|

市场调查报告书

商品编码

1444675

3D 列印资料 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)3D Printing Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

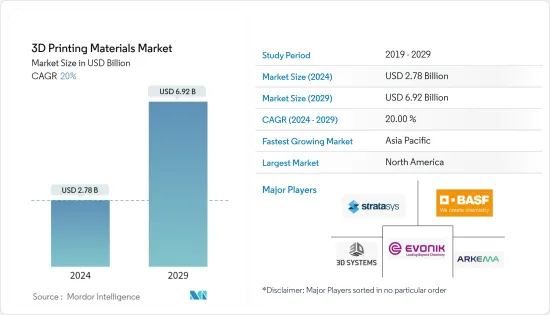

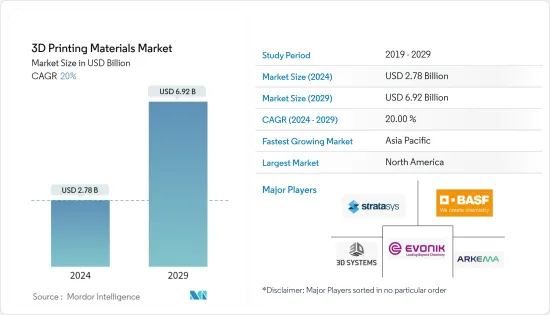

2024年3D列印材料市场规模预计为27.8亿美元,预计到2029年将达到69.2亿美元,在预测期内(2024-2029年)CAGR为20%。

随着COVID-19大流行的爆发,3D列印材料市场因供应链中断而遭受损失,导致多个专案延迟。此外,各国资金流动中断和严格封锁,导致生产线工人缺勤率上升,对市场产生了不利影响。然而,由于汽车产业需求增加,市场在2021年出现反弹。

主要亮点

- 推动市场成长的主要因素是製造应用需求的激增、与3D列印相关的大规模客製化以及汽车应用需求的激增。

- 另一方面,高昂的设备和材料成本以及有限的材料供应可能会阻碍市场的成长。

- 石墨烯等新材料的引入开启了新的应用,而在家庭列印中采用3D列印技术有望为3D列印材料市场创造新的机会。

3D列印材料市场趋势

增加在汽车产业的应用

- 3D列印材料广泛应用于汽车产业来製造用于测试的比例模型。它们也用于製造波纹管、前保险桿、空调管道、悬吊叉骨、仪表板介面、交流发电机安装支架、电池盖等零件。汽车OEM製造商正在使用 3D 列印材料进行快速原型製作。

- 由于3D列印製程具有成本低、製造时间短、材料浪费少等优点,汽车製造商正在转向这种製程。奥迪、劳斯莱斯、保时捷、Hackrod 等世界上一些最大的汽车製造商正在使用这些材料来製造备用零件和金属原型。

- 中国汽车製造业规模全球第一。根据中国汽车工业协会统计,2023年3月,汽车产销量分别为258.4万辆和245.1万辆,环比分别增长27.2%和24%,环比增长24%。年比分别增长15.3%和9.7%。

- 根据中国汽车工业协会统计,2023年1-3月,乘用车产销分别完成526.2万辆和513.8万辆,年比分别成长4.3%和7.3% -按年计算。同样,商用车产销分别完成94.8万辆和93.8万辆,较去年同期成长3.9%和2.9%。

- 根据国际汽车製造商组织(OICA)的数据,2022年全球乘用车总产量为61,598,650辆; 2021 年为 57,054,295 套。由于多种因素,例如预测期内私人出行需求的增加以及电动车的指数增长,预计对车辆的需求将增加。

- 由于上述因素,汽车产业对3D列印材料的需求预计将成长。

亚太地区预计将以最快的速度成长

- 亚太地区是全球成长最快的经济体之一,其中中国是全球成长最快的国家之一,由于人口、生活水平和人均收入的不断增长,几乎所有最终用户产业都在成长。

- 该地区由多个汽车产业产量显着的国家组成。此外,电动车的出现预计将进一步为3D列印材料市场提供实质成长机会。

- 到 2022 年,印度、印尼、马来西亚和越南等几个国家的汽车产量预计将大幅成长。例如,根据国际汽车製造商组织(OICA)的数据,2022年,印度和印尼的汽车总产量分别为5,456,857辆和1,470,146辆,较去年同期成长24%和31%。年。

- 2022年9月20日,财政部、工业及资讯化部、国税局联合宣布,2023年1月至12月新能源汽车购置2023年免征车辆购置税。这支持了中国新型电动车的需求和销售。

