|

市场调查报告书

商品编码

1686280

自旋电子学:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Spintronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

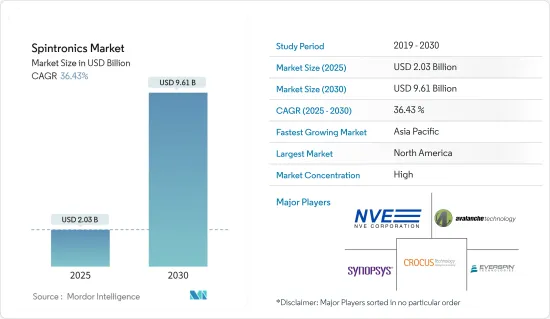

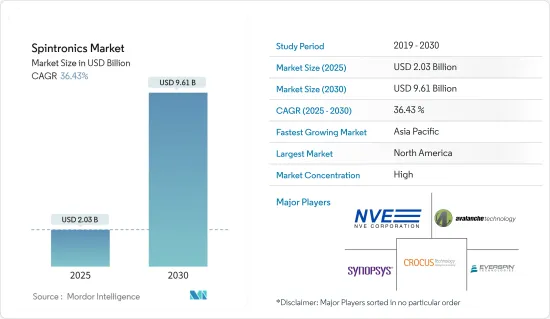

自旋电子学市场规模预计在 2025 年为 20.3 亿美元,预计到 2030 年将达到 96.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 36.43%。

主要亮点

- 除了基本电子电荷外,自旋电子学还研究固体元件中固有的电子自旋及其相关磁矩。自旋电子学是一种驱动下一代奈米电子设备的技术,它可以提高记忆体和处理能力,同时降低功耗。在这些装置中,自旋极化由磁性层或自旋轨道交互作用控制。自旋电子学的当前应用是电脑和便携式音乐播放器使用的硬碟的读写头。

- 此外,疫情影响巨大,多个国家政府实施封锁等各种遏制措施,对工业部门的成长造成严重影响。因此,受访的市场出现了放缓迹象,尤其是在早期阶段。然而,随着资料中心和云端处理等公司的需求和采用激增,这种情况扩大了研究市场的范围。

- 现代资料革命在某种程度上得益于数十年来对磁性和自旋现象的研究。例如,巨磁电阻的观测以及由此产生的自旋阀读头的演变等突破性成就继续推动着设备研究。然而,对更快的资料处理速度和更大的资料储存容量的不断增长的需求引发了人们对能源消费量和环境的严重担忧。因此自旋电子学的研究发展需要提高资讯处理能力,同时降低消费量。随着资料储存容量的不断增长以及能源消费量的增加,这一点至关重要。

- 自旋电子学可以透过实现更快、更节能的逻辑运算来提高运算效能。自旋电子元件,例如基于自旋的电晶体和自旋逻辑闸,有可能克服传统 CMOS(互补型金属氧化物半导体)技术的局限性,实现更快、更低功耗的运算。

- 多种因素刺激了这项需求,包括 5G 网路的日益普及。 5G 网路的推出将需要更快的资料传输来满足日益增长的频宽和连线需求。自旋电子技术可以实现更快的资料传输速度,非常适合 5G 应用。

- 替代技术和材料的随时可用性是所研究市场面临的关键挑战之一。自旋电子学市场仍处于起步阶段,面临系统级和设备级的挑战,必须解决这些挑战才能将自旋电子材料和功能整合到主流微电子平台中。

自旋电子学市场趋势

预计半导体设备将实现显着成长

- 根据半导体产业协会(SIA)和WSTS的预测,2023年全球半导体销售额预计将达到5,151亿美元。半导体是电子设备的关键元件,产业竞争非常激烈。虽然预计 2024 年将快速復苏,但 2023 年的与前一年同期比较减幅度为 10.3%。预计不断发展的半导体产业将推动市场的成长。

- 市场研究涵盖自旋二极体、自旋滤波器和自旋场效电晶体。自旋二极体是一种可以测量电路中电流的半导体元件。有几种趋势正在塑造自旋二极体产业。对于记忆体应用,人们正在探索自旋二极管,它在非挥发性、电源存取速度和节能方面具有潜在优势。

- 自旋滤波器在自旋电子学的各种应用中发挥重要作用,自旋电子学利用电子自旋来处理、储存和操纵资讯。这些仪器对于产生、改变和测量自旋极化电流至关重要,并且是自旋电子技术发展的基本要素。

