|

市场调查报告书

商品编码

1444458

液流电池 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Flow Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

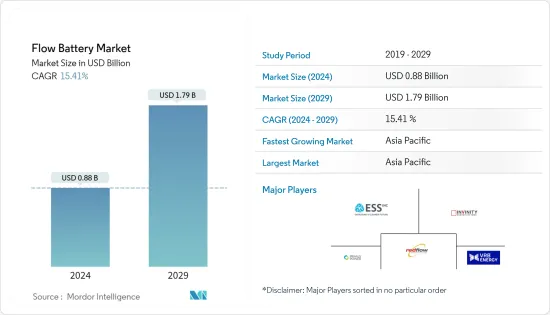

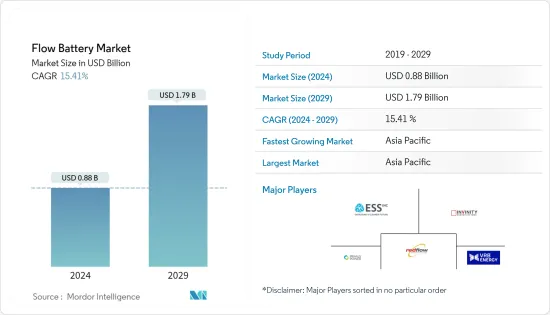

液流电池市场规模预计到2024年为8.8亿美元,预计到2029年将达到17.9亿美元,在预测期内(2024-2029年)CAGR为15.41%。

2020年,COVID-19对市场产生了不利影响。目前,市场已达到疫情前的水准。

主要亮点

- 从长远来看,由于液流电池技术在再生电力系统等长期储能应用中的渗透率不断提高,且使用寿命长,液流电池市场的应用可能会在研究期间成长。

- 另一方面,由于电池不能储存太多能量,因此市场在不久的将来可能不会成长得那么快。

- 儘管如此,新的技术创新使液流电池在新的商业领域的范围多样化,为市场成长创造了巨大的机会。

- 由于该地区即将开展许多再生能源和储存项目,预计亚太地区在预测期内将以最快的速度成长。

液流电池市场趋势

全钒氧化还原液流电池预计将显着成长

- 钒氧化还原液流电池 (VRFB) 是一种氧化还原液流电池 (RFB),透过分别在负极和正极半电池中使用 V2+/V3+ 和 V4+/V5+ 钒氧化还原对来储存能量。这些电池彼此不相关,并且每种电池都可以针对不同类型的使用进行最佳化。

- 许多国家一直致力于不遗余力地增加能源需求。因此,许多储能係统已在独立能源系统和再生能源系统中部署到位。

- 在过去的十年中,全球再生能源装置容量和发电量一直在稳步增长。 2021年,全球再生能源装置容量为3063.93吉瓦,成长近9.1%。由于太阳能和风能等再生资源间歇性地、不同程度地发电,因此在高需求期间储存这些能源至关重要。

- 因此,现代储能係统(ESS)在再生能源专案中变得不可或缺。再生能源产业的快速成长预计将成为全球 ESS 市场成长的最强劲驱动力之一。

- 例如,2022年12月,台湾工业科技公司Everdura向Invinity Energy Systems发出了15 MWh的订单。这显示对VRF电池的需求正在成长,这正是预测期内预计会发生的情况。

- 随着更新、更便宜的电池技术的发展,现在有更多的住宅、商业和工业太阳能屋顶光伏系统也配备了 ESS。

- 预计此类发展将在预测期内推动市场发展。

预计亚太地区将主导市场

- 亚太地区是电池製造的主要地区。全球电池产量最高的地区是在该地区生产的。中国和日本等国家对该地区电池的发展发挥了重要作用。该地区电池市场的另一个重要推动力是储能项目投资的不断增长,目前该项目的发展速度是该地区最快的。因此,预计未来几年将宣布许多再生能源和储能项目。

- 液流电池具有易于运输、模组化、效率高等优点。这些电池可以大规模部署,并且可以轻鬆跨越千瓦到兆瓦的范围。因此,亚太地区的利害关係人专注于开发与再生能源发电相结合的电力系统或电网储能係统。

- 此外,中国在最新的五年计画(2021-25)中强制要求其太阳能和风能专案安装储能係统。这也可能支持研究期间该地区市场的成长。

- 2022年8月,罗克能源宣布将在大连市的一个电力专案中使用氧化还原液流电池储存系统。该电池系统可储存来自风力涡轮机和其他来源的能量高达 400 兆瓦时。该项目预计投资约2.81亿美元。截至2021年8月,融科累计交付氧化还原液流电池约560MWh。大连工程将额外增加400兆瓦时的储能容量。

- 住友电工2022年4月表示,将在日本北部的北海道岛上建造一个51兆瓦时的液流电池计画。北海道岛是清洁能源的热点地区,因为它有大量的土地可以利用。然而,近年来,该公司在跟上电网能源容量的增长方面遇到了困难,该电网仅部分连接到日本南部人口最多的岛屿本州岛。北海道电力已在其南早井变电站安装了新系统,它将支援公用电网。北海道电力和其他利害关係人将分摊电池营运成本。

- 因此,凭藉新的可再生能源和能源储存製造设施和项目,该地区预计将在未来几年内引领市场。

液流电池产业概况

液流电池市场适度分散。市场上一些主要的参与者包括(排名不分先后):VRB Energy、RedFlow Ltd.、Invinity Energy Systems PLC、Primus Power Corporation 和 ESS Tech Inc. 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究范围

- 市场定义

- 研究假设

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场概览

- 介绍

- 到 2028 年市场规模与需求预测(百万美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 司机

- 限制

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 全钒液流电池

- 锌溴液流电池

- 铁液流电池

- 锌铁液流电池

- 地理

- 北美洲

- 欧洲

- 亚太

- 南美洲

- 中东和非洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 领先企业采取的策略

- 公司简介

- VRB Energy

- ESS Tech Inc.

