|

市场调查报告书

商品编码

1444758

全球发泡聚苯乙烯(EPS)市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Expanded Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

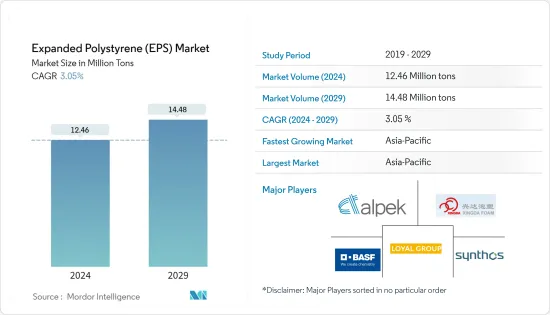

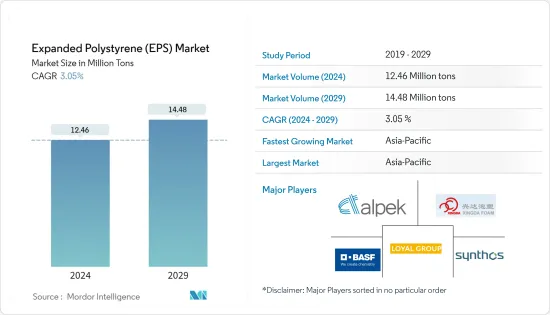

预计2024年全球发泡聚苯乙烯(EPS)市场规模将达到1246万吨,到2029年将达到1448万吨,2024-2029年预测期内复合年增长率为3.05%。我来了。

2020 年,市场受到 COVID-19 的负面影响。 2021年,随着主要终端用户产业恢復运营,市场显着復苏。

主要亮点

- 短期内,对具有更高价值和品质的产品(例如有机和公平贸易产品、健康和保健产品)的需求增加,表明对包装材料的潜在需求良好。 EPS核准可与食品一起使用。

- 另一方面,EPS 替代品的可用性和环境法规正在阻碍所研究市场的成长。

- 对生物基聚苯乙烯的需求不断增长及其在海洋浮体和浮体中的应用可能为所研究的市场带来了机会。

- 亚太地区占据最高的市场占有率,预计在预测期内将主导市场。

发泡聚苯乙烯(EPS)市场趋势

包装产业需求增加

- EPS 是最具成本效益的保护性包装材料之一,在世界各地用于保护货物在运输过程中免受损坏。 EPS 在轻质、刚性和减震方面具有良好的平衡,因此通常用于包装精緻的物品,例如白色家电和其他易碎产品。

- 发泡聚苯乙烯 (EPS) 是一种由小型中空球体组成的轻质多孔塑胶。由于其闭孔结构,EPS 具有许多优越的品质,使其可用于各种包装行业,包括食品包装、工业包装和药品包装。

- 在工业包装中,常使用EPS包装。由于其减震能力,EPS 为工业产品提供了完美的材料,可在运输和装卸过程中提供全面的保护和安全,免受风险。这种坚硬、轻质的泡棉可以模製成任何形状,以在储存和运输过程中保护和绝缘脆弱的医疗设备、电子元件、家用电器、玩具和园艺产品等精緻物品。

- 根据PMMI「包装与加工技术协会」发布的报告,人口成长、对永续性关注、发展中地区购买力的增加,最重要的是,对智慧包装的需求不断增加。

- 根据印度包装工业协会(PIAI)预测,印度包装产业在预测期内预计将成长 22%。此外,到2025年,印度包装市场预计将达到2,048.1亿美元,2020-2025年复合年增长率为26.7%。因此,该地区的EPS泡沫市场预计将会成长。

- EPS 是包装各种鱼类和食品的完美材料。根据Statista统计,2021年全球水产品市场规模达2,530亿美元,预计2025年将达到3,360亿美元。因此,在整个预测期内,对用于水产品包装的 EPS 产品的需求预计将增加。

- 此外,由于经济扩张和高购买力中阶的壮大,近年来中国包装产业持续快速成长。食品包装是包装产业的主要企业,约占中国总市场占有率的60%。根据Interpack预测,2023年中国食品包装产业包装总数预计将达到4,470亿件。

