|

市场调查报告书

商品编码

1444468

超级电脑:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Supercomputers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

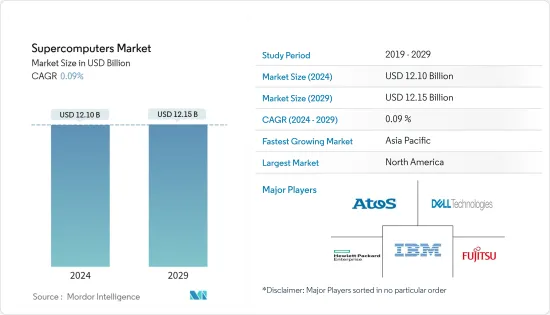

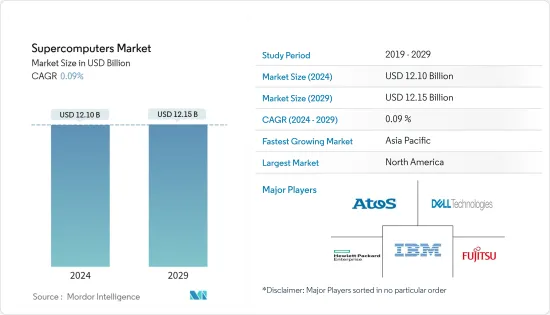

超级电脑市场规模预计到 2024 年为 121 亿美元,预计到 2029 年将达到 121.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 0.09%。

云端技术日益广泛的使用是超级电脑市场的主要趋势之一。随着工作负载的增加,超级运算中心正在采用云,并行应用程式在云端中运行,因为它们不需要特定的架构。

主要亮点

- 现代超级电脑的架构主要由平行处理组成,即将一个问题分成几个部分,同时处理多个部分。百万兆级计算是全球投资运算系统的重要趋势。每秒至少可以执行一次 exaFLOPS 计算。

- 超级电脑将为国家的科学进步和国家安全做出巨大贡献。超级运算中心越来越多地使用云端服务来处理工作负载和安全性。云端服务运作不需要高度专业化基础架构的平行程序。然而,我们预计未来几年将会看到更复杂的应用程式在云端上运行。例如,美国超级电脑製造商Cray与微软合作,将其设备和储存系统部署在Azure云端平台上。 Microsoft Azure 让客户在 Microsoft Azure 云端服务上执行最具策略性的工作负载。

- 市场供应商的增加是出于保持竞争力并提供具有更高处理能力的尖端技术的愿望。 2022 年 2 月,印度政府部署了一台名为 Param Pravega 的强大超级电脑,拥有 3.3 petaflops 的超级运算能力。它是在班加罗尔印度科学研究所设立的,也是「倡议製造」计画的一部分。

- 主要公司增加对超级电脑研发的投资有助于增加市场收益。例如,英特尔与美国能源局阿贡国家实验室合作开发的超级电脑Aurora,用于人工智慧研究,其速度是预期的两倍。据英特尔称,这台计算机每秒可以处理 2 兆次计算。新兴国家联邦组织活动的扩大预计也将推动市场收益的成长。

- 安装成本高和空间不足是市场收益扩大的主要障碍。超级电脑的成本是普通电脑的 10 倍,并且需要大量的维护成本。必须任命一个专门的团队来监督和管理超级电脑,并使用特定的应用程式来检测问题以及一般机器的使用情况。缺点除了价格高之外,还包括尺寸、维护、功耗和散热。

- 由于 COVID-19,企业(包括政府和教育等公共和私营部门)对资料中心、人工智慧和机器学习的需求激增。这种增长对超级电脑的需求产生了积极的影响。这种成长预计将持续到 2022年终,从而扩大超级电脑在各个最终用户产业的影响力和重要性。 IBM 正在与美国COVID-19 部门和白宫科技政策办公室合作,提供超过 330 petaflops 的处理能力、775,000 个治疗方法和潜力治疗方法。

超级电脑市场趋势

对更高处理能力的需求不断增长以推动市场成长

- 由于需要管理和处理大量资料,公司寻求分析这些资料以支援决策。最终用户也希望保持他们的竞争优势。因此,与较少依赖资料的组织相比,高度资料驱动的组织显着改善了决策。对资料管理和决策的更高处理能力不断增长的需求正在推动超级电脑市场的发展。

- 许多专注于提高各个最终用户领域处理能力的供应商进一步推动了市场的发展。例如,印度理工学院甘地讷格尔分校 (IIT Gandhinagar) 于 2022 年 5 月推出了 Param Ananta。这为多个领域的研究计划提供了额外的空间,包括机器学习、资料科学、计算流体力学、生物工程等。

