|

市场调查报告书

商品编码

1849873

毫米波技术:市场占有率分析、产业趋势、统计数据和成长预测(2025-2031)Millimeter Wave Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

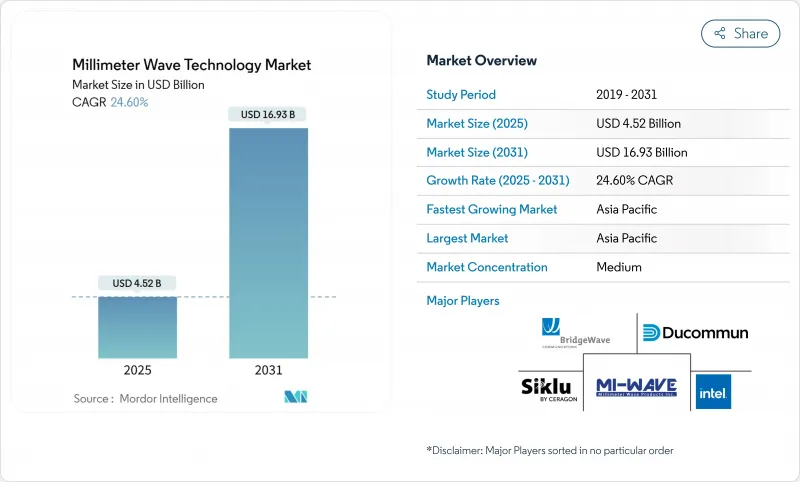

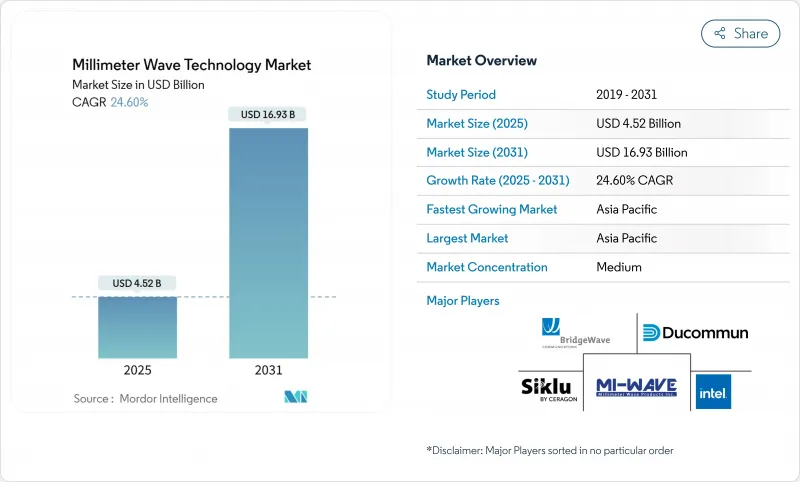

据估计,毫米波技术市场规模预计将在 2025 年达到 45.2 亿美元,到 2031 年达到 169.3 亿美元,预测期内(2025-2031 年)的复合年增长率为 24.60%。

网路营运商正在转向 24 GHz 以上的频率以缓解容量压力,而国防机构则正在将雷达系统升级到 94 GHz 以实现更高解析度的瞄准。密集的 5G 部署和早期 6G 试验的双重需求正在支持资本投资,而设备成本的下降则推动了医疗成像、工业自动化和汽车 ADAS 等领域的采用。亚太地区将以数百万个 5G 部署占据主导地位,而北美将受益于频谱自由化和《晶片法案》(CHIPS Act) 支持的半导体资金,推动创新。零件供应商将受益于受专利保护的射频前端,但供应链暴露于氮化镓晶圆会带来策略风险。

全球毫米波技术市场趋势与洞察

5G网路密集化及小型基地台回程传输需求

通讯业者很快发现,当小型基地台密度超过都市区分区限制时,光纤变得不经济。在中国、美国和印度进行的现场试验已实现数Gigabit的吞吐量,并证实毫米波回程传输可以取代高成本的挖沟。设备供应商目前正在整合软体定义的波束控制以缩短对准时间,市政当局也在简化屋顶许可审批以加快站点启动。资本效率和缩短时间使无线回程传输成为毫米波技术市场的基石。

