|

市场调查报告书

商品编码

1640688

数位香味市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Scent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

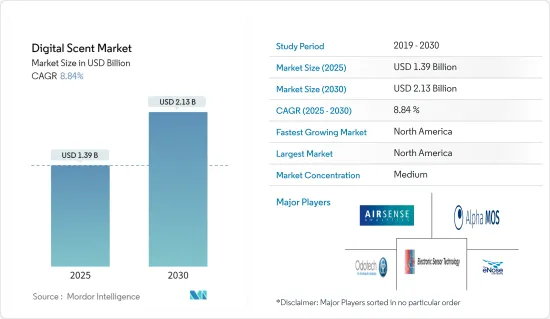

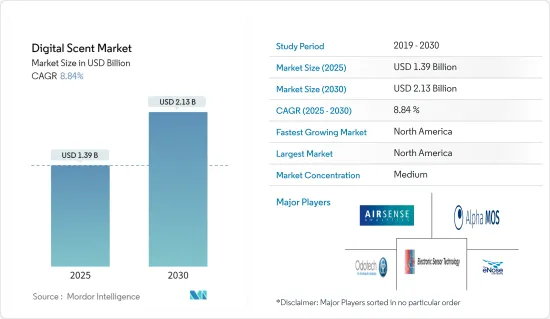

预计 2025 年数位气味市场规模为 13.9 亿美元,到 2030 年将达到 21.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.84%。

预计在预测期内,数位气味技术市场将稳步扩大,这主要归功于线上互动中气味感知技术的进步。目前,网路交流涉及三种感官:听觉、触觉和视觉。虚拟实境的概念之一是数位气味。一般来说,数位气味是硬体和软体技术的结合。

关键亮点

- 数位气味技术在香水产业的品质保证部门中得到越来越多的应用。此外,为了简化劳动密集且耗时的品管流程,不断扩张的全球香水企业正在越来越多地投资数位香水技术,以满足最高的市场标准:顶级香水产业。数位嗅觉感测器可以监测香水在接触特定皮肤类型和环境因素后的变化。数位嗅觉感测器的这些吸引人的特点正在推动数位气味技术市场的成长。

- 在香水、食品饮料等技术等许多应用中,数位嗅觉技术很大程度上依赖人的能力。即使是警犬,其检测和辨别不同气味的能力也有限。因此,量化和处理资讯需要时间。但 IBM 和 E-Nose Systems 等公司正在成功地利用人工智慧进一步处理和分类气味。人工智慧使得提高灵敏度和扩展系统功能成为可能。 IBM 的演算法简化了製造实验室香水和气味剂所需的劳动密集製造步骤。

- 根据通讯统计,全球51%的人口使用行动电话,约有40亿人可以使用网路。随着网路智慧型手机在世界各地越来越普及,研究人员正在扩大智慧型手机内建数位分身技术的使用。近年来,我们看到数位气味在各行业的应用。研究人员的目标是透过虚拟实境实现远距离讨论。这使得使用者体验到真实的视觉、语音和嗅觉的感觉。这些进步预计将对全球数位香技术市场产生重大影响。主要市场开发商已开始投资研发以建构此类智慧型手机系统。

- 拥有快速且经济地筛检COVID-19 的能力对于有效对抗这场流行病至关重要。美国宇航局正在提供其专业知识来支持这项工作。美国卫生与公众服务部正在与美国太空总署位于加州硅谷的艾姆斯研究中心合作,改进电子鼻设备,该设备使用取得专利的奈米感测器和奈米感测器阵列技术来检测COVID-19,并向美国太空总署提供380万美元。美国太空总署正在开发 E-Nose,这是一种基于智慧型手机的设备,可以透过「闻」人的呼吸来检测 COVID-19。这是基于以前用于监测航天器内部空气品质的技术。

