|

市场调查报告书

商品编码

1444586

高性能轮胎:市场占有率分析、产业趋势与统计、成长预测(2024-2029)High Performance Tire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

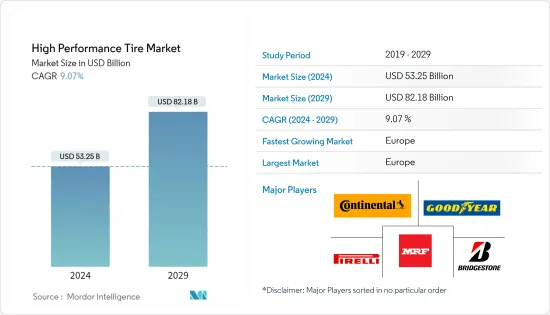

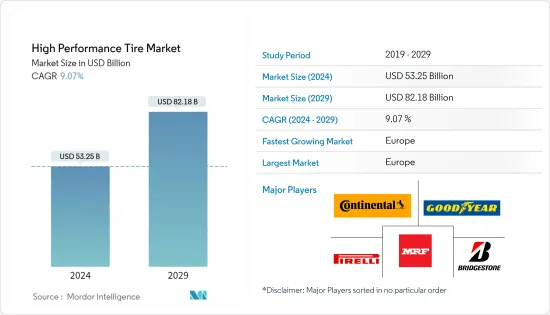

高性能轮胎市场规模预计到2024年为532.5亿美元,预计到2029年将达到821.8亿美元,在预测期内(2024-2029年)增长9.07%,以复合年增长率增长。

主要亮点

- 由于2020年新车产销量下降,COVID-19大流行在短期内对汽车轮胎市场产生了重大影响。此外,政府的限制措施使人们大多待在室内,由于高昂的维护成本进一步减少了收益。并更换轮胎。

- 近年来,由于各类赛车比赛的增加,高性能轮胎的销售量大幅成长,这是高性能和超高性能轮胎市场的关键驱动力。

- 世界各地不同类型赛车的日益普及极大地推动了市场的成长。竞技赛车运动最初主要集中在F1、NASCAR、摩托车赛车等热门赛车系列赛上,吸引了大量的赞助和推广活动。然而,近年来,赛车比赛中不同类型的赛车有所增加,不同引擎尺寸的车辆,如SUV、越野车、巨型卡车、太阳能车、短跑车和旅行车等。

- 此外,轮胎製造商正在利用新技术来製造高性能轮胎,突破尺寸、速度和性能特征的极限。许多新一代高性能轮胎可提供多季节驾驶安全性、乘坐舒适性、低噪音和更高的燃油效率,以满足不断变化的客户需求。

高性能轮胎市场趋势

对高性能汽车的需求不断增长

- 全球汽车产业的快速扩张正在推动高性能轮胎市场的发展。这可以归因于商用车和小客车的需求不断增长、运输业蓬勃发展、可支配收入不断增加以及该国先进的汽车基础设施。

- 此外,由于减少噪音和污染的好处,人们对电动车的需求日益增长,预计将在整个预测期内产生对高性能轮圈的巨大需求。此外,人们对高性能轮胎的优势(例如加速、燃油效率和轻量化)的认识不断提高,预计将推动该领域的市场扩张。

- 高性能轮胎具有较短的煞车距离、横向抓地力和强大的湿地牵引力,使您的车辆更安全。在美国,SUV占2021年汽车总销量的77.6%,而在欧洲,SUV约占2021年汽车销量的40%。

- 跑车在年轻人中的日益普及预计将在预测期内推动市场扩张。市场也可能受益于主要汽车製造商不断尝试生产更强大、更安全的车辆。

- 此外,售后市场对高性能轮胎的需求主要是由于超高速所需的软橡胶轮胎磨损较快。在典型的赛车锦标赛(拥有最大穿透力)中,车队通常使用 9 到 14 组轮胎,具体取决于赛道长度、路面类型(例如沥青或混凝土)以及赛道类型。短道、高速公路、超级高速公路或公路路线。因此,售后市场对高性能轮胎的需求远高于OEM领域。

- 考虑到所有这些因素,高性能替换轮胎市场预计在预测期内将会成长。

欧洲市场成长速度较快

- 英国、德国、法国等西欧国家在高性能轮胎市场的贡献中扮演重要角色。法拉利、戴姆勒、宝马、大众集团、雷诺等西欧製造商经常参加欧洲各地举办的赛车活动,以测试和推广其产品。这增加了OEM对赛车轮胎的需求。许多汽车比赛都在这个地区举行,主要是在法国、义大利、英国和英国等国家。随着赛车市场的扩大,赛车轮胎的需求预计将会增加。

