|

市场调查报告书

商品编码

1444483

超级资料中心:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Mega Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

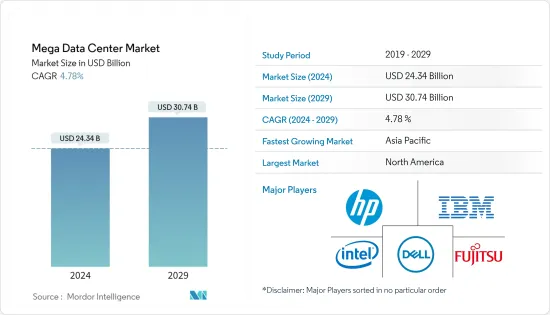

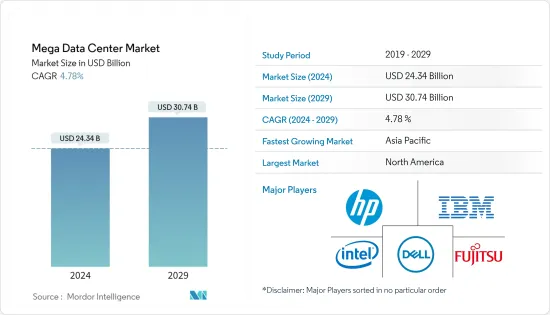

超级资料中心市场规模预计到 2024 年为 243.4 亿美元,预计到 2029 年将达到 307.4 亿美元,预测期内(2024-2029 年)复合年增长率为 4.78%

主要亮点

- 多年来,虚拟一直在推动资料中心产业的发展。公司正试图透过将 IT 营运集中在更少、利用率更高的机器上来减少基础设施。这个过程整体为资料中心创造了更广阔的视野。经营多个资料中心的公司可能会选择将其设施集中到几个大型实施中,以降低复杂性和成本。

- 透过减少建立的超级资料中心的数量(取决于其位置),公司可以享受特定的区域优势,例如税收优惠、较低的能源价格、气候和替代能源的可用性。事实确实如此。因此,超级资料中心的出现是为了最小化成本和最大化利润。

- 选择软体主导、行业相关且设置良好的超级资料中心的好处是,与现在相比,IT 管理成本更低,并且可以在本地存取大量互联网和工业互联网资料。这是可能的。资料中心速度和频宽。这项功能可能会增加全球的 IT 支出,因为早期采用者有很大机会投资新的 IT 技术,以降低整体成本并增加业务收益。

- 云端和主机代管服务数量的增加、相关的成本效益以及规模经济的增加等因素正在推动超级资料中心市场的发展。 Microsoft、Google、Amazon Web Services (AWS) 和 Facebook资料中心自成一类。透过到每个节点的多条途径,创建一个完全自动化、自我修復、网路附加的巨资料结构,该结构以光纤速度运行,以创建一个超级资料中心必须正常运转。

- 然而,较高的初始投资和较低的资源可用性是对该市场构成挑战的一些因素。儘管存在这些挑战,许多组织已经实施或开始实施超级资料中心。

超级资料中心市场趋势

银行和金融领域对资料中心的需求不断增长

- 银行和金融部门是资料产生最多的部门之一,对资料中心调节营运成本的需求是主要驱动力。金融和银行组织使用资料中心来储存客户记录、员工管理、交易以及远端银行业务、银行业务和自助查询等电子银行业务服务,但它们需要资料中心才能发挥作用。

- 资料中心作为基础设施被认为是金融的未来。许多金融机构正在建立具有大型网路、储存和伺服器容量的私有云端系统,以支援零售金融中心、ATM 和活跃线上帐户。

- 儘管许多银行都拥有自己的资料中心,但据观察,由于银行利润的波动,这种趋势正在改变。维护资料中心也很麻烦,因为它需要适当的冷却、安全和电力设备,导致 IT、房地产和营运成本。在预测期内,这可能对 BFSI 产业构成挑战。

亚太地区需求不断成长推动市场

- 中国各地对高密度、冗余设施不断增长的需求正在推动中国资料中心设计和开发的变化。中国每100人就有50个网路用户,发展空间很大。连接生态系统还包括 73 个主机代管资料中心、52 个云端服务供应商和 0 个网路结构。

- 然而,在中国,电力、空间和IP传输都是有代价的,凸显了资料中心维护的困难。同样,在印度,数位经济对GDP的贡献率为9.5%。数位经济包括255.18亿美元的固定电话合约和10110.54亿美元的行动电话合同,显示资料中心的发展空间巨大。

- 此外,由于监管和安全原因,印度的许多组织,尤其是 BFSI 部门,不允许将资料託管在国外的资料中心。因此,资料中心供应商正在印度建立本地资料中心,这表明印度庞大的资料中心设施正在成长。

超级资料中心产业概况

超级资料中心市场由于初始投资高、资源可用性低而高度集中,为该市场带来了挑战。该市场的主要企业包括思科系统公司、戴尔软体公司、富士通有限公司和惠普企业。市场的最新发展包括:

2022 年 9 月,微软在卡达推出了新的资料中心区域,成为该国第一家提供企业级服务的超大规模云端供应商。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件和定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 市场驱动因素与阻碍因素简介

- 市场驱动因素

- 资料中心整合需求不断成长

- 银行和金融领域对资料中心的需求不断增长

- 市场限制因素

- 投资及安装成本高

- 技术简介

第五章市场区隔

- 按解决方案

- 贮存

- 联网

- 伺服器

- 安全

- 其他解决方案

- 按最终用户

- BFSI

- 通讯和资讯技术

- 政府

- 媒体与娱乐

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Cisco Systems Inc.

