|

市场调查报告书

商品编码

1685814

机器视觉系统 (MVS) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Machine Vision Systems (MVS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

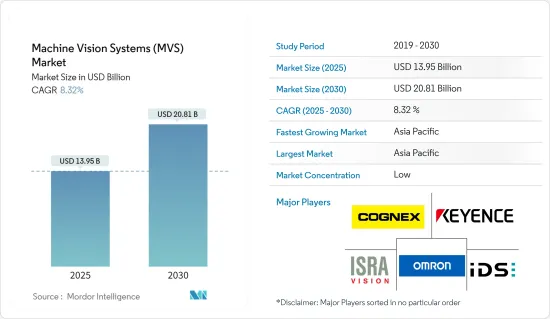

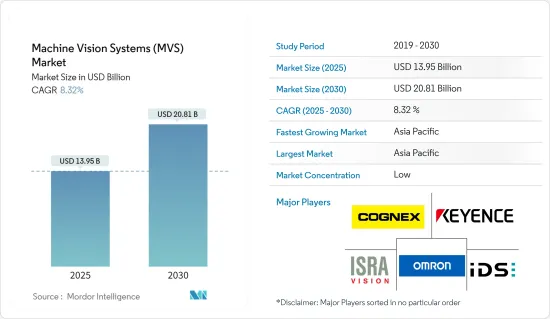

机器视觉系统市场规模预计在 2025 年为 139.5 亿美元,预计到 2030 年将达到 208.1 亿美元,在市场估计和预测期(2025-2030 年)内以 8.32% 的复合年增长率增长。

机器视觉系统依靠工业相机内部受专门光学元件保护的数位感测器来捕捉影像,以便电脑硬体和软体可以处理、分析和测量各种特性以进行决策。

主要亮点

- 过去几十年,工业自动化逐渐发展,市场结构几乎没有改变。但由于技术颠覆、产业回流、全球技术纯熟劳工短缺以及环境、社会和管治(ESG) 措施等宏观趋势,变化的步伐正在加快。最近,第一波新冠疫情导致大部分製造业放缓。但这只是暂时的。随着製造业的復苏,产量激增。随着企业开始復工,保持社交距离仍是新常态,越来越多的员工无法占用同一工作空间或进入办公室,因此对视觉和自动化系统的需求日益增长,以填补这一空白。

- 工业自动化的潜力在一小部分被称为「数位灯塔工厂」的製造基地中表现得最为明显。这些工厂在自动化方面处于领先地位。根据世界经济论坛的一项研究,93%的灯塔工厂已透过采用自动化实现了成长效益。大部分成长效益来自于提高产量的能力,自动化为少数工厂带来了新的收入来源。

- 因此,他们看到机器视觉的应用激增,并积极寻找在其营运中实施这项革命性技术的方法。决策者一直在寻找提高生产力、品质和可追溯性的方法,并因此发现製造和物流线中越来越多的应用可以透过机器视觉进行改进。

- 这一增长是由製造业对改进产品检验和品管的需求,以及製造和仓储业对更智慧协作机器人的不断增长的需求所推动的。此外,自动化和机器视觉技术提高了业务效率和生产力,降低了生产成本并扩展了工人的能力。

- 推动成长的另一个因素是製造业需要改进产品检验和品管,以及製造和仓储对更智慧的协作机器人的需求不断增长。此外,自动化和机器视觉技术提高了业务效率和生产力,降低了生产成本并扩展了工人的能力。

- 然而,目前市场缺乏能够有效整合高品质图形、使用者友善介面和以程式码为中心的演算法的高度适应性软体。因此,上述熟练工人的短缺正在阻碍市场扩张。

机器视觉系统(MVS)市场趋势

相机是最大的硬体部分

- 机器视觉相机在工业影像处理链中发挥关键作用。这些相机使用特定的通讯协定与电脑通讯,然后电脑可以分析影像资料并调整相机设定。机器视觉相机具有广泛的应用范围。它们可用于生产控制、物体流控制、表面检查、电子元件製造、机器人引导等。

- 机器视觉相机可以将光学影像转换为类比或数位讯号。这些摄影机采用基于 PC 的处理硬体和软体演算法来分析影像、视讯和资料,从而实现手动任务的自动化。另一方面,传统的智慧相机是自足式的单元,将机器视觉相机、处理器和照明设备整合到一个紧凑的机壳中。这些智慧相机无需单独的 PC 即可撷取和分析影像和资料。

- 智慧相机已成为 MV 系统中流行的硬体组件。透过整合照明、影像感测器、软体和 I/O,它大大简化了机器视觉系统设计过程。随着时间的推移,智慧相机的功能和规格不断扩展。这包括推出具有更大影像感测器的模型、充当智慧相机的嵌入式视觉相机的出现,以及开发可以执行深度学习和人工智慧任务的新型相机。