- BFSI 产业已与许多供应商合作实施自动化并投入研究计划,推动超级电脑市场的扩张。例如,2022年1月,创新科技部(ITM)与OTP银行合作打造了人工智慧超级电脑的第一个模组。该模组采用匈牙利特定语言模型构建,允许您管理匈牙利地区的电话银行业务业务。

- 此外,超级电脑架构的第一个分区是使用 Atos 的 BullSequana 部门(CEA/DAM)发布的。它是最广泛的超级运算系统,基于已安装的通用 CPU,具有 12,960 个 AMD 处理器。它使用 4.96 MW 的功率,并具有 23.2 petaflops 的运算能力。

- 美国国防部资助军事和国防研究。超级电脑方面也正在进行大量工作,特别是支援美国运输司令部的通用紧急行动要求。该计划正在寻找方法来大幅降低与 COVID-19 乘客航空运输相关的风险,同时利用空军为机组人员和医务相关人员提供服务。

- 世界各国政府意识到他们需要超级电脑来实现经济安全和竞争。他们使用超级电脑开发尖端电子战设备和防御系统。

亚太地区成长强劲

亚太地区在技术方面正在快速成长。中国和日本等国家对该地区超级运算系统的快速成长负有主要责任。

- 与其他国家相比,中国等国家拥有发达的超级运算环境,投资规模也较大。根据 Top500.org 的数据,截至 2022 年 6 月,中国拥有世界 500 台最强大的超级电脑中的约 173 台,是最接近的竞争对手美国的三倍,另外还有 128 台超级电脑。

- 据通讯,中国研究人员声称已经建造了一台原型量子计算机,可以透过高斯玻色子取样检测多达 76 个光子。中国研究人员正在与Google、亚马逊和微软公司等美国大公司争夺技术主导。此外,习近平政府声称正在斥资 100 亿美元建设量子资讯科学国家实验室,作为更大规模推动该领域的一部分。

- 印度等新兴国家在亚太市场的成长中发挥关键作用。该国已推出国家超级运算任务,计画在2023年吸引投资7.3亿美元,建造由73个高效能运算设施组成的超级运算网格。据科学技术部 (DST) 称,印度计划在 2022 年至今推出四台新超级电脑,提高超级电脑能力。安装完成后,超级电脑总数将增加至19台。

- 日本也是亚太超级超级电脑市场的主要贡献者,拥有全球 500 台最强大的超级电脑中约 33 台,持有K 电脑。日本2020年的旗舰计画旨在投资超过10亿美元,开发比该国K电脑更有效率的系统。 2022年8月,日本超级电脑「富岳」启动,旨在发现新药和预测恶劣天气。

- 根据法韩会议的报告,韩国计划在 2030 年建造五台速度最快的百亿亿次百万兆级超级电脑之一,可能使用国产晶片。这些处理能力趋势将进一步推动亚太地区超级运算的成长。

超级电脑产业概况

超级电脑市场正在整合,少数主要企业占据了更大的市场占有率。主要企业包括 HPE、Atos SE、戴尔公司、富士通公司、IBM 公司、联想公司和 NEC Technologies India Private Limited。

- 2022 年 1 月 - Meta(以前称为 Facebook)演变成新一代 AI,称为 AI Research SuperCluster (RSC),旨在为令人印象深刻的壮举等即时互动提供支援。世界正在建造一台大型新型超级电脑.它可以帮助使用不同语言的大型团体无缝协作研究计划或一起玩 AR 游戏。

- 2021 年 11 月 - Atos SE 与 NVIDIA 合作,透过卓越人工智慧实验室 (EXAIL) 下的百亿亿次级超级运算推进医疗保健和气候研究计算。该计划旨在汇集科学家和研究人员,支持欧洲计算技术、教育和研究的进步。此次合作还包括研究人员在 Djurich 超级运算中心欧洲最快的超级电脑上运行新的人工智慧和深度学习模型。

- 2021 年 11 月 - 慧与宣布推出欧洲最强大的超级计算机,该计算机将在法国三个高性能计算 (超级电脑 ) 中心之一的 CINES(国家高等教育计算中心)安装和运行。他们的一台电脑。这台新超级电脑由法国国家机构 GENCI 采购,该机构投资并提供 HPC 资源以支援法国的学术和工业研究界。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对更高处理能力的需求不断增长

- 加大研究投入

- 市场限制因素

- 初始设定成本高

- 安装空间大

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间敌对的强度

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 按最终用户产业

- 商业业

- 政府机关

- 调查机构

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Atos SE

- Intel Corporation

- Hewlett Packard Enterprise

- Dell EMC(Dell Technologies Inc.)

- Fujitsu Ltd

- IBM Corporation

- Lenovo Inc.

- NEC Technologies India Private Limited

第七章 投资分析

第八章市场机会与未来趋势

The Supercomputers Market size is estimated at USD 12.10 billion in 2024, and is expected to reach USD 12.15 billion by 2029, growing at a CAGR of 0.09% during the forecast period (2024-2029).

The increasing use of cloud technology is one of the significant supercomputer market trends. With the growing workload, supercomputing centers are adopting the cloud, and the cloud is running parallel applications as they do not require particular architecture.

Key Highlights

- A modern supercomputer's architecture is majorly configured with parallel processing, meaning it splits the problems into pieces while working on several pieces simultaneously. Exascale computing is a significant trend that has enabled worldwide investment in computing systems. Exascale can provide at least one exaFLOPS (a quintillion) calculation per second.

- Supercomputers substantially contribute to the scientific progress of a country and national security. Supercomputing centers are increasingly using cloud services to handle workloads and security. Cloud service executes parallel programs that do not require a highly specialized infrastructure. However, more sophisticated apps are expected to be run on the cloud in the coming years. For instance, Cray, a supercomputer manufacturer located in the U.S., partnered with Microsoft to deploy its devices and storage systems to the Azure Cloud platform. By using Microsoft Azure, customers can run their most strategic workload in Microsoft Azure's cloud service.

- The increase in market suppliers is driven by the desire to stay competitive and provide the most advanced technologies with higher processing power. In February 2022, A powerful supercomputer named Param Pravega with a supercomputing capability of 3.3 petaflops was introduced by the Indian government. It was installed at the Indian Institute of Science in Bangalore as part of the Made in India initiative.

- Increased investments in the R&D of supercomputers by significant companies are contributing to the market's revenue growth. For instance, Aurora, a supercomputer built by Intel in the Chicago suburbs with the U.S. Department of Energy's Argonne National Laboratory for artificial intelligence research, will be twice as fast as anticipated. According to Intel, the computer can process two quintillion calculations per second. Expanding federal organization activities in developing countries is also expected to fuel market revenue growth.

- The high installation cost and ample space are significant barriers to expanding market revenue. Supercomputers are ten times more expensive than regular computers and have a hefty maintenance cost. A specialist team must be appointed to oversee and manage a supercomputer, and a specific application is employed that can detect issues as well as general machine usage. Its drawbacks are its size, maintenance, power consumption, and heat release, in addition to its high price.

- Due to COVID-19, there has been an exponential spike in need for data centers, AI, and ML among businesses, including those in the public and private sectors of government and education. This growth is positively impacting the demand for supercomputers. It is anticipated that this growth will continue through the end of 2022, spreading the influence and significance of supercomputers across a range of end-user industries. IBM, in association with the U.S. Department of Energy and the White House Office of Science and Technology Policy, launched the COVID-19 high-performance consortium with 16 systems that have more than 330 petaflops of processing power, 775,000 CPU cores, 34,000 GPUs, and counting in better understanding COVID-19, its treatments, and potential cures.

Supercomputers Market Trends

Increasing Demand for Higher Processing Power to Drive the Market Growth

- Enterprises with vast amounts of data to manage and process are looking to analyze this data to aid decision-making. It is also desired by end users to maintain a competitive advantage. Thus, highly data-driven organizations are witnessing significant improvements in decision-making than those who rely less on data. This increasing demand for higher processing power for managing data and decision-making is driving the supercomputers market.

- The market is further driven by many vendors' emphasis on more processing power for various end-user sectors. For instance, IIT Gandhinagar introduced Param Ananta in May 2022, which had additional space for research projects in multiple disciplines, including machine learning, data science, computational fluid dynamics, bioengineering, and more.

- The BFSI industry is partnering with many vendors for automation implementation and spending on research projects, fueling the supercomputer market's expansion. For instance, in January 2022, the Ministry of Innovation and Technology (ITM) and OTP Bank collaborated to build the first module of an AI supercomputer. The module was built in a unique Hungarian language model and will be able to manage phone banking operations in their region.

- Additionally, the first partition of "EXA1," a supercomputer built using Atos' BullSequana XH2000 architecture and featuring increased processing power for military and defense applications, was announced in November 2021 Atos and the CEA's Military Applications Division (CEA/DAM). It is the most extensive supercomputing system based on installed general-purpose CPUs, with 12,960 AMD processors. It uses 4.96 MW of power and has a computational capacity of 23.2 petaflops.

