|

市场调查报告书

商品编码

1444475

水溶性聚合物 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Water-soluble Polymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

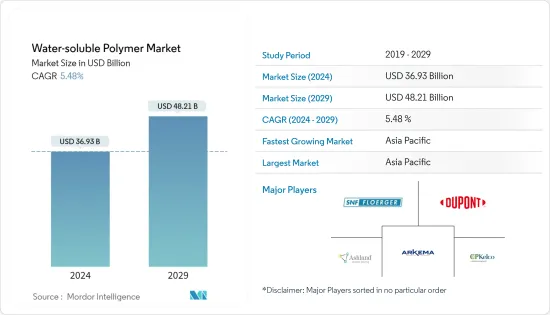

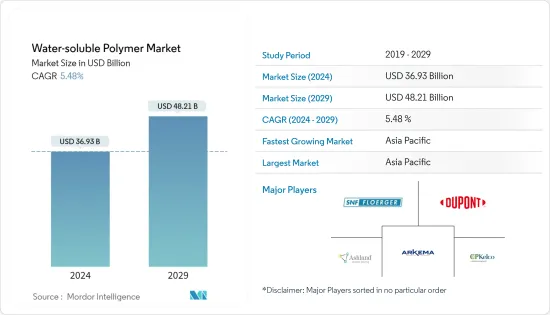

水溶性聚合物市场规模预计到2024年为369.3亿美元,预计到2029年将达到482.1亿美元,在预测期内(2024-2029年)CAGR为5.48%。

COVID-19大流行对水溶性聚合物市场产生了负面影响。然而,由于其在食品和饮料行业的应用激增,疫情后市场受到推动。

主要亮点

- 推动市场成长的因素是北美不断成长的页岩气产业和不断崛起的水处理产业。

- 另一方面,原物料价格的波动可能会阻碍预测期内的市场成长。

- 对生物基丙烯酰胺的需求不断增长及其在製药行业中不断增长的应用可能会为製造商提供大量未来机会。

- 亚太地区在全球市场中占据主导地位,预计在预测期内复合CAGR最高。

水溶性聚合物市场趋势

水处理产业可望主导市场

- 水处理有广泛的用途,包括满足农业、医疗、家庭、药理学、化学和工业应用的要求。

- 絮凝剂促进用凝结剂处理后所获得的不稳定颗粒的聚集。凝结剂中和胶体颗粒上负责将它们分开的电荷。

- 水溶性聚合物絮凝剂是处理受製程影响的废水的固液分离装置的重要组成部分。它们是长链水溶性聚合物,可将不沉淀的细小固体从水悬浮液中分离出来。

- 水溶性聚合物用于选矿、工业和城市废水处理、油砂尾矿脱水、造纸和生物技术。

- 由于中国、印度和日本等国家的高需求,亚太地区占据了水和废水处理市场的主要份额。该地区的水和废水处理行业是全球最大的行业之一。

- 2021年至2025年,中国计画新建或升级污水收集管网8万公里,扩大污水处理能力2000万立方公尺/日。到2025年,中国工业废水产业规模将达到194亿美元左右。此外,作为向更清洁、更永续的经济转型发展策略的一部分,中国计划向纺织、印刷、钢铁生产、石油和天然气开采、煤炭开采和製药生产等几个重污染行业投资500亿美元。

- 印度政府 Jal Shakti 部称,2022 财年,在场所内获得安全充足饮用水的农村人口比例从 2021 财年的 55.2% 增至 61.5%。此外,在印度,Suez、Abengoa、SPML Infra等多家公司正在投资水处理专案。到2030年,水务业的投资机会预计将增加至1,300亿美元。

- 基于上述因素,水处理产业预计将在预测期内主导市场。

中国可望主导亚太市场

- 水处理是我国水溶性聚合物最大的应用产业之一。由于政府对淡水供应和水污染(废水处理)的关注,中国的水处理产业持续成长。

- 根据「十三五」规划,中国在水处理产业的支出超过5,590亿元人民币(826亿美元),约占GDP总量的0.75%。它增加了该国对水溶性聚合物的需求。

- 製药是该国水溶性聚合物的另一个主要最终用户产业。近年来,中国製药公司主要集中在生产基础化学品、中间体和原料药(API)。因此,在很短的时间内,中国就数量而言成为全球领先的原料药供应国。

- 2021年,中国医药业务投资近3,010亿元人民币(445亿美元),较前一年下降15.7%。此外,2021年中国医药业务收入超过3.3兆元(4,870亿美元),较2020年成长20%。

- 近年来,中国药品製造商专注于开发和生产药品成品以服务当地市场。然而,随着政府根据《中国製造2025》产业规划推动政策改革,製药业将在预测期内实现高速成长。

- 综合以上几个方面,中国可望在亚太地区占据主导地位。

水溶性聚合物产业概况

水溶性聚合物市场本质上是分散的,众多参与者所占的市场份额较小。研究市场中的一些主要参与者(排名不分先后)包括 SNF 集团、亚什兰、杜邦、CP Kelco US Inc. 和阿科玛集团等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 北美不断发展的页岩气产业

- 亚太地区水处理产业蓬勃发展

- 限制

- 原物料价格波动

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 聚丙烯酰胺

- 聚乙烯醇

- 瓜尔胶

- 明胶

- 黄原胶

- 聚丙烯酸

- 聚乙二醇

- 其他类型(纤维素醚、果胶和淀粉)

- 最终用户产业

- 水处理

- 食品与饮品

- 个人护理和卫生

- 油和气

- 纸浆和造纸

- 製药

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Ashland

- Arkema

- BASF SE

- CP Kelco US Inc.