- 机器视觉已成为相机技术的前沿进步,并正在彻底改变物流、製造和智慧设备等多个工业领域。智慧相机技术的发展使製造商能够轻鬆开发和实施根据客户特定要求量身定制的机器视觉模型,帮助客户从其宝贵的资料中获得全面、可操作的见解。由于外形规格小巧、处理能力强的智慧相机日益普及,预计该市场将大幅成长。

- 例如,2023 年 5 月,Jivid 推出了其突破性的最先进的 3D 彩色相机系列,预计将对机器视觉和自动化领域产生重大影响。此次发展将使公司进一步增强其能力,使客户能够在包括拆垛、箱式拣选、拾取和放置、组装、包装和品管等各种应用中优化效率和生产力。这些发展预计将增加市场机会并为市场提供显着的推动力。

- 该技术的应用涉及许多行业,包括机器人引导和自动化、品管和检查以及地图绘製。在技术进步和各行各业对自动化日益增长的需求的推动下,机器人在製造业中的应用预计将扩大相机在机器视觉系统中的潜力。例如,国际机器人联合会(IFR)2023年的一项研究发现,美国製造业在2023年大幅加大了自动化力度,工业机器人安装数量飙升12%,达到44,303台。

亚太地区预计将占据主要市场占有率

- 中国工业生产率高,是世界上成长最快的国家之一。这推动了该国的机器视觉系统市场的发展。投资计画旨在提高成长品质、解决环境问题并减少产能过剩。与製造工厂的规模和员工数量相比,该国实施工厂自动化、流程和机器人技术的公司数量很少。这将为中国机器视觉领域的企业创造巨大的机会。

- 日本在半导体和电子产业中也占有重要地位。根据WSTS预测,日本半导体产业销售额预计在2022年成长14.2%,并在未来几年持续成长。此外,由于该国正在采取各种措施来增加自动驾驶汽车的采用,预计该国汽车行业的成长也将在预测期内支持市场成长。

- 韩国蓬勃发展的汽车工业正在推动对机器视觉系统的需求。不断增长的消费者需求和政府的支持政策是推动自动驾驶汽车和电动车普及的主要因素。根据韩国国土交通省发布的报告,2022年韩国註册的电动车数量将达到约39万辆,较2013年大幅增加。加上混合动力汽车汽车和氢动力汽车,环保汽车约占韩国註册汽车总数的6.2%。

- 印度的工业自动化部门正在透过添加数位和实体技术来实现最佳性能,彻底改变製造业。此外,对零废弃物製造和更快上市时间的重视正在推动市场成长。

- 亚太地区其他地区包括台湾、新加坡、印尼、马来西亚、泰国、澳洲等。在印尼,工业 4.0 的出现正在推动市场发展,重点是食品和饮料、纺织和服饰、汽车、化学和电子行业采用自动化系统。印尼和德国之间的一项政府间倡议正在加强该国的Start-Ups生态系统。

- 该地区拥有强大的电子和半导体市场,吸引了跨国企业在该地区开展业务。这是推动新解决方案需求的一个主要因素。消费品和食品加工产业需要节省成本、高功率的解决方案。自动化不仅可以实现这些目的,还可以带来其他好处,例如品质合规性和产品即时评估。这些新兴市场在创造需求方面发挥关键作用。

机器视觉系统(MVS)市场概览

机器视觉系统市场高度分散,主要参与者包括康耐视公司、基恩士公司、欧姆龙公司、Isra Vision AG(阿特拉斯科普柯集团)和 IDS Imaging Development Systems GmbH(Paul Hartmann AG)。市场参与企业正在采取伙伴关係和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023年10月,艾默生宣布收购NI。 NI 增加了艾默生在离散市场的终端市场曝光度,成为艾默生第二大工业部门。 NI 约 20% 的销售额来自软体,这笔交易还将增加艾默生在高成长工业软体市场的曝光率。收购 NI 提升了艾默生作为全球自动化领导者的地位,并扩大了机会利用近岸外包、数位转型、永续性和脱碳等关键趋势的机会。

- 2023年8月,康耐视公司以2.75亿美元的价格从中信资本控股有限公司的私募股权关联公司Trustar Capital手中收购了Moritex公司。 Moritex 是全球领先的光学元件供应商,在日本拥有强大的影响力。预计 Moritex 将为康耐视贡献约 6% 至 8% 的销售额,并在 2025 年增加 GAAP EPS。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 品质检验需求日益增长

- 对视觉引导机器人系统的需求不断增加

- 市场限制

- 缺乏灵活的机器视觉解决方案

第六章市场区隔

- 按组件

- 硬体

- 视觉系统

- 相机

- 光学和照明系统

- 影像撷取器

- 其他硬体

- 软体

- 硬体

- 按产品

- 基于PC

- 智慧型相机底座

- 按最终用户产业

- 食品和饮料

- 医疗保健和製药

- 物流与零售

- 车

- 电子和半导体

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 北美洲

第七章竞争格局

- 公司简介

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Isra Vision AG(Atlas Copco Group)