- The US Department of Defense is funding research in the military and defense fields. Significant work on supercomputers has also been performed, especially in support of a shared urgent operational requirement from the US Transportation Command. The project looks at ways to dramatically reduce the risk associated with airlifting COVID-19 passengers while utilizing the air force for aircrews and medical personnel.

- Governments worldwide recognize that supercomputers are necessary for achieving economic security and competitiveness for their respective countries. They are using supercomputers to develop state-of-the-art electronic warfare equipment and defense systems.

Asia-Pacific to Register a Significant Growth Rate

Asia-Pacific has been rapidly growing in terms of technology. Countries like China and Japan are majorly responsible for the region's rapid growth of supercomputing systems.

- Countries like China have well-developed supercomputing landscapes, with significant investments compared to other countries. According to Top500.org, as of June 2022, around 173 of the world's 500 most powerful supercomputers were located in China, three times more than its nearest competitor, the United States, accounting for an additional 128 supercomputers.

- According to Xinhua news agency, researchers from China claimed to have built a quantum computer prototype capable of detecting up to 76 photons through Gaussian boson sampling. Chinese researchers compete against major US corporations, including Google, Amazon, and Microsoft Corporation, for a lead in the technology. Additionally, Xi Jinping's government claimed it is building a USD 10 billion National Laboratory for Quantum Information Sciences as part of a big push in the field.

- Emerging nations like India play a significant role in the growth of the Asia-Pacific market. The National Supercomputing Mission in the country was introduced to raise USD 730 million in investment by 2023 to build a supercomputing grid, which will comprise 73 high-performance computing facilities. According to the Department of Science and Technology (DST), India was set to experience a boost in supercomputing capacities by launching four new supercomputers deployed in 2022 till date. Once deployed, the total number of supercomputers would grow to 19.

- Japan is another major contributor to the Asia-Pacific supercomputer market, with around 33 of the world's 500 most powerful supercomputers, including the K computer. Japan's flagship program 2020 aimed to invest more than USD 1 billion to develop more efficient systems than the K computer in the country. In August 2022, Japan's Fugaku supercomputer was launched to discover new drugs and predict severe weather forecasts.

- According to the report from French-Korean Conference, South Korea plans to build one of the five fastest exascale supercomputers by 2030, potentially with local chips. Such processing capabilities trends further encourage supercomputing growth in the Asia-Pacific region.

Supercomputers Industry Overview

The supercomputers market is consolidated due to a few significant players holding a greater market share. Some key players include HPE, Atos SE, Dell Inc., FUJITSU Corporation, IBM Corporation, Lenovo Inc., and NEC Technologies India Private Limited.

- January 2022 - Meta, formerly known as Facebook, is building a massive new supercomputer in the world intending to advance into a new generation of AI known as the AI Research SuperCluster (RSC) to power up real-time interactions, such as the impressive feat of helping large groups of people, each speaking a different language, seamlessly collaborate on a research project or play an AR game together.

- November 2021 - Atos SE partnered with NVIDIA to advance healthcare and climate research computing with Exascale Super Computing under Excellence AI Lab (EXAIL). The project aims to bring scientists and researchers together to help advance European computing technologies, education, and research. The partnership also includes researchers running new AI and deep learning models on Europe's fastest supercomputer at the Julich Supercomputing Center.

- November 2021 - Hewlett Packard Enterprise announced that it is building one of Europe's most powerful supercomputers to be installed and operated at CINES (National Computing Center for Higher Education), one of the three high-performance computing (HPC) centers in France. The new supercomputer was procured by GENCI, a French national agency that invests and provides HPC resources to support France's academic and industrial research communities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Higher Processing Power

- 4.2.2 Increasing Investments in Research

- 4.3 Market Restraints

- 4.3.1 High Initial Setup Cost

- 4.3.2 Large Installation Space

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the market

5 MARKET SEGMENTATION

- 5.1 By End User Industry

- 5.1.1 Commercial Industries

- 5.1.2 Government Entities

- 5.1.3 Research Institutions

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Atos SE

- 6.1.2 Intel Corporation

- 6.1.3 Hewlett Packard Enterprise

- 6.1.4 Dell EMC (Dell Technologies Inc.)

- 6.1.5 Fujitsu Ltd

- 6.1.6 IBM Corporation

- 6.1.7 Lenovo Inc.

- 6.1.8 NEC Technologies India Private Limited