- 电子鼻的数位化气味感测器技术和气味合成技术必须透过可靠的气流来改进。这些因素降低了电子鼻的商业价值。这些技术在气流受到控制且其他环境气味不会互相干扰的封闭空间中广泛使用。这些限制限制了电子鼻和其他技术在工业领域的应用。识别和测量微量浓度的气味是一项重大挑战。如果气味浓度较低,则可能会严重干扰讯号。

数位香味市场趋势

人工智慧在数位气味技术中的应用

- 人类的鼻子侦测无机和有机物质发出的气味分子,从而获得嗅觉。当物体能量增大时,气味就会蒸发,并透过鼻腔被吸入吸收。数字气味的工作原理类似。首先,生物感测器收集气味特征,然后分析气味资料并使用软体解决方案显示结果。人工智慧可以根据先前收集的气味资料库来解释和分类气味特征。

- 根据美国国家人工智慧安全委员会的最终报告,该委员会呼吁每年将联邦政府对人工智慧的研发资金提案一倍,到2026财年达到320亿美元。拜登政府本财年的预算提案将使联邦研发支出比2021财年的授权水准增加28%,达到2,040亿美元以上。国家人工智慧研究机构,包括新的和现有的,都将获得部分资金。此类投资预计将推动将人工智慧融入数位香水技术的需求。

- 此外,根据史丹佛大学预测,2021年全球企业对人工智慧(AI)的总投资将达到近940亿美元,较前一年大幅成长。 2018年人工智慧年度投入略为下降。但这只是暂时的。整体人工智慧商业投资大部分来自私人投资。

- 去年9月,GoogleAI利用人工智慧创建了气味和化学结构之间的关联图。它在描述物质恶臭时与人类一样准确,实验背后的研究人员认为这是气味数位化的重要一步。嗅觉的一个基本挑战是将分子结构与气味感知相匹配。 Google AI 的研究人员利用神经图网路 (GNN) 开发了主气味图 (POM),该图可以保留感知关联并能够预测新型气味剂的气味品质。

- 同样,由新加坡南洋理工大学(NTU Singapore)领导的科学家团队开发了一种人工嗅觉系统,可以透过模仿哺乳动物的鼻子来可靠地评估肉的新鲜度。电子鼻(e-nose)是利用根据肉类变质时释放的气体而随时间改变颜色的条码,以及搭载人工智慧的智慧型手机应用程式形式的条码读取器构成的系统。电子鼻经过训练可以从大量的条码颜色库中识别和预测肉类的新鲜度。

预计北美将占据主要份额

- 预计预测期内北美将在全球数位气味市场中获得关注。北美领先製造商如RoboScientific和ALPHA MOS正在致力于透过研发活动实现电子鼻的小型化,以加强基本客群并获得竞争优势。目标是创造一种便携、经济高效、小型的电子鼻,能够提供准确的结果并满足市场需求。这推动了北美全球电子鼻市场的扩张。

- 医疗保健支出的增加可能会推动市场发展。根据美国医疗保险和医疗补助服务中心预测,2021年美国医疗支出将成长2.7%,达到4.3兆美元,即每人1,2914美元。医疗保健支出占国内生产总值(GDP)的18.3%。此外,eNose 还可用于诊断多种疾病。人们早就认识到某些疾病会影响内臟和新陈代谢,进而改变呼出气体的成分。例如,糖尿病患者排放相对大量的挥发性化学化合物,例如丙酮。凭藉其易于使用的气味感测器,eNose 可用于测量血糖值和监测糖尿病状况。

- 市场扩张的驱动力之一是人们对健康的兴趣日益浓厚。因此,食品和饮料(F&B)行业对数位调味料的需求预计会增加,以改善食品质量,进而有助于减少因食品污染引起的疾病。根据美国疾病管制与预防中心 (CDC) 的数据,每年有 4,800 万人因美国感染疾病而患病,导致 3,000 人死亡。电子鼻由可以检测毒素和相关化学物质存在与否的感测器组成。因此,电子鼻贯穿整个食品生产过程,以确保食品品质。

