|

市场调查报告书

商品编码

1444739

夜视摄影机 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Night Vision Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

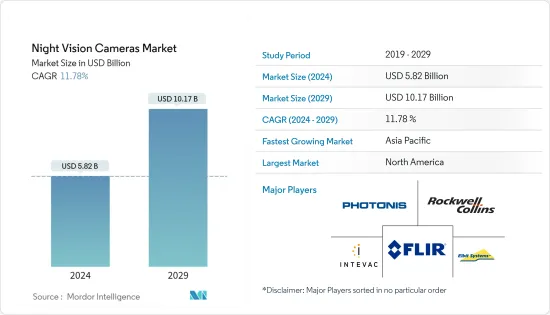

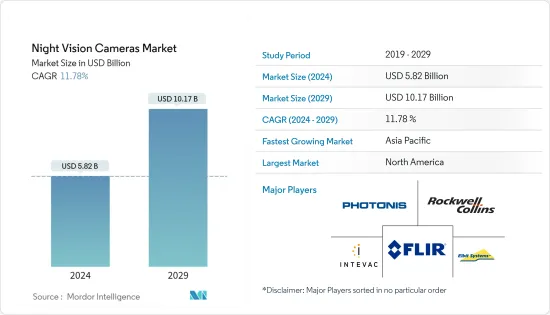

夜视相机市场规模预计到2024年为58.2亿美元,预计到2029年将达到101.7亿美元,在预测期内(2024-2029年)CAGR为11.78%。

夜视摄影机透过捕捉在低光源条件下故意破坏、盗窃和任何其他未经授权的活动的视讯证据来保护宝贵的资产。大多数标准安全系统或摄影机通常无法完成此任务。先进的夜视安全摄影机具有一系列令人印象深刻的功能,使下班后的视讯监控变得简单、高效和准确。它们是全球市场上成长最快的安全系统之一。因此,这些摄影机受到各行业的青睐,在某些情况下,住宅、公共基础设施和工业应用中的一些人也喜欢这些摄影机。

主要亮点

- 夜视摄影机具有多种优势,例如在各种应用中提供低光照区域的清晰视野。然而,此类相机仅产生黑白影像,这在大多数情况下是可以接受的折衷方案。加州大学欧文分校的多位研究人员旨在透过製造一种填补盲点并使图像着色的人工智慧来增强夜视能力。然而,着色仅适用于肖像,但在不久的将来,也许可以对其他特征进行着色,以获得更自然的感觉,将黑夜变成白天。

- 隐形夜视摄影机专为鸟箱、餵鸟器或其他巢箱监控而设计,支援隐形夜视,与常用的夜视安全摄影机不同,它配备了940nm 红外线(IR) LED 进行照明,并为鸟类提供服务。友善的夜视功能,因为只会发出微弱的红光,不会惊吓鸟类或野生动物,也不会在夜视突然自动打开时扰乱它们的自然睡眠週期。这使得大自然爱好者能够在行动装置上观看感兴趣的鸟类或野生动物夜间活动的清晰黑白影像,使他们能够探索和享受感兴趣的鸟类或野生动物的夜间活动。

- 热像仪的技术发展将使公司能够将这些技术融入他们的产品中,并在未来占领巨大的市场份额。例如,冷却式热成像摄影机需要能够将摄影机的热探测器冷却至低至 200 开尔文 (-100 F) 的温度的冷却设备。目前使用多种冷却技术,包括低温液化气体、珀耳帖冷却器和斯特林冷却器。斯特林冷却器是一种透过交替压缩和释放气体来调节温度的冷却装置。

- 这些夜视系统面临着充满挑战的战场环境和广泛的军事用途。更换和维护夜视装置的费用非常昂贵。翻新、维修或升级是一种低成本的替代解决方案。近视设备系统价格的上涨与实用且耐用的硬体有关。由于显像管的开发、建造和安装可能花费数百万美元,因此该设备包含投资所需的更大量的资本支出。由于冷却红外线侦测器系统的敏感性,冷却热像仪可提供最佳的影像品质和最显着的环境温度变化。儘管如此,冷却系统的使用寿命仍然有限。

- 在 COVID-19 疫情期间,南迭戈丘拉维斯塔警察局宣布投资超过 11,000 美元购买两架配备夜视摄影机的无人机,以减轻这些地区警察的风险。该部门的目的是在疫情爆发期间用这些无人机监视住在街上的人。即使在大多数国家,夜视摄影机的使用也显着增加,在后新冠疫情场景下,印度计划部署人工智慧驱动的无人机,用夜视摄影机放大这些地区。

