|

市场调查报告书

商品编码

1641856

情境感知计算:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Context Aware Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

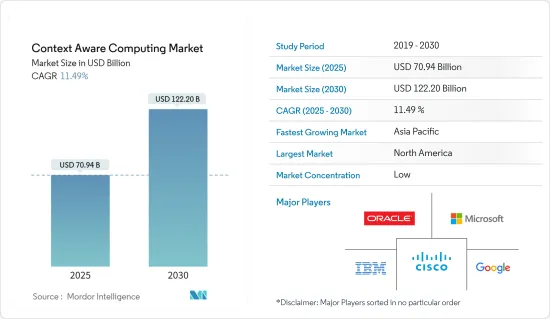

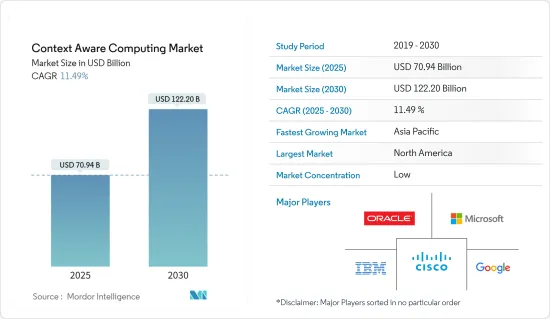

情境感知计算市场规模预计在 2025 年为 709.4 亿美元,预计到 2030 年将达到 1,222 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.49%。

主要亮点

- 网路商务平台在全球的使用日益增长,导致了情境感知运算(CAC)的兴起。 CAC已经成为一种很有前景的技术,可以提高整个系统软体和硬体抵御网路攻击的能力。 CAC 和人工智慧(AI)为企业网路提供进阶安全性具有无限的可能性。例如,情境感知人工智慧 (CAAI) 可以减少误报和漏报的机会,并为网路分析师提供准确的结果。

- 此外,CAAI 还可以协助分析师将企业部门产生的大量资料浓缩为可操作的情报。这种 CAAI 能力对于操作全球企业所采用的巨量资料系统的网路专业人员来说至关重要。此外,情境感知人工智慧运算具有预测能力,这对于预测资料外洩和预防有害事件发生非常有用。

- 智慧型手机、平板电脑和个人电脑等行动装置的普及率不断提高,以及智慧型穿戴装置的推出预计将推动CAC市场的需求。情境感知是行动装置的特性,被定义为位置感知的补充。人工智慧与行动应用的融合也正在推动市场的发展。例如,人工智慧正迅速成为商业和科学领域最重要的方面之一,越来越多的主要企业对投资人工智慧表现出兴趣。

- 谷歌斥资 4 亿美元收购 DeepMind 是企业收购人工智慧技术兴趣日益浓厚的典型例子。此外,联网汽车、自动驾驶和自主汽车的发展预计将为汽车产业提供巨大的市场刺激。然而,计算的复杂性阻碍了市场扩张。

- 此外,行动运算的未来可能会为未来几年CAC市场的成长提供更多机会。然而,获取和传递特定的上下文和资讯可能会对不久的将来情境感知计算市场的成长带来各种挑战。

- 由于在家工作模式增加了对安全存取公司资料和网路的需求,COVID-19 疫情推动了情境感知运算市场的成长。此外,由于 5G 预计将提供强大且快速的网路连接,主要经济体推出 5G 预计将推动对先进运算技术的需求。

情境感知计算市场趋势

消费性电子领域可望强劲成长

- 智慧型手机和平板电脑的功能已远远超出了发送文字讯息和打电话的范畴;如今,它们还可充当个人导航仪、储存设备、游乐场和社交中心。

- 智慧型手机配备了各种先进的传感器,包括加速计、GPS(全球定位系统)、麦克风、磁力计和摄像头,因此可以将情境感知应用程式添加到这些设备内建的检测器中。 。

- 此外,智慧型手机的进步和计算能力的增强使开发人员能够创建创新的情境感知应用程序,识别任何情况或地点中用户相关的社交和认知行为。

- 您的智慧型手机会根据周围的光线调整萤幕亮度以优化可读性,这是情境感知技术的一个显着例子。由于市场上的每部智慧型手机都具备此功能,因此预计智慧型手机销量的增加将推动消费性电子设备对情境感知技术的需求。

