|

市场调查报告书

商品编码

1444768

对二甲苯 (PX) - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Paraxylene (PX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

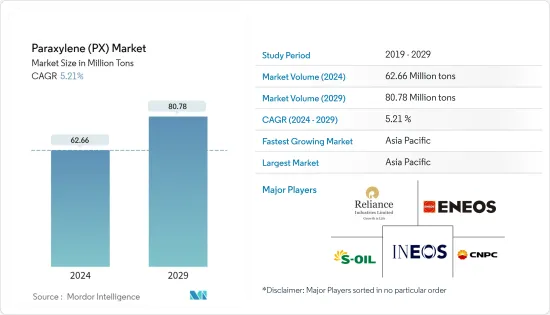

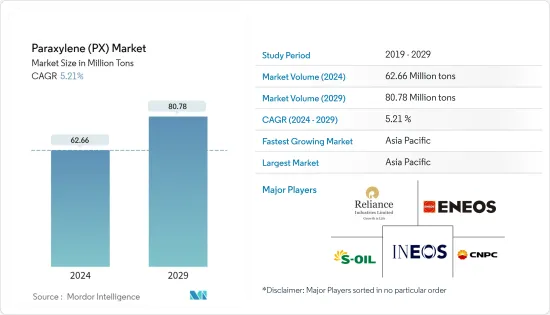

预计2024年对二甲苯市场规模为6,266万吨,预计2029年将达到8,078万吨,预测期间(2024-2029年)CAGR为5.21%。

2020年,市场受到了COVID-19的适度影响。纯化对苯二甲酸是一种对二甲苯产品,用于製造汽车涂料配方中的聚酯涂料树脂。汽车产业的衰退和汽车製造的暂时关闭对市场产生了负面影响。然而,面罩、透明口罩、食品和电子商务包装的使用量增加,从而提振了对二甲苯衍生物的需求。它还包括纯化对苯二甲酸、对苯二甲酸二甲酯和聚对苯二甲酸乙二醇酯,进一步增加了对二甲苯的需求。

主要亮点

- 短期内,亚太地区塑胶产业对聚对苯二甲酸乙二醇酯(PET)的高需求预计将推动市场成长。

- 然而,欧洲消费者对无塑胶产品以及 PET 收集和回收率的认识不断提高,阻碍了市场的成长。

- 在生物塑胶 PET 瓶(Bio-PET)和其他生物塑胶产品中使用生物基对二甲苯的创新可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并在预测期内实现最高的CAGR。

对二甲苯市场趋势

塑胶产业需求不断增加

- 对二甲苯是製造聚对苯二甲酸乙二酯 (PET) 塑胶、聚酯织物等的原料。

- 精对苯二甲酸(PTA)是由次级石油产品对二甲苯(PX)和乙酸反应产生的有机化合物。

- PTA主要用于生产聚酯,如聚酯薄膜、聚酯瓶、家具等。它也用于製造高性能塑料,例如聚对苯二甲酸丁二醇酯(PBT)和对苯二甲酸二甲酯(DMT)。

- 汽车、食品和饮料、电子和建筑行业产量的增加正在推动对 PET 和 PBT 等塑胶的需求。因此,它增加了对高性能塑胶的需求,可能会增加其产量。

- 根据中国国家统计局统计,2022年上半年塑胶製品产量约3,821万吨。2021年塑胶製品产量较上年增加约5.27%。

- 2021 年 5 月,石化生产商 Indorama Ventures Ltd 的子公司 Indo Rama Synthetics (India) Limited (IRSL) 宣布计划投资 60 亿印度卢比(约 7,243 万美元)用于 PET 树脂产能扩张。该厂的日产能将增加 700 吨,印度那格浦尔的製造厂将实施设备升级计划,将于 2022 年最后一个季度开始生产。

- 由于上述因素,对二甲苯(PX)市场在预测期内可能会成长。

中国将主导亚太地区

- 在亚太地区,中国已成为世界上最大的生产国之一。目前也是最大的对二甲苯生产商和消费国。

- 中国石油天然气集团公司是最大的对二甲苯生产商之一,年产量100万吨。中石油PTA技术有效地以对二甲苯为原料,透过经济有效的方法生产PET。

- 中国对 PET 的需求不断增长,正在提升 PET 价值链,迅速推动对二甲苯市场的发展。 2022年,中国将占全球PET产能的38%左右。由于包装和纺织业对 PET 的需求不断增长,中国多年来不断增加产能。

- 中国是PET树脂的主要生产国,中油集团和江苏三坊祥是全球最大的PET树脂生产商,产能超过200万吨。因此,终端用户产业对 PET 的需求不断增长,推动了对二甲苯的需求。

- 纺织业是中国的主要产业之一,也是全球最大的服装出口国。根据中国国家统计局的数据,2022年中国纺织品产量为382亿公尺。2023年前两个月,中国纺织品产量为50亿公尺。

- 由于电子商务的兴起和不断增长的中国人口对技术的掌握程度不断提高,对塑胶树脂的需求预计也会增加。这种需求的成长主要是由中国的电子商务、食品生产和饮料消费等所推动的。

- 因此,由于预测期内终端用户产业的需求不断增长,对二甲苯市场可能会成长。

对二甲苯产业概况

对二甲苯(PX)市场部分整合。从市占率来看,目前很少有主要参与者占据市场主导地位。该市场的一些主要参与者(排名不分先后)包括 ENEOS Corporation、INEOS、Reliance Industries Limited、S-OIL Corporation 和中国石油天然气集团公司。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 对聚对聚对苯二甲酸乙二酯(PET) 的高需求

- 其他司机

- 限制

- 消费者对使用无塑胶产品的意识增强

- 欧洲 PET 收集和回收率

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场规模按数量计算)

- 应用

- 精对苯二甲酸 (PTA)

- 对苯二甲酸二甲酯 (DMT)

- 其他应用

- 最终用户产业

- 塑胶

- 纺织品

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Braskem

- China National Petroleum Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- FUJAN REFINING & PETROCHEMICAL COMPANY LIMITED

- INEOS

- Indian Oil Corporation Limited

- Mangalore Refinery & Petrochemicals Ltd

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- National Petrochemical Company

- PT Pertamina (Persero)

- Reliance Industries Limited

- Rongsheng Petrochemical Co. Ltd

- SK Innovation Co. Ltd

- China Petroleum & Chemical Corporation

- S-Oil Corporation

第 7 章:市场机会与未来趋势

- 生物基对二甲苯在生物塑胶 PET 瓶 (Bio-PET) 和其他生物塑胶产品中的使用创新。

The Paraxylene Market size is estimated at 62.66 Million tons in 2024, and is expected to reach 80.78 Million tons by 2029, growing at a CAGR of 5.21% during the forecast period (2024-2029).

The market was moderately impacted by COVID-19 in 2020. Purified terephthalic acid, a paraxylene product, was used to manufacture polyester coating resins in the formulation of automotive coatings. The declining automotive industry and the temporary shutdown of automotive manufacturing negatively impacted the market. However, face shields, transparent masks, food, and e-commerce packaging usage increased, thus boosting the demand for paraxylene derivatives. It also includes purified terephthalate acid, dimethyl terephthalate, and polyethylene terephthalate, further augmenting the demand for paraxylene.

Key Highlights

- Over the short term, the high demand for polyethylene terephthalate (PET) from the plastic industry in Asia-Pacific is expected to drive the market's growth.

- However, increasing consumer awareness regarding plastic-free products and PET collection and recycling rates in Europe are hindering the market's growth.

- Innovation in using bio-based paraxylene in bioplastic PET bottles (Bio-PET) and other bioplastic products will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and register the highest CAGR during the forecast period.

Paraxylene Market Trends

Increasing Demand from Plastic Industries

- Paraxylene is a building block for manufacturing polyethylene terephthalate (PET) plastics, polyester fabrics, and others.

- Purified terephthalic acid (PTA) is an organic compound produced by reacting secondary petroleum product paraxylene (PX) and acetic acid.