夜视相机市场趋势

军事和国防领域预计将推动市场

- 夜视设备在军事防御和执法应用中的广泛使用是由于需要增强弱光和夜间环境下的态势感知、目标识别和作战效率。军队严重依赖夜视技术,特种部队在执行谨慎任务时使用夜视镜 (NVG),例如美国海豹部队在关键行动中执行的任务。同样,执法机构也依赖夜视设备进行监视、搜救工作以及人群控制。

- 此外,这些国家正在军事和国防方面进行大量投资,这需要大量使用视觉相机。此类投资也可能刺激市场需求。例如,2022 年 2 月,印度财政部长在 2022-23 财政年度向国防部拨款 5,2516.15 亿印度卢比(630.5 亿美元)。这比前一年的拨款47819.6亿印度卢比(574.1亿美元)增加了4697亿印度卢比(56.4亿美元),即10%,是近年来国防预算增幅最大的一次。

- 同样,2022年3月,根据预算建议草案,中国政府提出2022财年国防预算为1.45兆日圆(2,300亿美元),较去年同期成长7.1%。中国国防开支的增加恰逢中国人民解放军在至关重要的印度-太平洋地区日益炫耀武力的同时。 2020年,中国国防开支首次突破2,000亿美元。 2021年国防预算成长6.8%,达2,090亿美元。

- 英国国会称,2020/21年度国防开支以现金计算为424亿英镑(536.9亿美元)。这比去年名目增加25亿英镑(31.7亿美元),自然成长17亿英镑(21.5亿美元)。因此,2024/25年度国防预算以现金计算将比2020/21年度增加62亿英镑(78.5亿美元)。然而,这种支出成长的实际价值较低,特别是考虑到通货膨胀不断加剧。根据通货膨胀调整后,国防开支预计将增加 15 亿英镑(19 亿美元)。

- 美国军方也使用人工智慧夜视设备,将其固定在士兵的头盔上,并提供有关潜在可疑活动的警报。为了促进这项决策,国防部长埃斯珀启动了全面的全国防审查,最终为 2021 财年节省了近 57 亿美元,週转基金效率提高了 2 亿美元,活动和职能节省了 21 亿美元重新调整服务。该计划使国防部能够更好地为更高级别的国防战略(NDS)优先事项提供资源。

- 根据北约预测,2022年美国的国防开支预计将达8,210亿美元,是北约国家中国防开支最多的国家。英国的国防开支位居第二,为 720 亿美元,德国为 620 亿美元,法国为 550 亿美元。

亚太地区将见证显着成长

- 由于政府为增强人员能力而在国防基础设施上的支出不断增加,预计亚太地区的夜视摄影机市场将大幅成长。此外,随着新技术的发展,夜视设备的成本预计会降低,从而增加最终用户的支出。

- 不同地区的研究人员正在试验不同的材料,以提高产品的效率。研究人员表示,这种由砷化镓半导体构成的超薄膜也可用于开发微型灵活的红外线感测器。儘管它只是一个概念验证,但研究人员相信它有潜力成为军事、警察和安全环境中使用的大型夜视镜的低成本、轻量级替代品。由澳洲和欧洲学者组成的团队创作了这部电影,详细资讯发表在《Advanced Photonics》上。它将人类通常看不见的红外光转化为可见光。

- 此外,许多政府更喜欢为其智慧摄影机安装配备夜视功能。例如,2022年3月,印度德里政府打算完成闭路电视摄影机安装计画的最后部分。由于与大流行相关的限制,公共工程部 (PWD) 声称过去两年安装了 133,000 个闭路电视摄影机,而目标是 14 万个。 PWD打算使用30-40个摄影机覆盖每个市场和居民福利协会监管的区域。四兆像素摄影机安装在桿子或墙上,并具有夜视功能,可实现最佳视讯品质。

- 对安全监控的投资不断增长,特别是在新兴国家,推动了对所研究市场产品的需求。例如,中国和印度等国家越来越多地投资这些技术,激励外国和本地製造商投资该市场。这为所研究的市场带来了进步和创新。此外,区域公司正在筹集投资来开发和生产夜视设备。 2022 年4 月,中国深圳GD Digital Ltd. 在Kickstarter 上为高迪夜视镜发起了众筹活动,高迪夜视镜是一款紧凑、轻便的夜视解决方案,配备双TFT 1.4 英寸显示屏,解析度为390 x 390。此类设备很可能以拉动市场需求。

- 高品质的智慧视讯监控将是安防产业的未来。随着新的先进技术的引入,当今监控系统的功能变得更加复杂和智慧。随着网路、多核心处理、数位讯号处理、影像处理和大容量储存等多种技术的集成,智慧监控系统已经并将逐渐取代旧系统。这将为未来夜视监控系统带来显着成长。

