|

市场调查报告书

商品编码

1686202

蛋白酶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Proteases - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

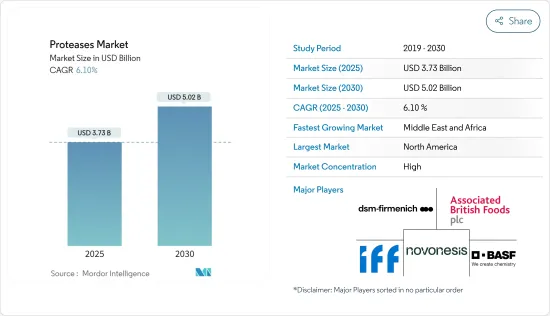

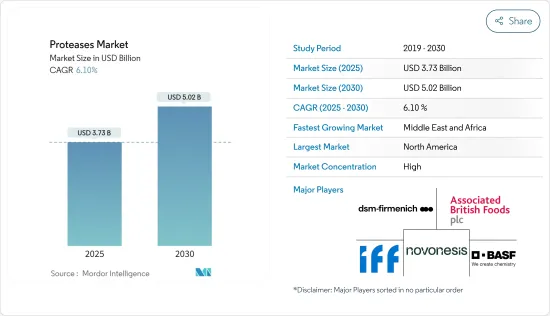

蛋白酶市场规模预计在 2025 年为 37.3 亿美元,预计到 2030 年将达到 50.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.1%。

由于消费者生活方式的改变决定了对 RTC/RTE 产品的需求,全球加工食品产业正在经历显着成长。预计这将在预测期内推动对蛋白酶的需求。此外,微生物蛋白酶由于其在代谢活动中的重要作用及其在工业中的巨大用途而引起了广泛的兴趣。市面上现有的微生物衍生蛋白酶由于产量高、消费量少、成本效益高,适合市面上的生物技术应用。

蛋白酶是一类功能多样的酶,可用作蛋白酶、胜肽酶和酰胺酶,具有广泛的工业应用,特别是在食品、清洁剂和製药行业。蛋白酶是必需的工业酶,可分解蛋白质中的肽键,在化学和生物过程中有广泛的应用。使用蛋白酶的主要优点之一是其能够产生天然产物、在温和的反应条件下具有活性、立体特异性、特异性和生物分解性。各公司推出了创新产品,缩短了反应时间并提高了整体产量。蛋白酶对于许多快速消费品 (FMCG) 产品的开发至关重要。市场的关键驱动力是蛋白酶在各行业的多样化应用。此外,它无毒、无致病性,对环境友好,进一步促进了市场发展。

蛋白酶用于动物饲料工业,以改善饲料的营养成分和消化率,促进动物更好的生长和整体健康。蛋白酶将猪、家禽和水产养殖物种等动物消化道中的复杂蛋白质分解成更简单的胜肽和胺基酸,以便于吸收。这种酵素作用不仅可以提高营养利用率,还可以减少可能干扰吸收和消化的抗营养素。此外,蛋白酶可以透过减少对高蛋白饲料成分的需求来降低饲料成本,并且可以透过减少氮排泄来减轻畜牧业生产对环境的影响。根据德国联邦畜牧业和营养管理局预测,2023年德国家禽产量将达153万吨左右。畜牧业的扩张和饲料需求的增加为全球蛋白酶市场提供了充足的机会。

蛋白酶市场趋势

蛋白酶在食品和饮料行业的用途不断扩大,推动了市场成长

在食品工业中,蛋白酶被广泛用于增强各种食品的质地、风味和营养价值。木瓜蛋白酶和凤梨蛋白酶等蛋白酶在肉类加工过程中分解肌肉纤维,使坚硬的切片变嫩,使肉类更加多汁。由于世界各地的肉类消费量很高,肉类和家禽业对蛋白酶的需求有充足的成长机会。根据美国农业部经济研究局的数据,2022 年人均肉鸡、牛肉和猪肉消费量分别为 98.9 磅、59.1 磅和 51.1 磅。

