|

市场调查报告书

商品编码

1444504

生物有机肥料 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Biological Organic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

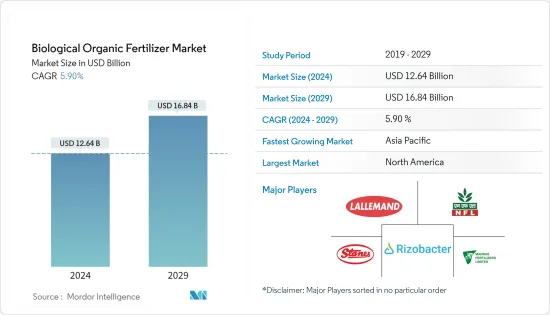

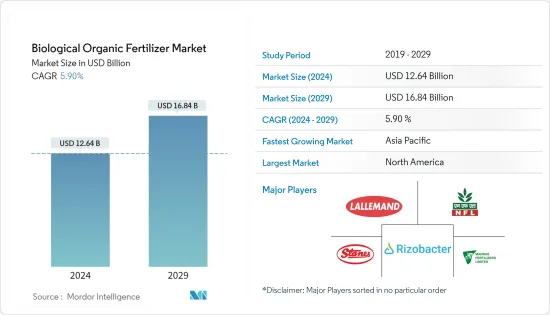

生物有机肥市场规模预计到 2024 年为 126.4 亿美元,预计到 2029 年将达到 168.4 亿美元,在预测期内(2024-2029 年)CAGR为 5.90%。

主要亮点

- 有机农业实践的增加是生物有机肥市场成长的重要因素之一。对永续农业的重视和政府对製造商的支持是促进市场发展的其他因素。

- 此外,最近的研究显示生物有机肥对谷物的影响。生物有机肥料是一种有机基生物肥料,含有 RP(5%)、生物炭(15%)和植物生长促进细菌的活细胞( PGPB),主要是芽孢桿菌属、变形桿菌属和类芽孢桿菌属,它们是从洪氾区、阶地和盐渍土中分离出来的。孟加拉水稻公司进行的16次田间试验和18次农民示范试验的结果证明,添加PGPB透过生物固氮补充了水稻生产所需的30%合成氮,并透过溶解在植物生长期间充分补充了磷矿中的速效磷。生物有机肥的活性成分与有机质的共同作用,可节省30%尿素氮,100%淘汰水稻生产中三重过磷酸钙肥料的使用,同时提高养分吸收、氮、磷利用效率,提高水稻产量和产量。土壤健康,最终提高生物有机肥料的采用。

生物有机肥料市场趋势

增加有机农业

有机产品和消费的日益普及迫使有机农业在全球扩张。随后,由于最近人们对再生农业、有机农业和土壤健康的兴趣激增,生物有机肥料市场急剧增长。天然有机肥料含有特定水平的微生物(例如固氮细菌);有机肥料同样含有微生物,通常来自动物和植物,例如牲畜粪便和农作物残留物,非常适合有机农业。

根据有机农业研究所的数据,2020年有机农业面积成长了4.1%。此外,已开发国家和发展中国家的区域统计数据都描绘了该国有机农业的成长。例如,根据印度政府的统计,2021-2022年印度有机农业认证面积几乎翻了一番,显示有机农业的措施和采用不断增加,总产量达到20,540.63吨。因此,由于有机种植面积的增加和对优质作物的需求不断增加,预计种植者将使用生物有机肥料而不是过量的合成肥料,从而推动市场。

亚太地区是成长最快的市场

亚太地区的有机肥市场是其他地区中成长最快的。随着农民对生物基肥料和有机渣基肥料益处的认识不断提高,亚太地区有机肥料的消费量预计将增加。区域需求集中在中国、印度、泰国、印尼和越南等主要农业国家,而中国和印度则引领市场发展。

此外,该地区不同国家不仅对肥料有自己的一般法规,而且往往对生物和有机肥料有具体的要求和规则。例如,农业部第1/2019号关于印尼有机肥料、生物肥料和土壤改良登记的规定旨在确保市场上流通的化肥产品的质量,要求其通过合格机构的品质检测。农业部批准的机构。