- 由于其在军事和国防领域的广泛应用,北美爆炸物探测器市场预计在预测期内将实现成长。恐怖爆炸事件的增加对能够准确、快速地检测爆炸物以限制损害的技术产生了巨大的需求。军队和警察部队使用爆炸物探测设备来识别战区和公共场所的爆炸物,以保护平民。

- 数位感测技术的最新应用受到感测器设计、材料改进、软体创新以及微电路设计和系统整合的进步的推动。该地区新兴市场的基础设施建设,加上各行各业越来越多地采用技术进步来改善经营模式,预计将推动整个数位气味市场的成长。

数位香水产业概况

数位气味市场既具有凝聚力又具有凝聚力。预计持续的研究和技术进步将成为市场的主要趋势。公司采用各种策略来扩大基本客群并在市场上占有一席之地。主要企业包括 Alpha MOS SA、Electronic Sensor Technology Inc.、Plasmion GmbH、Odotech Inc.、The eNose Company 和 AIRSENSE Analytics GmbH。

- 2022 年5 月:生物相容性半导体的大规模生产商Cardea Bio, Inc. 正在开发一种高度敏感和特异性的生物标誌物,该标誌物包含一种可以检测挥发性化合物的受体,以快速津贴开发中国家的感染疾病。本研究旨在确定以昆虫嗅觉受体 [iOR] 功能化的 Chaldea BPU 是否可以检测促效剂气味。

- 2022 年 6 月:芬美意宣布与总部位于中国杭州的数位香味技术先驱 ScentRealm 建立战略合作伙伴关係。此次合作在中国尚属首例,将香味业务与感官体验探索者的专业知识结合在一起。这将使芬美意能够利用发达的数位设备并探索气味的数位化未来,增强客户和消费者的气味和嗅觉体验。芬美意走在数位转型的前沿,推出了业界首款人工智慧增强型衣物洗护香水和首款将人工智慧技术与人类创造力融为一体的人工智慧香精。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 人工智慧在数位气味技术中的应用

- 市场限制

- 电子鼻初始成本高

- 产业价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 透过硬体

- 芳香合成装置

- 电子鼻

- 按最终用户产业

- 军事和国防

- 医疗

- 饮食

- 废弃物管理(环境监测)

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争格局

- 公司简介

- Alpha MOS SA

- Electronic Sensor Technology

- Plasmion GmbH

- Odotech Inc.

- The eNose Company

- Airsense Analytics GmbH

- Aryballe Technologies SA

- Comon Invent BV

第七章投资分析

第八章 市场机会与未来趋势

The Digital Scent Market size is estimated at USD 1.39 billion in 2025, and is expected to reach USD 2.13 billion by 2030, at a CAGR of 8.84% during the forecast period (2025-2030).

The Digital Scent Technology Market is expected to increase steadily over the forecast period, owing mostly to technological advances for establishing a sense of scent in online communication. Currently, three senses are involved in internet communication: hearing, touching, and sight. One of the notions of virtual reality is the digital smell. In general, the digital smell is a combination of hardware and software technology.

Key Highlights

- In the quality assurance division of the fragrance industry, digital scent technology has been used more and more. Further, to streamline the labor-intensive and time-consuming quality control process, the expanding global fragrance business is investing more and more in digital scent technology and focusing on meeting the market's highest criteria, the top fragrance industries. Digital olfactory sensors can monitor changes in perfume after exposure to specific skin types or environmental factors. The market for digital scent technology has expanded due to these appealing features of digital noses.

- In many applications, including those involving perfumes, food and beverages, and other technologies, digital scent technology is highly dependent on human ability. Even police dogs have limited ability to detect and distinguish between distinct odors. The information took time to quantify and process as a result. However, businesses like IBM and E-Nose Systems have successfully used AI to process further and categorize the scents. With AI, it is now possible to gain more sensitivity and expand the system's capabilities. IBM's algorithm has simplified the labor-intensive manufacturing procedure needed to make lab-made fragrances and odorants.

