|

市场调查报告书

商品编码

1444752

黏剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Hot-melt Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

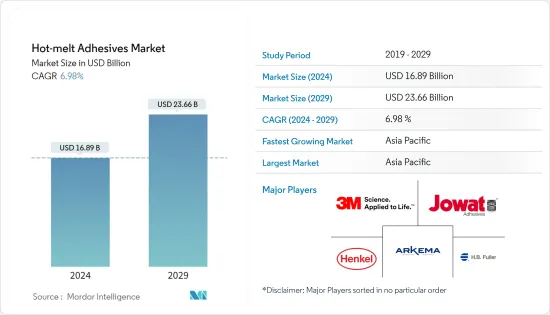

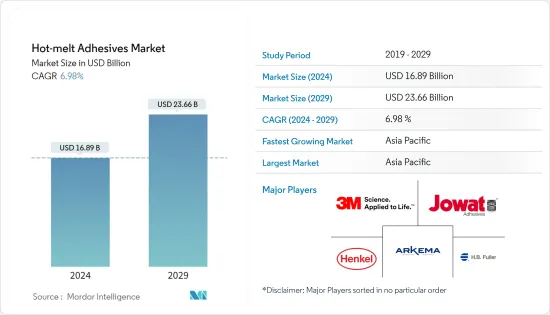

黏剂市场规模预计到2024年为168.9亿美元,预计到2029年将达到236.6亿美元,在预测期内(2024-2029年)增长6.98%,复合年增长率为

2020年,COVID-19的蔓延造成了不利条件,导致市场难以成长,但此后已恢復并持续成长。

主要亮点

- 推动所研究市场的主要因素是各种最终用途行业的需求增加、从溶剂型黏剂转向热熔性黏剂以及不织布产品的需求增加。

- 可能导致市场放缓的因素包括房地产问题和需要遵守的规则。

- 永续包装的可生物分解性黏剂可能是未来的机会。

- 由于印度和中国等国家的经济显着成长,预计亚太地区将在预测期内主导市场。

黏剂市场趋势

纸、纸板和包装产业需求快速成长

- 黏剂是纸张、纸板和包装产业的主流黏剂。最广泛用于纸箱密封、密封和托盘稳定。

- 黏剂可用于製造瓦楞纸箱和层压印刷板。也可用于包装各种消费品和大型工业管材和芯材。

- 由于包装食品和其他包装应用的需求不断增加,用于包装领域的黏剂的需求也在增加。例如,在印度,包装产业是成长最快的产业之一,年增长率为15%至20%。目前,包装业已成为该国经济的第五大部门。该行业在过去几年中经历了稳定成长,预计将迅速扩张,特别是在出口领域。

- 美国纸浆和造纸工业每年生产超过 7,000 万吨纸和纸板。国际纸业、Georgia-Pacific Corporation 和 WestRock 等国内大型纸浆生产商的存在创造了竞争环境。快速变化的消费品的消费量不断增加可能会增加对国内包装纸的需求。

- 据联合国粮农组织称,2021年,全球最大的纸张生产国中国生产了超过1.3亿吨加工纸和纸板。

- 大部分包装需求来自食品和饮料行业。该国的烘焙业正在不断成长,约有350家中型烘焙店和150家大型植物烘焙店,该公司正在大力推动包装产品的销售,以满足该国的成长趋势。

- 造成包装产业对黏剂潜在需求的另一个因素是传统上自动化程度较低。这导致许多包装製造商使用其他形式的黏剂。

亚太地区主导市场

- 亚太地区以超过 45% 的份额主导全球市场。随着中国、印度、日本和韩国等国家包装和医疗保健产业的发展,该地区的黏剂消费量正在增加。

- 此外,该国最近见证了日常消费品(FMCG)行业的快速成长。日常消费品市场的发展主要得益于中国中产阶级消费者对高级产品和健康产品的支出增加。

- 此外,印度拥有世界第五大包装业,且该行业正在显着成长。业界不断创新,使产品更加便携和紧凑,正在推动该国包装行业的发展。

- 中国政府推出政策支持并鼓励国内医疗设备创新,为市场提供了机会。 「中国製造2025」措施将提高产业效率、产品品质和品牌美誉度,促进国内医疗设备生产企业发展,并增强竞争力。