凝乳酵素中的凝乳酵素等酵素在乳酪和乳製品的生产中至关重要,因为它们有助于凝固牛奶并形成凝乳,并在成熟过程中增强乳酪的风味。蛋白酶在烘焙业也有应用,因为它们可以改变麵筋结构,使麵团更有弹性和黏性,这是饼干和薄脆饼干等烘焙点心的重要品质。蛋白酶可以去除啤酒酿造过程中会引起混浊的蛋白质,确保啤酒的稳定性和清澈度。同样,果汁生产中也需要这些酵素来去除蛋白质引起的浑浊并产生清澈的饮料。因此,蛋白酶在整个食品和饮料行业中得到广泛的应用。

在市场上营运的公司正在开发新的创新产品。我们也制定了测试和开发新蛋白酶的策略,以满足日益增长的需求。例如,2022 年 9 月, 创新 Enzymes 推出了来自酿酒酵母的 Kex2 蛋白酶(重组),用于酵母中外源蛋白表达中分泌肽的裂解。蛋白酶在食品和饮料工业中具有广泛的用途。由于它在减少废弃物、提高加工效率和节省自然资源方面发挥着至关重要的作用,预计未来几年市场将大幅成长。

北美主导蛋白酶市场

北美拥有先进的生物技术和製药行业,这些行业使用蛋白酶进行药物开发、蛋白质工程和治疗应用。例如,2023 年 3 月,IFF 业务部门丹尼斯克动物营养与健康部门推出了 Axtra PRIME(木聚醣酶、β-葡聚醣酶、α-淀粉酶和蛋白酶的组合),这是一种优化的酵素混合物,旨在解决仔猪生产中的关键挑战。蛋白酶广泛应用于北美庞大而复杂的食品和饮料行业的各种应用。例如,蛋白酶可用于酿造过程、乳酪製作和肉类嫩化。百威英博和卡夫亨氏等公司使用蛋白酶来改善产品品质和加工流程。

美国食品药物管理局(FDA) 提供的法规环境支持蛋白酶类产品的开发和商业化,尤其是在食品和药品领域。此监管支持确保了蛋白酶的功效和安全性,并提高了市场接受度。对机能性食品和膳食补充剂的需求不断增长,推动了产品中蛋白酶的使用。在北美,随着消费者越来越意识到蛋白酶的健康益处,对膳食补充剂的需求正在增长。根据美国国家医学图书馆的资料,蛋白酶的主要用途是治疗心血管疾病,但它们也正在成为治疗败血症、胃肠道疾病、发炎、囊肿纤维化、视网膜病变、干癣和其他疾病的有用药物。

因此,北美在蛋白酶市场的领导地位得到了强劲的工业需求、创新的技术发展、有利的法规结构、大量的研发支出以及各个行业的广泛应用的支持。所有这些因素都支持了该区域市场的主导地位和稳定扩张。

蛋白酶产业概况

蛋白酶市场呈现整合态势,主要企业占据主要市场占有率。该市场的主要企业包括国际香精香料公司 (International Flavors & Fragrances Inc.)、帝斯曼-芬美意集团 (DSM-Firmenich AG)、Novonesis 集团、巴斯夫公司(BASF SA) 和英国联合食品公司 (Associated British Foods PLC)。这些参与者正在采取各种策略来保持主导地位并建立强大的品牌形象。这些公司采取的主要策略包括併购,这有助于它们巩固市场地位并扩大产品系列。

产品创新和新产品开发是主要企业满足消费者需求和偏好的关键策略。公司投入大量资金进行研发活动,推出新的和改进的产品,使其产品与竞争对手区分开来,并扩大基本客群。此外,公司也致力于透过增加新的产品线和收购新业务来扩大产品系列。这项策略使公司能够满足消费者不断变化的需求和偏好并增加市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 酶工程和生物加工的技术进步。

- 对特色和永续原料的偏好日益增长

- 市场限制

- 高製造成本阻碍市场成长

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 起源

- 动物

- 胰蛋白酶

- 胃蛋白酶

- 列宁

- 其他动物来源

- 植物

- 木瓜蛋白酶

- 凤梨蛋白酶

- 其他植物来源(角蛋白酶和无花果蛋白酶)

- 微生物来源

- 碱性蛋白酶

- 酸性蛋白酶

- 中性蛋白酶

- 动物

- 应用

- 饮食

- 乳製品

- 麵包店

- 饮料

- 肉类和家禽

- 婴儿奶粉

- 药品

- 动物饲料

- 其他用途

- 饮食

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 新加坡

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 主要企业策略

- 市场占有率分析

- 公司简介

- Novus International Inc.