- According to the International Telecommunication Union, 51% of the global population uses mobile-cellular devices, with around 4 billion having internet access. Researchers have been expanding the installation of Digital Scent Technology in-built into smartphones due to the widespread availability of smartphones with internet connectivity worldwide. In recent years, the industry has seen the introduction of Digital Smell. Researchers hope to create virtual-reality long-distance discussions. This will give users a true sensation of sight, speech, and smell. These advancements will significantly impact the global Digital Scent Technology Market. Major market players have already invested in research and development to build these smartphone systems.

- In order to effectively combat the pandemic, it is crucial to have the ability to swiftly and affordably screen people for COVID-19. NASA is using its expertise to aid with this effort. The Department of Health and Human Services has provided NASA with USD 3.8 million to improve the E-Nose device created at NASA's Ames Research Center in California's Silicon Valley using patented nanosensors and nanosensor array technology for COVID-19 detection. NASA is developing E-Nose, a smartphone-based gadget, to detect COVID-19 by "sniffing" a person's breath. It is based on technology previously used to help monitor air quality inside spacecraft.

- The digitalized smell sensor technology of the E-noses and the scent synthesizer technologies must be improved by reliable airflow. These elements have decreased the E-noses' product value. These technologies are heavily used in enclosed spaces where the airflow is controlled, and other environmental odors don't interfere with one another. These limitations have limited the industry's use of E-noses and other technologies. Identifying and measuring the odor in the little concentration is the main challenge. There is a larger likelihood of significant signal interference when an odor is present in low concentrations.

Digital Scent Market Trends

Introduction of AI in Digital Scent Technology

- The human nose employs odor molecules emitted by inorganic and organic things to enable the sense of smell. When the energy in things increases, the odor evaporates, allowing them to be inhaled and absorbed through the nasal cavity. Digital olfaction functions similarly. It first gathers odor signatures with biosensors, analyzes the odor data, and displays the results with software solutions. Artificial intelligence helps interpret the signatures and classify them based on a database of previously collected smells.

- According to National Security Commission on Artificial Intelligence, In its final report, it proposed Congress increase federal R&D funding for AI by a factor of two annually, up to a total of USD32 billion in fiscal 2026. The federal R&D budget will be increased by 28% from FY 2021 authorized levels to more than USD 204 billion under the Biden administration's fiscal of this year budget plan. The National AI Research Institutes, both new and established, would get some of that funds. Such investments are expected to drive the demand for incorporating AI in digital scent technology.

- Further, according to Stanford University, global total business investment in artificial intelligence (AI) will reach almost USD 94 billion in 2021, a considerable rise from the previous year. The annual investment in AI showed a modest decrease in 2018. However, this was only temporary. The majority of overall AI business investment is made up of private investments.

- In September last year, Google AI used artificial intelligence to create a map correlating odors to chemical structures. It is as accurate as a human in describing a substance's stench, and the researchers behind the experiment think it is an important step toward digitizing scents. A fundamental difficulty in olfaction is mapping molecular structure to odor perception. The Google AI researchers create a Principal Odor Map (POM) that preserves perceptual associations and enables odor quality prediction for novel odorants using neural graph networks (GNN).

- Similarly, a team of scientists led by Nanyang Technological University, Singapore (NTU Singapore) has developed an artificial scent system that reliably assesses the freshness of meat by mimicking the mammalian nose. The 'electronic nose' (e-nose) consists of a 'barcode' that changes color over time in response to the gases released by meat as it decays and a barcode reader in the form of an artificial intelligence-powered smartphone app. The e-nose has been trained to recognize and predict meat freshness from a wide library of barcode colors.

North America is Expected to Hold Major Share

- North America is expected to gain traction in the global digital scent market during the projected period. Top North American manufacturers such as RoboScientific, ALPHA MOS, and others are aiming to reduce the size of electronic noses through research and development (R&D) operations to boost their client base and gain a competitive advantage. The goal is to create a portable, cost-effective, and tiny electronic nose that can produce accurate results and suit market demands. This is fueling the expansion of North America's worldwide electronic nose market.

