planning and construction of such buildings are witnessing growth in Japan in the short term.

- All the aforementioned factors are expected to drive the demand for the market studied in the region during the forecast period.

Anchors and Grouts Industry Overview

The anchors and grouts market is fragmented in nature. Some of the major players in the market studied include Saint-Gobain, Fosroc Inc., Sika AG, MBCC Group, and Mapei SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Growth in Petrochemical Plant Expansions

- 4.2 Restraints

- 4.2.1 Regulations for VOC Emissions and Inadequacy of Skilled Labor

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Cementitious Fixing

- 5.1.2 Resin Fixing

- 5.1.2.1 Epoxy Grout

- 5.1.2.2 Polyurethane Grout

- 5.1.3 Other Product Types

- 5.2 Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Infrastructure

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bayshield International IBM

- 6.4.2 Bostik (Arkema)

- 6.4.3 Elmrr

- 6.4.4 Five Star Products Inc.

- 6.4.5 Fosroc Inc.

- 6.4.6 Gantrex

- 6.4.7 GCP Applied Technologies Inc.

- 6.4.8 GRUPA SELENA

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 LATICRETE International Inc.

- 6.4.11 MAPEI SPA

- 6.4.12 MBCC Group

- 6.4.13 Nano Vision (PVT) Ltd

- 6.4.14 Saint-Gobain

- 6.4.15 Sika AG

- 6.4.16 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 Technological Advancements in the Anchor Grout System

02-2729-4219

+886-2-2729-4219