此外,该地区不同国家不断增长的有机农业以及对有机产品不断增长的需求推动了该地区的市场。此外,一些亚洲国家也制定了与有机产业相关的重大政策。日本的农业和管理基本计画取得了重大进展,目标是到 2030 年将有机农民和有机土地的数量增加两倍,从而促进市场的成长。

生物有机肥料产业概况

由于国际和地区知名企业的参与,生物有机肥市场呈现分散状态。与政府组织的合作、市场扩张、产品创新是这些公司采取的一些策略。 Rizobacter Argentina SA、Lallemand 和 National Fertilizers Limited 是生物有机肥市场的一些领先市场参与者。市场上不受监管的情况维持了小公司的生存,使市场变得分散,只要有适当的监管,市场很快就会转变为整合的市场。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 微生物

- 根瘤菌

- 固氮菌属

- 固氮螺菌属

- 蓝绿藻

- 解磷细菌

- 菌根

- 其他微生物

- 有机残留物

- 绿肥

- 鱼粉

- 骨粉

- 油饼

- 其他的

- 微生物

- 应用

- 谷物和谷物

- 豆类和油籽

- 水果和蔬菜

- 经济作物

- 草坪和观赏植物

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第 6 章:竞争格局

- Most Adopted Competitor Strategies

- 市占率分析

- 公司简介

- Rizobacter Argentina SA

- Lallemand Inc.

- National Fertilizers Limited

- Madras Fertilizers Limited

- T Stanes & Company Limited

- Gujarat State Fertilizers & Chemicals Ltd

- String Bio

- Rashtriya Chemicals & Fertilizers Ltd

- Agrinos

- Biomax Naturals

- Symborg (Corteva Agriscience)

- Agri Life

- Premier Tech

- Biofosfatos do Brasil

- Kiwa Bio-Tech Products Group Corporation

- Protan AG

- Mapleton Agri Biotech Pty Limited

- Bio Nature Technology PTE Ltd.

- Kribhco

- Bio Ark Pte Ltd

- Novozymes

- Savio BIO Organic AND Fertilizers Private Limited

- ACI Biolife

第 7 章:市场机会与未来趋势

The Biological Organic Fertilizer Market size is estimated at USD 12.64 billion in 2024, and is expected to reach USD 16.84 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Key Highlights

- The increased practice of organic farming is one of the significant factors behind the growth of the biological organic fertilizer market. The emphasis on sustainable agriculture and government support to the manufacturers are the other factors that augment the development of the market.

- Moreover, recent studies have shown the effect of bio-organic fertilizers on grains. Bio-organic fertilizer that exhibited various qualities, such as nutrient acquisition and plant growth promotion of rice, is an organic-based biofertilizer that contains RP (5%), biochar (15%), and the living cells of Plant Growth Promoting Bacteria (PGPB), mostly Bacillus, Proteus, and Paenibacillus spp., which were isolated from the floodplain, terrace, and saline soils. The results of 16 field experiments and 18 farmers' demonstration trials undertaken by Bangladesh Rice proved that added PGPB supplemented the 30% synthetic N requirement of rice production through biological nitrogen fixation and fully complemented available P from rock phosphate by solubilization during the plant growth period. The combined effect of living ingredients and organic matter of the bio-organic fertilizer saved 30% urea-N, eliminated 100% Triple Super Phosphate fertilizer use in rice production, and simultaneously improved nutrient uptake, N, P use efficiencies, rice yield, and soil health, eventually enhancing the adoption of biological organic fertilizers.

Biological Organic Fertilizer Market Trends

Increasing Organic Farming

The rising popularity of organic products and consumption has forced the expansion of organic farming across the globe. Subsequently, the market for biological organic fertilizers has grown dramatically in response to the recent surge in interest in regenerative agriculture, organic farming, and soil health. Natural organic fertilizers contain specific levels of microorganisms (such as nitrogen-fixing bacteria); organic fertilizers similarly contain microorganisms and typically come from animals and plants, such as livestock manure and crop residues, which are highly suitable for Organic Farming.