- The increase in healthcare spending is likely to drive the market. According to the Centers for Medicare and Medicaid Services, U.S. healthcare spending would increase by 2.7% in 2021, reaching USD 4.3 trillion, or USD 12,914 per person. Health spending accounted for 18.3%of the nation's GDP. Further, it is also possible to use eNose to diagnose various disorders. It has long been recognized that certain diseases affect internal organs or metabolism and alter the composition of exhaled air. Diabetes patients, for example, expel comparatively large amounts of volatile chemical compounds such as acetone. The eNose, which comes with an easy-to-use smell sensor, could be used to determine blood sugar levels and monitor diabetes settings.

- One of the driving factors for market expansion is the growing health concern. Thus, demand for digital scents is predicted to rise for usage in the food and beverage (F&B) business to improve food quality, which in turn aids in the reduction of diseases caused by food contamination. According to the Centers for Disease Control and Prevention (CDC), 48 million people get sick from food-borne infections yearly, with 3,000 dying. This electronic nose comprises sensors that can detect the presence or absence of toxins and associated chemicals. As a result, this electronic nose is employed throughout the food manufacturing process to ensure food quality.

- The explosive detectors segment in the North America region is expected to develop during the forecast period due to its extensive application in military and defense. The growing number of terrorist bombings has produced a significant demand for technologies that can detect explosives accurately and swiftly to limit damage. The military and police employ explosive detectors to identify explosives in combat zones and public locations in order to protect citizens.

- The recent applications of digital scent technologies have come through advancements in sensor design, material improvements, software innovations, and progress in microcircuitry design and systems integration. The developing infrastructure in the region, coupled with the rising adoption of technological advancements across various industries to better the business model, is set to boost the growth of the overall digital scent market.

Digital Scent Industry Overview

The digital scent market is both cohesive and cohesive. Ongoing research and technological advancements are expected to be the key trends in the market. The companies are adopting various strategies to expand their customer base and mark their presence in the market. Some key players are Alpha MOS SA, Electronic Sensor Technology Inc., Plasmion GmbH, Odotech Inc., The eNose Company, and AIRSENSE Analytics GmbH, among others.

- May 2022: Cardea Bio, Inc., the mass producer of biocompatible semiconductors, announced that the Bill & Melinda Gates Foundation had awarded it a USD 1.1 million grant to develop a BPU (Biosignal Processing Unit) assay with high sensitivity and specificity that incorporates receptors capable of detecting volatile compounds to diagnose infectious diseases in developing countries rapidly. This study aims to see if Cardea BPUs functionalized with an insect Odorant Receptor [iOR] can detect an agonist odorant.

- June 2022: Firmenich has announced a strategic alliance with ScentRealm, a pioneer in digital scent technology based in Hangzhou, China. This relationship is the first of its type in China, bringing together the expertise of a fragrance business and a sense experience explorer. It will allow Firmenich to improve the fragrance and olfactory experience for its clients and consumers by utilizing developed digital devices and investigating the digital future of scent. Firmenich is at the forefront of digital transformation, having introduced the industry's first AI-augmented laundry care fragrances and the first flavor created by AI by merging AI technology with human creativity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Introduction of AI in Digital Scent Technology

- 4.4 Market Restraints

- 4.4.1 High Initial Cost of Electronic Noses

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Hardware

- 5.1.1 Scent Synthesizer

- 5.1.2 E-Nose

- 5.2 By End-user Industry

- 5.2.1 Military and Defense

- 5.2.2 Healthcare

- 5.2.3 Food and Beverage

- 5.2.4 Waste Management (Environmental Monitoring)

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alpha MOS SA

- 6.1.2 Electronic Sensor Technology

- 6.1.3 Plasmion GmbH

- 6.1.4 Odotech Inc.

- 6.1.5 The eNose Company

- 6.1.6 Airsense Analytics GmbH

- 6.1.7 Aryballe Technologies SA

- 6.1.8 Comon Invent BV