- Vanadis Power GmbH

- Primus Power Corporation

- RedFlow Ltd.

- Invinity Energy Systems PLC

- Dalian Rongke Power Co. Ltd.

- CellCube Energy Storage Systems Inc.

- Stryten Energy

- H2, Inc.

第 7 章:市场机会与未来趋势

The Flow Battery Market size is estimated at USD 0.88 billion in 2024, and is expected to reach USD 1.79 billion by 2029, growing at a CAGR of 15.41% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market.Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the applications of the flow battery market are likely to grow during the study period due to the growing penetration of the technology in long-duration energy storage applications, such as renewable power systems, and their long service lives.

- On the other hand, because battery cells don't hold much energy, the market may not grow as fast in the near future.

- Nevertheless, the new technological innovations to diversify the scope of flow batteries in new commercial areas create tremendous opportunities for market growth.

- The Asia-Pacific region is expected to grow at the fastest rate during the forecast period due to many upcoming renewable energy and storage projects in the region.

Flow Battery Market Trends

Vanadium Redox Flow Batteries are Expected to Witness Significant Growth

- The Vanadium Redox Flow Battery (VRFB) is a Redox Flow Battery (RFB) that stores energy by using V2+/V3+ and V4+/V5+ redox couples of vanadium in the negative and positive half-cells, respectively.The power ratings and energy ratings of these batteries are not related to each other, and each can be optimized for a different type of use.

- Many countries have always worked to increase their energy needs without any gaps. As a result, many energy storage systems have been put in place in both stand-alone energy systems and renewable energy systems.

- Over the last decade, installed renewable energy capacity and generation have been rising steadily across the globe. During 2021, global installed renewable energy capacity stood at 3063.93 GW, increasing by nearly 9.1%. As renewable resources such as solar and wind generate power intermittently and at various levels, storing this energy during high demand is vital.

- Due to this, modern energy-storing systems (ESS) are becoming indispensable in renewable energy projects. The rapid growth in the renewable energy sector is expected to be one of the strongest drivers for the growth of the global ESS market.

- For example, in December 2022, Everdura, an industrial technology company in Taiwan, gave Invinity Energy Systems an order for 15 MWh.This shows that the need for VRF batteries is growing, which is what is expected to happen during the forecast period.

- With the development of newer, cheaper battery technologies, there are now a lot more residential, commercial, and industrial solar rooftop PV systems that also have ESS.

- Such developments are expected to propel the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is a major region for the manufacturing of batteries. The highest volumes of batteries worldwide are manufactured in this region. Countries like China and Japan have been instrumental in the development of batteries in the region. Another prominent driver for the region's battery market is the growing investments in energy storage projects, which are currently moving at the fastest pace in the region. Thus, many renewable energy and energy storage projects are expected to be announced in the coming years.

- Flow batteries have the advantages of easy transportability, modularity, and high efficiency. The batteries can be deployed on a large scale and can easily span the kW to MW range. As a result, stakeholders in Asia-Pacific are focused on developing power systems or grid energy storage systems in combination with renewable energy generation.

- Furthermore, China mandated energy storage systems for its solar and wind projects in its latest five-year plan (2021-25). This may also support the market's growth in the region during the study period.

- In August 2022, Rogkepower announced that a redox flow battery storage system would be used in a power project in the city of Dalian. The battery system can store energy from wind turbines and other sources for up to 400 megawatt-hours. The investment in the project is estimated to be around USD 281 million. As of August 2021, Rongke delivered a total of about 560 MWh of redox flow batteries. An additional 400 MWh of storage will be added to the Dalian project.

- Sumitomo Electric said in April 2022 that a 51 MWh flow battery project on the island of Hokkaido in northern Japan would be done.Hokkaido Island is a hotspot for clean energy because it has a lot of land that can be used. However, it has had trouble in recent years keeping up with the increased energy capacity on its grid, which is only partially connected to Honshu, Japan's most populated island, to its south.Hokkaido Electric has installed the new system at its Minami-Hayarai substation, and it will support the utility grid.Hokkaido Electric and the other stakeholders will split the costs of the battery operation.

- Thus, with new manufacturing facilities and projects for renewable energy and energy storage, the region is expected to lead the market over the next few years.

Flow Battery Industry Overview

The flow battery market is moderately fragmented. Some of the major players in the market are, in no particular order, VRB Energy, RedFlow Ltd., Invinity Energy Systems PLC, Primus Power Corporation, and ESS Tech Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Vanadium Redox Flow Battery

- 5.1.2 Zinc Bromine Flow Battery

- 5.1.3 Iron Flow Battery

- 5.1.4 Zinc Iron Flow Battery

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 VRB Energy

- 6.3.2 ESS Tech Inc.

- 6.3.3 Vanadis Power GmbH

- 6.3.4 Primus Power Corporation

- 6.3.5 RedFlow Ltd.

- 6.3.6 Invinity Energy Systems PLC

- 6.3.7 Dalian Rongke Power Co. Ltd.

- 6.3.8 CellCube Energy Storage Systems Inc.

- 6.3.9 Stryten Energy

- 6.3.10 H2, Inc.