|

市场调查报告书

商品编码

1640538

聚丙烯纤维:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Polypropylene Fibers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

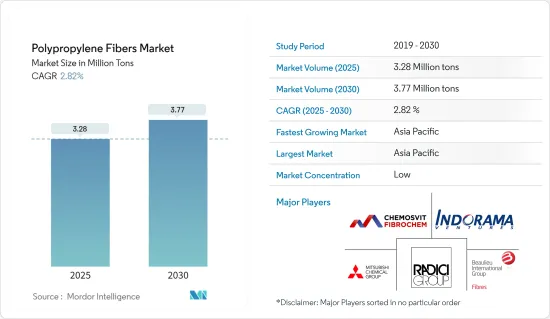

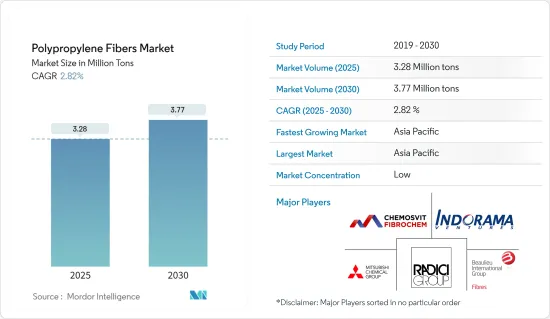

聚丙烯纤维市场规模估计预测2025年为328万吨,预计2030年将达到377万吨,预测期(2025-2030年)的复合年增长率为2.82%。

短期内,卫生和医疗领域对聚丙烯纤维的使用增加以及建筑业的需求上升是推动市场发展的主要因素。

可用性、更便宜的替代品的可用性以及低熔点等因素可能会阻碍市场成长。

然而,再生聚丙烯纤维的前景很可能成为市场成长的机会。

亚太地区在全球聚丙烯纤维市场中占据主导地位,并可能在预测期内呈现最高的成长率。

聚丙烯纤维市场趋势

纺织业可望主导市场

- PPF 在纺织业的应用包括纤维、纤维材料和其他基于 PP 的纺织材料,并用于床罩、地毯、衬垫、地毯、胶带、绳索、服饰(家居、运动、婴儿等)防护衣)、技术纺织品和环保纺织品。 PP短纤维的主要分类有地毯型、羊毛型、棉型、超细纤维。

- 聚丙烯绳用于农业和农作物包装,也可用于重型蔬果人工林,帮助水果蔬菜挂在茎枝上。

- 技术过滤器用于各种工业应用,包括湿式过滤和製药。这些过滤器对油漆、被覆剂、石化产品等具有优异的耐化学性。

- 根据美国全国纺织组织理事会(NCTO)的资料,2023年美国纺织品和服装出货收益将达648亿美元。此外,美国纺织业也向美国军方供应8,000多种不同的纺织产品。

- 同样,根据联邦统计局(德国联邦当局)的数据,纺织业收益预计将在 2022 年达到 129.7 亿欧元(139.6 亿美元),2023 年达到 123.8 亿欧元(133.7 亿美元)。

- 聚丙烯纤维因其耐用性、防污性和防潮性、成本效益以及保持鲜艳色彩的能力而常用于地毯。这使得它成为各种环境(包括高流量区域)的实用选择。

- 根据英国国家统计局的数据,2022 年英国地毯和地垫製造收入达到 7.8 亿英镑(9.8134 亿美元)。

- 同样,根据巴西纺织服饰协会统计,巴西纺织服饰链出口额为11.4亿美元,进口额为59亿美元。

- 鑑于上述情况,纺织业预计将占据市场主导地位。

亚太地区可望主导市场

- 亚太地区在全球聚丙烯纤维市场中占据主导地位,预计在预测期内将出现最高成长率。中国凭藉其大规模的生产活动成为聚丙烯纤维的主要生产国。

- 中国是世界上最大的纺织品和服饰生产国和出口国。中国拥有庞大的生产能力,需要更多的纺织和服饰产品。根据国务院新闻办公室预测,2023年我国重点纺织企业利润总额年均成长7.2%。同时,2023年中国纺织品服饰出口额将达2,936亿美元。

- 但人事费用上升和全球保护主义抬头削弱了该国的竞争力。近年来,该国人事费用大幅上升,超过了许多亚洲其他国家。

- 此外,聚丙烯纤维具有无毒、低过敏性的特点,广泛应用于医疗产业,如医用服饰、一次性产品、创伤护理、医疗设备过滤器和手术网片等。

- 中国拥有仅次于美国的世界第二大医疗产业,医疗市场监管更严格。到2030年,中国预计将占全球医疗保健产业收益的25%。

- 根据中国国家统计局的数据,2023年中国医疗保健费用将达到人民币22,393亿元(3,099.4亿美元),与前一年的资料相比增长迅速。

- 印度医疗保健产业的发展主要受健康意识的增强、保险覆盖率的扩大、收入的增加以及疾病的减少所驱动。印度的医疗保健产业受惠于每年1.6%的人口成长率。

- 印度医院产业占全球医疗保健市场的80%,正面临来自国内外投资者的庞大投资需求,到2023年将达到1,320亿美元。

- 聚丙烯纤维广泛用于建筑业,以增强混凝土,提高耐久性,减少开裂,并抵抗化学品和环境因素。

- 预计所有这些因素都将在预测期内推动亚太聚丙烯纤维市场的发展。

聚丙烯纤维产业概况

全球聚丙烯纤维市场细分化,参与企业众多。然而,主要企业Indorama Ventures 占有相当大的市场占有率。主要参与企业(不分先后顺序)包括 Beaulieu Fibers International (BFI)、Chemosvit Fibrochem SRO、Radici Partecipazioni SpA、Indorama Ventures 和三菱化学株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大卫生和医疗领域的应用

- 建筑业需求增加

- 其他的

- 限制因素

- 有更便宜的替代品

- 熔点低,在某些应用中无法使用

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

第五章 市场区隔(市场规模(数量))

- 类型

- 史泰博

- 线

- 最终用户产业

- 纤维

- 建筑学

- 医疗健康产业

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 土耳其

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ABC Polymer Industries LLC

- Beaulieu Fibres International(BFI)

- Belgian Fibers

- Chemosvit Fibrochem SRO

- China National Petroleum Corporation

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Indorama Ventures

- International Fibres Group

- Radici Partecipazioni SpA

- Sika AG

- Mitsubishi Chemical Corporation

- Huimin Taili Chemical Fiber Products Co. Ltd

- Tri Ocean Textile Co. Ltd

- W. Barnet GmbH & Co. KG

- Zenith Fibres Ltd

- Kolon Fiber Inc.

第七章 市场机会与未来趋势

- 回收聚丙烯纤维的未来用途

The Polypropylene Fibers Market size is estimated at 3.28 million tons in 2025, and is expected to reach 3.77 million tons by 2030, at a CAGR of 2.82% during the forecast period (2025-2030).

Over the short term, the significant factors driving the market are the rising usage of polypropylene fibers in hygiene and health care and the increasing demand for these fibers from the construction industry.

Factors such as availability, cheaper substitute availability, and lower melting points likely hinder the market's growth.

However, the prospects of recycled polypropylene fibers are likely to act as opportunities for market growth.

Asia-Pacific dominated the global polypropylene fibers market and is likely to witness the highest growth rate during the forecast period.

Polypropylene Fibers Market Trends

The Textile Industry is expected to Dominate the Market

- PPF applications in the textile industry include fibers, fibrous materials, and other PP-based textile materials, including bed covers, carpets, underlays, rugs, tapes, ropes, clothing (home, sport, children's protective), technical textiles, and environmentally-friendly textiles. The primary classification of PP staple fibers is carpet, woolen, cotton types, and microfibers.

- Polypropylene ropes are used for agriculture and crop packing and can also be used in heavy fruit and vegetable plantations to help the fruit/vegetable hold on to its stem or branch.

- Technical filters are used in various industrial applications, such as wet filtration and pharmaceuticals. These filters provide excellent chemical resistance to paints, coatings, petrochemicals, etc.

- According to National Council of Textile Organization (NCTO) data, US textile and apparel shipments totaled USD 64.8 billion in 2023. Moreover, the US textile industry supplies over 8,000 different textile products to the US military.

- Similarly, according to the Federal Statistical Office (a federal authority of Germany), the revenue of the textile industry reached EUR 12.97 billion (USD 13.96 billion) in 2022 and EUR 12.38 billion (USD 13.30 billion) in 2023.

- Polypropylene fiber is commonly used in carpets due to its durability, stain, moisture resistance, cost-effectiveness, and ability to retain vibrant colors. This makes it a practical choice for various settings, including high-traffic areas.

- According to the Office for National Statistics (United Kingdom), sales from the manufacture of carpets and rugs in the United Kingdom reached GBP 780 million (USD 981.34 million) in 2022.

- Similarly, as per the Brazilian Association of the Textile and Clothing Industry, Brazil's textile and apparel chain exports and imports are valued at USD 1.14 billion and USD 5.9 billion, respectively.

- Thus, based on the aspects above, the textile segment is expected to dominate the market.

Asia-Pacific to is expected Dominate the Market

- Asia-Pacific dominated the global polypropylene fibers market and will likely witness the highest growth rate during the forecast period. China is a leading producer of polypropylene fibers due to the high number of large-scale manufacturing activities.

- China is the world's largest producer and exporter of textiles and clothing. Due to its enormous production capacity, China needs more textiles and clothing products. According to the State Council Information Office of the People's Republic of China, the total profits of China's major textile enterprises increased by 7.2% annually in 2023. Meanwhile, the country's textile and garments exports hit USD 293.6 billion in 2023.

- However, the increasing labor costs and rising global protectionism weakened its competitiveness. The labor costs in the country increased significantly in recent years and surpassed that of many other countries in Asia.

- Also, polypropylene fiber, known for its non-toxic and hypoallergenic properties, is extensively used in the healthcare industry for applications such as medical clothing, disposable products, wound care, filters for medical devices, and surgical mesh.

- China has the second-largest healthcare industry in the world after the United States, and its healthcare market is more rigorous. By 2030, China will account for 25% of the global healthcare industry's revenue.

- According to the National Bureau of Statistics of China, health expenditures in China were valued at CNY 2,239.3 billion (USD 309.94 billion) in 2023 and have been rapidly growing compared to the previous year's data.

- The healthcare sector in India is mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical industry in India is benefiting from the growing population at a rate of 1.6% per year.

- The hospital industry in India, which accounts for 80% of the global healthcare market, is witnessing colossal investor demand from international and domestic investors, reaching USD 132 billion by 2023.

- Polypropylene fiber is widely employed in the construction industry for applications such as reinforcing concrete, enhancing durability, reducing cracking, and resisting chemicals and environmental factors.

- All these factors are expected to boost the polypropylene fibers market in Asia-Pacific during the forecast period.

Polypropylene Fibers Industry Overview

The global polypropylene fibers market is partially fragmented, with many players. However, the leading company, Indorama Ventures, occupies a considerable market share. Some of the key players (not in any particular order) include Beaulieu Fibers International (BFI), Chemosvit Fibrochem SRO, Radici Partecipazioni SpA, Indorama Ventures, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Usage in Hygiene and Healthcare

- 4.1.2 Rising Demand from the Construction Industry

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Availability of Cheaper Substitutes

- 4.2.2 Low Melting Point Hinders Usage in Some Applications

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Staple

- 5.1.2 Yarn

- 5.2 End-user Industry

- 5.2.1 Textile

- 5.2.2 Construction

- 5.2.3 Healthcare and Hygiene

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABC Polymer Industries LLC

- 6.4.2 Beaulieu Fibres International (BFI)

- 6.4.3 Belgian Fibers

- 6.4.4 Chemosvit Fibrochem SRO

- 6.4.5 China National Petroleum Corporation

- 6.4.6 DuPont

- 6.4.7 Fiberpartner Aps

- 6.4.8 Freudenberg Group

- 6.4.9 Indorama Ventures

- 6.4.10 International Fibres Group

- 6.4.11 Radici Partecipazioni SpA

- 6.4.12 Sika AG

- 6.4.13 Mitsubishi Chemical Corporation

- 6.4.14 Huimin Taili Chemical Fiber Products Co. Ltd

- 6.4.15 Tri Ocean Textile Co. Ltd

- 6.4.16 W. Barnet GmbH & Co. KG

- 6.4.17 Zenith Fibres Ltd

- 6.4.18 Kolon Fiber Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Applications For Recycled Polypropylene Fibers