- Dell Software Inc.

- Fujitsu Ltd

- Hewlett-Packard Enterprise

- IBM Corporation

- Intel Corporation

- Juniper Networks Inc.

- Verizon Wireless

第七章 投资分析

第八章市场机会及未来趋势

The Mega Data Center Market size is estimated at USD 24.34 billion in 2024, and is expected to reach USD 30.74 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

Key Highlights

- Virtualization has driven the data center industry over the years. Companies have sought to reduce infrastructure by focusing IT operations on fewer, more highly utilized machines. This process has led to a wider view of data centers in general. Companies operating multiple data centers can choose to focus their facilities on fewer and larger implementations to decrease complexity and costs.

- Implementing fewer mega data centers, depending on their locations, can allow a company to enjoy advantages of certain local benefits, such as tax incentives, low energy prices, climate, or availability of alternative energy sources. Thus, mega data centers result from attempts to minimize cost and maximize profit.

- The merits of choosing a software-led, industry-relevant, and adequately set-up mega data center are lower costs of IT management compared to the present, as well as the ability to access a vast amount of internet and industrial Internet data at local data center speed and bandwidth. This capability is likely to spur IT spending worldwide, as early adopters will have substantial opportunities to invest in new IT techniques to reduce overall business costs and increase revenues.

- Factors including increasing cloud and colocation services, associated cost benefits, and improved economies of scale drive the market for mega data centers. Microsoft, Google, Amazon Web Services (AWS), and Facebook data centers are in a class by themselves. They have to function fully automatic, self-healing, networked mega data centers that operate at fiber optic speeds to make a fabric that can access any node in any particular data center, as there are multiple pathways to every node.

- However, higher initial investments and low resource availability are some factors presenting challenges to this market. Despite such challenges, various organizations have already adopted or are initiating the adoption of mega data centers.

Mega Data Center Market Trends

Rising Demand of Data Centers in Banking and Finance Sectors

- The banking and finance sector is one of the largest generators of data, and the need for a data center to regulate the cost of operations is a primary driver. Finance and banking structures use data centers to store customer records, employee management, transactions, and electronic banking services, such as remote banking, telebanking, and self-inquiry, which need data centers to function.

- Data centers, as infrastructure, are believed to be the future of finance. Many institutions have created private cloud systems to accommodate massive network, storage, and server capacities to support their retail financial centers, ATMs, and active online accounts.

- Many banks maintain their own data centers, but it has been observed that the trend is changing due to fluctuations in the banks' profits. Also, maintaining a data center is cumbersome, owing to the cost drain on IT, real estate, and operations, as it requires proper cooling, security, and power facilities. This can act as a challenge for the BFSI industry during the forecast period.

Growing Demand from Asia-Pacific to Drive the Market

- The growing demand for high-density, redundant facilities throughout China is precipitating a shift in the design and development of the country's data centers. China has 50 internet users per 100 population, indicating scope for a lot of development, and the connectivity ecosystem comprises 73 colocation data centers, 52 cloud service providers, and 0 network fabrics.

- However, power, space, and IP transit all cost more in China, emphasizing the difficulties in maintaining a data center. Similarly, in India, the digital economy contributes 9.5% of the GDP. The digital economy includes USD 25,518 million fixed-line telephone subscriptions and 1,011.054 million mobile telephone subscriptions, indicating a lot of scope for the development of data centers.

- Moreover, owing to regulatory and security reasons, a number of organizations in India, especially from the BFSI sector, are not allowed to host their data in a data center that is out of the country. As a result, the data center providers are setting up local data centers in India, indicating the growing mega data center facilities in India.

Mega Data Center Industry Overview

The mega data center market is highly concentrated due to higher initial investments and low availability of resources, which present challenges to this market. Some of the key players in the market are Cisco Systems Inc., Dell Software Inc., Fujitsu Ltd, and Hewlett-Packard Enterprise. Some recent developments in the market include:

In September 2022, Microsoft launched its new data center region in Qatar, becoming the first hyper-scale cloud provider to offer enterprise-grade services in the nation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Data Center Consolidation

- 4.4.2 Rising Demand of Data Centers in Banking and Finance Sectors

- 4.5 Market Restraints

- 4.5.1 High Investment and Installation Costs

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Storage

- 5.1.2 Networking

- 5.1.3 Server

- 5.1.4 Security

- 5.1.5 Other Solutions

- 5.2 By End-user

- 5.2.1 BFSI

- 5.2.2 Telecom and IT

- 5.2.3 Government

- 5.2.4 Media and Entertainment

- 5.2.5 Other End-users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Dell Software Inc.

- 6.1.3 Fujitsu Ltd

- 6.1.4 Hewlett-Packard Enterprise

- 6.1.5 IBM Corporation

- 6.1.6 Intel Corporation

- 6.1.7 Juniper Networks Inc.

- 6.1.8 Verizon Wireless