- PTA is majorly used to produce polyesters, such as polyester films, PET bottles, and furniture. It is also used in making high-performance plastics, such as polybutylene terephthalate (PBT) and dimethyl-terephthalate (DMT).

- The increasing production in the automotive, food and beverage, electronics, and construction industries is boosting the demand for plastics, such as PET and PBT. Thus, it increases demand for high-performance plastics, likely increasing their production.

- According to the National Bureau of Statistics of China, around 38.21 million metric tons of plastic products were produced in the first half of 2022. In 2021, plastic product production increased by around 5.27% over the previous year.

- In May 2021, Indo Rama Synthetics (India) Limited (IRSL), a subsidiary of petrochemical producer Indorama Ventures Ltd, announced its plans to invest up to INR 6 billion (~USD 72.43 million) for the capacity expansion of PET resin. It comes with an additional 700-ton capacity per day and an equipment upgrading program in the manufacturing facility in Nagpur, India, to start production in the last quarter of 2022.

- Due to the abovementioned factors, the paraxylene (PX) market will likely grow during the forecast period.

China to Dominate the Asia-Pacific Region

- In Asia-Pacific, China emerged as one of the biggest production houses in the world. Presently, it is also the largest manufacturer and consumer of Paraxylene.

- China National Petroleum Corporation is one of the largest producers of Paraxylene, with an annual production quantity of 1 million tons. CNPC PTA technology is effective in using Paraxylene as an input to produce PET through a cost-effective method.

- Growing demand for PET in China is ramping up the PET value chain, rapidly driving the market for Paraxylene. In 2022 China accounted for around 38% of the global PET production capacity. Due to the growing demand for PET from the packaging and textile industries, China included added capacities through the years.

- China is a major producer of PET resins, with the PetroChina Group and Jiangsu Sangfangxiang among the largest global manufacturers in terms of volume, with more than 2 million ton capacities. Thus, the rising demand for PET from end-user industries is driving the demand for Paraxylene.

- China's textile industry is one of the major industries, and the country is the largest clothing exporter worldwide. According to the National Bureau of Statistics of China, textile production in the country stood at 38.20 billion m in 2022. In the first two months of 2023, the country produced 5 billion m of textiles.

- Due to rising e-commerce and increasing tech-savviness among the growing Chinese population, the demand for plastic resins is also expected to increase. This increase in demand is particularly driven by China's e-commerce, food production, and beverage consumption, among many others.

- Therefore, the market for Paraxylene will likely grow due to the rising demand from end-user industries during the forecast period.

Paraxylene Industry Overview

The paraxylene (PX) market is partially consolidated. By market share, few major players currently dominate the market. Some of the market's major players (not in any particular order) include ENEOS Corporation, INEOS, Reliance Industries Limited, S-OIL Corporation, and China National Petroleum Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Polyethylene Terephthalate (PET)

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increase in Consumer Awareness Regarding the Use of Plastic-free Products

- 4.2.2 PET Collection and Recycling Rates in Europe

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Purified Terephthalic Acid (PTA)

- 5.1.2 Dimethyl Terephthalate (DMT)

- 5.1.3 Other Applications

- 5.2 End-user Industry

- 5.2.1 Plastics

- 5.2.2 Textile

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 China National Petroleum Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FUJAN REFINING & PETROCHEMICAL COMPANY LIMITED

- 6.4.6 INEOS

- 6.4.7 Indian Oil Corporation Limited

- 6.4.8 Mangalore Refinery & Petrochemicals Ltd

- 6.4.9 MITSUBISHI GAS CHEMICAL COMPANY INC.

- 6.4.10 National Petrochemical Company

- 6.4.11 PT Pertamina (Persero)

- 6.4.12 Reliance Industries Limited

- 6.4.13 Rongsheng Petrochemical Co. Ltd

- 6.4.14 S.K. Innovation Co. Ltd

- 6.4.15 China Petroleum & Chemical Corporation

- 6.4.16 S-Oil Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in the Use of Bio-based Paraxylene in Bioplastic PET Bottles (Bio-PET) and Other Bioplastic Products.