According to the Research Institute of Organic Agriculture, the area under organic farming increased by 4.1% in 2020. In addition, the regional statistics of both developed and developing countries have depicted the growth of organic agriculture in the country. For instance, according to the statistics by the government of India, the area under the organic farming certification process in India has almost doubled in 2021-2022, indicating the increasing initiatives and adoption of organic farming, with the full production accounting for 20,540.63 metric tons. Thus, owing to the rising organic area under cultivation and the increasing demand for good-quality crops, cultivators are anticipated to use biological organic fertilizers instead of excessive synthetic fertilizers, driving the market.

Asia Pacific is the fastest growing market

The organic fertilizer market in Asia-Pacific is the fastest-growing among all the other regions. The consumption of organic fertilizers in Asia-Pacific is anticipated to increase with rising awareness among farmers about the benefits of bio-based and organic residue-based fertilizers. The regional demand is concentrated among major agriculture-based countries like China, India, Thailand, Indonesia, and Vietnam while China and India are leading the market developments.

In addition, not only do different countries in the region have their own regulations for fertilizers in general, but they also often have specific requirements and rules for biological and organic fertilizers. For instance, the Regulation of the MOA No. 1/2019 concerning the Registration of Organic Fertilizers, Biological Fertilizers, and Soil Improvement in Indonesia aims to ensure the quality of fertilizer products circulating in the market by requiring them to pass a quality test by an MOA-approved institution.

Further, the growing organic farming in different countries under the region and the increasing demand for organic products drive the market in the region. Moreover, there have been major policy developments related to the organic sector in some Asian countries. In Japan, there was a major development in the Basic Plan for Agriculture and Management, aiming to triple the number of organic farmers and organic land by 2030, in turn boosting the growth of the market.

Biological Organic Fertilizer Industry Overview

The Biological organic fertilizer market is fragmented due to prominent international and regional players. Collaborations with government organizations and expansion in the market, along with product innovation, are some of the strategies adopted by the companies. Rizobacter Argentina S.A, Lallemand, and National Fertilizers Limited are some of the leading market players in the biological organic fertilizer market. The unregulated scenario in the market has sustained the small companies, making the market fragmented, which could be converted to a consolidated one with the proper regulations shortly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Microorganism

- 5.1.1.1 Rhizobium

- 5.1.1.2 Azotobacter

- 5.1.1.3 Azospirillum

- 5.1.1.4 Blue-green Algae

- 5.1.1.5 Phosphate Solubilizing Bacteria

- 5.1.1.6 Mycorrhiza

- 5.1.1.7 Other Microorganisms

- 5.1.2 Organic residues

- 5.1.2.1 Green Manure

- 5.1.2.2 Fish Meal

- 5.1.2.3 Bone Meal

- 5.1.2.4 Oil Cakes

- 5.1.2.5 Others

- 5.1.1 Microorganism

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops

- 5.2.5 Turf and Ornamentals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Competitor Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Rizobacter Argentina S.A.

- 6.3.2 Lallemand Inc.

- 6.3.3 National Fertilizers Limited

- 6.3.4 Madras Fertilizers Limited

- 6.3.5 T Stanes & Company Limited

- 6.3.6 Gujarat State Fertilizers & Chemicals Ltd

- 6.3.7 String Bio

- 6.3.8 Rashtriya Chemicals & Fertilizers Ltd

- 6.3.9 Agrinos

- 6.3.10 Biomax Naturals

- 6.3.11 Symborg (Corteva Agriscience)

- 6.3.12 Agri Life

- 6.3.13 Premier Tech

- 6.3.14 Biofosfatos do Brasil

- 6.3.15 Kiwa Bio-Tech Products Group Corporation

- 6.3.16 Protan AG

- 6.3.17 Mapleton Agri Biotech Pty Limited

- 6.3.18 Bio Nature Technology PTE Ltd.

- 6.3.19 Kribhco

- 6.3.20 Bio Ark Pte Ltd

- 6.3.21 Novozymes

- 6.3.22 Savio BIO Organic AND Fertilizers Private Limited

- 6.3.23 ACI Biolife