- International Flavors & Fragrances Inc.

- DSM-Firmenich AG

- Biocatalyst Ltd

- Novonesis Group

- Advanced Enzyme Technologies

- Associated British Foods PLC

- Bioseutica BV

- BASF SE

- Kemin Industries Inc.

第七章 市场机会与未来趋势

The Proteases Market size is estimated at USD 3.73 billion in 2025, and is expected to reach USD 5.02 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The global processed food industry is experiencing significant growth, driven by changing consumer lifestyles that demand ready-to-cook/eat products. This is expected to drive the demand for proteases during the forecast period. Additionally, microbial proteases have gained interest due to their vital role in metabolic activities and their immense utilization in industries. The proteases available in the market that are of microbial origin offer higher yield, lower time consumption, and cost-effectiveness, which have made them suitable for biotechnological applications in the market.

Proteases are a diverse group of enzymes that act as proteinases, peptidases, and amidases and have a broad range of industrial applications, particularly in the food, detergent, and pharmaceutical industries. Proteases are essential industrial enzymes that break down peptide bonds in proteins and find numerous uses in chemical and biological processes. One of the main advantages of using proteases is their ability to produce natural products, exhibit activity under mild reaction conditions, and exhibit stereospecificity, specificity, and biodegradability. Companies have introduced innovative products that reduce reaction time to enhance overall yield. Proteases are crucial in developing many fast-moving consumer good (FMCG) products. The market's primary driver is the multiple applications of proteases in various industries. Additionally, their non-toxic and non-pathogenic attributes make them eco-friendly, further boosting the market.

Proteases are used in the animal feed industry to improve the nutritional content and digestibility of feed, which promotes better animal growth and general health. Proteases facilitate the easier absorption of complex proteins in the digestive tracts of animals like pigs, poultry, and aquaculture species by breaking them down into simpler peptides and amino acids. In addition to improving the effectiveness of nutrient utilization, this enzymatic action also lessens the anti-nutritional elements that may impede absorption and digestion. Furthermore, by reducing the need for high-protein feed ingredients, proteases can reduce feed costs and the environmental impact of animal production by reducing nitrogen excretion. According to the Bundesanstalt fur Landwirtschaft und Ernahrung, approximately 1.53 million tons of dressed-weight poultry were produced across Germany in 2023. The expansion of the animal husbandry industry and rising demand for animal feed offer ample opportunities for the protease market worldwide.

Proteases Market Trends

Rising Application of Proteases in the Food & Beverage Industry Driving Market Growth

In the food industry, proteases are widely used to enhance various food products' texture, flavor, and nutritional value. Proteases such as papain and bromelain break down muscle fibers to tenderize tough cuts and produce more succulent meat during meat processing. The high consumption of meat across various regions worldwide offers ample opportunities for the growth of protease demand in the meat and poultry industry. According to the US Department of Agriculture and Economic Research Service, in 2022, the per capita consumption of broilers, beef, and pork was 98.9 pounds, 59.1 pounds, and 51.1 pounds, respectively.

Enzymes like chymosin found in rennet are essential for the production of cheese and dairy products as they aid in the coagulation of milk and the formation of curds, as well as enhancing the flavor of the cheese as it ages. Proteases have applications in the baking industry since they alter the structures of gluten, enhancing the dough's elasticity and consistency, which are important qualities for baked goods like biscuits and crackers. Proteases remove proteins that cause haze in beer brewing, guaranteeing its stability and clarity. Similarly, these enzymes are necessary for the production of juice, which removes turbidity caused by proteins to produce clear drinks. Hence, proteases are widely used across the food and beverage industry.

Companies operating in the market have been innovating and developing new products. They are also using other strategies to test and develop new proteases to cater to the rising demand for the same. For instance, in September 2022, Creative Enzymes launched Kex2 Protease from Saccharomyces cerevisiae, Recombinant, for the cleavage of secreted peptides in yeast exogenous protein expression. Protease enzymes have diverse applications in the food and beverage industries. The market is expected to grow significantly in the upcoming years due to its vital role in reducing waste production, improving processing efficiency, and preserving natural resources.

