|

市场调查报告书

商品编码

1686642

奈米物联网-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Internet Of Nano Things - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

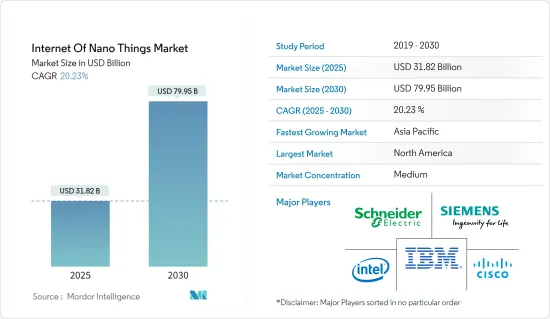

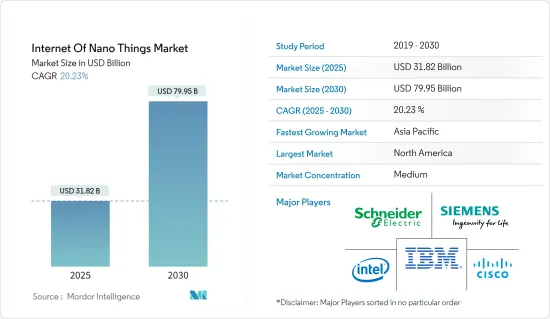

奈米物联网市场规模预计在 2025 年为 318.2 亿美元,预计到 2030 年将达到 799.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.23%。

主要亮点

- 奈米物联网 (IoNT) 促进了奈米感测器和奈米设备与包括互联网在内的现有通讯技术的互连。透过开发具有通讯能力的奈米机器并将其与微型和大型设备互连,IoNT 将得到增强。这些设备的尺寸在 1nm 到 100nm 之间,将与经典网路互连,带来新的网路范式。

- IoNT 是一项新兴技术,允许大量奈米设备透过高速网路相互通讯。 IoNT 将用于收集、预处理并与最终用户共用资料。此外,云端处理、巨量资料和机器学习(ML)等新技术开启了许多可能性。

- 在预测期内,政府在航太和国防领域的支出增加预计将推动 IoNT 市场的发展,因为 IoNT 在可用于监视并可携带足够爆炸物穿透目标物体的奈米无人机领域有着重要的应用。

- 过去几年的技术进步主要推动了智慧环境(办公室、家庭、城市等)的快速成长。这些环境的快速成长为应用程式互联和互联网使用铺平了道路,刺激了物联网技术的出现。物联网概念的扩展也使得人们能够使用 IoNT,这是一种主要基于奈米技术和物联网的新型通讯网路范式。

- 奈米无人机用于军事力量的监视和运输,也是 IoNT 的重要应用。此外,IoNT 还可以提供城市、住宅和工厂的更详细、最新的图像。在智慧城市计划中使用 IoNT 可以监测大城市的空气和水质等各种特性。 IoNT 将提供可用于改善基础设施、公共和服务的即时资料。此外,随着人们对 IoNT 的诸多优势和奈米机器发展的认识不断提高,预测期内市场的收益成长将显着增强。

- 奈米技术系统价格昂贵,需要先进的技术。对于许多计划扩大策略的中小型企业来说,高昂的成本是采用该技术的障碍。

- 后新冠疫情时代改变了世界各地的商业性质和工作条件。公司进一步实现业务自动化,员工继续远距工作。 IoNT 开发人员致力于实现 IoNT 技术,推动 IoNT 业务的崛起。奈米无人机可用于运送医疗物资或监视特定位置,不再仅被视为战争武器或不起眼的武器。此外,医疗保健领域的 IoNT 解决方案带来了许多好处,包括降低服务成本和改善治疗结果,推动了 IoNT 市场的发展。

奈米事物互联网市场趋势

医疗保健产业预计将占很大份额

- 奈米技术和奈米物联网 (IoNT) 正在不断影响医疗保健领域及其转型,并带来更好的结果。奈米技术透过奈米材料和设备融入医学,即奈米医学,为疾病的预防、诊断和治疗带来了许多好处。预计医疗保健和生命科学领域在预测期内将快速成长。 IoNT 将透过更早发现危及生命的疾病并协助收集患者的即时资料来实现紧急医疗对策。

- 根据美国癌症协会预测,2023年美国将新增195万例癌症确诊病例,并有609,360例癌症死亡病例。因此,癌症患者的增加将推动医疗奈米技术产业向前发展。随着独特的奈米系统在癌症、心血管、眼科和中枢神经系统疾病等各种疾病的诊断、影像和治疗方面的发展,奈米技术产品在医疗保健领域的益处越来越大。

- IoNT概念引入医疗保健领域,使得健康监测和治疗更加个人化、及时性和便利性。因此,奈米技术和 IoNT 有可能彻底改变 21 世纪的医疗保健,创建能够早期发现和诊断疾病并随后进行准确、及时和有效治疗的系统,同时显着降低医疗成本。

- 奈米药物和奈米设备的进步促使许多研究人员探索替代治疗方法,因为目前的方法在早期检测和治疗方面有其限制。各种奈米材料和奈米系统的显着特性和应用使得它们在即将部署的技术创造中无所不在。

- IoNT 还可以形成身体感测器网路 (BSN),轻鬆应用内部奈米感测器来监测患者的健康和生理活动。患者可以与医生一起透过穿戴式装置查看奈米感测器捕获的资料。根据美国专利商标局(USPTO)的资料,美国在2023年公布了6,926份奈米技术专利申请,其次是韩国,有1,715份。这些专利证明了市场参与者对奈米技术的投资。

- 智慧型穿戴装置在扩大 IoNT 在该领域的覆盖范围方面发挥关键作用。健身追踪设备的大规模采用以及 Apple、Fitbit 和 Android 等公司不断增加的投资正在透过增加医疗保健功能进一步扩大其覆盖范围。很多新兴企业也在这个领域进行创新。

预计北美将占最大份额

- 现代美国製造工厂依靠新技术和创新以显着降低的成本生产更高品质的产品。高速、安全的5G连线有望实现更敏捷的营运和更灵活的生产。该技术可望促进自动化仓库、自动化组装、互联物流、包装、产品处理和自动推车的发展。

- 市场上的公司正在投资寻找促进业务成长的创新解决方案。例如,英特尔宣布将于2023年10月进入1.8nm製造工艺,旨在彻底改变半导体产业并推动市场动态。英特尔代工服务 (IFS) 已与 Arm 合作,专注于使用英特尔 18A 製程创建低功耗计算系统晶片(SoC)。虽然最初的重点将放在行动 SoC 上,但英特尔和 Arm 的目标是扩展到多个领域,包括汽车、物联网、资料中心、航太和政府应用。

- 预计将从现有技术中涌现的新技术将改变美国製造业,其中包括人工智慧和 IoNT 的融合,SAS Software 等公司将 IoNT 誉为下一波基于奈米技术的物联网浪潮。

- 该地区的领先公司正在开发新的解决方案以保持竞争力。 2024 年 1 月,提供端对端物联网解决方案的公司 Telit Cinterion 宣布在其 ME910G1 和 ME310G1 模组上提供蜂巢和卫星连接服务。 floLIVE 和 Skylo Technologies 之间的伙伴关係旨在提供新的解决方案,确保移动资产(包括货柜、农业机械、卡车和其他高价值资产)可以在任何地方(从乡村公路到沙漠和海洋)进行追踪和监控。

- 此外,具有新无线电 (NR) 目标功能(例如车联网和超可靠低延迟通讯)的新兴 5G 标准将用于工业用例。 PROFINET 和 Modbus 等 IEC 标准化工业通讯汇流排正在推动市场走向可靠、安全的工业应用。

奈米物联网产业概况

奈米物联网市场处于半竞争状态,由Schneider Electric、IBM 和英特尔等几家主要企业组成。然而,市场仍在整合,许多公司正在争夺份额。Schneider Electric在研发方面投入巨资,并不断创新其产品和服务,使其在与其他公司的竞争中占据优势。

2024 年 5 月:CGI 和诺基亚宣布扩大合作计划,重点将 5G 私人无线网路技术与 CGI 的商业服务套件相结合。该战略联盟旨在简化以资料为中心的即时业务运营的数位解决方案的部署和管理。利用两家公司的综合能力,合作伙伴已成功在北爱尔兰的製造和教育环境中部署了 5G 和 4G 专用网路。该计划提供了网路技术存取权限,现在还包括对窄频物联网 (NB-IoT) 的支援。

2023年9月,英特尔将先进晶片工具部门10%的股份出售给台积电。 IMS Nanofabrication 总部位于奥地利维也纳,专门製造多光束遮罩工具,这些工具对于尖端晶片的生产至关重要,尤其是那些依赖极紫外光微影术(EUV) 技术的晶片。 IMS 将继续作为独立子公司在执行长下运作。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 主要研究方法及主要受访者

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- COVID-19 市场影响评估

- 技术简介

第五章市场动态

- 市场驱动因素

- 广泛的设备连接

- 奈米科技的出现

- 市场挑战/限制

- 安全问题

- 技术成本高

第六章市场区隔

- 按组件

- 硬体

- 软体

- 连线/服务

- 按最终用户

- 卫生保健

- 后勤

- 国防与航太

- 製造业

- 能源与电力

- 零售

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Schneider Electric SE

- Siemens AG

- IBM Corporation

- Intel Corporation

- Cisco Systems Inc.

- SAP SE

- Juniper Networks Inc.

- Qualcomm Inc.

- Nokia Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Internet Of Nano Things Market size is estimated at USD 31.82 billion in 2025, and is expected to reach USD 79.95 billion by 2030, at a CAGR of 20.23% during the forecast period (2025-2030).

Key Highlights

- The internet of nano things (IoNT) facilitates the interconnection of nano-sensors and nanodevices with the existing communication technologies in the market, including the internet. Developing nano-machines with communication capabilities and interconnection with micro-and macro-devices will empower IoNT, which is increasingly seen as the next major technological innovation. These devices have dimensions ranging from 1 nm to 100 nm and are interconnected with classical networks, leading to new networking paradigms.

- IoNT is a modern technology that allows numerous nano gadgets to communicate with one another via a high-speed network. IoNT is used for data gathering, pre-processing, and sharing with end users. It also opens up many possibilities with new technologies, such as cloud computing, big data, and machine learning (ML).

- The increased government spending in the aerospace and defense segment is expected to drive the IoNT market during the forecast period, as IoNT has found significant applications in the fields of nano-drones that could be used for monitoring and carrying explosives sufficient enough to penetrate the targetted subject.

- The technological advancements over the past few years have primarily led to the rapid growth of smart environments (offices, homes, and cities, among others). This rapid increase in such environments has paved the way for the interconnectivity of applications and internet usage, prompting the emergence of IoT technology. The expansion of the IoT concept has also given access to IoNT, a new communication network paradigm primarily based on nanotechnology and IoT.

- Nano-drones, employed for monitoring and transporting military troops, are another key use of IoNT. In addition, IoNT can provide more detailed and up-to-date images of cities, houses, and factories. The use of IoNT in smart city projects may monitor various characteristics, such as air and water quality, throughout a metropolis. IoNT can capture real-time data that can be utilized to improve infrastructure, public utilities, and services. Also, rising awareness of the many benefits of IoNT and the development of nano-machines will considerably enhance market revenue growth during the forecast period.

- Nanotechnology systems are expensive and require advanced technology. The high cost is a barrier for many businesses operating on a small and medium scale to use this technology that is planning to deploy expansion strategies in the market.

- The post-COVID-19 era has changed the nature and working conditions of businesses worldwide. Companies automated their operations even more while employees continued to work remotely. IoNT developers were working on implementing IoNT techniques, which helped the IoNT business to flourish. Nano drones helped deliver medical supplies and monitor specific locations, and they were no longer regarded as merely a weapon of war and obscurity. Also, IoNT solutions in the healthcare sector offer numerous benefits, such as lowering service costs and increasing treatment outcomes, propelling the IoNT market forward.

Internet Of Nano Things Market Trends

The Healthcare Segment is Expected to Hold a Significant Share

- Nanotechnology and the internet of nano things (IoNT) have continuously impacted the healthcare segment and its transformation and contributed to better results. Including nanotechnology in medicine through nanomaterials and devices, known as nanomedicine, has brought many benefits to disease prevention, diagnosis, and treatment. The healthcare and life sciences area is predicted to grow rapidly during the forecast period. IoNT can detect life-threatening disorders early on and assists in the collecting of real-time data from patients, allowing for life-saving medical measures.

- According to the American Cancer Society, there were 1.95 million new cancer cases identified in the United States in 2023, with 609,360 cancer deaths. As a result, the rising number of cancer patients propels the healthcare nanotechnology industry forward. Nanotechnology products have been increasingly beneficial in healthcare, developing unique nanosystems for diagnosing, imaging, and treating various diseases, including cancer, cardiovascular, ophthalmic, and central nervous system ailments.

- Incorporating the concept of IoNT into healthcare has enabled more personalized, timely, and convenient health monitoring and treatment. Therefore, nanotechnology and IoNT have the potential to revolutionize healthcare in the 21st century completely, creating a system that enables early detection and diagnosis of illness, followed by accurate, on-time, and effective treatment, significantly reducing medical costs.

- The advancement of nanomedicines and nanodevices has spurred many researchers to seek alternative remedies, as current approaches are limited in earlier identification and treatment. The remarkable features and applications of diverse nanomaterials and nanosystems have made them ubiquitous in creating technologies that will be deployed shortly.

- The IoNT can also form a body sensor network (BSN) that easily applies internal nano-sensors to monitor patient health and physiological activity. The patient can view this data obtained by the nano-sensor on a wearable gadget with a doctor. As per data from the United States Patent and Trademark Office (USPTO), there are 6,926 published nanotechnology patent applications in the United States, followed by 1,715 in South Korea in 2023. These patents are testimonials of the market players investing in nanotechnology.

- Smart wearables have played a significant role in expanding the scope of IoNT in the segment. The massive adoption of fitness tracking devices and growing investments by companies like Apple, Fitbit, and Android enhance the range further by adding more healthcare features. Many startups are also bringing innovation to this segment.

North America is Expected to Hold the Largest Share

- Modern manufacturing facilities in the United States rely on new technologies and innovations to produce higher quality products significantly with lower costs. Fast and secure 5G connectivity is expected to enable agile operations and flexible production. This technology is expected to facilitate automated warehouses, automated assembly, connected logistics, packing, product handling, and autonomous carts.

- Market players are investing in catering to innovative solutions for business growth. For instance, in October 2023, Intel announced its foray into the 1.8 nm production process, aiming to revolutionize the semiconductor industry and drive market dynamics. Intel Foundry Services (IFS) partnered with Arm, emphasizing the creation of low-power compute system-on-chips (SoCs) using Intel's 18A process. While the initial focus was on mobile SoCs, Intel and Arm are set on expanding into diverse sectors, including automotive, IoT, data centers, aerospace, and government applications.

- Among emerging technologies that are expected to emerge out of the existing technologies transforming manufacturing in the United States is the convergence of AI and IoNT, with companies like SAS Software touting IoNT as the next wave for IoT based upon nanotechnology.

- The key players across this region are developing new solutions to remain competitive. In January 2024, Telit Cinterion, an end-to-end IoT solutions enabler, announced cellular and satellite connectivity services on its ME910G1 and ME310G1 modules. This partnership between floLIVE and Skylo Technologies planned to deliver the new solution, ensures that mobile assets, including shipping containers, agricultural equipment, trucks, and other high-value assets, can be tracked and monitored anywhere, from rural highways to deserts and oceans.

- Also, the emerging 5G standards with new radio (NR) target capabilities, such as vehicle-to-everything and ultra-reliable low-latency communications, are used in industrial use cases. With industrial communication buses standardized by IEC, such as PROFINET and Modbus, the market is headed toward reliable and secure industrial adoption.

Internet Of Nano Things Industry Overview

The internet of nano things market is semi-competitive and consists of several key players like Schneider Electric, IBM, and Intel. However, the market remains consolidated, with many players trying to occupy the share. Their ability to continually innovate their products and services by investing significantly in research and development has allowed them to gain a competitive advantage over other players.

May 2024: CGI and Nokia unveiled plans to bolster their collaboration, focusing on merging 5G private wireless networking technology with CGI's suite of business services. This strategic alliance aims to streamline the deployment and management of digital solutions tailored for data-centric, real-time business operations. Leveraging their collective strengths, the partners successfully implemented a 5G and 4G private network in Northern Ireland's manufacturing and educational environments. This initiative granted access to network technologies and included support for the narrowband-internet of things (NB-IoT).

September 2023: Intel divested its 10% stake in the advanced chip tool sector to TSMC. IMS Nanofabrication, headquartered in Vienna, Austria, specializes in crafting multi-beam masking tools pivotal for producing cutting-edge chips, particularly those reliant on extreme ultraviolet lithography (EUV) technology. Intel remains the majority stakeholder of IMS, which will continue to operate as a standalone subsidiary under CEO Elmar Platzgummer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Primary Research Approach and Key Respondents

- 2.5 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Wide Connectivity in Devices

- 5.1.2 Emergence of Nanotechnology

- 5.2 Market Challenges/Restraints

- 5.2.1 Security Concerns

- 5.2.2 High Costs of the Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Connectivity/Services

- 6.2 By End User

- 6.2.1 Healthcare

- 6.2.2 Logistics

- 6.2.3 Defense and Aerospace

- 6.2.4 Manufacturing

- 6.2.5 Energy and Power

- 6.2.6 Retail

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Siemens AG

- 7.1.3 IBM Corporation

- 7.1.4 Intel Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 SAP SE

- 7.1.7 Juniper Networks Inc.

- 7.1.8 Qualcomm Inc.

- 7.1.9 Nokia Corporation