- 品牌忠诚度透过原始OEM和车辆团队以与最初安装的相同品牌更换汽车轮胎来证明。因此,轮胎製造商寻求与OEM和车队所有者达成交易。这些合约对于轮胎製造商来说非常重要且有吸引力,因为它们可以节省分销和广告成本。

- 由于英国基础设施的强劲成长和汽车持有的增加,预计英国轮胎市场在未来几年将会成长。米其林、固特异和邓禄普、倍耐力和库柏轮胎是全球领先的轮胎製造商,在英国设有生产基地,并计划在未来五年内扩大产能。

- 大多数世界上最大的汽车OEM,包括日产、路虎、丰田、本田和达夫,都在英国设有製造工厂,导致该国对高性能轮胎的需求量很大。

- 例如,通用汽车于2021年7月推出了欧洲版新款中置引擎Corvette Stingray,共有16款高配首发版本,其中包括8款小轿车和8款敞篷车。 Corvette Stingray 配备了米其林的 Michelin Pilot Sport 4S 高性能轮胎。 2021年5月,英国Bridgestone在市场上推出了全新旗舰Potenza Sport高性能轮胎,该轮胎的自订开发版本由玛莎拉蒂、兰博基尼和宝马等主要汽车製造商选择。

- 轮胎製造生产标准的提高、永续创新和优秀的国内技术诀窍预计将继续加强德国作为高性能轮胎製造地在供应方面的动态。预测期。

高性能轮胎产业概况

高性能轮胎市场的特点是国际厂商较多、地区厂商较少,市场竞争激烈。该市场的主要企业包括大陆集团、Bridgestone公司、Pirelli & C. SpA、MRF 和米其林。

这家市场领导者与多家子公司共同经营,为不同国家的特定产品提供服务。尤其是横滨和倍耐力,正在寻求根据修订后的 F1 规则,透过建立生产基地、製造新轮胎和建立全面的供应链来渗透市场。Bridgestone和米其林正在加拿大进行重大投资,以扩大产品系列。

终端市场对高性能、高效率和安全操控轮胎的需求预计将使市场在预测期内具有竞争力和活力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(市场规模、金额)

- 轮胎类型

- 赛车光头胎

- 胎面轮胎

- 其他轮胎类型

- 销售管道类型

- OEM

- 更换/售后

- 车辆类型

- 赛车

- 越野车

- 其他车型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Bridgestone Corporation

- Continental AG

- Goodyear Tire &Rubber Company

- Hankook Tire &Technology Co. Ltd

- Kumho Tire Co. Inc.

- Michelin

- MRF Limited

- Pirelli &C. SpA

- Sumitomo Rubber Industries Ltd

- Yokohama Rubber Co. Ltd

第七章市场机会与未来趋势

The High Performance Tire Market size is estimated at USD 53.25 billion in 2024, and is expected to reach USD 82.18 billion by 2029, growing at a CAGR of 9.07% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic significantly affected the automotive tire market in the short term, as the production and sales of new vehicles declined in 2020. Moreover, people stayed mostly indoors owing to the restrictions imposed by authorities, which further decreased revenues due to low maintenance and tire replacements.

- The sales of high-performance tires have increased significantly over the years, owing to a rise in the different types of automotive racing competitions, which acts as a significant driver for the high-performance and ultra-high-performance tires market.

- The growing popularity of various types of automotive racing worldwide has helped boost the market's growth to a significant extent. Competitive automotive racing was initially focused on popular car racing series, such as Formula One, NASCAR, and motorbike races, which attracted many sponsorships and promotional activities. However, over the years, racing competitions have witnessed an increase in the number of different types of races, with vehicles having varying engine sizes, such as SUVs, dirt bikes, monster trucks, solar cars, sprint cars, and touring cars.

- Furthermore, tire manufacturers are utilizing new technologies in producing high-performance tires that push the boundaries of size, speed, and performance characteristics. Many of these next-generation high-performance tires offer multi-season driving safety, ride comfort, low noise, and improved fuel efficiency to satisfy changing customer needs.

High Performance Tires Market Trends

Rise in Demand for High Performance Vehicles

- The rapid expansion of the auto sector across the globe is driving the high-performance tires market. This may be credited to expanding commercial and passenger vehicle demand, a booming transportation industry, rising disposable incomes, and the country's advanced automotive infrastructure.

- Furthermore, the increased desire for electric cars due to the benefits of decreased noise and pollution is expected to produce a great demand for high-performance wheels throughout the forecast period. Additionally, rising awareness of the advantages of high-performance tires in terms of acceleration, fuel efficiency, and lightweight is expected to drive market expansion in the area.