- 到2022年,印度医疗保健产业预计将达到3,720亿美元,这主要是由于健康意识的提高、保险的普及、收入的增加和疾病发生率的上升。印度的医疗保健产业受益于每年 1.6% 的人口成长。超过一亿人口的老化、文明病发病率的增加、收入的增加以及健康保险普及的提高推动了该行业的成长。

- 过去五年,中国投入公立医院的金额翻了一番,达到 380 亿美元。目标是到 2030 年将医疗保健产业的价值增加一倍以上,达到 2.3 兆美元。

- 预计2025年印度将成为全球第五大消费性电子与电器产品产业大国。此外,5G、LTE 网路以及物联网 (IoT) 的推出等技术变革正在推动消费性电子产品在印度的普及。关于电子产品。 「数位印度」和「智慧城市」计划等措施增加了该国对物联网的需求。

- 随着该国就业的增加,「即食」食品的使用量不断增加。此外,国内对化妆品的需求也不断增加。

- 这些因素可能会在预测期内推动该地区的黏剂市场。

黏剂产业概况

据估计,全球黏剂市场本质上是分散的。市场主要企业包括(排名不分先后)3M、Jowat SE、Henkel AG &Co. KGaA、Arkema Group (Bostik)、HB Fuller 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 不同最终用途产业的需求不断增加

- 从溶剂型黏剂过渡到热熔黏剂

- 对不织布产品的需求不断扩大

- 抑制因素

- 黏剂的缺点和法规遵循性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(按金额的市场规模)

- 合成树脂型

- 乙烯醋酸乙烯酯

- 苯乙烯嵌段共聚物

- 热塑性聚氨酯

- 其他合成树脂类型

- 最终用户产业

- 建筑与建造

- 纸、纸板和包装

- 木工和细木工

- 运输

- 鞋子和皮革

- 卫生保健

- 电气/电子设备

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- 3M

- Alfa International Corporation

- Arkema Group

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Beardow &Adams(adhesives)Limited

- Dow

- Drytac

- Franklin International

- HB Fuller Company

- Henkel AG &Co. KGaA

- Hexcel Corporation

- Huntsman International LLC

- Jowat SE

- Mactac

- Master Bond Inc.

- Paramelt BV

- Pidilite Industries Ltd

- Sika AG

- The Yokohama Rubber Co., Ltd.

第七章市场机会与未来趋势

- 永续包装的可生物分解性黏剂

The Hot-melt Adhesives Market size is estimated at USD 16.89 billion in 2024, and is expected to reach USD 23.66 billion by 2029, growing at a CAGR of 6.98% during the forecast period (2024-2029).

In 2020, the COVID-19 outbreak caused bad conditions that made it hard for the market to grow, but it has since recovered and is still growing.

Key Highlights

- The main things that are driving the market that was studied are the growing demand from different end-use industries, the switch from solvent-borne adhesives to hot-melt adhesives, and the growing demand for non-woven products.

- Some things that could slow down the market are problems with properties and rules that need to be followed.

- Biodegradable hot-melt adhesives for sustainable packaging are likely to present an opportunity in the future.

- The Asia-Pacific region is expected to dominate the market in the forecast period because of vastly growing economies such as India and China.

Hot Melt Adhesives Market Trends

Soaring Demand from the Paper, Board, and Packaging Industries

- Hot-melt adhesives are mainstream adhesives in the paper, board, and packaging industries. It is most widely used for carton closing, sealing, and pallet stabilization.

- Hot-melt adhesives can be used to make corrugated boxes and laminate printed sheets. They can also be used to package all kinds of consumer goods and large industrial tubes and cores.

- The increasing demand for packaged foods and other packaging applications is in turn boosting the demand for hot-melt adhesives used in the packaging sector. For instance, in India, packaging is one of the fastest-growing industries, with an annual growth rate of 15%-20%. Currently, packaging represents the fifth-largest sector in the country's economy. The sector has witnessed steady growth over the past several years, and it is expected to rapidly expand, particularly in the export sector.