- 目前,利用量子点的自旋过滤装置正受到人们的关注。 2023 年 1 月,一个国际科学家团队展示了在量子点中自旋量子位元保持量子相干性方面取得的飞跃,这是全球推动实用量子网路和量子电脑发展的一部分。这些技术的应用有望改变许多工业和研究活动,从资讯传输的安全性,到寻找具有新特性的材料和化学物质,再到测量需要感测器之间精确时间同步的基本现象。

- 根据美国物理学会的研究,高自旋注入效率(SIE)和从磁性材料到势垒材料的热自旋过滤效应(SFE)分别对于高性能自旋电子学和自旋热电子学装置至关重要。

- 自旋场效电晶体(Spin-FET)是自旋电子元件的代表性类别,其利用夹在铁磁源极和汲极接触之间的半导体通道中的闸极调谐自旋轨道相互作用来实现电晶体功能。最近,一种新型自旋场效电晶体(FET)被提案。这种自旋场效电晶体 (FET) 的独特振动传输特性,透过对量子材料中的应变进行闸极调节,可以实现倍频等令人兴奋的模拟应用。

预计亚太地区将占据主要市场占有率

- 自旋电子学相关研究活动的增加、半导体製造业的全球主导地位以及铸造和电子製造等全球行业的领先地位是扩大亚太地区自旋电子学技术范围的一些关键因素。

- 中国、日本、新加坡和韩国等国家由于加大对自旋电子技术相关研究的投资,成为研究市场的重要投资者。此外,印度和东南亚国家凭藉其较高的製造水平,正成为自旋电子技术的重要终端用户。

- 由于科学、工业和医疗应用的需求不断增长,该地区对自旋电子学的需求也日益增加。主要市场参与者正在向其他地区扩张,以增加市场占有率和盈利。例如,2023 年 8 月,印度 SN Bose 国家基础科学中心的科学家开发出世界上第一种二维复合量子材料,这种材料表现出一种称为拉什巴分裂的异国风量子特性,可用于自旋电子电晶体和二极体等自旋电子装置。这种材料可以与自旋电晶体、自旋二极体和自旋滤波器等自旋电子装置中的二维基板(例如石墨烯)连接,其中可以利用电子自旋的量子特性来实现更高的性能。

- 此外,亚太半导体产业主要由中国、日本、台湾和韩国推动,这四个国家合计占全球半导体市场收益的约35%。韩国拥有超过2万家半导体相关企业,其中包括2,650家半导体设备公司、4078家半导体材料公司和369家IC製造相关企业。亚太地区电子产业的预期成长率高于其他地区。

自旋电子学产业概览

自旋电子学市场的特征是产品渗透持续、产品差异化有限、竞争激烈。创新对于确保竞争优势起着至关重要的作用。值得注意的是,Avalanche Technology、Everspin Technologies Inc.、Synopsys Inc.、NVE Corporation、Crocus Technology Inc.、Allegro Microsystems, Inc. 等主要市场参与者近年来已获得资金以加强产品创新。

2023 年 6 月,Crocus Technology 推出了 CT40x,这是一款突破性的电流感测解决方案,重新定义了动态和苛刻环境中的电流感测。它们具有出色的性能和准确性,支援接触式和非接触式电流感测应用,并可无缝整合到各种电力系统中。 CT40x TMR 感测器与传统霍尔和 MR 替代品相比,保证了毫不妥协的性能,加速了市场对 TMR 技术的采用。

2023 年 5 月,NVE 推出了 SM223,扩大了其智慧磁力仪系列,SM223 是其隧道磁阻 (TMR) 智慧磁力仪的高灵敏度版本。这些新元件的灵敏度有所提高,可提高增强型机器人的精确位置控制,以及更有效率马达的微小电流测量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 和其他宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 由于功耗降低,电子设备对自旋电子学的需求不断增加

- 对更快的资料传输速度和更大的储存容量的需求日益增加

- 市场挑战

- 随时可用的替代技术和材料

第六章 自旋电子学专利趋势

第七章市场区隔

- 设备类型

- 金属基元件

- 巨磁电阻元件(GMR)

- 隧道磁阻(TMR)

- 自旋转移扭矩装置

- 自旋波装置

- 半导体装置

- 自旋二极体

- 旋转过滤器

- 自旋场效电晶体(FET)

- 金属基元件

- 应用领域

- 电动汽车和工业马达

- 资料储存/MRAM

- 磁感应

- 其他用途

- 地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

第八章竞争格局

- 公司简介

- NVE Corporation

- Everspin Technologies Inc.

- Crocus Technology Inc.(Allegro Microsystems, Inc.)

- Synopsys Inc.

- Avalanche Technology Inc.

第九章投资分析

第十章:市场的未来

The Spintronics Market size is estimated at USD 2.03 billion in 2025, and is expected to reach USD 9.61 billion by 2030, at a CAGR of 36.43% during the forecast period (2025-2030).

Key Highlights

- Spintronics studies the intrinsic spin of the electron and its associated magnetic moment in solid-state devices, in addition to its fundamental electronic charge. Spintronics is the driving technology behind next-generation nano-electronic devices to increase their memory and processing abilities while reducing power consumption. In these devices, the spin polarization is controlled by magnetic layers or spin-orbit coupling. The current application of spintronics is in the read/write heads of the hard disk drives used in computers and portable music players.

- Furthermore, a notable impact of the pandemic has been observed on the market as various containment measures were taken by governments across multiple countries, such as lockdowns, which significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase. However, the scenario expanded the scope of the market studied as enterprises like data centers and cloud computing witnessed a surge in demand and adoption.

- The contemporary data revolution has, in part, been fostered by decades of research into magnetism and spin phenomena. For instance, milestones such as the observation of giant magnetoresistance and the resulting evolution of the spin-valve read head continue to motivate device research. However, the ever-increasing need for higher data processing speeds and more extensive data storage capabilities has significantly increased energy consumption and environmental concerns. Therefore, ongoing research and development in spintronics should reduce energy consumption while increasing information processing capabilities. This is crucial as data storage capacity continues to increase, leading to a corresponding increase in energy consumption.

- Spintronics can enhance computing performance by enabling faster and more energy-efficient logic operations. Spintronics devices like spin-based transistors and spin logic gates have the potential to overcome the limitations of traditional CMOS (complementary metal-oxide semiconductor) technology and enable high-speed, low-power computing.

- This demand is fueled by several factors, including the growing penetration of 5G networks. The deployment of 5G networks requires higher data transfer speeds to support the increased bandwidth and connectivity demands. Spintronics technology can enable faster data transfer rates, making it suitable for 5G applications.

- The easy availability of substitute technologies and materials is one of the significant challenges in the market studied. The spintronics market is still in its nascent stage and faces challenges at both the system and device levels that need to be addressed to integrate spintronic materials and functionalities into mainstream microelectronic platforms.

Spintronics Market Trends

Semiconductor-based Devices are expected to Witness Major Growth

- According to the Semiconductor Industry Association (SIA) and WSTS, 2023 semiconductor sales were expected to reach USD 515.1 billion worldwide. Semiconductors are crucial components of electronic devices, and the industry is highly competitive. The year-on-year decline rate in 2023 was 10.3 percent, although a swift recovery is expected in 2024. The growing semiconductor industry is expected to aid the studied market's growth.

- Spin diode, spin filter, and spin field-effect transistor are considered for the market study. A spin diode is a semiconductor device that can measure the current flow in an electrical circuit. Several trends are shaping the spin diode industry. In the case of memory applications, spin diodes are being explored and offer potential advantages in terms of their nonvolatility, speed of access to power, and energy savings.

- Spin filters play an essential role in different applications in spintronics, which uses electron spin to perform information processing, storage, and manipulation. These instruments are vital for generating, modifying, and measuring spin-polarized currents, making them a fundamental element in spintronic technology's evolution.

- Currently, spin filter devices based on quantum dots are gaining traction. Adhering to this, in January 2023, an international team of scientists demonstrated a leap in preserving the quantum coherence of quantum dot spin qubits as part of the global push for practical quantum networks and quantum computers. The application of these technologies will transform many industries and research efforts, from the safety of information transfer to the search for materials or chemicals with new properties, such as measurements of fundamental phenomena that require accurate time synchronization between sensors.

- According to the American Institute of Physics, high spin-injection-efficiency (SIE) and thermal spin-filter-effect (SFE) from a magnetic material to a barrier material are crucial to the high performance of a spintronic device and a spin caloritronic device, respectively.

- Spin field effect transistors (Spin-FET) are an iconic spintronic device class exploiting gate-tuned spin-orbit interaction in semiconductor channels interposed between the ferromagnetic source and drain contacts to elicit transistor functionality. Recently, a novel type of spin-FET has been suggested. It could lead to exciting analog applications such as frequency multiplication due to its unique oscillatory transfer characteristics in the form of gate-tuned strain on quantum materials.

Asia Pacific is Expected to Hold a Major Market Share

- An increase in the number of research activities related to spintronics, global dominance in semiconductor manufacturing, foundries, and lead in global industries such as electronic product manufacturing are some of the major factors expanding the scope of spintronics technologies in the Asia-Pacific region.

- Countries like China, Japan, Singapore, and South Korea are prominent investors in the market studied due to increasing investments in research related to spintronics technologies. In addition to that, countries like India and others in Southeast Asia are emerging as significant end users for these technologies due to the high level of manufacturing.

- The demand for spintronics is on the rise for the region, owing to the rising demand for scientific, industrial, and medical applications. The major market players are trying to expand their business in other regions to increase their market share and profitability. For instance, in August of 2023, scientists at S.N. Bose National Centre for Basic Sciences, India, developed the first-of-its-kind 2D Composite Quantum Material that exhibits the exotic quantum property of Rashba splitting, which is useful for Spintronic devices such as Spintronic transistors & Diodes. The material can interface with 2D substrates (Graphene, for example) in Spintronic Devices such as Spin Transistors, Spin Diodes, and Spin Filters that exploit the quantum property of electron spin for higher performance.

- Moreover, The semiconductor industry in the Asia-Pacific region is majorly driven by China, Japan, Taiwan, and South Korea, which together constitute around 35% of the global semiconductor market revenue. South Korea has more than 20,000 semiconductor-related companies, including 2650 semiconductor equipment enterprises, 4078 semiconductor material enterprises, and 369 IC manufacturing enterprises. The estimated growth of the electronic industry in the Asia-Pacific region is higher compared to other regions.

Spintronics Industry Overview

The spintronics market is marked by continual product penetration, limited product distinction, and intense competition. Innovation plays a pivotal role in securing a competitive edge. Notably, key market players like Avalanche Technology, Everspin Technologies Inc., Synopsys Inc., NVE Corporation, and Crocus Technology Inc. (Allegro Microsystems, Inc.) have secured funding to bolster their product innovation in recent years.

In June 2023, Crocus Technology introduced the CT40x, a groundbreaking current sensing solution that redefines current sensing in dynamic, high-demand environments. With exceptional performance and accuracy, it caters to both contact and contactless current sensing applications, seamlessly integrating into diverse power systems. The CT40x TMR sensor ensures uncompromised performance compared to traditional Hall and MR alternatives, facilitating widespread adoption of TMR technology across the market.

In May 2023, NVE expanded its range of smart magnetometers by unveiling the SM223, a high-sensitivity variant of its tunnel magnetoresistance (TMR) smart magnetometers. The heightened sensitivity of this new component enables more precise position control for enhanced robotics and finer current measurement for more efficient motors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 and Other Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Spintronics in Electronic Devices, Due to Lesser Power Consumption

- 5.1.2 Rising Need for Higher Data Transfer Speed and Increased Storage Capacity

- 5.2 Market Challenges

- 5.2.1 Easy Availability of Substitute Technologies and Materials

6 SPINTRONICS PATENT LANDSCAPE

7 MARKET SEGMENTATION

- 7.1 Type of Device

- 7.1.1 Metal Based Devices

- 7.1.1.1 Giant Magneto Resistance-based Device (GMRs)

- 7.1.1.2 Tunnel Magneto Resistance-based Device (TMRs)

- 7.1.1.3 Spin-transfer Torque Device

- 7.1.1.4 Spin-wave Logic Device

- 7.1.2 Semiconductor Based Device

- 7.1.2.1 Spin Diode

- 7.1.2.2 Spin Filter

- 7.1.2.3 Spin Field-effect Transistor (FETs)

- 7.1.1 Metal Based Devices

- 7.2 Application

- 7.2.1 Electric Vehicle and Industrial Motor

- 7.2.2 Data Storage/MRAM

- 7.2.3 Magnetic Sensing

- 7.2.4 Other Applications

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 NVE Corporation

- 8.1.2 Everspin Technologies Inc.

- 8.1.3 Crocus Technology Inc. (Allegro Microsystems, Inc.)

- 8.1.4 Synopsys Inc.

- 8.1.5 Avalanche Technology Inc.