夜视摄影机产业概况

夜视摄影机市场较为分散,有多家公司在该市场营运。领先企业目前专注于为客户提供技术先进的产品。对夜视摄影机的需求不断增加,从长远来看,其成本不断下降,预计将鼓励投资者在未来几年内投资这项技术,这可能会带来更多的市场竞争。主要参与者包括 Intevac Inc.、Photonis USA Inc. 和 Elbit Systems Ltd.。市场的最新发展包括:

- 2023 年 6 月:TP-Link 最新的 Tapo 户外安全摄影机具有令人印象深刻的彩色夜视功能。据 TP-Link 称,Tapo C325WB 中的 ColorPro 夜视技术即使在相当于无月午夜的极低光照条件下,也能以 HDR 捕捉 2K 解析度的生动影像。此外,该摄影机与 Alexa 和 Google Assistant 相容,并具有双向音讯和板载警报器,以阻止不需要的入侵者。该摄影机具有防风雨功能,并提供无线网路连接,还可以选择使用乙太网路连接埠来实现可靠的电缆连接。但是,它确实需要 3 公尺长的电源线。

- 2023 年 4 月:Douvox 宣布为备受期待的 Douvox Ultra 夜视相机启动新的 Kickstarter 活动。基于先前产品 Mate Pro 夜视相机的成功,Douvox 很高兴推出 Douvox Ultra,它提供增强的影像和记录功能,使其成为即使在最黑暗的环境中也能捕捉瞬间的宝贵工具。这款单眼摄影机采用尖端的 5MP Sony Starvis 高灵敏度 CMOS 影像感测器,即使在极低光照场景下也能提供生动的全彩 FHD 视频,灵敏度低至 0.001 勒克斯。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究成果

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素与限制简介

- 市场驱动因素

- 对先进监控技术的需求不断增长

- 汽车夜视应用

- 市场限制

- 穿过透明障碍物瞄准

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 按类型

- 有线夜视摄影机

- 无线夜视摄影机

- 按最终用户

- 军事与国防

- 工业的

- 公共和住宅基础设施

- 运输

- 研究

- 其他最终用户

- 地理

- 北美洲

- 欧洲

- 亚太

- 世界其他地区

第 6 章:竞争格局

- 公司简介

- Intevac Inc.

- Photonis

- Elbit Systems Ltd

- Rockwell Collins Inc.

- FLIR Systems Inc.

- Panasonic Corporation

- BAE Systems PLC

- TAK Technologies Private Limited

- Harris Corporation

- Tactical Night Vision Company Inc.

- General Dynamics Global Imaging Technologies Inc.

- Nivisys LLC

- Sony Corporation

- Sharp Corporation

第 7 章:投资分析

第 8 章:市场机会与未来趋势

The Night Vision Cameras Market size is estimated at USD 5.82 billion in 2024, and is expected to reach USD 10.17 billion by 2029, growing at a CAGR of 11.78% during the forecast period (2024-2029).

Night vision cameras protect valuable assets by capturing video evidence of vandalism, theft, and any other unauthorized activity in low-light conditions. Most standard security systems or cameras often fail to fulfill this task. Advanced night vision security cameras enable an impressive array of features to make after-hours video surveillance easy, efficient, and accurate. They are one of the fastest-growing security systems in the global market. As a result, these cameras are being preferred across various industries and in some cases, by several individuals for residential, public infrastructure, and industrial applications.

Key Highlights

- Night vision cameras have several advantages, such as providing a clear view of low-lit areas across various applications. However, such cameras only produce black-and-white images, which is an acceptable compromise in most cases. Various researchers at the University of California, Irvine, aimed to enhance night vision by making an Artificial Intelligence that fills in the blind spots and colorizes the images. The colorization, however, only works with portraits, but in the near future, it may be possible to colorize other features for a more natural feel that turns night into day.

- Invisible Night Vision cameras are specifically designed for bird boxes, bird feeders, or other nest boxes monitoring support invisible night vision, which, unlike commonly used security cameras with night vision, are equipped with 940nm infrared(IR) LEDs for illumination and serve bird-friendly night vision because only a dim red light will be emitted, which will not spook birds or wildlife, or disturb their natural sleep cycles if the night vision is turned on automatically in a sudden manner. This enables nature lovers to be able to watch crisp black-and-white images of evening activities of birds or wildlife of interest on their mobile devices, allowing them to explore and enjoy the nightly activities of birds or wildlife of interest.