- High-performance tires increase vehicle safety by having a shorter stopping distance, lateral grip, and strong wet traction. In the United States, SUVs accounted for 77.6% of total vehicle sales in 2021, whereas in Europe, SUVs accounted for about 40% of vehicles sold in 2021.

- The rising popularity of sports vehicles among the young population is expected to fuel the market expansion throughout the forecast period. Also, the market will likely benefit from the major car manufacturers' increasing attempts to build more powerful and safe vehicles.

- Furthermore, the demand for high-performance tires in the aftermarket is mainly attributed to the faster wear and tear of softer rubber tires required to perform at extremely high speeds. In a typical racing championship (for which they have the maximum penetration), a team usually uses between 9-14 sets of tires, depending upon the length of the track, surface type, like asphalt and concrete, and types of track, such as short track, speedway, superspeedway, or road course. Therefore, the demand for high-performance tires in the aftermarket is higher to a considerable extent than in the OEM segment.

- Considering all these factors, the market for high-performance replacement tires is expected to grow over the forecast period.

The European Market is Growing at a Faster Pace

- Countries in Western Europe, such as the United Kingdom, Germany, and France, play a significant role in contributing to the high-performance tire market. Manufacturers in Western Europe, such as Ferrari, Daimler, BMW, Volkswagen Group, and Renault, frequently participate in automotive racing events organized across Europe to test and promote their products. This has increased the demand for racing tires by OEMs. The region also hosts many auto races, primarily in countries such as France, Italy, Spain, and the United Kingdom. A rise in the auto races market is expected to increase the demand for racing tires.

- Brand loyalty is exhibited by OEMs and vehicle teams, which replace tires on their cars with the same brand as originally installed. As a result, tire manufacturers have strived to enter contracts with OEMs and vehicle team owners. These contracts are important and attractive to tire manufacturing companies, as they save on distribution expenses and advertising costs.

- The United Kingdom's tire market is expected to rise in the following years due to the country's strong infrastructure growth and increasing automotive fleet size. Michelin, Goodyear & Dunlop, Pirelli, and Cooper Tyres are among the world's leading tire manufacturers, with production operations in the UK with plans to grow production capacity over the next five years.

- Most of the world's biggest auto OEMs, including Nissan, Land Rover, Toyota, Honda, DAF, and others, have manufacturing facilities in the United Kingdom, resulting in high demand for performance tires in the country.

- For instance, in July 2021, GM launched European versions of the new mid-engine Corvette Stingray in 16 highly equipped launch editions, including eight coupes and eight convertibles. The Corvette Stingray has been equipped with Michelin Pilot Sport 4S performance tires from Michelin. In May 2021, Bridgestone UK introduced new flagship Potenza Sport high-performance tires in the market, whose custom-developed version tires have been selected by leading car manufacturers, including Maserati, Lamborghini, and BMW.

- The increase in production standards of tire manufacturing, sustainable innovation, and excellent technical know-how based in the country are expected to continue strengthening the position of Germany to emerge as a leading high-performance tire manufacturing location, in the supply side dynamics, during the forecast period.

High Performance Tires Industry Overview

The high-performance tires market is characterized by the presence of numerous international and few regional players, resulting in a highly competitive market environment. Some of the leading players in the market are Continental AG, Bridgestone Corporation, Pirelli & C. SpA, MRF, Michelin, and others.

Market leaders operate with many subsidiaries that cater to specific products in different countries. Yokohama and Pirelli, in particular, are trying to increase their market penetration by setting up production bases and manufacturing new tires per the modified F1 rules to have comprehensive supply chains. Bridgestone and Michelin have invested huge amounts in Canada to expand their product portfolios in the automotive tire segment.

The demand for high-performance, highly efficient, and safe-handling tires from the end market is expected to make the market more competitive and effectively dynamic during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Tire Type

- 5.1.1 Racing Slick

- 5.1.2 Tread Tires

- 5.1.3 Other Tire Types

- 5.2 Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Replacement/Aftermarket

- 5.3 Vehicle Type

- 5.3.1 Racing Cars

- 5.3.2 Off-the Road Vehicles

- 5.3.3 Other Vehicle Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 Japan

- 5.4.2.3 India

- 5.4.2.4 South Korea

- 5.4.2.5 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Bridgestone Corporation

- 6.2.2 Continental AG

- 6.2.3 Goodyear Tire & Rubber Company

- 6.2.4 Hankook Tire & Technology Co. Ltd

- 6.2.5 Kumho Tire Co. Inc.

- 6.2.6 Michelin

- 6.2.7 MRF Limited

- 6.2.8 Pirelli & C. SpA

- 6.2.9 Sumitomo Rubber Industries Ltd

- 6.2.10 Yokohama Rubber Co. Ltd