24-100 GHz 频段行动与固定无线资料流量的成长

固定无线用户的资料消耗量比行动用户高出五倍,这迫使通讯业者必须为住宅闸道分配连续的28 GHz频段。监管机构已做出回应,协调了70/80/90 GHz频段的规则,以允许更宽的通道,晶片组製造商也推出了整合AI技术进行链路优化的第二代CPE平台。这些进步支持了农村宽频项目,并刺激了整个市场对毫米波技术的需求。

100 GHz以上射频前端的温度控管限制

随着频率的升高,热集中度会急剧上升,导致氮化镓装置的结温不稳定。虽然采用钻石基板和微流体冷却的先进封装技术正在评估中,但这些方法会增加材料成本并延长认证週期。在可扩展的热感解决方案出现之前,短期内此技术的应用将集中在100 GHz以下频段,限制毫米波技术市场在高频段的成长。

細項分析

由于兆赫成像技术能够实现肿瘤学和烧烫伤评估中的无标定组织诊断,到2030年,成像感测器的复合年增长率将达到最快。相比之下,天线和收发器将透过为行动基地台提供无线电前端,在2024年保持38%的最大份额。预计到2030年,毫米波技术在影像感测器中的市场规模将超过30亿美元,这得益于医院采用非电离诊断工具的推动。通讯和网路积体电路将在大型基地台緻密化的推动下实现互补成长,而介面和控制积体电路将顺应片上雷达整合的趋势。

NTT 在 300GHz 下实现 280Gbps 讯号产生等热感突破改善了链路预算,刺激了对频率捷变合成器的需求,而随着整合商寻求更高的功率密度,其他组件(尤其是先进的基板和热界面材料)也变得越来越重要,从而支援毫米波技术市场的组件堆迭不断扩大。

到2024年,完全或部分授权频谱将占总收入的78%,这反映了电讯大型基地台和国防网路对无干扰运作的重视。然而,随着监管机构制定简化的工业存在感知规则,95 GHz以上未授权频谱分配将以26.43%的复合年增长率成长。中小企业正在利用这项简化的製度,在工厂车间部署用于机器人和品质检测的雷达,为毫米波技术市场增添新的收益来源。

供应商现在正在推出双模晶片组,可以自动检测法规环境并即时调整 EIRP 设置,从而消除主要的采用障碍。虽然授权频谱对于关键任务链路仍然至关重要,但非授权频谱的激增正在扩大整体可寻址基础。

mmWave 技术市场报告按组件(天线和收发器、通讯和网路 IC、介面和控制 IC、频率产生和滤波器等)、授权模式(完全/部分授权和未授权)、频段(24-57GHz、57-95GHz、95-300GHz)、应用(通讯基础设施、行动和消费性设备、固定式接取)和消费性设备、固定区域进行无线存取。

区域分析

预计到2024年,亚太地区将占全球收益的42%,到2030年,复合年增长率将达到28.02%,这得益于中国440万个5G基地台的建设以及印度FWA的快速普及。地方政府正在拨出公共资金用于5G-Advanced研究,委託製造也在投资氮化镓晶圆生产线以实现在地化供应。在日本的私有5G模式中,由于土地征用复杂,毫米波的普及进展缓慢,但企业园区正在试用60GHz室内网路进行AR训练。

在北美,频谱政策与产业创新相契合,开放了37 GHz和70/80/90 GHz频段,而CHIPS法案的奖励则瞄准了国内工厂。国防雷达升级和固定无线部署支撑了稳健的基本客群,而诺基亚-T-Mobile等伙伴关係则确保了多年的设备供应管道。加拿大采用毫米波进行农村宽频试验,进一步扩大了毫米波技术的市场。