- Technical developments in thermal imaging cameras will enable companies to incorporate those techniques in their products and capture a vast market share in the future. For example, Cooled thermal imaging cameras necessitate cooling equipment capable of cooling the camera's thermal detector to temperatures as low as 200 Kelvin (-100 F). Several cooling techniques are currently used, including cryogenic liquefied gases, Peltier coolers, and Stirling coolers. A stirling cooler is a cooling device that alternately compresses and releases gas to regulate temperature.

- These night-vision systems are subjected to challenging battlefield circumstances and extensive military use. The expense of replacing and maintaining a night vision gadget is prohibitively expensive. Refurbishment, repair, or upgrade is a low-cost alternative solution. The increased prices of near-vision device systems relate to practical and durable hardware. Because an image tube can cost millions of dollars to develop, build, and install, the equipment contains a more significant capital expenditure necessary to invest in it. Because of the sensitivity of the cooled infrared detector system, cooled thermal imaging cameras give the best image quality and the most significant variation in ambient temperature. Still, the cooling systems have a limited lifetime.

- During COVID-19, the South Diego Chula Vista Police Department announced an investment of over USD 11,000 in acquiring two drones equipped with night vision cameras to mitigate the risk for the officers in these areas. The department aimed to watch over people living on the streets with these drones amid the outbreak. Even in most of the countries, the use of night vision cameras has been increased significantly, In Post COVID scenario, India planned to deploy drones powered by artificial intelligence to zoom in on these localities with night-vision cameras.

Night Vision Camera Market Trends

Military and Defense Segment is Expected to Drive the Market

- The widespread utilization of night vision devices in military defense and law enforcement applications is motivated by the necessity for enhanced situational awareness, target identification, and operational effectiveness in low-light and nighttime circumstances. Military forces heavily depend on night vision technology, with special forces utilizing night vision goggles (NVGs) in discreet missions like those undertaken by the US Navy SEALs during critical operations. Similarly, law enforcement agencies rely on night vision devices for surveillance, search & rescue efforts, and crowd control.

- Moreover, the countries are making significant investments in Military and defense, which requires the high use of vision cameras. Such investments are also likely to boost the demand in the market. For instance, In Feb 2022, The Finance Minister of India allocated INR 525,166.15 crore (USD 63.05 billion) to the Ministry of Defense for the fiscal year 2022-23. This represents an increase of INR 46,970 crore (USD 5.64 billion), or 10%, over the previous year's allocation of INR 478,196 crore (USD 57.41 billion) and the most significant rise in the defense budget in recent years.

- Similarly, In March 2022, According to draught budget recommendations, the Chinese government proposed a defense budget of JPY 1.45 trillion (USD 230 billion) for the fiscal year 2022, a 7.1% rise year on year. China's increase in defense spending coincides with the People's Liberation Army's increasing muscle-flexing in the vital Indo-Pacific. In 2020, China's defense spending, for the first time, crossed USD 200 billion. In 2021 the defense budget grew by 6.8% to USD 209 billion.

- According to the UK parliament, defense spending in 2020/21 was GBP 42.4 billion (USD 53.69 billion) in cash terms. This is a nominal rise of GBP 2.5 billion (USD 3.17 billion) over the previous year and a natural increase of GBP 1.7 billion (USD 2.15 billion). As a result, the yearly defense budget in 2024/25 will be GBP 6.2 billion (USD 7.85 billion) more in cash terms than in 2020/21. However, the real worth of this spending rise is lower, especially in light of growing inflation. Defense spending is estimated to rise by GBP 1.5 billion (USD1.90 billion) when adjusted for inflation.

- The United States military also utilizes AI-enabled night vision devices, which are affixed to a soldier's helmet and provide alerts regarding potential suspicious activity. To facilitate that decision-making, Secretary of Defense Esper launched a comprehensive Defense-Wide Review, which resulted in nearly USD 5.7 billion in savings for FY 2021, USD 0.2 billion in Working Capital Fund efficiencies, and another USD 2.1 billion in activities and functions realigned to the Services. This program enabled the Department better to resource higher-level National Defense Strategy (NDS) priorities.

- According to NATO, the United States will spend an estimated USD 821 billion on defense in 2022. As a result, their defense spending is the largest among NATO countries. The United Kingdom has the second biggest defense spending, at USD 72 billion s and germany USD 62 billion, france USD 55 billion.

Asia-Pacific to Witness the Significant Growth

- The Night Vision cameras market is expected to grow significantly in Asia-Pacific, owing to rising government spending on defense infrastructure for enhanced personnel capabilities. Further, with the development of new technologies, the cost of night vision devices is expected to reduce, enabling increased spending by the end-users.

