|

市场调查报告书

商品编码

1444647

醋酸 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Acetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

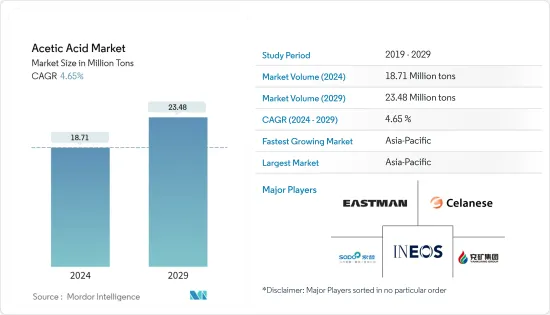

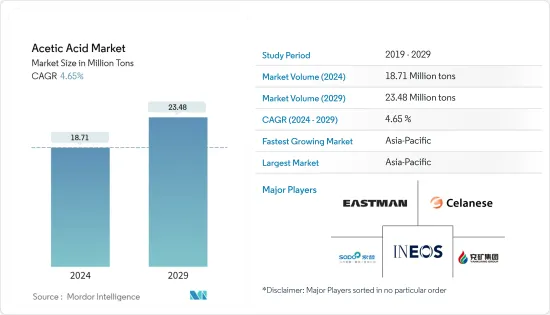

2024年醋酸市场规模预估为1,871万吨,预估到2029年将达到2,348万吨,在预测期间(2024-2029年)CAGR为4.65%。

由于全球各国政府实施的多项限制,2020 年 COVID-19 大流行对市场产生了负面影响。然而,自限制解除以来,该行业一直在良好復苏。由于各个最终用户行业的消费增加,市场在 2021-22 年期间显着復苏,并且预计将继续这种情况。

主要亮点

- 短期内,醋酸乙烯单体(VAM)需求的增加、纺织和包装行业需求的增加以及油漆和涂料行业中酯溶剂使用的增加正在推动醋酸市场的成长。

- 相反,对醋酸有害影响的环境担忧正在阻碍市场的成长。

- 开发新的分离技术以提高乙酸的生产效率预计将在预测期内为市场创造机会。

- 预计亚太地区将主导市场。预计在预测期内CAGR最高。

醋酸市场趋势

增加在黏合剂、油漆和涂料行业的应用

- 乙酸及其酯衍生物,如乙酸乙酯、乙酸丁酯和乙酸乙烯酯,广泛用于製造黏合剂、油漆和涂料。乙酸的酸性及其溶解极性和非极性化合物的能力使其成为黏合剂、油漆和涂料中的有用成分。

- 醋酸乙烯酯单体 (VAM) 用于生产水性涂料、黏合剂、防水涂料以及纸张和纸板涂料。 PTA 基聚酯和聚酰胺也用于热熔黏合剂。 PTA甚至被用作油漆的载体。

- 世界油漆和涂料工业协会预计,2022年,全球油漆和涂料销售额将超过1800亿美元。同时,预计到 2027 年油漆和涂料行业的CAGR将达到 3% 左右。

- 根据该协会的年度报告,2022年北美市场价值为339.2亿美元,而欧洲市场价值为423.7亿美元。人们认为,由于加拿大、德国和美国住宅改造计画的增加,这些地点都将独立成长。

- 根据美国涂料协会(Coatings Tech)的数据,到2022年,美国油漆和涂料行业预计将达到280.6亿美元。同样,从数量上看,到2022年,油漆和涂料行业预计将达到14.16亿加仑。2022 亿加仑。年。这可能会增加该国油漆和涂料行业对乙酸的需求。

- 欧洲拥有许多重要的涂料公司,这里是欧洲大陆四大经济体的所在地:德国、法国、义大利和西班牙。欧洲最大的油漆和涂料市场在德国。这里有 300 多家涂料、油漆和印刷油墨生产公司。

- WPCIA 报告还包括油漆和涂料行业的主要公司及其市场份额。预计宣伟公司(Sherwin-Williams)(216.4 亿美元)将占据市场主导地位,其次是 PPG Industries(171.5 亿美元)、阿克苏诺贝尔 NV(119 亿美元)和 Nippon Paints(99.5 亿美元)。

- 由于所有这些因素,不同行业投资的增加将增加世界各地对黏合剂、油漆和涂料的需求,从而对醋酸市场产生积极影响。

亚太地区将主导市场

- 亚太地区是全球市场上最大的醋酸消费国。由于其强大的工业基础,亚太市场预计将成为黏合剂、油漆和涂料、食品和饮料以及纺织业的最大市场。

- 乙酸广泛用于润滑脂、涂料、聚酯和密封剂,在电子、汽车、纺织、包装等众多行业中有着广泛的应用。这些行业的广泛成长是推动亚太地区市场成长的主要因素之一。

- 根据世界油漆和涂料工业协会的数据,到 2022 年,亚太地区油漆和涂料市场的价值预计将达到 630 亿美元。中国在该地区市场占据主导地位,过去几年的CAGR为 5.8%。 2022年,中国市场成长5.7%。依目前趋势,2022年中国油漆涂料总销售额将超过450亿美元,占东亚地区78%的市占率。

- 根据欧洲涂料协会统计,中国有近万家涂料生产商。大多数全球领先的涂料製造商,如立邦涂料、阿克苏诺贝尔、中国船舶涂料、PPG工业、巴斯夫、艾仕得涂料等,都在中国设有生产基地。油漆和涂料公司一直在增加在该国的投资。例如,2022年7月,巴斯夫扩大了在华南广东省的汽车修补漆产能。公司年产能3万吨。

- 根据日本经济产业省统计,2021年日本合成树脂涂料产量约101万吨,涂料产量庞大。整体而言,2021年涂料产量总计近153万吨,而上一年为150万吨。

- 此外,2022年1月,印度化学品和肥料部发布了乙酸、苯胺、吗啉和甲醇的品质管制令,推迟了其实施日期。它涵盖了醋酸生产的规范和标准。

- 根据化学品和化肥部的统计数据,2022-23年(截至2022年7月)印度主要化学品产量增加5.73%,达到435.1万吨,而去年同期为411.5万吨。时期。

- 随着全球对各种化学品的需求不断增长,该产业对乙酸等中间体的需求预计在预测期内将大幅增加。

- 由于上述因素,该地区醋酸市场预计在预测期内将稳定成长。

醋酸行业概况

醋酸市场本质上是部分整合的。市场上的一些主要参与者包括(排名不分先后)塞拉尼斯公司、英力士公司、江苏SOPO(集团)、兖矿集团和伊士曼化学公司等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 对醋酸乙烯酯单体 (VAM) 的需求不断增加

- 纺织和包装产业需求不断增长

- 酯类溶剂在油漆和涂料行业中的使用不断增加

- 限制

- 关于有害影响的环境问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场规模按数量计算)

- 衍生物

- 醋酸乙烯酯单体 (VAM)

- 精对苯二甲酸 (PTA)

- 乙酸乙酯

- 醋酸酐

- 其他衍生性商品

- 应用

- 塑胶和聚合物

- 食品与饮品

- 黏合剂、油漆和涂料

- 纺织品

- 医疗的

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率分析

- 领先企业采取的策略

- 公司简介

- Celanese Corporation

- Chang Chun Group

- Daicel Corporation

- Eastman Chemical Company

- GNFC Limited

- INEOS

- Jiangsu SOPO (Group) Co. Ltd.

- Kingboard Holdings Limited

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- PetroChina Company Limited

- Sabic

- Shandong Hualu-Hengsheng Chemical Co. Ltd.

- Shanghai Huayi Holding Group Co. Ltd.

- Sipchem Company

- Svensk Etanolkemi AB (SEKAB)

- Tanfac Industries Ltd.

- Yankuang Group

第 7 章:市场机会与未来趋势

- 开发新分离技术以提高生产效率

The Acetic Acid Market size is estimated at 18.71 Million tons in 2024, and is expected to reach 23.48 Million tons by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020, owing to several restrictions imposed by governments all around the globe. However, the sector has been recovering well since restrictions were lifted. The market recovered significantly in the 2021-22 period, owing to rising consumption from various end-user industries, and is projected to continue doing so.

Key Highlights

- Over the short term, the increasing demand for vinyl acetate monomer (VAM), the increasing demand from the textile and packaging industries, and the growing use of ester solvents in the paints and coatings industry are driving the growth of the acetic acid market.

- On the contrary, environmental concerns regarding the harmful effects of acetic acid are hindering the growth of the market.

- The development of new separation technologies to increase the production efficiency of acetic acid is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period.

Acetic Acid Market Trends

Increasing Applications in the Adhesives, Paints, and Coatings Industry

- Acetic acid, as well as its ester derivatives, such as ethyl acetate, butyl acetate, and vinyl acetate, are widely used in making adhesives, paints, and coatings. The acidic nature of acetic acid and its ability to dissolve polar and nonpolar compounds make it a useful ingredient in adhesives, paints, and coatings.

- Vinyl acetate monomer (VAM) is used in producing water-based paints, adhesives, waterproofing coatings, and paper and paperboard coatings. PTA-based polyesters and polyamides are also used in hot-melt adhesives. PTA is even used in paints as a carrier.

- The World's Paint and Coatings Industry Association estimated that in 2022, global sales of paints and coatings exceeded USD 180 billion. At the same time, the paints and coatings industry is anticipated to register a CAGR of about 3% by 2027.

- The value of the North American market was 33.92 billion USD in 2022, while the value of the European market was 42.37 billion USD, according to the association's annual report. It was considered that each of these locations would grow independently due to an increase in residential renovation projects in Canada, Germany, and the United States.

