|

市场调查报告书

商品编码

1444700

锡 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Tin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

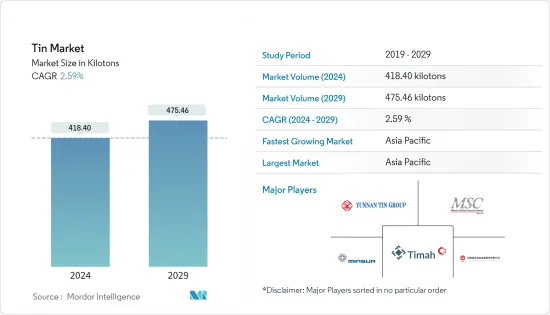

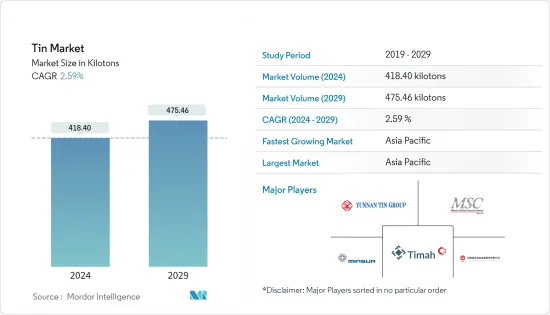

2024年锡市场规模预计为418.40千吨,预计到2029年将达到475.46千吨,在预测期内(2024-2029年)CAGR为2.59%。

2020 年,市场因 COVID-19 受到负面影响,影响了市场成长。然而,锡业恢復了COVID-19疫情,锡精矿进口恢復到正常水准。因此,在预测期内推动市场,

主要亮点

- 从中期来看,电动车市场需求的激增以及电气和电子行业应用的增加预计将在预测期内推动市场发展。

- 用于生产容器等金属产品的铝和无锡钢等替代品的可用性阻碍了市场的成长。

- 将重点转向回收锡预计将在未来几年为市场创造机会。

- 亚太地区预计将主导市场,并且预计在预测期内复合CAGR最高。

锡市场趋势

电子领域主导市场成长

- 锡在电子工业中用作焊料,并且经常以各种纯度和合金形式使用,通常与铅和铟一起使用。所生产的锡总量中约 50-70% 用于电子电气行业的各种产品,如手机、平板电脑、电脑、手錶、钟錶和其他消费性电子设备。

- 例如,根据日本电子资讯科技产业协会(JEITA)的数据,2022年全球电子资讯科技产业产值预计为35,366亿美元,年成长5%,而去年同期为3,360.2美元。2021 年将达到 10 亿。

- 在全球范围内,对智慧型手机的需求正在显着增长。 TelefonaktiebolagetLM Ericsson 的数据显示,2021 年全球智慧型手机订阅量为 62.59 亿,而 2020 年为 59.24 亿。此外,到 2027 年订阅量可能会达到 76.90 亿,从而增加了电子应用中锡的消耗。

- 此外,亚太地区电子产品的需求主要来自中国、印度和日本。此外,由于中国低廉的劳动力成本和灵活的政策,中国对于电子产品生产商来说是一个强劲且有利的市场。根据中国国家统计局数据,2021年全国电子製造业增加价值年平均成长15.7%,而上年度为7.7%。

- 在欧洲,德国的电子工业是该地区最大的。根据ZVEI统计,2021年全年德国电子和数位产业营业额达1998亿欧元(2363.9亿美元),较2020年增长9.8%。此外,从产量来看,电子和数位产业与2020年相比,2021年工业成长率为8.8%。

- 因此,由于上述因素,电子工业中锡的使用量不断增加。

亚太地区将主导市场

- 亚太地区主导了锡市场。中国是全球最大的锡生产国和消费国之一。

- 汽车产业是锡市场和汽车产业的主要贡献者之一,一直在进行产品演变,由于中国污染日益严重,环境问题日益严重,中国专注于製造产品,以确保燃油经济性并最大限度地减少排放。国家。

- 锡与其他金属一起用于许多汽车应用,包括油箱、密封剂、电线、散热器、座垫、接缝和焊接、紧固件、螺丝、螺母、螺栓和屋顶。

- 亚太地区被认为是世界上一些最有价值的汽车製造商的所在地。中国、印度、日本和韩国等发展中国家一直在努力加强製造基础,发展高效的供应链,以提高获利能力。

- 从年销量和製造产量来看,中国仍然是全球最大的汽车市场。根据OICA统计,2021年中国汽车产量达2,609万辆,较2020年同期成长3%。

- 此外,在印度,根据印度汽车製造商协会(SIAM)的数据,2021-22财年(2021年4月至2022年3月),该国汽车工业总共生产了22,933,230辆汽车,而2020年4月至2021年3月期间为22,655,609辆。

- 此外,锡的其他主要最终用户行业包括电气和电子、重型工程、包装。由于中国政府的支持以及有利的数位化计划和政策,中国的资讯和通讯技术(ICT)产业在过去十年中快速成长。

- 然而,由于所有这些因素,预计该地区的锡市场在预测期内将稳定成长。

锡行业概况

锡市场高度整合,五大生产商占全球市场60%以上的份额。市场上一些主要的参与者(排名不分先后)包括云南锡业集团(控股)、Timah、MINSUR、马来西亚冶炼有限公司和云南丰有色金属等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 电动车市场需求激增

- 增加在电气和电子产业的应用

- 限制

- 替代者的存在

- 其他限制

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争程度

- 价格分析

第 5 章:市场区隔(按数量分類的市场规模)

- 产品类别

- 金属

- 合金

- 化合物

- 应用

- 焊接

- 镀锡

- 化学品

- 其他应用(特殊合金、铅酸电池等)

- 最终用户产业

- 汽车

- 电子产品

- 包装(食品和饮料)

- 玻璃

- 其他最终用户产业

- 地理

- 生产分析

- 澳洲

- 玻利维亚

- 巴西

- 缅甸

- 中国

- 刚果(金沙萨)

- 印尼

- 马来西亚

- 秘鲁

- 越南

- 其他国家

- 消费分析

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 奥地利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 中东和非洲其他地区

- 生产分析

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- ArcelorMittal

- Aurubis AG

- Avalon Advanced Materials

- Indium Corporation

- Jiangxi New Nanshan Technology Co. Ltd

- Malaysia Smelting Corporation Berhad

- MINSUR

- Thailand Smelting and Refining Co., Ltd.

- Timah

- Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- Yunnan Tin Industry Group (Holdings) Co., Ltd.

第 7 章:市场机会与未来趋势

- 将重点转向锡回收

The Tin Market size is estimated at 418.40 kilotons in 2024, and is expected to reach 475.46 kilotons by 2029, growing at a CAGR of 2.59% during the forecast period (2024-2029).

The market was negatively affected due to COVID-19 in 2020, thus affecting the market growth. However, the tin industry recovered COVID-19 outbreak, with imports of tin concentrate returning to normal levels. Thus, driving the market during the forecast period,

Key Highlights

- Over the medium term, surging demand from the electric vehicle market and increasing applications in the electrical and electronics industry are expected to drive the market during the forecast period.

- The availability of substitutes like aluminum and tin-free steel for producing metallic products like containers is hindering the market's growth.

- Shifting focus toward recycling tin is expected to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market, and it is also expected to witness the highest CAGR during the forecast period.

Tin Market Trends

Electronic Segment to Dominate the Market Growth

- Tin is used in the electronics industry as a solder and is often used in various purities and alloys, generally with lead and indium. About 50-70% of the overall tin produced is used in the electronics and electrical industry in various products, such as mobiles, tablets, computers, watches, clocks, and other consumer electronic devices.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,536.6 billion in 2022, registering a growth rate of 5% year on year, compared to USD 3,360.2 billion in 2021.

- Globally, the demand for smartphones is increasing at a significant rate. According to TelefonaktiebolagetLM Ericsson, smartphone subscriptions accounted for 6,259 million in 2021 globally, compared to 5,924 million in 2020. Moreover, the subscription is likely to reach 7,690 million by 2027, enhancing the consumption of tin from electronics applications.