欧洲正将自己定位为科技实验室。德国正在支持6G试验台和微电子丛集,监管机构正在製定优先考虑製造业创新的42GHz竞标条款。德国OEM厂商对汽车雷达的需求正在推动与专业晶片製造商的合作,英国正在探索60GHz交通基础设施连结。中东正在投资智慧城市示范,南非正在试行28GHz FWA,巴西正在推出针对毫米波CPE组装的有针对性的税收优惠政策。虽然这些新兴市场的收益贡献仍维持在个位数,但成长率正超过成熟地区,为市场动态增添活力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 5G 网路密集化和小型基地台回程传输需求

- 24-100 GHz 频段行动与固定无线资料流量的成长

- 40GHz以上频段的自由化与新的竞标

- 国防雷达升级至 94GHz,实现低延迟瞄准

- 室内毫米波 FWA 用于最后 50 公尺光纤替换

- 122 GHz 工业存在感知法规出台

- 市场限制

- 100 GHz以上射频前端的温度控管限制

- 量产中高成本相相位阵列校准

- 人口密集地区市政「街道家具」分区的障碍

- 氮化镓晶圆供应链集中风险

- 价值链/供应链分析

- 监管格局

- 技术展望

- GaN 在毫米波应用的重要性

- 毫米波基板前景:LCP、PI 和 PTFE 如何影响 5G 硬件

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19影响评估

第五章市场规模及成长预测

- 按组件

- 天线和收发器

- 通讯与网路 IC

- 介面和控制IC

- 频率产生和滤波器

- 影像感测器

- 其他组件

- 按许可模式

- 全部/部分许可

- 未经许可

- 按频宽

- 24~57GHz

- 57~95GHz

- 95~300GHz

- 按用途

- 通讯基础设施(RAN 和回程传输)

- 行动和消费设备

- 固定无线接入(FWA)

- 雷达和安全成像

- 汽车ADAS和V2X

- 工业自动化和工业物联网

- 医疗和生命科学成像

- 航太和国防通讯

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Anokiwave Inc.

- Aviat Networks

- Broadcom Inc.

- BridgeWave Communications(REMEC)

- Ducommun Incorporated

- Eravant(SAGE Millimeter)

- Farran Technology

- Huawei Technologies

- Intel Corporation

- Keysight Technologies

- L3Harris Technologies

- Millimeter Wave Products Inc.

- NEC Corporation

- Nokia Corporation

- NXP Semiconductors

- Qualcomm Technologies

- Samsung Electronics

- Sivers Semiconductors

- Siklu Communication(Ceragon)

- Smiths Interconnect

- Vubiq Networks

第七章 市场机会与未来展望

The Millimeter Wave Technology Market size is estimated at USD 4.52 billion in 2025, and is expected to reach USD 16.93 billion by 2031, at a CAGR of 24.60% during the forecast period (2025-2031).

Network operators are turning to frequencies above 24 GHz for capacity relief, and defense agencies are upgrading radar systems to 94 GHz for higher-resolution targeting. Dual demand arising from dense 5G rollouts and early 6G trials sustains capital spending, while falling device costs encourage adoption in medical imaging, industrial automation, and automotive ADAS. Asia Pacific commands the largest regional position thanks to multi-million-site 5G deployments, whereas North America drives innovation through spectrum liberalization and CHIPS-Act-backed semiconductor funding. Component suppliers benefit from patent-protected RF front-ends, yet supply-chain exposure to gallium-nitride wafers introduces strategic risk.

Global Millimeter Wave Technology Market Trends and Insights

5G network densification and small-cell backhaul demand

Operators quickly discover that fiber becomes uneconomical when small-cell density exceeds urban zoning caps, so 60 GHz and E-band radio links are adopted to connect sites within weeks instead of months. Field trials in China, the United States, and India deliver multi-gigabit throughput, confirming that millimeter-wave backhaul can substitute for high-cost trenching activities. Equipment vendors now integrate software-defined beam steering to reduce alignment time, while urban authorities streamline rooftop permitting to accelerate site activation. Capital efficiency and time-to-market gains make wireless backhaul a cornerstone of the millimeter wave technology market.