- Researchers in different regions are experimenting with different materials to increase the efficiency of the products. According to the researchers, the ultra-thin film, constructed of a gallium arsenide semiconductor, might also be used to develop tiny and flexible infrared sensors. Though it is yet a proof of concept, the researchers believe it has the potential to be a low-cost and lightweight replacement for large night-vision goggles used in military, police, and security settings. A team of Australian and European academics created the film, and details were published in Advanced Photonics. It transforms infrared light, which is ordinarily invisible to humans, into visible light.

- Additionally, many governments prefer night vision capabilities for their smart camera installations. For instance, in March 2022, In India, the Delhi government intends to complete the final part of the CCTV camera installation project. Due to pandemic-related constraints, the public works department (PWD) claimed 1,33,000 CCTV cameras had been installed in the last two years, compared to a target of 1.4 lakhs. PWD intends to use 30-40 cameras to cover areas overseen by each market and resident welfare association. The four-megapixel cameras are installed on a pole or a wall and contain a night-vision feature for optimal video quality.

- The growing investment in security surveillance, especially in emerging countries, drives the demand for the studied market products. For instance, countries like China and India increasingly invest in these technologies, motivating foreign and local manufacturers to invest in the market. This is bringing advancement and innovation into the studied market. Moreover, regional companies are raising investments to develop and produce night vision devices. In April 2022, Shenzhen GD Digital Ltd., based in China, launched a Kickstarter fundraiser for GAODI night goggles, a compact, lightweight night vision solution with dual TFT 1.4-inch displays, offering a resolution of 390 x 390. Such devices are likely to boost the demand in the market.

- High-quality intelligent video surveillance would be the future of the security industry. With the introduction of new advanced technologies, the functions of today's surveillance systems are becoming more sophisticated and smarter. With the integration of several techniques: networking, multi-core processing, digital signal processing, image processing, and high-capacity storage, intelligent surveillance systems have and would gradually replace older systems. Which will provide significant growth for night vision surveillance systems in the future.

Night Vision Camera Industry Overview

The night vision cameras market is fragmented, with several companies operating in the market. Leading players are currently focusing on providing technologically advanced products to customers. Increasing demand for night vision cameras, with their cost decreasing in the long run, is expected to encourage investors to invest in this technology in the next few years, which will likely create more market competition. Key players are Intevac Inc., Photonis USA Inc., and Elbit Systems Ltd. Recent developments in the market are:

- June 2023: TP-Link's latest Tapo outdoor security camera has impressive color night vision capabilities. According to TP-Link, the ColorPro night vision technology in the Tapo C325WB can capture vivid images in 2K resolution with HDR, even in extremely low light conditions equivalent to a moonless midnight. Additionally, this camera is compatible with Alexa and Google Assistant and features two-way audio and an onboard siren to discourage unwanted intruders. The camera is weatherproof and offers wireless network connectivity, with the option of using an ethernet port for a reliable cable connection. However, it does require a 3-meter cord for power.

- April 2023: Douvox announced the launch of their new Kickstarter campaign for the highly anticipated Douvox Ultra night vision camera. Building on the success of their previous product, the Mate Pro Night Vision camera, Douvox is excited to introduce the Douvox Ultra, which offers enhanced image and recording capabilities, making it an invaluable tool for capturing moments even in the darkest of environments. Utilizing a cutting-edge 5MP Sony Starvis high-sensitivity CMOS image sensor, this monocular camera delivers vibrant, full-color FHD video, even in extremely low light scenarios, with a remarkable sensitivity down to 0.001 lux.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Need for Advanced Surveillance Technology

- 4.3.2 Automotive Night Vision Applications

- 4.4 Market Restraints

- 4.4.1 Targetting through Transparent Obstacles

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired Night Vision Cameras

- 5.1.2 Wireless Night Vision Cameras

- 5.2 By End User

- 5.2.1 Military and Defense

- 5.2.2 Industrial

- 5.2.3 Public and Residential Infrastructure

- 5.2.4 Transportation

- 5.2.5 Research

- 5.2.6 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intevac Inc.

- 6.1.2 Photonis

- 6.1.3 Elbit Systems Ltd

- 6.1.4 Rockwell Collins Inc.

- 6.1.5 FLIR Systems Inc.

- 6.1.6 Panasonic Corporation

- 6.1.7 BAE Systems PLC

- 6.1.8 TAK Technologies Private Limited

- 6.1.9 Harris Corporation

- 6.1.10 Tactical Night Vision Company Inc.

- 6.1.11 General Dynamics Global Imaging Technologies Inc.

- 6.1.12 Nivisys LLC

- 6.1.13 Sony Corporation

- 6.1.14 Sharp Corporation