|

市场调查报告书

商品编码

1444491

生物农药:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

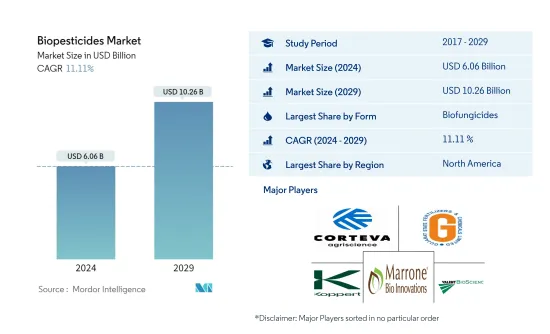

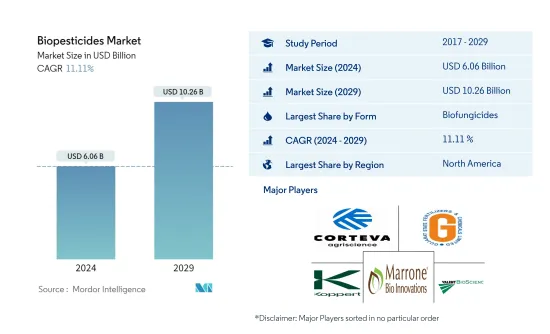

2024年生物农药市场规模预估为60.6亿美元,预估至2029年将达102.6亿美元,预测期间(2024-2029年)复合年增长率为11.11%。

主要亮点

- 生物杀菌剂是最大的型态。市面上贩售的商业生物杀菌剂可针对多种病原体提供保护,例如腐霉属、丝核菌属、镰刀菌属、核盘菌属、梭菌属和葡萄孢属。

- 生物农药是成长最快的型态。对各种受害虫侵害的作物使用生物杀虫剂,显着增加了有害昆虫的死亡率并减少了其后代的数量。

- 中耕作物是最大的作物类型。水稻、小麦、玉米、大豆、高粱、大麦是主要的有机作物,由于有机种植面积大,这些作物在生物农药的消费量中占据主导地位。

- 北美是最大的地区。该地区的种植区种植有机作物,农民正在高度采用生物解决方案,使其成为全球生物农药的主要消费者。

生物农药市场趋势

生物杀菌剂是最大的型态

- 生物农药由动物、植物、细菌和某些矿物质等天然材料製成。这些用于透过利用自然控制机制以环境友善的方式控制害虫。生物农药通常具有选择性,针对特定害虫,从而减少对非目标物种和环境的影响。生物农药通常对人类和动物的毒性较小,并且在环境中分解得更快。

- 生物杀菌剂是应用最广泛的生物农药。截至 2022 年,这些市场占有率占 47.6%。芽孢桿菌属、木霉属、链霉菌属和假单胞菌属是农业中最商业性使用的微生物物种。这些生物杀菌剂可有效对抗腐霉属、丝核菌属、镰刀菌属、菌核属、拟霉属、葡萄孢属和白粉病等病原体。

- 2022年,生物农药占全球生物农药市场的27.9%。每个季节都有几种害虫会对某些作物造成毁灭性损害,可以使用有针对性的生物农药来有效控制这些害虫。例如,棉花是世界各地种植的重要经济作物。无论在哪个地区,棉花害虫都会影响棉花植株的产量。苏云马币是一种商业性重要的生物杀虫剂,已知可以有效控制这种会导致产量损失 30-90% 的毁灭性害虫。

- 生物农药在控制特定目标病虫害而不损害环境或动物方面的有效性预计将推动全球生物农药市场的发展。在预测期内(2023-2029年),生物农药市场预计将以 11% 的复合年增长率发展。

北美是最大的地区

- 生物农药利用自然控制机制,以环境友善的方式控制害虫。生物农药通常具有选择性并针对特定害虫,减少对非目标物种和环境的影响。 2022年生物农药消费量最高的地区是亚太和北美。

- 有机农业在中国和印度等农业强国的亚太地区正在显着成长。这种增长是由于对永续和更健康食品选择的需求不断增加以及对传统农药有害影响的认识不断提高而推动的。该地区有机作物面积从2017年的310万公顷增加到2021年的360万公顷,增加了15.5%。

- 北美是生物农药第二大消费量地区,2021年占38.5%。该地区对有机食品的需求正在迅速增长。 2021 年,北美人均有机食品支出为 109.7 美元。该地区的农民正在以更快的速度适应新的生物技术。永续农业的趋势预计将推动该地区生物农药的使用。

- 政府的措施和各地区有机农业的推广进一步加强了这种永续方法的趋势。例如,欧盟委员会宣布了一项增加成员国有机面积的行动计划,以便在2030年它们占该地区农业面积的25.0%。秘鲁、阿根廷等南美国家政府当局禁止使用化学农药,因而带动了南美洲生物农药市场的发展。

生物农药产业概况

生物农药市场较为分散,前五家企业占比为6.03%。市场的主要企业包括(按字母顺序排列)Corteva Agriscience、Gujarat State Fertilizers & Chemicals Ltd、Koppert Biological Systems Inc.、Marrone Bio Innovations Inc. 和 Valent Biosciences LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章执行摘要和主要发现

第二章 提供报告

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 有机种植面积

- 人均有机产品支出

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 形状

- 生物杀菌剂

- 生物除草剂

- 生物杀虫剂

- 其他生物农药

- 作物类型

- 经济作物

- 园艺作物

- 中耕作物

- 地区

- 非洲

- 按国家/地区

- 埃及

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 按国家/地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家/地区

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 土耳其

- 英国

- 其他欧洲国家

- 中东

- 按国家/地区

- 伊朗

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

- 按国家/地区

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 按国家/地区

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章 竞争形势

- 重大策略倡议

- 市场占有率分析

- 公司形势

- 公司简介

- Andermatt Group AG

- Atlantica Agricola

- Biolchim SPA

- Bioworks Inc.