- According to the American Coatings Association (Coatings Tech), the paint and coatings industry in the United States is expected to reach USD 28.06 billion by 2022. Similarly, in terms of volume, the paint and coatings industry is estimated to reach 1,416 million gallons by 2022. This is likely to enhance the demand for acetic acid from the paints and coatings sector in the country.

- There are numerous significant paint companies in Europe, which is home to the continent's four largest mainland economies: Germany, France, Italy, and Spain. Europe's largest market for paints and coatings is in Germany. It is home to over 300 coatings, paint, and printing ink production firms.

- The key firms in the paints and coatings sector were also included in the WPCIA report, along with their market shares. It was anticipated that Sherwin-Williams (USD 21.64 billion) dominated the market, followed by PPG Industries (USD 17.15 billion), AkzoNobel NV (USD 11.9 billion), and Nippon Paints (USD 9.95 billion).

- Owing to all these factors, the rising investments in different industries will increase the demand for adhesives, paints, and coatings from all around the world and thus positively influence the acetic acid market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is the largest consumer of acetic acid in the global market. The Asia-Pacific market is anticipated to be the largest market for the adhesives, paints and coatings, food and beverage, and textile industries, owing to its strong industrial base.

- Acetic acid is widely used in greases, coatings, polyesters, and sealants, which have extensive applications in numerous industries, such as electronics, automobiles, textiles, and packaging. The extensive growth in these industries represents one of the major factors driving market growth in the Asia-Pacific region.

- The Asia-Pacific paints and coatings market was estimated to be worth USD 63 billion in 2022, according to the World's Paint and Coatings Industry Association. China dominates the region's market, which has been registering a CAGR of 5.8% over the last few years. In 2022, the Chinese market grew by 5.7%. According to current trends, China's total sales of paints and coatings exceeded USD 45 billion in 2022, giving the country a 78% market share in East Asia.

- According to European Coatings, there are nearly 10,000 coatings manufacturers located in China. Most of the leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BASF SE, and Axalta Coatings, have their manufacturing bases in China. Paint and coatings companies have been increasing their investments in the country. For instance, in July 2022, BASF expanded its production capacity of automotive refinish coatings in Guangdong Province in South China. The company has an annual capacity of 30,000 metric tons per year.

- According to the Ministry of Economy, Trade, and Industry (Japan), the production volume of synthetic resin paints in Japan amounted to approximately 1.01 million metric tons in 2021, making up an enormous production volume of paints. Overall, the production volume of paints added up to nearly 1.53 million metric tons in 2021, compared to 1.50 million metric tons in the prior year.

- Additionally, in January 2022, India's Ministry of Chemicals and Fertilizers published the quality control orders on acetic acid, aniline, morpholine, and methanol to postpone the implementation dates on them. It covers the specifications and standards of acetic acid production.

- According to the statistics presented by the Ministry of Chemicals and Fertilizers, in India, major chemical production climbed by 5.73% to 43.51 lakh metric tons in 2022-23 (up to July 2022), compared to 41.15 lakh metric tons in the previous year's similar period.

- With the growing global demand for various chemicals, the demand for intermediates, such as acetic acid, from this sector is expected to increase significantly during the forecast period.

- Due to the abovementioned factors, the market for acetic acid in the region is expected to have steady growth during the forecast period.

Acetic Acid Industry Overview

The acetic acid market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Celanese Corporation, INEOS, Jiangsu SOPO (Group) Co. Ltd, Yankuang Group, and Eastman Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Vinyl Acetate Monomer (VAM)

- 4.1.2 Increasing Demand from the Textile and Packaging Industry

- 4.1.3 Increasing Use of Ester Solvents in the Paints and Coating Industry

- 4.2 Restraints

- 4.2.1 Environmental Concerns Regarding the Harmful Effects

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Vinyl Acetate Monomer (VAM)

- 5.1.2 Purified Terephthalic Acid (PTA)

- 5.1.3 Ethyl Acetate

- 5.1.4 Acetic Anhydride

- 5.1.5 Other Derivatives

- 5.2 Application

- 5.2.1 Plastics and Polymers

- 5.2.2 Food and Beverage

- 5.2.3 Adhesives, Paints, and Coatings

- 5.2.4 Textile

- 5.2.5 Medical

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Chang Chun Group

- 6.4.3 Daicel Corporation

- 6.4.4 Eastman Chemical Company

- 6.4.5 GNFC Limited

- 6.4.6 INEOS

- 6.4.7 Jiangsu SOPO (Group) Co. Ltd.

- 6.4.8 Kingboard Holdings Limited

- 6.4.9 LyondellBasell Industries Holdings BV

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 PetroChina Company Limited

- 6.4.12 Sabic

- 6.4.13 Shandong Hualu-Hengsheng Chemical Co. Ltd.

- 6.4.14 Shanghai Huayi Holding Group Co. Ltd.

- 6.4.15 Sipchem Company

- 6.4.16 Svensk Etanolkemi AB (SEKAB)

- 6.4.17 Tanfac Industries Ltd.

- 6.4.18 Yankuang Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Separation Technologies to Increase the Production Efficiency