|

市场调查报告书

商品编码

1444460

PGM(铂族金属):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

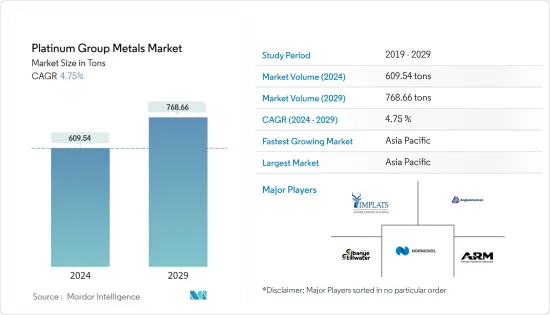

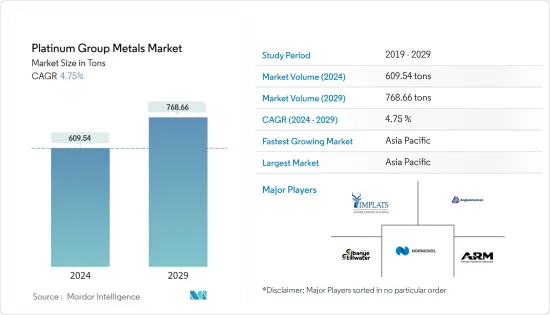

PGM(铂族金属)市场规模预计到2024年为609.54吨,预计到2029年将达到768.66吨,在预测期内(2024-2029年)复合年增长率为4.75%。

COVID-19 大流行对 2020 年的市场产生了负面影响。然而,市场预计将达到大流行前的水平,并在预测期内稳定成长。

主要亮点

- 短期内,汽车产业对触媒转换器的需求不断增长,以及电子产业对铂、钯和钌的需求不断增长,预计将推动市场成长。

- 然而,与维护 PGM(铂族金属)相关的高成本预计将阻碍市场成长。

- 儘管如此,PGM(铂族金属)在电子领域应用的研发活动不断增加,以及非洲国家对PGM(铂族金属)投资的增加,将在未来几年为市场创造机会。 。

- 预计亚太地区将在预测期内占据主导地位并呈现出最高的复合年增长率。

PGM(铂族金属)市场趋势

自动催化剂领域占据市场主导地位

- 触媒转换器使用蜂巢状结构中涂有 PGM(铂族金属)的陶瓷工具来引发转化有害污染物的化学反应。它安装在排气系统中的引擎和消音器之间。当引擎加热金属时,它会中和污染物。

- 铂金受益于 2022 年汽车产量的增加,因为经济型汽车製造商越来越多地寻求用更昂贵的钯金取代铂金。铂金是柴油触媒转换器的首选,钯金是汽油动力车辆的首选。儘管如此,在柴油车和汽油车中,这两种金属都可以互换为一种金属,如果一种金属相当昂贵,这种情况很常见。

- 根据国际汽车建设组织(OICA)的数据,2021年所有汽车的全球销量为8268万辆,而2020年为7877万辆。根据OICA的数据,2021年所有汽车的总产量统计为8014万辆。 2020年将增至7,762万人。

- 根据世界贸易组织的数据,2021年进口额约2,860亿美元,使美国成为第二大汽车产品进口国。同时,该国出口了价值约 1,260 亿美元的汽车产品。

- 所有上述因素预计将在预测期内推动汽车催化剂领域的发展并增加对 PGM(铂族金属)的需求。

亚太地区预计将主导市场

- 亚太地区在PGM(铂族金属)市场中占据最大份额,几乎占据全球份额的一半。预计它将成为成长最快的市场。

- 2021年3月,根据当局製定的节能汽车发展计画,中国宣布计画在2030年拥有100万辆燃料电池汽车运作。儘管未来八年建造了 1,000 个加氢站(主要集中在重型车辆),但去年该类型汽车仅售出 2,700 辆。这可能会在预测期内推动国内燃料电池需求。

- 印度电子市场预计未来三年将达到4000亿美元。此外,预计2025年印度将成为全球第五大消费性电子与电器产品产业。

- 此外,计划推出的 5G 网路和物联网 (IoT) 使用的增加等技术变革正在推动印度电子产品的采用。由于「数位印度」和「智慧城市」计划等倡议,该国对物联网的需求正在增加。

- 日本化学工业是该国仅次于运输设备的第二大製造业,为贵金属催化剂提供了优良的市场基础。主要企业集团主导日本的化学工业。大多数都高度多元化,并拥有众多子公司。

- 因此,所有上述因素都可能增加预测期内PGM(铂族金属)市场的需求。

PGM(铂族金属)产业概况

PGM(铂族金属)市场得到整合,前五名公司占据了主要市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车产业对触媒转换器的需求不断增长