- Certis USA LLC

- Corteva Agriscience

- Gujarat State Fertilizers &Chemicals Ltd

- Henan Jiyuan Baiyun Industry Co. Ltd

- IPL Biologicals Limited

- Koppert Biological Systems Inc.

- Lallemand Inc.

- Marrone Bio Innovations Inc.

- Seipasa SA

- T Stanes and Company Limited

- Valent Biosciences LLC

第七章 CEO 面临的关键策略问题

第8章附录

- 世界概况

- 概述

- 波特的五力框架

- 全球价值链分析

- 市场动态(DRO)

- 来源和参考文献

- 表格和图形列表

- 重要见解

- 资料包

- 词彙表

The Biopesticides Market size is estimated at USD 6.06 billion in 2024, and is expected to reach USD 10.26 billion by 2029, growing at a CAGR of 11.11% during the forecast period (2024-2029).

Key Highlights

- Biofungicides is the Largest Form. Commercial bio-fungicides available in the market provide protection against various pathogens such as Pythium, Rhizoctonia, Fusarium, Sclerotinia, Thielaviopsis, and Botrytis

- Bioinsecticides is the Fastest-growing Form. The application of Bioinsecticides in different pest-infested crops has significantly increased the mortality of harmful insects and decreased their progeny number.

- Row Crops is the Largest Crop Type. Rice, wheat, corn, soybean, sorghum, and barley are the major organic row crops produced and their dominanance in biopesticide consumption is due to the large organic area.

- North America is the Largest Region. The growing area under cultivation of organic crops and high adaption of biological solutions by the farmers of the region has made it the large consumer of biopesticides globally.

Biopesticides Market Trends

Biofungicides is the largest Form

- Biopesticides are made from natural materials such as animals, plants, bacteria, and certain minerals. They are used to control pests in an environmentally friendly way by harnessing natural mechanisms of control. Biopesticides are often selective, and they target specific pests, thereby reducing the impact on non-target species and the environment. Biopesticides are also typically less toxic to humans and animals, and they break down more quickly in the environment.

- Biofungicides are the most popularly used biopesticides. They held a market share of 47.6% in 2022. Bacillus, Trichoderma, Streptomyces, and Pseudomonas are the most commercially used species of microorganisms in agriculture. These biofungicides effectively act against pathogens, such as Pythium, Rhizoctonia, Fusarium, Sclerotinia, Thielaviopsis, Botrytis, and powdery mildew.

- Bioinsecticides accounted for 27.9% of the global biopesticides market in 2022. There are several pests that cause devastating losses to specific crops in each season, which can be effectively controlled by using target-specific bioinsecticides. For instance, cotton is an important cash crop grown globally. The cotton bollworm pest affects the yield of cotton plants, irrespective of the region. Bacillus thuringiensis , a commercially important bioinsecticide, is known to effectively control this devastating pest that can cause potential yield losses of 30-90%.

- The effectiveness of biopesticides in controlling target-specific pests and diseases with no harm to the environment and animals is expected to drive the global market for biopesticides. The biopesticides market is estimated to register a CAGR of 11% during the forecast period (2023-2029).

North America is the largest Region

- Biopesticides are used to control pests in an eco-friendly way by harnessing natural control mechanisms. Biopesticides are often selective and target specific pests, reducing the impact on non-target species and the environment. Asia-Pacific and North America were the most biopesticides-consuming regions in 2022.

- The Asia-Pacific region, which is home to large agricultural countries like China and India, has seen significant growth in organic farming. This growth has been driven by rising demand for sustainable and healthier food options and increased awareness about the harmful effects of conventional pesticides. The organic crop area in the region increased from 3.1 million hectares in 2017 to 3.6 million hectares in 2021, representing a growth of 15.5% during the period.

- North America is the second most biopesticides-consuming region, and it had a share of 38.5% in 2021. The demand for organic food in the region is growing rapidly. The average per capita spending on organic food products in North America was recorded as USD 109.7 in 2021. Farmers of the region are adapting to new biological technologies at a faster pace. The trend toward sustainable agriculture is expected to drive the usage of biopesticides in the region.

- Government initiatives and promotion of organic farming in different regions further intensify this trend of sustainable approaches. For instance, the European Commission has unveiled an action plan to increase the organic area in the member countries to occupy 25.0% of the region's agricultural land area by 2030. Government authorities in South American countries like Peru and Argentina have banned the usage of chemical pesticides, thus driving the South American biopesticides market.

Biopesticides Industry Overview

The Biopesticides Market is fragmented, with the top five companies occupying 6.03%. The major players in this market are Corteva Agriscience, Gujarat State Fertilizers & Chemicals Ltd, Koppert Biological Systems Inc., Marrone Bio Innovations Inc. and Valent Biosciences LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Nigeria

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 Thailand

- 5.3.2.1.8 Vietnam

- 5.3.2.1.9 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Andermatt Group AG

- 6.4.2 Atlantica Agricola

- 6.4.3 Biolchim SPA

- 6.4.4 Bioworks Inc.

- 6.4.5 Certis USA LLC

- 6.4.6 Corteva Agriscience

- 6.4.7 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.8 Henan Jiyuan Baiyun Industry Co. Ltd

- 6.4.9 IPL Biologicals Limited

- 6.4.10 Koppert Biological Systems Inc.

- 6.4.11 Lallemand Inc.

- 6.4.12 Marrone Bio Innovations Inc.

- 6.4.13 Seipasa SA

- 6.4.14 T Stanes and Company Limited

- 6.4.15 Valent Biosciences LLC

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms