|

市场调查报告书

商品编码

1444702

药品包装 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

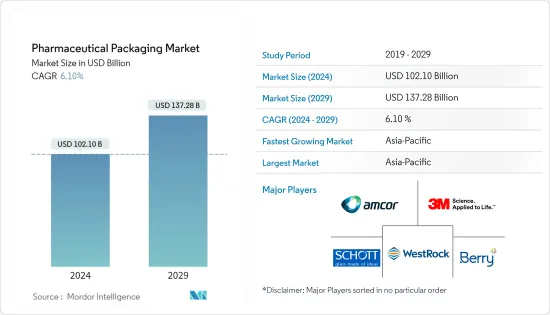

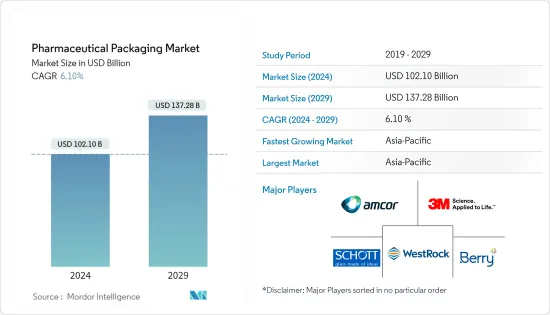

2024年药品包装市场规模预估为1,021.0亿美元,预估至2029年将达到1,372.8亿美元,在预测期间(2024-2029年)CAGR为6.10%。

主要亮点

- 全球製药业不断发展,对治疗传染性和非传染性疾病的包装产生了需求。因此,药品製造中对包装的需求不断增长,因为它可以保护药品免受损坏、生物污染和外部影响。

- 药品需求的增加与产业技术进步有关,并直接创造了对瓶子、小瓶和其他包装解决方案的需求。此外,对注射剂的需求不断增长正在推动製药业玻璃瓶的成长。对肿瘤药物和其他高效药物(例如抗体偶联物和速效类固醇)的强劲需求以及人均药品支出的增加预计将成为关键的成长动力。

- 全球医药产品的需求情境支持了包装产业的创收,并预计在预测期内将持续下去。总体而言,随着药品包装的持续扩张和研发,预计药品包装市场将保持稳定成长。因此,预计需求在预测期内将出现巨大增长。

- 塑胶包装产业面临聚合物成本上涨,使得塑胶更加昂贵。此外,乌克兰和俄罗斯之间的战争再次推高了价格。塑胶及塑胶製品的需求量逐年增加。供应跟不上需求的成长也是推动聚合物价格上涨的因素之一,预计将阻碍市场成长。

- 由于COVID-19的传播,预计市场将大幅成长。受疫情影响,消费者转向网上购物。 COVID-19 大流行对发展中国家和已开发国家的包装材料扩张造成了沉重打击。然而,对无菌药品包装的强劲需求鼓励了对该领域的投资。此外,业内人士预计医疗保健产业对包装技术将表现出强劲的需求。

药品包装市场趋势

塑胶包装占有重要的市场份额

- 塑胶是最受欢迎的药品包装材料之一,因为它更适用、耐用、灵活且可持续。药品包装采用由各种材料製成的塑胶瓶,包括聚氯乙烯、聚乙烯、聚丙烯和聚苯乙烯。该行业使用透明、耐用、轻质的塑胶来储存和销售。

- 塑胶用于包装泡罩包装、小袋、预填充注射器和吸入器、注射液袋和瓶子。药品包装中使用的材料需要具有化学惰性、水蒸气渗透性低且易于处理。此外,包装材料与药品和生物製剂直接接触,因此需要遵守监管机构的严格规定。塑胶和聚合物满足这些要求;因此,它常用于药品包装。

- 药品包装瓶由防儿童开启的瓶盖和封口组成。美国FDA要求药用塑胶製造商在产品标籤上突出显示“儿童安全包装”,以供消费者评估。对儿童安全包装的需求不断增长是预测期内推动医药塑胶包装市场的因素之一。