北美可望主导市场

- 北美在人工智慧(AI)和机器学习(ML)技术方面占据主导地位,是情境感知运算最重要的市场之一。该市场的大部分主要供应商都位于美国,这使得该地区在技术创新方面具有优势。此外,该地区的政府越来越多地鼓励采用人工智慧、机器学习和情境感知技术,为市场供应商扩大在该地区的业务创造了机会。

- 该地区拥有一些最先进的情境感知计算技术用户和整合商。这些公司,包括Google等科技领导者、电子商务巨头亚马逊、Visa 等金融机构以及 Verizon 和 AT&T 等通讯巨头,都在利用科技改善客户服务和产品供应。

- 亚马逊、苹果、谷歌等公司的手錶、音箱等智慧型设备已进入北美市场。在该地区智慧家庭普及的推动下,智慧穿戴装置与物联网设备的日益融合预计将推动市场的发展。

情境感知计算行业概览

情境感知计算市场高度分散。由于参与者创建上下文感知应用程式介面(API)来开发创新的商业应用程序,市场竞争非常激烈。此外,许多参与者正在透过技术创新和发展进入市场。该行业的主要参与者包括 Google LLC、IBM Corporation、Microsoft Corporation、Cisco Systems Inc. 和 Oracle Corporation。

2022 年 4 月,IBM 宣布推出下一代系统 IBM z16,该系统整合了片上人工智慧 (AI) 加速器,可实现延迟优化的推理。这项创新旨在实现对信用卡、医疗保健和金融交易等即时交易的大规模分析。基于 IBM 在安全领域的领先地位,IBM z16 也专门设计用于帮助防御可能用于破解当今加密技术的近期威胁。

此外,2022 年 3 月, Oracle云端基础架构 (OCI) 推出了新的服务和功能,为客户提供弹性。 OCI 正在扩展 11 项新的运算、网路和储存服务和功能,以使客户能够以更低的成本更快、更安全地运行工作负载。新服务为客户提供了灵活的核心基础设施服务,可自动优化资源以满足应用需求,从而大幅降低成本。沃达丰、三星证券、GoTo 和考克斯汽车等全球企业依靠 OCI 运行各种工作负载,从微服务到人工智慧。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 将人工智慧融入行动应用程式

- 综合物联网服务的兴起

- 市场限制

- 计算复杂性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场区隔

- 按类型

- 硬体

- 软体

- 服务

- 按供应商(定性分析)

- 设备製造商

- 行动网路营运商

- 线上、网路和社交网路供应商

- 按最终用户产业

- BFSI

- 消费性电子产品

- 媒体与娱乐

- 车

- 卫生保健

- 通讯

- 物流与运输

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corp.

第七章投资分析

第八章 市场机会与未来趋势

The Context Aware Computing Market size is estimated at USD 70.94 billion in 2025, and is expected to reach USD 122.20 billion by 2030, at a CAGR of 11.49% during the forecast period (2025-2030).

Key Highlights

- Context-aware computing (CAC) has increased due to the growing use of Internet commerce platforms worldwide. CAC has emerged as a promising technology that can improve the system-wide capabilities of software and hardware to combat cyber-attacks. CAC and artificial intelligence (AI) has limitless potential for providing sophisticated security to company networks. For example, context-aware artificial intelligence (CAAI) can reduce the possibility of false positives and false negatives, delivering accurate results to network analysts.

- Furthermore, CAAI can assist analysts in condensing the vast volumes of data generated by the corporate sector into actionable intelligence. This CAAI capability is critical for network experts navigating big data systems adopted by businesses worldwide. Moreover, context-aware AI computing is equipped with predictive capabilities that can be extremely useful in anticipating data breaches and preventing adverse events well in advance.

- The increasing penetration of mobile devices such as smartphones, tablets, and PCs and the introduction of smart wearable devices are expected to drive demand in the CAC market. This is because contextual awareness is a property of mobile devices defined as complementing location awareness. AI integration into mobile apps is also propelling the market. AI, for example, is quickly becoming one of the most important aspects of both business and science, and more leading technology companies are showing interest in AI investment.

- Google's USD 400 million acquisition of DeepMind is a prime example of players' growing interest in acquiring AI technology. Furthermore, the automotive industry is expected to provide significant market stimulus due to the development of connected cars, self-driving, and autonomous vehicles. However, computational complexities are impeding market expansion.