- The pulp and paper industry in the United States produces more than 70 million tons of paper and board every year. The presence of major pulp and paper manufacturers in the country, including International Paper, Georgia-Pacific Corporation, and WestRock, is creating a competitive environment. The rising consumption of fast-moving consumer products is likely to boost the demand for packaging paper in the country.

- The FAO says that in 2021, over 130 million metric tons of processed paper and cardboard were made in China, which makes the most paper in the world.

- Most of the demand for packaging is from the food and beverage industry. The country's bakery sector is growing, with about 350 medium-sized bakeries and 150 large plant bakeries, which is strongly driving the sales of packaged products to cater to the rising trend in the country.

- Another factor contributing to the potential demand for hot-melt adhesives in the packaging industry is the traditionally low levels of automation. This has caused many packaging producers to use alternate forms of adhesive.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global market with a share of more than 45%. With growing packaging and healthcare industries in countries like China, India, Japan, and South Korea, the consumption of hot-melt adhesives is increasing in the region.

- Moreover, the country has witnessed rapid growth in the fast-moving consumer goods (FMCG) sector in the recent past. The development of the FMCG market was largely driven by the increased spending on premium and healthier products by middle-class consumers in the country.

- Additionally, India has the fifth-largest packaging industry worldwide, and this industry is growing significantly. The increasing innovation in industries to make their products portable and compact is what drives the country's packaging industry.

- The Chinese government has started policies to support and encourage domestic medical device innovation, providing opportunities for the market. The "Made in China 2025" initiative improves industry efficiency, product quality, and brand reputation, which will spur the development of domestic medical device manufacturers and increase competitiveness.

- The healthcare sector in India is expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical sector in India is benefiting from a growing population at a rate of 1.6% per year. The industry's growth is being fueled by an aging population of over 100 million people, rising incidences of lifestyle diseases, rising incomes, and increased penetration of health insurance.

- China has doubled the amount it has been pouring into public hospitals in the last five years to USD 38 billion. It aims to raise the healthcare industry's value to USD 2.3 trillion by 2030, more than twice its size now.

- India is expected to become the fifth-largest consumer electronics and appliances industry in the world by 2025. Additionally, in India, technology transitions, such as the rollout of 5G and LTE networks and the IoT (Internet of Things), are driving the adoption of electronic products. Initiatives such as "Digital India" and "Smart City" projects raised the demand for IoT in the country.

- With increasing employment in the country, there is an increase in the use of "ready-to-eat" food. In addition, the demand for cosmetic products is also increasing in the country.

- Such factors are likely to drive the hot-melt adhesives market in the region during the forecast period.

Hot Melt Adhesives Industry Overview

The global hot-melt adhesives market is estimated to be fragmented in nature. Some of the major players in the market include (not in any particular order) 3M, Jowat SE, Henkel AG & Co. KGaA, Arkema Group (Bostik), and H.B. Fuller, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Diverse End-use Industries

- 4.1.2 Shift from Solvent-borne Adhesives to Hot-melt Adhesives

- 4.1.3 Growing Demand in Non-woven Products

- 4.2 Restraints

- 4.2.1 Disadvantageous Properties of Hot-melt Adhesives and Regulatory Compliances

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Ethylene Vinyl Acetate

- 5.1.2 Styrenic Block Co-polymers

- 5.1.3 Thermoplastic Polyurethane

- 5.1.4 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Paper, Board, and Packaging

- 5.2.3 Woodworking and Joinery

- 5.2.4 Transportation

- 5.2.5 Footwear and Leather

- 5.2.6 Healthcare

- 5.2.7 Electrical and Electronic Appliances

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Alfa International Corporation

- 6.4.3 Arkema Group

- 6.4.4 Ashland Global Holdings Inc.

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Beardow & Adams (adhesives) Limited

- 6.4.7 Dow

- 6.4.8 Drytac

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Hexcel Corporation

- 6.4.13 Huntsman International LLC

- 6.4.14 Jowat SE

- 6.4.15 Mactac

- 6.4.16 Master Bond Inc.

- 6.4.17 Paramelt BV

- 6.4.18 Pidilite Industries Ltd

- 6.4.19 Sika AG

- 6.4.20 The Yokohama Rubber Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Biodegradable Hot-melt Adhesives For Sustainable Packaging