- 此外,3D 列印中的逐层沉积製程可将感测器、天线和其他功能性电子产品直接列印到塑胶零件、金属表面、玻璃面板和陶瓷材料上。

- 中国资讯通信研究院的报告显示,2022年前两个月,电子製造业保持稳定成长。 2022年1-2月主要电子製造业增加价值年增12.7%;然而,同期整体工业成长率为7.5%。

- 中国是新技术和建筑创新材料成长最快的市场之一。随着中国作为全球建筑中心的主导地位,3D列印在家庭列印领域的加速发展可能会彻底改变中国传统的建筑产业,其应用范围从住宅建筑到纪念碑。该国成功地 3D 列印房屋和其他大型结构,这使得其他每个国家都开始研究 3D 列印在建筑中的可能性。

- 建筑领域的 3D 列印存在一些限制,例如建筑开发商缺乏信心以及缺乏使用该技术的适当法规。然而,随着对新技术及其优势的认识不断增强,组织和个人越来越多地考虑节省成本的替代方案。这反过来又推动了该国3D列印材料市场的需求。

- 由于上述所有因素,亚太地区对 3D 列印材料的需求预计将推动所研究的市场。

3D列印材料行业概况

3D列印材料市场趋于整合,少数厂商占据市场主要份额。 3D 列印材料市场的主要参与者(排名不分先后)包括 Stratasys、BASF SE、Evonik Industries AG、Arkema 和 3D Systems Inc. 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 在製造应用中的使用不断增长

- 与 3D 列印相关的大规模定制

- 汽车应用需求激增

- 限制

- 设备及材料成本高

- 有限类型材料的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 材料种类

- 塑胶

- 丙烯腈丁二烯苯乙烯 (ABS)

- 聚乳酸 (PLA)

- 尼龙

- 聚酰胺

- 聚碳酸酯

- 其他塑料

- 陶瓷

- 金属

- 其他材料类型

- 塑胶

- 形式

- 粉末

- 灯丝

- 液体

- 最终用户产业

- 汽车

- 医疗的

- 航太和国防

- 消费性电子产品

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- 3D Systems, Inc.

- Arkema

- BASF SE

- CRP TECHNOLOGY Srl

- CRS Holdings, LLC

- ENVISIONTEC US LLC

- EOS

- Evonik Industries AG

- General Electric

- Henkel AG & Co. KGaA

- Hoganas AB

- Materialise

- Sandvik AB

- Solvay

- Stratasys

第 7 章:市场机会与未来趋势

- 石墨烯等新材料的引入开启了新的应用

- 3D列印技术在家庭列印的应用

The 3D Printing Materials Market size is estimated at USD 2.78 billion in 2024, and is expected to reach USD 6.92 billion by 2029, growing at a CAGR of 20% during the forecast period (2024-2029).

With the outbreak of the COVID-19 pandemic, the 3D printing materials market suffered due to the disruption in the supply chain, resulting in delays in several projects. Moreover, disrupted financial flows and strict lockdowns in various countries, resulting in growing absenteeism among production line workers, affected the market adversely. However, the market rebounded in 2021 due to increased demand from the automotive industry.

Key Highlights

- The major factors driving the market growth are the surge in demand for manufacturing applications, mass customization associated with 3D printing, and the surge in demand for automotive applications.

- On the flip side, high equipment and material costs and limited materials availability will likely hinder the market's growth.

- Introducing new materials, like graphene, opens up new applications, and adopting 3D printing technology in home printing is expected to create new opportunities for the 3D printing materials market.

3D Printing Materials Market Trends

Increasing Applications in the Automotive Industry

- 3D printing materials are extensively used in the automotive industry to manufacture scaled models for testing. They are also used for components, such as bellows, front bumper, air conditioning ducting, suspension wishbone, dashboard interface, alternator mounting bracket, battery cover, etc. Automotive OEM manufacturers are using 3D printing materials for rapid prototyping.

- Due to the advantages of the 3D printing process, such as low cost, less manufacturing time, reduced material wastage, etc., automotive manufacturers are moving toward this process. Some of the largest automotive manufacturers in the world, such as AUDI, Rolls Royce, Porsche, Hackrod, and many others, are using these materials for manufacturing spare parts and metal prototypes.

- The Chinese automotive manufacturing industry is the largest in the world. According to the China Association of Automobile Manufacturers (CAAM), In March 2023, the production and sales of automobiles accounted for 2.584 million and 2.451 million units, respectively, with an increase of 27.2% and 24% respectively on the month every month and an increase of 15.3% and 9.7% respectively on a year-on-year basis.