- Furthermore, the future of mobile computing will provide additional opportunities for the CAC market to grow in the coming years. However, the specific contexts and information access and delivery may pose different challenges to the growth of the context-aware computing market in the near future.

- The COVID-19 pandemic outbreak aided the growth of the context-aware computing market, as work-from-home models increased demand for secure access to corporate data and networks. Furthermore, as 5G ensures strong and fast Internet connectivity, 5G rollouts in leading economies are expected to drive demand for advanced computing technologies.

Context Aware Computing Market Trends

Consumer Electronics Segment is Expected to Witness Significant Growth

- Smartphones and tablets have evolved far beyond the ability to send text messages or make phone calls, and they now serve as personal navigators, storage devices, arcades, and social hubs.

- Due to the reason that smartphones are equipped with a variety of sophisticated sensors, such as accelerometers, a global positioning system (GPS), microphones, magnetometers, and cameras, among others, adding context-aware applications to detectors equipped in such devices improves user experience.

- Furthermore, the evolution of smartphones and increasing computational power have enabled developers to create innovative context-aware applications that recognize user-related social and cognitive actions in any situation and location.

- The way smartphones respond to ambient light by adjusting screen brightness for optimal readability is a prominent example of context-aware technologies. Since this feature is available in every smartphone on the market, the rise in smartphone sales is expected to drive demand for context-aware technology in consumer electronics.

North America is Expected to Dominate the Market

- Because of its dominance in artificial intelligence (AI) and machine learning (ML) technologies, North America is one of the most important markets for context-aware computing. Most of the major market vendors are based in the United States, giving the region an advantage in innovation. Furthermore, regional governments are increasingly encouraging the adoption of AI, ML, and context-aware technologies, creating opportunities for market vendors to expand their presence in the region.

- The region is home to some of the most advanced users and integrators of context-aware computing technology. These companies include technology leaders like Google, e-commerce behemoth Amazon, financial institutions like Visa, and telecom behemoths like Verizon and AT&T, which have constantly incorporated this technology to improve customer service and product offerings.

- Amazon, Apple, and Google smart devices, such as watches and speakers, have made inroads into the North American market. The increased integration of smart wearables into IoT devices, fueled by the region's adoption of smart homes, is expected to boost the market.

Context Aware Computing Industry Overview

The context aware computing market is highly fragmented. Due to players creating context-aware application programming interface (API) for the development of innovative commercial applications, the market is becoming very competitive. Moreover, many players are entering the market with innovation and development. Some of the key players in the industry are Google LLC, IBM Corporation, Microsoft Corporation, Cisco Systems Inc., and Oracle Corporation.

In April 2022, IBM introduced the IBM z16, the company's next-generation system with an integrated on-chip artificial intelligence (AI) accelerator that enables latency-optimized inference. This innovation is intended to allow clients to analyze real-time transactions at scale, such as credit card, healthcare, and financial transactions. Building on IBM's security leadership, the IBM z16 is also explicitly designed to help protect against near-future threats that could be used to crack today's encryption technologies.

Furthermore, in March 2022, Oracle Cloud Infrastructure (OCI) launched new services and capabilities to give customers greater flexibility. OCI expanded with 11 new computing, networking, and storage services and capabilities, allowing customers to run workloads faster and more securely at a lower cost. New offerings provide customers with flexible core infrastructure services, automatically optimizing resources to match application requirements and significantly lowering costs. Global organizations such as Vodafone, Samsung Securities, GoTo, and Cox Automotive rely on OCI to run various workloads, from microservices to AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of Artificial Intelligence into Mobile Apps

- 4.2.2 Rise in Integrated IoT Offerings

- 4.3 Market Restraints

- 4.3.1 Computational Complexities

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 Vendor (Qualitative Analysis)

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online, Web, and Social Networking Vendors

- 5.3 End-user Industry

- 5.3.1 BFSI

- 5.3.2 Consumer Electronics

- 5.3.3 Media and Entertainment

- 5.3.4 Automotive

- 5.3.5 Healthcare

- 5.3.6 Telecommunication

- 5.3.7 Logistics and Transportation

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Google LLC

- 6.1.5 Oracle Corporation

- 6.1.6 Amazon Web Services Inc.

- 6.1.7 Verizon Communications Inc.

- 6.1.8 Samsung Electronics Co. Ltd

- 6.1.9 Intel Corp.