- 电子业对铂、钯和钌的需求增加

- 亚太国家珠宝消费增加

- 抑制因素

- 维护成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 生产分析

- 价格趋势

第五章市场区隔(市场规模(数量))

- 金属型

- 铂

- 钯

- 铑

- 铱

- 钌

- 钡

- 目的

- 汽车触媒

- 电气和电子

- 燃料电池

- 玻璃、陶瓷、颜料

- 珠宝

- 医疗(牙科和製药)

- 化学品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率分析**/排名分析

- 主要企业采取的策略

- 公司简介

- African Rainbow Minerals

- Anglo American Platinum

- Glencore

- Implats Platinum Limited

- Johnson Matthey

- Northam Platinum Limited

- PJSC MMC Norilsk Nickel

- Royal Bafokeng Platinum

- Sibanye-Stillwater

- Vale Acton

第七章市场机会与未来趋势

- 燃料电池的未来用途

- 增加对非洲国家的投资

The Platinum Group Metals Market size is estimated at 609.54 tons in 2024, and is expected to reach 768.66 tons by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and grow steadily during the forecast period.

Key Highlights

- Over the short term, the growing demand for catalytic converters from the automotive industry and increasing demand for platinum, palladium, and ruthenium from the electronics industry are expected to drive market growth.

- However, the high costs involved in maintaining platinum group metals are expected to hinder the market's growth.

- Nevertheless, increasing R&D activities for applying platinum group metals in the electronics sector and increasing investments in the African countries in platinum group metals will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate and witness the highest CAGR during the forecast period.

Platinum Group Metals Market Trends

Autocatalysts Segment Dominated the Market

- Catalytic converters employ a ceramic tool structured like a honeycomb and covered with PGMs (platinum group metals) to initiate a chemical reaction that transforms hazardous pollutants. It is installed between the engine and the muffler in the exhaust system. When the engine heats the metals, the procedure neutralizes the contaminants.

- Platinum profited from increased car manufacture in 2022 as economical automakers increasingly attempt to swap it for more expensive palladium. Platinum is preferred in diesel catalytic converters, while palladium is preferred in gas-powered automobiles. Nevertheless, both metals may be exchanged, one for the other, in diesel- and gas-powered vehicles, which is common when one of the metals is somewhat expensive.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global sales of all vehicles in 2021 were 82.68 million, compared to 78.77 million in 2020. According to the OICA, total production statistics for all vehicles was 80.14 million in 2021, compared to 77.62 million in 2020.

- According to the World Trade Organization, with a value of about USD 286 billion in 2021, the United States was the second largest importer of automotive products. Simultaneously, the country exported automobile items worth around USD 126 billion.

- All the factors above are expected to drive the autocatalysts segment, enhancing the demand for platinum group metals during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region accounted for the largest share in the market for platinum group metals, with almost half of the global share. It is expected to be the fastest-growing market.

- In March 2021, the country announced the plan to include 1 million fuel-cell vehicles in operation by 2030, according to an energy-savings vehicle development plan drafted by authorities. Despite only 2,700 such cars selling in the country last year and the construction of 1,000 hydrogen refueling stations over the next eight years, majorly focusing on heavy-duty vehicles. It will likely drive the demand for fuel cells in the country during the forecast period.

- The Indian electronics market is expected to reach USD 400 billion over the next three years. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- Additionally, in India, technology transitions, such as the country planning to introduce 5G networks and the increasing use of IoT (Internet of Things), are driving the adoption of electronics products. Initiatives such as 'Digital India' and 'Smart City' projects have raised the demand for IoT in the country.

- The Japanese chemical industry is the country's second-largest manufacturing industry behind transportation machinery, providing a good market base for precious metal catalysts. A group of significant corporations dominates the Japanese chemical industry. Most of them are highly diversified and sport a large number of subsidiaries.

- Thus, all the above factors will likely increase the demand for the platinum group metals market during the forecast period.

Platinum Group Metals Industry Overview

The platinum group metals market is consolidated, with the top five players accounting for a significant market share. Some of the major players in the market include (not in a particular order) Anglo American Platinum, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, and African Rainbow Minerals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.1.2 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.1.3 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.2 Restraints

- 4.2.1 High Costs Involved in Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Analysis

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics, and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharmaceuticals)

- 5.2.7 Chemicals

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 African Rainbow Minerals

- 6.4.2 Anglo American Platinum

- 6.4.3 Glencore

- 6.4.4 Implats Platinum Limited

- 6.4.5 Johnson Matthey

- 6.4.6 Northam Platinum Limited

- 6.4.7 PJSC MMC Norilsk Nickel

- 6.4.8 Royal Bafokeng Platinum

- 6.4.9 Sibanye-Stillwater

- 6.4.10 Vale Acton

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Use of Fuel Cells

- 7.2 Increasing Investment in the African Countries