- 作为利用药品包装的一部分,公司专注于扩大业务。例如,2022 年 6 月,Constantia Flexibles 推出了 Perpetua Alta,这是一种面向製药市场的新型聚丙烯单一材料。这种单聚合物解决方案取代了化学成分产品(例如液体和凝胶药物组合物)的多组分包装。此外,德国实验室 Cyclos-HTP 的独立认证确认材料回收率高达 96%,具体取决于最终材料成分。这些创新推动了医药包装市场中塑胶材料的发展。

- 此外,通常用作主要包装材料的聚氯乙烯和 PVDC(聚偏二氯乙烯)可以保护药品免受氧气和异味、湿气、水蒸气穿透、污染和细菌的影响。这使得 PVC 和 PVDC 成为泡罩包装的首选材料。它们卓越的感官品质确保包装食品和药物的风味不受影响。 PVC 单晶薄膜耐阳光和紫外线,可在预测期内阻止生产和分销过程中细菌的传播,从而起到防止污染的屏障作用。

亚太地区将占据主要份额

- 中国医药产业的强劲成长为该国的医药包装公司创造了庞大的商机。对于公司来说,寻找满足药品包装市场新兴需求的包装概念现在变得至关重要。

- 中国政府加速医学体制转型的政策预计将促进医药包装产业的发展。此外,中国正积极升级医药包装设施与材料,以实现医药产品多元化,为医药包装企业带来新的机会。

- 在发展中经济体製药业的成长和医疗保健服务改善的推动下,日本药品包装市场的前景看好。在这个市场中,塑胶、玻璃、纸张和铝箔是主要的材料类型。直接影响药品包装产业动态的新兴趋势包括对环保包装的需求不断增长、奈米包装的使用增加以及吹灌封技术的采用增加。

- 印度的药品包装产业多年来一直在大幅成长。由于创新和新兴治疗方法,製药业的这一领域还有进一步成长的空间。 COVID-19 大流行让人们重新认识到高效包装和分销产品的必要性。人们期望更快地製造和分销产品,甚至包括包装。包装公司将面临新的压力,需要开发解决方案,以加快速度并增加需求。

- 韩国是亚洲成长最快的製药地区之一,正成为全球医疗保健创新的重要贡献者。在过去几年中,它极大地推进了新药研究和开发。特别是在过去几年中,韩国在全球製药和生技领域的新药研发能力不断增强。

- 亚太其他地区的范围包括印尼、澳洲、新加坡、泰国、马来西亚等多个国家。该市场是由国际合作伙伴关係的激增、生物仿製药、成品製剂出口的扩大以及强劲的仿製药市场推动的。

医药包装行业概况

药品包装市场现有参与者之间的竞争非常激烈。该市场因 Amcor PLC、Schott AG、WestRock Company、Berry Global、Aptar Group Inc. 等多家主要参与者的存在而变得分散。公司正在透过产品发布、合作和投资来扩展业务。

- 2023 年 2 月:肖特在美国开设了第一家工厂,以扩大其诊断和生命科学产品的能力和製造能力。投资数百万美元在亚利桑那州凤凰城建设新工厂,将致力于生产客製化 DNA 和蛋白质生物感测器以及玻璃、半导体和聚合物微流体消耗设备上的其他微阵列。

- 2022 年 5 月:CCL Industries Inc. 宣布计划扩建德国莱比锡附近的 Innovia 业务部门。一条新的 8 m 宽多层共挤生产线将生产高度工程化的薄规格标籤薄膜,以满足可持续发展驱动的对减少树脂含量材料不断增长的需求。这项新技术是标籤薄膜独有的,年产能为 36,000 吨,能源效率一流。生产将于 2024 年下半年开始,大部分资本将在明年投入。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- COVID-19 对市场影响的评估

第 5 章:市场动态

- 市场驱动因素

- 包装监管标准和假冒伪劣产品的严格规范

- 奈米技术对创新和新一代包装解决方案的影响

- 市场挑战

- 供应商议价能力导致原物料成本波动

第 6 章:市场细分

- 按材质

- 塑胶

- 玻璃

- 其他材料

- 依产品类型

- 瓶子

- 注射器

- 小瓶和安瓿

- 管

- 瓶盖和瓶盖

- 标籤

- 其他产品类型

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- Amcor PLC

- 3M Company

- Schott AG

- WestRock Company

- Berry Global Group Inc.

- McKesson Corporation

- AptarGroup Inc.

- Klockner Pentaplast Group

- CCL Industries Inc.

- FlexiTuff International Ltd

- Gerresheimer AG

- West Pharmaceutical Services Inc.

- Becton, Dickinson and Company

- Vetter Pharma International GmbH

- Catalent Inc.

- WL Gore & Associates Inc.

- Nipro Corporation

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Pharmaceutical Packaging Market size is estimated at USD 102.10 billion in 2024, and is expected to reach USD 137.28 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

Key Highlights

- The pharmaceutical industry is increasing worldwide, creating a need for packaging to treat communicable and non-communicable diseases. Therefore, the demand for packaging in pharmaceutical manufacturing is growing as it protects pharmaceuticals from damage, biological contamination, and external influences.

- Increased demand for pharmaceuticals is associated with technological advancements in the industry and directly creates demand for bottles, vials, and other packaging solutions. Additionally, the growing demand for injectables is driving the growth of glass vials in the pharmaceutical industry. Strong demand for oncology and other high-potency drugs (such as antibody conjugates and fast-acting steroids) and increasing per capita spending on pharmaceuticals are expected to be key growth drivers.

- The global demand scenario for pharmaceutical products has supported revenue generation in the packaging sector and is expected to continue during the forecast period. Overall, the pharmaceutical packaging market is projected to register a steady growth rate coupled with ongoing expansion and research and development to improve pharmaceutical packaging. Thus, demand is anticipated to witness enormous growth over the forecast period.

- The plastic packaging industry faces rising polymer costs, making plastics more expensive. Additionally, the war between Ukraine and Russia has pushed prices up again. The demand for plastics and plastic products is increasing year by year. The lack of supply keeping up with the increase in demand is also one factor driving higher polymer prices, expected to hinder the market growth.

- Owing to the spread of COVID-19, the market is expected to grow significantly. Due to the pandemic, customers shifted toward online purchasing. The COVID-19 pandemic hit hard on expanding packaging materials in developing and developed countries. However, strong demand for sterilized pharmaceutical packaging encouraged investment in the landscape. Moreover, industry players expect the healthcare industry to show strong demand for packaging technology.

Pharmaceutical Packaging Market Trends

Plastic Packaging Holds a Significant Market Share

- Plastic is one of the most popular materials for pharmaceutical packaging as it is more applicable, durable, flexible, and sustainable. Pharmaceutical packaging utilizes plastic bottles constructed from various materials, including polyvinyl chloride, polyethylene, polypropylene, and polystyrene. The industry uses transparent, durable, lightweight plastic to store and market.

- Plastics are used for packaging blister packs, sachets, prefilled syringes and inhalers, parenteral solution pouches, and bottles. Materials used in pharmaceutical packaging need to be chemically inert, have low permeability to water vapor, and are easy to handle. In addition, packaging materials come in direct contact with pharmaceuticals and biological agents and hence need to comply with strict regulations from regulatory authorities. Plastics and polymers meet these requirements; therefore, it is often used for pharmaceutical packaging.

- Bottles for pharmaceutical packaging consist of child-resistant caps and closures. The US FDA requires pharmaceutical plastic manufacturers to highlight "child-resistant packaging" on product labels for consumer evaluation. Rising demand for child-safe packaging is one of the factors driving the pharmaceutical plastic packaging market during the forecast period.

- Companies are focused on expanding their business as part of leveraging pharmaceutical packaging. For instance, in June 2022, Constantia Flexibles introduced Perpetua Alta, a new polypropylene-based mono-material for the pharmaceutical market. This mono-polymer solution replaces multi-component packaging for chemically assertive products, such as liquid and gel pharmaceutical compositions. In addition, independent certification by the German laboratory Cyclos-HTP confirms up to 96% material recovery, depending on the final material composition. Such innovations drive the plastic materials in the pharmaceutical packaging market.

- Moreover, polyvinyl chloride and PVDC (polyvinylidene chloride), commonly used as principal packaging materials, protect pharmaceutical items from oxygen and odor, moisture, water vapor transmission, contamination, and bacteria. This makes PVC and PVDC the preferred materials for blister packing. Their superior organoleptic qualities ensure that the flavor of packaged food and medications remains unaffected. PVC mono films are sunlight and UV-ray-resistant and serve as a barrier against contamination by halting the spread of germs during production and distribution over the forecast period.

Asia-Pacific to Occupy Major Share

- The robust growth of the Chinese pharmaceutical sector creates significant business opportunities for the country's pharmaceutical packaging companies. It is now becoming critical for companies to look for packaging concepts that meet emerging needs in the pharmaceutical packaging market.

- The Chinese government's policies to accelerate the transformation of the country's medical regime are expected to promote the development of the pharmaceutical packaging sector. Furthermore, China is actively upgrading its pharmaceutical packaging facilities and materials and diversifying its pharmaceutical products, bringing new opportunities to pharmaceutical packaging firms.

- The future of the pharmaceutical packaging market in Japan looks good, driven by the pharmaceutical industry's growth and improving healthcare services in developing economies. In this market, plastic, glass, paper, and aluminum foil are the main material types. Emerging trends directly impacting the dynamics of the pharmaceutical packaging industry include rising demand for eco-friendly packaging, increasing use of nano-enabled packaging, and increasing adoption of blow-fill-seal technology.

- The pharmaceutical packaging industry in India has been experiencing substantial growth for several years. Due to innovations and emerging treatments, there is room for further growth in this section of the pharma industry. The COVID-19 pandemic has brought a new awareness of the need to package and distribute products efficiently. There will be expectations to manufacture and distribute products quicker, right down to the packaging. Packaging companies will face new pressures to develop solutions to get things moving faster and increase demand.

- South Korea is one of the fastest-growing pharma regions in Asia, emerging as a critical contributor to global healthcare innovation. It has tremendously advanced new drug research and development in the last few years. Especially during the past few years, Korea has developed new drug R&D capabilities in the global pharmaceutical and biotech landscape.

- The scope of the Rest of the Asia-Pacific region includes multiple countries, such as Indonesia, Australia, Singapore, Thailand, and Malaysia. The market is driven by the surge of international partnerships, biosimilars, an expansion in the export of finished formulations, and a robust generics market.

Pharmaceutical Packaging Industry Overview

The rivalry among the existing players is intense in the pharmaceutical packaging market. The market is fragmented with the presence of various major players, such as Amcor PLC, Schott AG, WestRock Company, Berry Global, Aptar Group Inc., and more. Companies are expanding their business through product launches, collaborations, and investments.

- February 2023: Schott opened its first facility in the United States to expand its capabilities and manufacturing capacity for diagnostics and life sciences products. The construction of a new facility in Phoenix, Arizona, with a multimillion-dollar investment, will be dedicated to producing custom DNA and protein biosensors and other microarrays on glass, semiconductors, and polymer microfluidic consumable devices.

- May 2022: CCL Industries Inc. announced plans for an expansion at its Innovia business unit near Leipzig in Germany. A new 8 m wide multi-layer co-extrusion line will manufacture highly engineered thin gauge label films to meet the rising, sustainability-driven demand for materials with reduced resin contents. With a capacity of 36,000 ton annually and best-in-class energy efficiency, the new technology is exclusive to label films. Production will begin in the second half of 2024, with most of the capital invested in the next year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Assessment of Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards on Packaging and Stringent Norms against Counterfeit Products

- 5.1.2 Impact of Nanotechnology due to Innovative and New- generation Packaging Solutions

- 5.2 Market Challenges

- 5.2.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastics

- 6.1.2 Glass

- 6.1.3 Other Materials

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Syringes

- 6.2.3 Vials and Ampoules

- 6.2.4 Tubes

- 6.2.5 Caps and Closures

- 6.2.6 Labels

- 6.2.7 Other Product Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 3M Company

- 7.1.3 Schott AG

- 7.1.4 WestRock Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 McKesson Corporation

- 7.1.7 AptarGroup Inc.

- 7.1.8 Klockner Pentaplast Group

- 7.1.9 CCL Industries Inc.

- 7.1.10 FlexiTuff International Ltd

- 7.1.11 Gerresheimer AG

- 7.1.12 West Pharmaceutical Services Inc.

- 7.1.13 Becton, Dickinson and Company

- 7.1.14 Vetter Pharma International GmbH

- 7.1.15 Catalent Inc.

- 7.1.16 W. L. Gore & Associates Inc.

- 7.1.17 Nipro Corporation