- IDS Imaging Development Systems GmbH(Paul Hartmann AG)

- National Instruments Corporation(Emerson)

- MVTec Software GmbH

- Sony Group Corporation

- Teledyne DALSA(Teledyne Technologies Company)

- Toshiba Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Machine Vision Systems Market size is estimated at USD 13.95 billion in 2025, and is expected to reach USD 20.81 billion by 2030, at a CAGR of 8.32% during the forecast period (2025-2030).

Machine vision systems rely on digital sensors protected inside industrial cameras with specialized optics to acquire images so that computer hardware and software can process, analyze, and measure various characteristics for decision-making.

Key Highlights

- Over the past few decades, industrial automation has evolved gradually, with few changes in market structure. But the pace of change is accelerating thanks to technology disruptions and macro trends such as reshoring, a global skilled-labor shortage, and environmental, social, and governance (ESG) efforts. In the recent past, the first wave of the COVID-19 pandemic created a slowdown in much of manufacturing. However, it was only temporary. As manufacturing returned, there was a boom in production. As companies began to return to work while maintaining social distancing as the new norm, there was an increased need for vision systems and automation systems to help fill the void, with more workers being unable to occupy the same workspace or unable to come in.

- The potential of industrial automation is most obvious in the tiny percentage of manufacturing sites known as "digital lighthouse factories." These plants are leading the way in automation. A survey by the World Economic Forum found that 93% of lighthouse factories had gotten a growth benefit from their embrace of automation. Most of the growth benefit came from the ability to increase their output, with automation leading to new revenue streams for a handful of factories.

- As a result, machine vision is experiencing a surge in adoption, with organizations actively seeking more ways to deploy this transformative technology across their operations. Decision-makers are continually searching for ways to enhance productivity, quality, and traceability, and as a result, are identifying more applications on their manufacturing and logistics lines that can be improved with machine vision.

- Driving this growth is the need for improved product inspection and quality control in the manufacturing sector, as well as the growing demand for smarter collaborative robots in manufacturing and warehousing. Automation and machine vision technologies also improve operational efficiency and productivity, reduce production costs, and expand worker capabilities.

- Another factor driving growth is the need for improved product inspection and quality control in the manufacturing sector, as well as the growing demand for smarter collaborative robots in manufacturing and warehousing. Automation and machine vision technologies also improve operational efficiency and productivity, reduce production costs, and expand worker capabilities.

- However, the current market is experiencing a deficiency in adaptable software that effectively integrates high-quality graphics and user-friendly interfaces with code-centric algorithms. Thus, due to the aforementioned shortage of proficient individuals, the market encounters a hindrance in its expansion.

Machine Vision Systems (MVS) Market Trends

Cameras to be the Largest Hardware Segment

- Machine vision cameras play a crucial role in the industrial image processing chain. These cameras utilize a particular protocol to communicate with a computer, which then analyzes the image data and can even adjust the camera's settings. The applications of machine vision cameras are diverse and extensive. They can be utilized for production control, managing object flow, inspecting surfaces, manufacturing electronic components, and guiding robots.

- Machine vision cameras are capable of transforming an optical image into an analog or digital signal. These cameras employ PC-based processing hardware and software algorithms to analyze images, videos, and data, facilitating the automation of manual tasks. On the other hand, traditional smart cameras are self-contained units that integrate a machine vision camera, a processor, and lighting within a compact enclosure. These smart cameras have the ability to capture and analyze images and data without requiring a separate PC.

- Smart cameras are becoming a popular hardware component in the MV System. They have greatly simplified the process of designing machine vision systems by integrating lighting, image sensors, software, and I/O. Over time, the capabilities and specifications of smart cameras have expanded. This includes the introduction of models with larger image sensors, the emergence of embedded vision cameras that can function as smart cameras, and the development of new cameras that are capable of executing deep learning and artificial intelligence tasks.

- Machine vision has emerged as a cutting-edge advancement in camera technology, revolutionizing multiple industrial sectors such as logistics, manufacturing, and smart devices. With the advent of smart camera technologies, manufacturers can effortlessly develop and implement machine vision models tailored to their customer's specific requirements, helping customers gain comprehensive and actionable insights from valuable data. The market is poised to witness significant growth due to the rising popularity of smart cameras, which offer enhanced processing capabilities in compact form factors.

- For instance, in May 2023, Zivid launched a revolutionary line of its latest 3D color cameras, poised to make a significant impact on the machine vision and automation sectors. This development empowers the company to further enhance its capabilities, enabling customers to optimize efficiency and productivity across various applications such as de-palletizing, bin-picking, pick-and-place, assembly, packaging, and quality control. Such developments are expected to increase the potential of the market opportunities and drive the market at a significant rate.