- 由于上述因素,包装领域的发泡聚苯乙烯(EPS)市场可能在预测期内显着成长。

亚太地区主导市场

- 中国是亚太地区最大的消费国。中国拥有全球最大、成长最快的EPS市场。由于政府提案改善公共基础设施和增加密集型非住宅的建议,预计预测期内发泡聚苯乙烯(EPS)的消费量将增加。

- 建筑业在中国经济持续发展中扮演重要角色。根据国家统计局数据,2021年建筑业产值占国内生产毛额的比重为25.7%,高于2020年的11.0%。

- 根据2022年1月发布的中国五年规划,预计2022年建筑业将成长6%。预製件,即零件或整体製造并运送到建筑工地进行组装的预製件,预计将占全国新建设的30%。

- 预计到2025年,印度数位经济将达到1兆美元,印度电子系统设计与製造业(ESDM)产业预计到2025年将产生超过1,000亿美元的经济价值。印度製造、国家电子政策、电子产品净零进口和零缺陷零效应承诺发展国内製造业、减少进口依赖并促进出口和製造业。

- 根据印度汽车协会统计,2021年4月至2022年3月,汽车产业总合生产了22,933,230辆汽车,包括小客车、商用车、三轮车、两轮车和四轮车,与2020年4月相比. 22,655,609 单位。直到 2021 年 3 月。

- 日本工业协会(JAMA)的报告显示,2021年日本小客车和轻型汽车产量为7,846,955辆。然而,与 2020 年相比,该产业的产量下降了 3%。

- 所有这些因素预计将在预测期内扩大该地区的发泡聚苯乙烯(EPS)市场。

发泡聚苯乙烯(EPS)产业概述

扩大后的聚苯乙烯市场较为分散,主要企业(排名不分先后)包括无锡兴达发泡塑胶新材料有限公司、Loyal Group、 BASF SE、Synthos 和 Alpek SAB de CV。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的需求不断成长

- 包装产业需求不断成长

- 抑制因素

- 环境法规

- EPS 的替代品

- 产业价值链分析

- 波特五力

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 进出口趋势

第五章市场区隔:市场规模(按数量)

- 产品类别

- 白色EPS

- 灰色/银色 EPS

- 最终用户产业

- 建筑/施工

- 电力/电子

- 包装

- 其他最终用户产业(农业/汽车)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧国家

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Atlas Roofing Corporation

- Alpek SAB de CV

- BASF SE

- BEWI

- Epsilyte LLC

- Kaneka Corporation

- Ravago Petrokimya Uretim AS

- SABIC

- SUNPOR

- Synthos

- Unipol Holland BV

- Versalis SpA

- Wuxi Xingda Foam Plastic New Material Limited

- Loyal Group

第七章市场机会与未来趋势

- 生物基聚苯乙烯需求增加

- 在海洋浮体和浮体甲板的应用

The Expanded Polystyrene Market size is estimated at 12.46 Million tons in 2024, and is expected to reach 14.48 Million tons by 2029, growing at a CAGR of 3.05% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. With the resumption of operations in major end-user industries, the market recovered significantly in 2021.

Key Highlights

- Over the short term, increasing demand for value and quality enriched products, including organic and fair trade and health and wellness goods, indicates a favorable potential demand for packaging materials. EPS is approved for use in conjunction with food products.

- On the flip side, the availability of alternative products for EPS and environmental regulations are hindering the growth of the market studied.

- The increasing demand for bio-based polystyrene and applications in marine floatation and floating decks are likely to act as opportunities for the studied market.

- The Asia Pacific accounts for the highest market share and is expected to dominate the market during the forecast period.

Expanded Polystyrene (EPS) Market Trends

Increasing Demand from the Packaging Industry

- EPS is one of the most cost-effective protective packaging materials available and is used worldwide to protect goods from transit damage. Because EPS offers an exceptional balance of lightness, rigidity, and shock absorption, it is frequently used to package delicate items like white goods and other fragile products.