North America Dominates the Proteases Market

North America is host to advanced biotechnology and pharmaceutical industries that use proteases for drug development, protein engineering, and therapeutic uses. For instance, in March 2023, Danisco Animal Nutrition & Health, a business unit of IFF, launched Axtra PRIME (a combination of xylanase, beta-glucanase, alpha-amylase, and protease enzymes), an optimized enzyme blend designed to address key challenges in piglet production. Proteases are used extensively in a variety of applications by the large and sophisticated food and beverage industry in North America. Proteases are utilized, for instance, in the brewing process, cheese production, and meat tenderization. Proteases are used by businesses like Anheuser-Busch InBev and Kraft Heinz to improve product quality and processing effectiveness.

The development and commercialization of protease-based products, particularly in food and pharmaceuticals, are supported by the regulatory environment provided by the US Food and Drug Administration (FDA). Protease efficacy and safety are guaranteed by this regulatory support, which increases market acceptance. Protease usage has increased in products due to the growing demand for functional foods and health supplements. There is a growing demand for nutraceuticals in North America as consumers become more conscious of the health benefits of proteases. According to the National Library of Medicine, while the predominant use of proteases has been in treating cardiovascular disease, they are also emerging as useful agents in the treatment of sepsis, digestive disorders, inflammation, cystic fibrosis, retinal disorders, psoriasis, and other diseases.

Hence, the protease market leadership of North America is fueled by strong industrial demand, innovative technology developments, a benevolent regulatory framework, significant R&D expenditure, and a wide range of applications in various industries. All these elements work together to support the regional market's leading position and steady expansion.

Proteases Industry Overview

The protease market is consolidated in nature, with the top players occupying major market shares. Some of the major players in this market include International Flavors & Fragrances Inc., DSM-Firmenich AG, Novonesis Group, BASF SA, and Associated British Foods PLC. These players adopt various strategies to maintain their leading position in the market and build a strong brand image. The key strategies these players adopt include mergers and acquisitions, which help them consolidate their market position and expand their product portfolios.

Product innovation and new product development are essential strategies adopted by top players to cater to consumer demand and preferences. Companies invest heavily in research and development activities to introduce new and improved products, which help them differentiate their products from their competitors and expand their customer base. Moreover, companies also focus on expanding their product portfolios by adding new product lines and acquiring new businesses. This strategy enables companies to cater to consumers' evolving needs and preferences and increase their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Technological Advancements in Enzyme Engineering & Bioprocessing

- 4.1.2 Growing Inclination Toward Specialty and Sustainable Ingredients

- 4.2 Market Restraints

- 4.2.1 High Production Costs Impede Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Animal

- 5.1.1.1 Trypsin

- 5.1.1.2 Pepsin

- 5.1.1.3 Renin

- 5.1.1.4 Other Animal Sources

- 5.1.2 Plant

- 5.1.2.1 Papain

- 5.1.2.2 Bromelain

- 5.1.2.3 Other Plant Sources (Keratinases and Ficin)

- 5.1.3 Microbial

- 5.1.3.1 Alkaline Protease

- 5.1.3.2 Acid Protease

- 5.1.3.3 Neutral Protease

- 5.1.1 Animal

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Dairy

- 5.2.1.2 Bakery

- 5.2.1.3 Beverages

- 5.2.1.4 Meat and Poultry

- 5.2.1.5 Infant Formula

- 5.2.2 Pharmaceuticals

- 5.2.3 Animal Feed

- 5.2.4 Other Applications

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Singapore

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Novus International Inc.

- 6.3.2 International Flavors & Fragrances Inc.

- 6.3.3 DSM-Firmenich AG

- 6.3.4 Biocatalyst Ltd

- 6.3.5 Novonesis Group

- 6.3.6 Advanced Enzyme Technologies

- 6.3.7 Associated British Foods PLC

- 6.3.8 Bioseutica BV

- 6.3.9 BASF SE

- 6.3.10 Kemin Industries Inc.