- The utilization of technology spans numerous industries, encompassing robotic guidance and automation, quality control and inspection, as well as mapping. The growing adoption of robotics in the manufacturing sector is anticipated to amplify the potential of cameras for machine vision systems, driven by technological advancements and the rising demand for automation in various industries. For instance, according to a survey published by the International Federation of Robotics (IFR) in 2023, In 2023, U.S. manufacturing firms significantly ramped up their automation efforts, with industrial robot installations surging by 12% to a total of 44,303 units.

Asia-Pacific is Expected to Hold Significant Market Share

- China is one of the world's fastest-growing countries with a high industrial production rate. This acts as a driver for the machine vision systems market in the country. Investments are planned to improve the quality of growth, address environmental issues, and reduce overcapacity. The number of companies deploying factory automation, process, and robotics technologies in the country is smaller than the enormous scale of its manufacturing facilities and the number of workers it employs. This represents a big opportunity for companies in China's machine vision sector.

- Japan also holds a significant position in the semiconductor and electronics industries as it is home to some essential semiconductor manufacturers. According to WSTS, the semiconductor industry revenue in Japan grew by 14.2% in 2022, and it is expected to grow further over the coming years. Furthermore, the country's growing automotive industry is also expected to support market growth over the forecast period as various steps have been taken to increase the adoption of autonomous vehicles.

- In South Korea, the automotive industry is flourishing, driving the demand for machine vision systems. Growing consumer demand and supportive government policies are among the significant factors driving the country's adoption of autonomous and electric vehicles. According to a report published by the Ministry of Land, Infrastructure and Transport (South Korea), around 390 thousand electric vehicles were registered in South Korea in 2022, with a sharp increase recorded after 2013. Together with hybrid and hydrogen vehicles, the share of environment-friendly vehicles among the total number of registered vehicles in South Korea was about 6.2%.

- India's industrial automation sector has been revolutionized by the addition of digital and physical technologies in manufacturing to deliver optimal performance. Additionally, emphasis on zero-waste manufacturing and a shorter time-to-market has increased market growth.

- The rest of Asia-Pacific comprises Taiwan, Singapore, Indonesia, Malaysia, Thailand, Australia, etc. In Indonesia, the onset of Industry 4.0 is driving the market studied, with a focus on implementing automation systems in the food and beverage, textiles and clothing, automotive, chemical, and electronics industries. Cross-government initiatives between Indonesia and Germany are strengthening the start-up ecosystem in the country.

- The presence of strong electronics and semiconductor markets in the region has pushed multinational industries to establish their operations there. This has been a significant factor in the growing demand for new solutions. Cost-cutting and high-output solutions are a few sought-out solutions in the consumer goods and food processing industry. Automation serves these purposes and brings additional benefits, such as quality adherence and real-time assessment of the products. These developments have been critical in demand generation in these regional markets.

Machine Vision Systems (MVS) Market Overview

The machine vision systems market is highly fragmented, with the presence of major players like Cognex Corporation, Keyence Corporation, Omron Corporation, Isra Vision AG (Atlas Copco Group), and IDS Imaging Development Systems GmbH (Paul Hartmann AG). The players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: Emerson announced the acquisition of NI. NI increases Emerson's end market exposure in discrete markets, which will be Emerson's second largest industry segment. With approximately 20% of its sales in software, NI also increases Emerson's exposure to high-growth industrial software markets. The acquisition of NI advances Emerson's position as a global automation leader and expands its opportunities to capitalize on critical secular trends like nearshoring, digital transformation, sustainability, and decarbonization.

- August 2023: Cognex Corporation acquired Moritex Corporation (Moritex) from Trustar Capital, a private equity affiliate of CITIC Capital Holdings Limited, for USD 275 million. Moritex is a leading global provider of optics components with a strong presence in Japan. Moritex is expected to contribute around 6-8% of Cognex's revenue, and the acquisition is expected to be accretive to GAAP EPS in 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Quality Inspections

- 5.1.2 Increasing Demand for Vision-guided Robotic Systems

- 5.2 Market Restraints

- 5.2.1 Scarcity of Flexible Machine Vision Solutions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabbers

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistics and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.4 Australia and New Zealand

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Isra Vision AG (Atlas Copco Group)

- 7.1.5 IDS Imaging Development Systems GmbH (Paul Hartmann AG)

- 7.1.6 National Instruments Corporation (Emerson)

- 7.1.7 MVTec Software GmbH

- 7.1.8 Sony Group Corporation

- 7.1.9 Teledyne DALSA (Teledyne Technologies Company)

- 7.1.10 Toshiba Corporation