- Expanded polystyrene is a light cellular plastic made up of tiny hollow spheres. Due to its closed cellular structure, EPS has numerous exceptional qualities that make it useful in a variety of packaging industries, including food packaging, industrial packaging, pharmaceutical packaging, etc.

- Industrial packaging frequently utilizes EPS packaging. Due to its shock absorption ability, EPS offers industrial items the perfect material for comprehensive protection and safety from risk during transit and handling. The hard, lightweight foam can be moulded into any shape to protect and insulate delicate things during storage and transportation, such as fragile medical equipment, electronic components, electrical consumer goods, toys, and horticultural products.

- According to a report published by PMMI, 'The Association for Packaging and Processing Technologies,' the value of the global packaging industry reached USD 42.2 billion in 2021, owing to the increasing population, growing sustainability concerns, more spending power in developing regions, and increasing demand for smart packaging, among others.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the EPS foam market is expected to grow in the region.

- EPS is the perfect material for packing a variety of fish and food products. According to Statista, the global seafood market reached a value of USD 253 billion in 2021, and it is projected to reach USD 336 billion by 2025. As a result, the demand for EPS products used for seafood packaging is anticipated to grow throughout the forecast period.

- Furthermore, the Chinese packaging industry has grown at a rapid and consistent rate in recent years, owing to expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023.

- Due to the aforementioned factors, the market for expanded polystyrene in the packaging segment is likely to grow substantially during the forecast period.

Asia-Pacific to Dominate the Market

- China is the largest consumer in the Asia-Pacific region. China has the world's largest and fastest-growing EPS market. Government proposals to improve public infrastructure and the rising cash-intensive non-residential construction are anticipated to increase the consumption of expanded polystyrene during the forecast period.

- The construction sector is a key player in China's continued economic development. The value of construction output accounted for 25.7% of China's GDP in 2021, up from 11.0% in 2020, according to the National Bureau of Statistics.

- According to China's Five-Year Plan unveiled in January 2022, the construction industry is estimated to register a growth rate of 6% in 2022. Prefabricated parts, which are either partially or wholly manufactured and transported to construction sites for assembly, may account for over 30% of the new construction in the country.

- India is expected to have a digital economy of USD 1 trillion by 2025, and India's electronics system design and manufacturing (ESDM) sector is expected to generate over USD 100 billion in economic value by 2025. Several policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, offer a commitment to growth in domestic manufacturing, lowering import dependence, and energizing exports and manufacturing.

- According to the Society of Indian Automobile Association, the auto industry produced a total of 22,933,230 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles from April 2021 to March 2022, as against 22,655,609 units from April 2020 to March 2021.

- As per reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,846,955 units of passenger cars and light vehicles in 2021. However, the industry witnessed a decline of 3% compared to the production numbers in 2020.

- All these factors are expected to increase the market for expanded polystyrene in the region during the forecast period.

Expanded Polystyrene (EPS) Industry Overview

The expanded polystyrene market is fragmented, with the major players (in no particular order) comprising Wuxi Xingda Foam Plastic New Material Limited, Loyal Group, BASF SE, Synthos, and Alpek SAB de CV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Environmental Regulations

- 4.2.2 Alternative Products For EPS

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-Export Trends

5 Market Segmentation (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 White EPS

- 5.1.2 Grey And Silver EPS

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Other End-user Industries (Agriculture and Automotive)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Nordic Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Atlas Roofing Corporation

- 6.4.2 Alpek SAB de CV

- 6.4.3 BASF SE

- 6.4.4 BEWI

- 6.4.5 Epsilyte LLC

- 6.4.6 Kaneka Corporation

- 6.4.7 Ravago Petrokimya Uretim AS

- 6.4.8 SABIC

- 6.4.9 SUNPOR

- 6.4.10 Synthos

- 6.4.11 Unipol Holland BV

- 6.4.12 Versalis SpA

- 6.4.13 Wuxi Xingda Foam Plastic New Material Limited

- 6.4.14 Loyal Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polystyrene

- 7.2 Applications in Marine Floatation and Floating Decks