Rising mobile and fixed-wireless data traffic in 24-100 GHz bands

Fixed-wireless customers consume up to five times the data of mobile subscribers, forcing operators to allocate contiguous 28 GHz blocks to residential gateways. Regulatory agencies respond by harmonizing 70/80/90 GHz rules to enable wider channels, and chipset makers have announced second-generation CPE platforms with integrated AI for link optimization. These advances support rural broadband programs and stimulate demand across the millimeter wave technology market.

RF front-end thermal management limits above 100 GHz

Heat concentration rises disproportionately as frequency increases, pushing gallium-nitride devices toward junction temperatures that degrade reliability. Advanced packaging using diamond substrates and micro-fluidic cooling is under evaluation, yet these approaches add material cost and prolong qualification cycles. Until scalable thermal solutions emerge, near-term deployments will cluster below 100 GHz, tempering the millimeter wave technology market's upper-band growth.

Other drivers and restraints analyzed in the detailed report include:

- Spectrum liberalization and new auctions above 40 GHz

- Defense radar upgrades to 94 GHz

- High-cost phased-array calibration in volume production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Imaging Sensors deliver the fastest 25.32% CAGR through 2030, as terahertz imaging enables label-free tissue diagnosis in oncology and burn assessment. In contrast, Antennas and Transceivers preserve the largest 38% share in 2024 by supplying radio front-ends for mobile base stations. The millimeter wave technology market size for Imaging Sensors is expected to cross USD 3 billion by 2030 as hospitals adopt non-ionizing diagnostic tools. Complementary growth in Communication and Networking ICs arises from densified macro-cell deployments, while Interface and Control ICs ride the trend toward radar-on-chip integration.

R&D breakthroughs such as NTT's 280 Gbps signal generation at 300 GHz improve link budgets and stimulate demand for frequency-agile synthesizers. Meanwhile, Other Components, chiefly advanced substrates and thermal interface materials, gain visibility as integrators seek higher power density. The result is a broadening component stack that anchors the millimeter wave technology market.

Fully or Partly Licensed spectrum delivered 78% of 2024 revenue, reflecting the premium attached to interference-free operations in telecom macro cells and defense networks. However, unlicensed allocations above 95 GHz advance at 26.43% CAGR as regulators create industrial presence-sensing rules that require minimal paperwork. SMEs leverage the simplified regime to deploy factory-floor radar for robotics and quality inspection, adding fresh revenue streams to the millimeter wave technology market.

Vendors now introduce dual-mode chipsets that auto-detect regulatory environments and adjust EIRP settings in real time, removing a key adoption barrier. Licensed spectrum will remain critical for mission-critical links, yet the unlicensed surge broadens the overall addressable base.

The Millimeter Wave Technology Market Report is Segmented by Component (Antennas and Transceivers, Communications and Networking ICs, Interface and Control ICs, Frequency Generation and Filters, and More), Licensing Model (Fully/Partly Licensed and Unlicensed), Frequency Band (24-57 GHz, 57-95 GHz, and 95-300 GHz), Application (Telecom Infrastructure, Mobile and Consumer Devices, Fixed Wireless Access, and More), and Geography.

Geography Analysis

Asia Pacific commands 42% of 2024 revenue and is forecast to grow at 28.02% CAGR through 2030, propelled by China's 4.4 million 5G base stations and India's rapid FWA penetration. Regional governments allocate public funds to 5G-Advanced research, and contract manufacturers invest in gallium-nitride wafer lines to localize supply. Japan's private 5G model shows slower mmWave uptake due to site-acquisition complexity, but corporate campuses are piloting 60 GHz indoor networks for AR training.

North America aligns spectrum policy with industrial innovation, releasing 37 GHz and 70/80/90 GHz bands while channeling CHIPS-Act incentives toward domestic fabs. Defense radar upgrades and fixed-wireless deployments underpin a resilient customer base, and partnerships such as Nokia-T-Mobile secure multi-year equipment pipelines. Canada adopts mmWave for rural broadband pilots, further expanding the millimeter wave technology market.