- DuPont

- Gantrade Corporation

- Kemira

- Kuraray Co. Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nouryon

- Polysciences Inc.

- SNF Group

- Sumitomo Seika Chemicals Company

第 7 章:市场机会与未来趋势

- 对生物基丙烯酰胺的需求不断增加

- 在製药业的应用不断增长

The Water-soluble Polymer Market size is estimated at USD 36.93 billion in 2024, and is expected to reach USD 48.21 billion by 2029, growing at a CAGR of 5.48% during the forecast period (2024-2029).

The COVID-19 pandemic affected the water-soluble polymer market negatively. However, the market is propelled after the pandemic owing to its surging application in the food and beverage industry.

Key Highlights

- The factors driving the market's growth are North America's growing shale gas industry and the rising water treatment industry.

- On the flip side, the fluctuating prices of raw materials will likely hamper the market growth during the forecast period.

- The increasing demand for bio-based acrylamide and its growing application in the pharmaceutical industry will likely provide numerous future opportunities for manufacturers.

- The Asia-Pacific region dominated the global market and is projected to register the highest CAGR during the forecast period.

Water-soluble Polymer Market Trends

The Water Treatment Industry is Expected to Dominate the Market

- Water treatment serves a wide range of purposes, which includes meeting requirements for agricultural, medical, household, pharmacological, chemical, and industrial applications.

- Flocculants promote the clumping of destabilized particles obtained after being treated with coagulants. The coagulants neutralize the charge on colloidal particles responsible for keeping them apart.

- Water-soluble polymer flocculants are important constituents of solid-liquid separation units for treating processaffected effluents. They are long-chain water-soluble polymers that separate nonsettling fine solids from aqueous suspensions.

- Water-soluble polymers are used in mineral processing, industrial and municipal wastewater treatment, oil sand tailings dewatering, paper making, and biotechnology.

- Asia-Pacific accounted for a major share of the water and wastewater treatment market due to the high demand from countries like China, India, and Japan. The water and wastewater sector in the region is one of the largest globally.

- Between 2021 and 2025, China intends to construct or upgrade 80,000 km of sewage collection pipeline networks and expand sewage treatment capacity by 20 million cubic meters/day. By 2025, China's industrial wastewater industry will reach around USD 19.4 billion. Moreover, China plans to invest USD 50 billion into several heavily polluting industries, including textile, printing, steel production, oil and gas extraction, coal mining, and pharmaceutical production, as part of its development strategy to transition to a cleaner and more sustainable economy.

- According to the Ministry of Jal Shakti of the Government of India, in FY 2022, the percentage of the rural population having access to safe and adequate drinking water within premises increased to 61.5% from 55.2% in FY2021. Moreover, in India, various companies, such as Suez, Abengoa, and SPML Infra, are investing in water treatment projects. The investment opportunities in the water industry are expected to increase to USD 130 billion by 2030.

- Based on the factors above, the water treatment industry is expected to dominate the market during the forecast period.

China is Expected to Dominate the Asia-Pacific Market

- Water treatment is one of China's largest application industries for water-soluble polymers. China's water treatment industry is consistently growing due to the government's focus on freshwater availability and water pollution (wastewater treatment).

- Under the 13th Five-year plan, the country spent more than CNY 559 billion (USD 82.6 billion) on its water treatment industry, about 0.75% of its total GDP. It increased the demand for water-soluble polymers in the country.

- Pharmaceuticals is another major end-user industry for water-soluble polymers in the country. Recently, Chinese pharmaceutical manufacturers have largely concentrated on producing basic chemicals, intermediates, and active pharmaceutical ingredients (APIs). Hence, in a short period, China became the leading global supplier of APIs in terms of volume.

- In 2021, nearly CNY 301 billion (USD 44.5 billion) were invested in the Chinese pharmaceutical business, a decrease of 15.7% from the previous year. Additionally, over CNY 3.3 trillion (USD 487 billion) in revenue was earned by the Chinese pharmaceutical business in 2021, an increase of 20% from 2020.

- Recently, Chinese pharmaceutical manufacturers have focused on developing and producing finished pharmaceutical products to serve the local market. However, the pharmaceutical industry is poised for high growth during the forecast period, with the government's push for policy reforms in line with the Made in China 2025 industrial plan.

- Based on the aspects above, China is expected to dominate the Asia-Pacific region.

Water-soluble Polymer Industry Overview

The water-soluble polymer market is fragmented in nature, with the presence of many players accounting for a less share of the market. Some of the major players in the market studied (in no particular order) include SNF Group, Ashland, DuPont, CP Kelco US Inc., and Arkema Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Shale Gas Industry in North America

- 4.1.2 Surging Water Treatment Industry in Asia-Pacific

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyacrylamide

- 5.1.2 Polyvinyl Alcohol

- 5.1.3 Guar Gum

- 5.1.4 Gelatin

- 5.1.5 Xanthan Gum

- 5.1.6 Polyacrylic Acid

- 5.1.7 Polyethylene Glycol

- 5.1.8 Other Types (Cellulose Ethers, Pectin, and Starch)

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care and Hygiene

- 5.2.4 Oil and Gas

- 5.2.5 Pulp and Paper

- 5.2.6 Pharmaceutical

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashland

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 CP Kelco US Inc.

- 6.4.5 DuPont

- 6.4.6 Gantrade Corporation

- 6.4.7 Kemira

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 Merck KGaA

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Nouryon

- 6.4.12 Polysciences Inc.

- 6.4.13 SNF Group

- 6.4.14 Sumitomo Seika Chemicals Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Acrylamide

- 7.2 Growing Application in the Pharmaceutical Industry