- Furthermore, the demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. Furthermore, China is a robust and favorable market for electronics producers, owing to the country's low labor cost and flexible policies. According to the National Bureau of Statistics of China, the annual growth rate of value added in the electronics manufacturing industry in the country accounted for 15.7% in 2021, compared to 7.7% in the previous year.

- In Europe, the German electronics industry is the largest in the region. According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 199.8 billion (USD 236.39 billion) in the full-year 2021, witnessing a growth rate of 9.8% compared to 2020. Furthermore, in terms of production, the electro and digital industry registered a growth rate of 8.8% in 2021 compared to 2020.

- Hence, due to the factors mentioned above, the use of tin is increasing in the electronics industry.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the tin market. China is one of the largest producers and consumers of tin globally.

- The automotive industry, one of the major contributors to the tin market and the automotive sector, has been shaping up for product evolution, with China focusing on manufacturing products to ensure fuel economy and minimize emissions owing to the growing environmental concerns due to mounting pollution in the country.

- Tin, along with other metals, is used in numerous automotive applications, including fuel tanks, sealants, wiring, radiator, seat cushions, seams and welds, fasteners, screws, nuts, bolts, and roofing.

- The Asia-Pacific region is referred to as a home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- China continues to be the world's largest automotive market by both annual sales and manufacturing output. According to OICA, the vehicle production in China reached a total of 26.09 million units in 2021 which is an increase of 3% over 2020 for the same period.

- Moreover, in India, according to the Society of Indian Automobile Manufacturers (SIAM), during FY 2021-22 (April 2021 to March 2022), the country's automotive industry produced a total of 22,933,230 vehicles compared to 22,655,609 units during April 2020 to March 2021.

- In addition, the other major end-user industries for tin include electrical and electronics, and heavy engineering, packaging. China's information and communication technology (ICT) sector has grown at a rapid pace in the past decade, owing to the support of the Chinese government and favorable digitization plans and policies.

- However, due to all such factors, the market for tin in the region is expected to have steady growth during the forecast period.

Tin Industry Overview

The tin market is highly consolidated, with the five major producers accounting for more than 60% of the global market. Some of the major players in the market (in no particular order) include Yunnan Tin Industry Group (Holdings) Co., Ltd., Timah, MINSUR, Malaysia Smelting Corporation Berhad, and Yunnan Chengfeng Nonferrous Metals Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Electric Vehicle Market

- 4.1.2 Increasing Applications in the Electrical and the Electronics Industry

- 4.2 Restraints

- 4.2.1 Presence of Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Metal

- 5.1.2 Alloy

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Solder

- 5.2.2 Tin Plating

- 5.2.3 Chemicals

- 5.2.4 Other Applications (Specialized Alloys, Lead-acid Batteries, and Others)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Electronics

- 5.3.3 Packaging (Food and Beverage)

- 5.3.4 Glass

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Production Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Bolivia

- 5.4.1.3 Brazil

- 5.4.1.4 Burma

- 5.4.1.5 China

- 5.4.1.6 Congo (Kinshasa)

- 5.4.1.7 Indonesia

- 5.4.1.8 Malaysia

- 5.4.1.9 Peru

- 5.4.1.10 Vietnam

- 5.4.1.11 Other Countries

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Mexico

- 5.4.2.2.3 Canada

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 France

- 5.4.2.3.4 Italy

- 5.4.2.3.5 Austria

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 South Africa

- 5.4.2.5.2 United Arab Emirates

- 5.4.2.5.3 Rest of Middle East & Africa

- 5.4.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Aurubis AG

- 6.4.3 Avalon Advanced Materials

- 6.4.4 Indium Corporation

- 6.4.5 Jiangxi New Nanshan Technology Co. Ltd

- 6.4.6 Malaysia Smelting Corporation Berhad

- 6.4.7 MINSUR

- 6.4.8 Thailand Smelting and Refining Co., Ltd.

- 6.4.9 Timah

- 6.4.10 Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- 6.4.11 Yunnan Tin Industry Group (Holdings) Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Recycling of Tin