Europe positions itself as a technology laboratory. Germany supports 6G testbeds and micro-electronics clusters, and regulators craft 42 GHz auction terms that prioritize manufacturing innovation. Automotive radar demand from German OEMs drives collaboration with specialist chipmakers, while the UK explores 60 GHz transport-infrastructure links. The Middle East invests in smart-city proof-of-concepts, South Africa pilots 28 GHz FWA, and Brazil introduces targeted tax breaks for mmWave CPE assembly. Although revenue contributions from these emerging markets remain single-digit, growth rates surpass mature regions, adding dynamism to the millimeter wave technology market.

- Anokiwave Inc.

- Aviat Networks

- Broadcom Inc.

- BridgeWave Communications (REMEC)

- Ducommun Incorporated

- Eravant (SAGE Millimeter)

- Farran Technology

- Huawei Technologies

- Intel Corporation

- Keysight Technologies

- L3Harris Technologies

- Millimeter Wave Products Inc.

- NEC Corporation

- Nokia Corporation

- NXP Semiconductors

- Qualcomm Technologies

- Samsung Electronics

- Sivers Semiconductors

- Siklu Communication (Ceragon)

- Smiths Interconnect

- Vubiq Networks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G network densification and small-cell backhaul demand

- 4.2.2 Rising mobile and fixed-wireless data traffic in 24-100 GHz bands

- 4.2.3 Spectrum liberalisation and new auctions above 40 GHz

- 4.2.4 Defense radar upgrades to 94 GHz for low-latency targeting

- 4.2.5 Indoor millimetre-wave FWA for last-50-metre fibre substitution

- 4.2.6 Emerging 122 GHz industrial presence-sensing regulations

- 4.3 Market Restraints

- 4.3.1 RF front-end thermal management limits above 100 GHz

- 4.3.2 High-cost phased-array calibration in volume production

- 4.3.3 Municipal "street-furniture" zoning hurdles for dense sites

- 4.3.4 Gallium-nitride wafer supply chain concentration risk

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Significance of GaN across mmWave applications

- 4.6.2 mmWave substrate landscape: LCP, PI, PTFE impact on 5G HW

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 COVID-19 Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Antennas and Transceivers

- 5.1.2 Communication and Networking ICs

- 5.1.3 Interface and Control ICs

- 5.1.4 Frequency Generation and Filters

- 5.1.5 Imaging Sensors

- 5.1.6 Other Components

- 5.2 By Licensing Model

- 5.2.1 Fully/Partly Licensed

- 5.2.2 Unlicensed

- 5.3 By Frequency Band

- 5.3.1 24-57 GHz

- 5.3.2 57-95 GHz

- 5.3.3 95-300 GHz

- 5.4 By Application

- 5.4.1 Telecom Infrastructure (RAN and backhaul)

- 5.4.2 Mobile and Consumer Devices

- 5.4.3 Fixed Wireless Access (FWA)

- 5.4.4 Radar and Security Imaging

- 5.4.5 Automotive ADAS and V2X

- 5.4.6 Industrial Automation and IIoT

- 5.4.7 Medical and Life-Sciences Imaging

- 5.4.8 Aerospace and Defense Communications

- 5.4.9 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anokiwave Inc.

- 6.4.2 Aviat Networks

- 6.4.3 Broadcom Inc.

- 6.4.4 BridgeWave Communications (REMEC)

- 6.4.5 Ducommun Incorporated

- 6.4.6 Eravant (SAGE Millimeter)

- 6.4.7 Farran Technology

- 6.4.8 Huawei Technologies

- 6.4.9 Intel Corporation

- 6.4.10 Keysight Technologies

- 6.4.11 L3Harris Technologies

- 6.4.12 Millimeter Wave Products Inc.

- 6.4.13 NEC Corporation

- 6.4.14 Nokia Corporation

- 6.4.15 NXP Semiconductors

- 6.4.16 Qualcomm Technologies

- 6.4.17 Samsung Electronics

- 6.4.18 Sivers Semiconductors

- 6.4.19 Siklu Communication (Ceragon)

- 6.4.20 Smiths Interconnect

- 6.4.21 Vubiq Networks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment