|

市场调查报告书

商品编码

1444737

资料中心电源 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

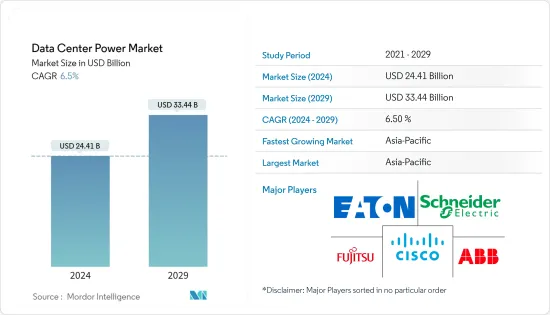

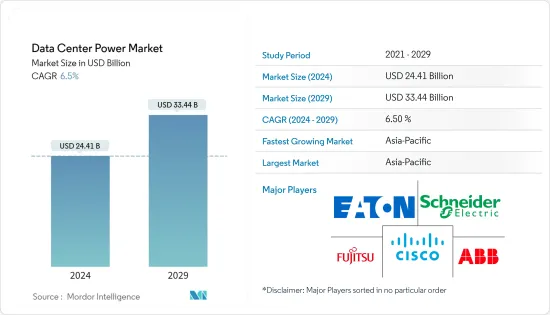

资料中心电力市场规模预计到 2024 年为 244.1 亿美元,预计到 2029 年将达到 334.4 亿美元,在预测期内(2024-2029 年)CAGR为 6.5%。

大型资料中心的日益普及正在推动市场发展。根据位置减少大型资料中心的数量可以使公司享受某些当地优势,例如低能源价格、有利的气候或替代能源的可用性。虚拟化大大提高了硬体利用率,并使公司能够减少耗电伺服器和储存设备的数量。

主要亮点

- 云端运算的日益普及也有助于市场成长,导致大规模超大规模云端资料中心的兴起。例如,2022 年10 月,思科推出了新的共享解决方案,帮助企业、网路规模公司和超大规模公司提供更丰富的云端应用程式和服务,同时平衡他们对增加频宽的需求,同时消耗更少的空间和电力。

- 此外,绿地和棕地设施的增加以及模组化资料中心的部署预计将推动对电力系统的需求。边缘运算的出现和二级资料中心市场不断扩大的设施推动了对模组化、高效电力基础设施解决方案的需求。电力成本上升、碳排放以及超大规模营运商整合再生能源的倡议预计将改变市场。设施营运商正在采用创新、高效的电力基础设施来减少碳排放和营运成本。

- 全球许多资料中心正在实施 2N 冗余 UPS 系统,以应对设施的各种馈电设计和频繁故障。成本、可靠性、效率和可维护性等因素影响 UPS 系统和发电机在全球市场的采用。

- 智慧机架PDU 解决方案旨在协助在具有大量机架的复杂设施中保持平稳运行。资料中心託管供应商正在寻找需要更少维护和更少空间且正常运行时间达到99.99% 的现代基础设施解决方案。这些多样化的需求预计将刺激供应商提供创新的电源解决方案。 PDU 是资料中心电源市场中规模最大、最成熟的产品类别,预计在预测期内将出现更为温和的成长水准。

- 然而,较高的投资限制了市场的成长,因为主要投资领域是布线、电力设施和资料中心基础设施管理(DCIM)解决方案,这些解决方案在初始投资期间需要很高的成本。

资料中心电力市场趋势

资讯科技领域预计将占据主要市场份额

- IT 产业需要本地私有资料储存和超大规模资料中心来进行运营,具体取决于组织的规模。此外,由于 SaaS 供应商的成长,云端储存的采用率逐年增加,使云端储存供应商能够扩展其容量。因此,不断增加的资料负载需要更多的电力。这就产生了对 IT 应用中高效能电源解决方案的需求。根据 Vertiv 最近发布的资料中心调查,98% 的参与者投票支持到 2025 年 IT 利用率达到 20% 以上。这表明 IT 公司正在重点为资料中心部署高效电源,提高资料中心利用率。

- AWS、微软和Google等云端储存供应商正在扩展其储存功能,以在云端提供更有效率的工作流程。这些公司正在对超大规模交易进行投资。例如,去年六月,亚马逊网路服务公司(AWS)宣布在以色列开设资料中心。该公司的目标是让该地区更多的开发商、新创公司、企业、政府、教育和非营利组织能够运行他们的应用程式并从该国的资料中心为最终用户提供服务。

- 此外,去年11 月,AWS 宣布计划于2023 年底或2024 年初在加拿大阿尔伯塔省开设基础设施区域。新的AWS 加拿大西部(卡加利)区域将在启动时由三个可用区(AZ) 组成,并加入位于蒙特娄的现有 AWS 加拿大(中部)区域,该区域也包含三个可用区。新的AWS加拿大西部(卡加利)区域将使更多的开发人员、新创公司、企业、教育、政府和非营利组织能够从加拿大的资料中心运行他们的应用程式并为最终用户提供服务。

- 此外,其他公司也在计划在各个地区扩建资料中心。例如,去年6月,澳洲房地产公司Stockland宣布计划在雪梨建造新的资料中心。该资料中心的最终价值为 1.81 亿美元。此外,还将包括6,300平方公尺的资料大厅、3,215平方公尺的办公空间以及超过13,000平方公尺的机电服务。预计资料中心产业的此类发展将推动预测期内资料中心电力市场的成长。 SpaceDC、吉宝资料中心和普林斯顿数位集团等一些新进业者也正在采取行动投资超大规模设施和资料中心。

- 儘管该行业正在迅速采用云,但对本地和混合资料中心的依赖仍然很大。这些公司正在尝试扩大自己的资料储存容量,预计这需要为资料中心提供高效的电源解决方案。此外,IT产业敏捷和DevOps营运框架的趋势正在增加对更有效率的资料储存解决方案的需求。

预计亚太地区市场将出现高速成长

- 根据Cloudscene统计,中国目前拥有447个资料中心和112家服务供应商。大量资料中心的存在正在推动该国资料中心电力系统的需求。此外,越来越多的新资料中心开发和现有资料中心的升级也预计将推动市场的成长。

- 去年4月,苹果正式宣布在中国贵州启用新资料中心。苹果公司与贵州云端大数据产业有限公司共同建造了这个资料中心。该国此类新资料中心的发展预计将增加对资料中心电源解决方案的需求。由于大多数资料中心由污染性煤炭提供动力,受影响国家的政府正在转向清洁和再生能源。中国的再生能源装置容量最大,其中太阳能发电量超过 174 吉瓦,风电发电量超过 184 吉瓦。此外,资料中心开发投资的激增预计将推动对资料中心电源解决方案的需求。

- 此外,日本政府还宣布计划为新的零碳排放资料中心的建筑成本提供 50% 的补贴,并升级现有设施,作为一项耗资 73 亿美元的新行业创新和减少碳排放计划的一部分。

- 根据 DataSpan 的一项研究,在高达 55% 的资料中心中,能源消耗用于运行冷却和通风系统。因此,为了减少碳排放和资料中心的能源使用量(主要是维持伺服器适合的温度),日本计划在较冷的地区建造更多设施。去年 11 月,AirTrunk 在日本开设了第一个资料中心,以支持该国越来越多的公司转向云端运算。该公司已在印西建设了一个 300 兆瓦的资料中心园区,并将开始营运 60 兆瓦的阶段。

- Colt 去年也推出了第三个 Inzai资料中心,这是一个 27 MW 的设施,毗邻其现有的两座 Inzai 大楼。反过来,预计将为该国资料中心电源解决方案市场创造利润丰厚的机会。

- 日本对绿色电力有着巨大的推动力,预计将会出现大量旨在改善监管框架以在市场上购买绿色电力的活动。市场供应商寻求与日本绿色能源的第三方供应商合作。 Google、微软和 Digital Realty 等公司正在寻找其他公司透过购电协议为再生能源提供资金,以建造太阳能和风电场。

资料中心电力产业概况

资料中心电力市场高度分散,存在多家供应商。参与者正在采取多种策略,例如併购(M&A)、合作、伙伴关係等。政府机构以及私人资料中心建设正在采取各种倡议,这正在造成激烈的竞争。主要参与者有施耐德电机、富士通、思科等。市场的最新发展有:

2022 年 10 月,数位基础设施企业 Equinix, Inc. 宣布了一项耗资 7,400 万美元在雅加达市中心建设国际商业交换 (IBX)资料中心的计画。 Equinix 的发展将使印尼公司以及在印尼开展业务的跨国公司能够利用其值得信赖的平台来连接和整合推动其企业发展的基础设施。

2022 年 1 月,伊顿的 Tripp Lite 推出了用于在工厂和仓库等要求苛刻的工业环境中连接和控製网路设备的实用选项。新型託管和精简託管工业十亿位元乙太网路交换器具有 IP30 级坚固金属外壳,可承受工厂车间常见的振动、衝击以及低温和高温。这些开关还提供静电放电 (ESD) 保护,静电放电可能会干扰正常操作。随附的导轨夹可安装至标准 35 毫米 DIN 导轨。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 大型资料中心和云端运算的采用不断增加

- 增加需求以降低营运成本

- 市场限制

- 安装和维护成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:技术概览

第 6 章:市场细分

- 按类型

- 解决方案

- 配电单元

- UPS

- 母线槽

- 其他解决方案

- 服务

- 咨询

- 系统整合

- 专业服务

- 解决方案

- 按最终用户应用

- 资讯科技

- 製造业

- BFSI

- 政府

- 电信

- 其他最终用户应用程式

- 按资料中心规模

- 中小型

- 大的

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 澳洲

- 新加坡

- 印度

- 亚太其他地区

- 世界其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- Schneider Electric SE

- Fujitsu Ltd

- Cisco Technology Inc.

- ABB Ltd

- Eaton Corporation

- Tripp Lite

- Rittal GmbH & Co. KG

- Schleifenbauer

- Vertiv Co.

- Legrand SA

- Black Box Corporation

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Data Center Power Market size is estimated at USD 24.41 billion in 2024, and is expected to reach USD 33.44 billion by 2029, growing at a CAGR of 6.5% during the forecast period (2024-2029).

The rising adoption of mega data centers is driving the market. Implementing fewer mega data centers depending on their locations can allow a company to enjoy the advantages of certain local benefits, such as low energy prices, a favorable climate, or the availability of alternative energy sources. Virtualization dramatically improves hardware utilization and enables firms to reduce the number of power-consuming servers and storage devices.

Key Highlights

- The rising adoption of cloud computing is also aiding market growth, leading to the rise of vast, hyperscale cloud data centers. For instance, in October 2022, Cisco introduced new shared solutions for assisting businesses, webscale firms, and hyperscale firms in delivering richer cloud applications and services while balancing their need for increased bandwidth while consuming less space and power.

- Further, the increase in greenfield and brownfield facilities, along with the modular data center deployment, is anticipated to drive the demand for power systems. The emergence of edge computing and expanding facilities in the secondary data center market drive the need for modular and efficient power infrastructure solutions. The market is expected to be transformed by rising electricity costs, carbon emissions, and hyperscale operators' initiatives to integrate renewable energy sources.The facility operators are adopting innovative and efficient power infrastructure to reduce carbon emissions and OPEX costs.

- Many data centers around the world are implementing 2N redundant UPS systems to deal with the facility's various feed designs and frequent failure.Factors such as cost, reliability, efficiency, and maintainability impact the adoption of UPS systems and generators in the global market.

- The intelligent rack PDU solutions are made to help keep things running smoothly in complex facilities with a lot of racks.Datacenter colocation providers are looking for modern infrastructure solutions that require less maintenance and less space, with 99.99% uptime. These diverse demands are expected to spur vendors to offer innovative power solutions. PDU is the biggest and most established product category in the data center power market, which is expected to register a much more moderate growth level during the forecast period.

- However, higher investment is restraining market growth as the primary investment areas are cabling, power facilities, and data center infrastructure management (DCIM) solutions, which require high costs during the initial investment.

Data Center Power Market Trends

The Information Technology Segment is Expected to Hold a Major Market Share

- The IT industry requires on-premise private data storage and hyper-scale data centres for its operations, depending on the size of the organization. Additionally, the adoption of cloud storage has increased over the years due to growth among SaaS providers, enabling cloud storage providers to expand their capacities. Hence, the increasing data load requires more power. This creates a requirement for efficient power solutions in IT applications. According to the Data Center Survey recently published by Vertiv, 98% of the participants voted for IT utilization to be above 20% by 2025. This indicates that IT companies are focusing on deploying an efficient power source for their data centres and increasing their utilization rate.

- Cloud storage providers, like AWS, Microsoft, and Google, are expanding their storage capabilities to offer more efficient workflows in the cloud. These companies are making investments in hyperscale deals. For instance, in June last year, Amazon Web Services Inc. (AWS) announced the opening of data centers in Israel. The company aims to enable more developers, startups, enterprises, the government, education, and non-profits in the region to run their applications and serve end-users from data centers in the country.

- Also, in November last year, AWS announced plans to open an infrastructure region in Alberta, Canada, in late 2023 or early 2024. The new AWS Canada West (Calgary) Region will consist of three availability zones (AZs) at launch and join the existing AWS Canada (Central) Region in Montreal, which also consists of three availability zones. The new AWS Canada West (Calgary) Region will enable even more developers, startups, enterprises, education, government, and non-profits to run their applications and serve end-users from data centers in Canada.

- Furthermore, other companies are planning data center expansion in various regions.For instance, in June last year, Stockland, an Australian real-estate firm, announced plans to build a new data center in Sydney. The data center is to have an end value of USD 181 million. Moreover, it will include 6,300 sq m of data halls, 3,215 sq m of office space, and more than 13,000 sq m of electrical and mechanical services. Such developments in the data center industry are anticipated to propel the growth of the data center power market during the forecast period. Some new entrants, like SpaceDC, Keppel Data Centers, and Princeton Digital Group, are also making moves to invest in hyperscale facilities and data center investments.

- Although the industry is rapidly adopting the cloud, the dependency on on-premise and hybrid data centers is still significant. These companies are trying to expand their own data storage capacities, which is expected to demand an efficient power solution for data centers. Moreover, the trend of the IT industry's agile and DevOps operational frameworks is increasing the need for more efficient data storage solutions.

The Asia Pacific Region is Expected to Witness a High Market Growth

- According to Cloudscene, China currently has 447 data centres and 112 service providers. The presence of a large number of data centres is driving the demand for data centre power systems in the country. Furthermore, the increasing number of new data centre developments and the upgrading of existing data centres are also expected to drive the market's growth.

- In April of last year, Apple officially announced the opening of a new data centre in Guizhou, China. Apple and Guizhou-Cloud Big Data Industry Co., Ltd. jointly built this data centre. Such new data centre developments in the country are expected to increase demand for data centre power solutions. As most of the data centres are powered by polluting coal, the governments of the affected countries are shifting toward clean and renewable energy sources. China has installed the most significant amount of renewable energy, with solar power reaching over 174 GW and wind power over 184 GW. Furthermore, the surge in investment in data centre development is expected to fuel the demand for data centre power solutions.

- Further, the Japanese government has announced its plan to subsidize 50% of the building costs for new zero-carbon-emissions data centers and upgrade existing facilities as part of a new USD 7.3 billion initiative to innovate the industry and reduce carbon emissions.

- According to a study by DataSpan, in up to 55% of data centers, energy consumption is used to run cooling and ventilation systems. Thus, to reduce carbon emissions and the amount of energy used by data centers, mainly required to maintain server-suited temperatures, Japan is planning to build more facilities in its colder regions. In November last year, AirTrunk opened its first data center in Japan to support the growing number of companies in the country shifting to the cloud. The company has built a 300MW data center campus in Inzai and is set to begin operations with a 60MW phase.

- Colt also launched its third Inzai data center last year, a 27 MW facility next to its existing two Inzai buildings. In turn, it is expected to create lucrative opportunities for the country's data center power solution market.

- Japan has a tremendous impetus for green power, and a lot of activity toward an improved regulatory framework to buy green power on the market is expected to be witnessed. Market vendors seek to work with third-party providers on green energy in Japan. Players like Google, Microsoft, and Digital Realty are looking for other companies to fund renewable power through power purchase agreements to build solar and wind farms.

Data Center Power Industry Overview

The Data Center Power market is highly fragmented, with multiple vendors present.Players are adopting several strategies, such as mergers and acquisitions (M&A), collaborations, partnerships, etc. Various initiatives are being undertaken by governmental bodies as well as private data center construction, which is creating intense competition. Key players are Schneider Electric SE, Fujitsu Ltd., Cisco Technology Inc., etc. Recent developments in the market are:

In October 2022, Equinix, Inc., a digital infrastructure business, unveiled a plan for a USD 74 million International Business Exchange (IBX) data center in the heart of Jakarta. Equinix's growth will allow Indonesian companies, as well as multinationals with a presence in Indonesia, to utilize their trusted platform to connect together and integrate the foundational infrastructure that will drive their enterprises.

In January 2022, Tripp Lite by Eaton introduced practical options for connecting and controlling network equipment in demanding industrial environments, such as factories and warehouses. The new managed and lite-managed industrial Gigabit Ethernet switches have an IP30-rated ruggedized metal case that can withstand vibration, shock, and the low and high temperatures often found on the factory floor. The switches also offer protection from electrostatic discharge (ESD), which can interfere with normal operation. A rail clip is included to allow mounting to standard 35 mm DIN rail.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 4.2.2 Increasing Demand to Reduce Operational Costs

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation and Maintenance

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.1.1 Power Distribution Unit

- 6.1.1.2 UPS

- 6.1.1.3 Busway

- 6.1.1.4 Other Solutions

- 6.1.2 Services

- 6.1.2.1 Consulting

- 6.1.2.2 System Integration

- 6.1.2.3 Professional Service

- 6.1.1 Solutions

- 6.2 By End-user Application

- 6.2.1 Information Technology

- 6.2.2 Manufacturing

- 6.2.3 BFSI

- 6.2.4 Government

- 6.2.5 Telecom

- 6.2.6 Other End-user Applications

- 6.3 By Data Center Size

- 6.3.1 Small and Medium

- 6.3.2 Large

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 Australia

- 6.4.3.4 Singapore

- 6.4.3.5 India

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Fujitsu Ltd

- 7.1.3 Cisco Technology Inc.

- 7.1.4 ABB Ltd

- 7.1.5 Eaton Corporation

- 7.1.6 Tripp Lite

- 7.1.7 Rittal GmbH & Co. KG

- 7.1.8 Schleifenbauer

- 7.1.9 Vertiv Co.

- 7.1.10 Legrand SA

- 7.1.11 Black Box Corporation