- According to the China Association of Automobile Manufacturers (CAAM), from January to March of 2023, passenger cars production and sales accounted for 5.262 million and 5.138 million units, respectively, with an increase of 4.3% and 7.3%, respectively, on a year-on-year basis. Similarly, commercial vehicle production and sales accounted for 948000 and 938000 units, respectively, with an increase of 3.9% and 2.9% year-on-year.

- According to the International Organization of Motor Vehicle Manufacturers(OICA), the world's total passenger car production in 2022 was 61,598,650; in 2021, it was 57,054,295 units. The demand for vehicles is expected to rise due to several factors, such as increased demand for private mobility and exponential growth in electric vehicles during the forecast period.

- The demand for 3D printing materials in the automotive industry is expected to grow due to the above factors.

Asia-Pacific is Expected to Grow at a Fastest Rate

- Asia-Pacific is among the fastest-growing economies globally, comprising China as one of the fastest-growing countries globally, and almost all the end-user industries have been growing due to the rising population, living standards, and per capita income.

- The region comprises several countries with noteworthy production in the automotive sector. Moreover, the emergence of electric vehicles is expected to further provide substantial growth opportunities in the 3D printing materials market.

- In 2022, several countries, such as India, Indonesia, Malaysia, and Vietnam, were expected to grow tremendously in automotive production. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total production of motor vehicles in India and Indonesia stood at 5,456,857 and 1,470,146 units, respectively, showing growth of 24% and 31% compared to the previous year.

- On September 20, 2022, the Ministry of Finance (MOF), the Ministry of Industry and Information Technology (MIIT), and the State Taxation Administration (STA) jointly announced that the purchase of new energy vehicles (NEVs) from January 2023 to December 2023 would be exempt from the vehicle purchase tax. This supports the demand for and sales of new electric vehicles in China.

- Furthermore, the layer-by-layer deposition process in 3D printing allows sensors, antennas, and other functional electronics to be printed directly onto plastic components, metal surfaces, glass panels, and ceramic materials.

- According to a report by the China Academy of Information and Communications Technology, during the first two months of 2022, the electronics manufacturing industry maintained a steady expansion. The added value of major electronics manufacturers from January to February 2022 increased by 12.7% yearly; however, overall industrial growth stood at 7.5% during the same period.

- China is among the fastest-growing markets regarding new technologies and using innovative materials for construction. With China's dominating role as a global construction center, the accelerated development of 3D printing in the home printing sector is likely to revolutionize the traditional construction industry in the country, with applications ranging from residential buildings to monuments. The country managed to 3D print homes and other large-scale structures, making every other country look into the possibilities of 3D printing in construction.

- There are a few limitations to 3D printing in the construction sector, such as a lack of confidence from building developers and the absence of proper regulations for using this technology. However, with increasing awareness of new technologies and their advantages, organizations, and individuals are increasingly considering cost-saving alternatives. This, in turn, is driving demand in the 3D printing materials market in the country.

- Owing to all the abovementioned factors, the demand for 3D printing materials in Asia-Pacific is expected to drive the market studied.

3D Printing Materials Industry Overview

The 3D printing materials market is consolidated, with few players holding the major share in the market. Key players in the 3D printing materials market (not in any particular order) include Stratasys, BASF SE, Evonik Industries AG, Arkema, and 3D Systems Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Manufacturing Applications

- 4.1.2 Mass Customization Associated with 3D Printing

- 4.1.3 Surge in Demand in Automotive Application

- 4.2 Restraints

- 4.2.1 High Equipment and Material Cost

- 4.2.2 Availability of Limited Types of Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Plastics

- 5.1.1.1 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Nylon

- 5.1.1.4 Polyamide

- 5.1.1.5 Polycarbonates

- 5.1.1.6 Other Plastics

- 5.1.2 Ceramics

- 5.1.3 Metals

- 5.1.4 Other Material Types

- 5.1.1 Plastics

- 5.2 Form

- 5.2.1 Powder

- 5.2.2 Filament

- 5.2.3 Liquid

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Medical

- 5.3.3 Aerospace and Defense

- 5.3.4 Consumer Electronics

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Singapore

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3D Systems, Inc.

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 CRP TECHNOLOGY S.r.l.

- 6.4.5 CRS Holdings, LLC

- 6.4.6 ENVISIONTEC US LLC

- 6.4.7 EOS

- 6.4.8 Evonik Industries AG

- 6.4.9 General Electric

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Hoganas AB

- 6.4.12 Materialise

- 6.4.13 Sandvik AB

- 6.4.14 Solvay

- 6.4.15 Stratasys

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Introduction of New Materials, like Graphene Opens Up New Applications

- 7.2 Adoption of 3D Printing Technology in Home Printing