|

市场调查报告书

商品编码

1444851

应用交付网路 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Application Delivery Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

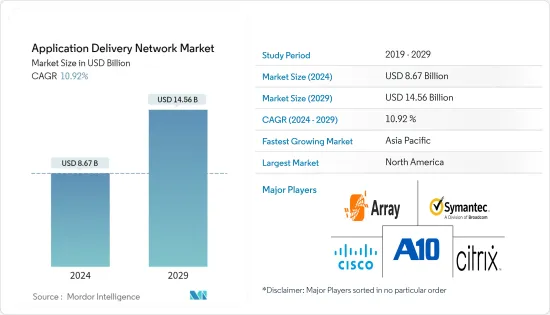

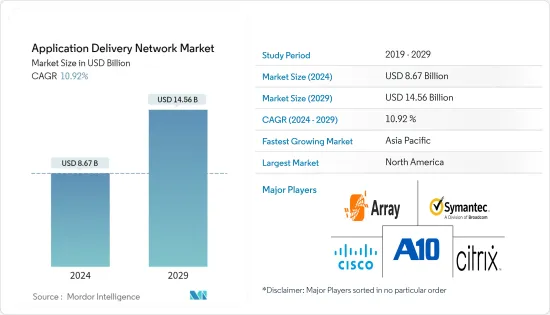

应用程式交付网路市场规模预计到 2024 年为 86.7 亿美元,预计到 2029 年将达到 145.6 亿美元,在预测期内(2024-2029 年)CAGR为 10.92%。

应用程式交付网路是指透过网路同时部署的服务集合,以提供从应用程式伺服器到应用程式最终用户的应用程式可用性、安全性、可见性和加速。应用交付网路包括 WAN 最佳化控制器 (WOC) 和应用程式交付控制器 (ADC)。

主要亮点

- 执行各种任务(例如负载平衡、复杂流量管理、SSL 加密、Web 应用程式防火墙、DDoS 防护、身份验证和 SSL VPN)的需求现在已成为应用程式交付不可或缺的元素。因此,应用程式交付网路在正在经历快速数位转型的最终用户产业中变得至关重要。

- 市场的一个重要驱动因素是云端中託管的应用程式数量的爆炸性增长,这给在多云环境中拥有大量应用程式组合的组织带来了部署和管理的挑战。

- 虚拟化是扩大 ADN 市场的另一个突出趋势。当企业寻求维护消费者和员工友善的介面,同时保持各种设备的一致性、安全性和控制时,应用程式交付网路发挥着至关重要的作用。桌面虚拟化、基于 Web 的应用程式和虚拟化行动应用程式的日益普及正在增加 ADN 的重要性,特别是在 BFSI、IT 和电信以及在以数据为中心的营运中数位化采用率最高的政府部门。

- 缺乏熟练劳动力以及缺乏标准和协议等因素限制了市场的成长。此外,复杂的整合系统以及与现有系统的整合是一项限製成长的艰鉅任务。

- 由于 COVID-19,全球数位转型计画正在推动多云和混合环境的快速采用,以服务客户并促进劳动力转型,特别是在最近在家工作 (WFH) 需求激增的情况下。

应用程式交付网路市场趋势

基于云端的交付见证最高成长

- 云端平台正在改善复杂的商业模式,同时也掌控更多的全球整合网路。云端平台特别适合不断变化的业务需求,并提供与本地解决方案相同的功能。

- 儘管传统的本地交付网路解决方案仍然拥有相当大的市场份额,但云端运算、SaaS 平台以及公有云和私有云的使用的持续趋势推动了基于云端的应用程式交付网路的普及。

- 由于云端储存只有在强大的应用程式交付网路的情况下才可行,因此最终用户和企业向云端储存的迁移预计将开闢巨大的市场前景。

- 此外,透过允许经常缺乏必要安全专业知识的企业 IT 团队将安全管理工作转移到云端,采用云端进行应用程式交付可以提高满足频宽激增的能力,同时为组织节省时间和资源。

- 由于基于云端的应用程式的快速扩展以及许多公司 BYOD 的成长趋势,预计应用程式交付网路市场将在整个预测期内出现显着增长。

亚太地区是成长最快的地区

- BYOD 趋势和不断扩大的云端运算采用预计将推动该领域的市场发展。随着公有云运算在中国的应用越来越广泛,许多企业正在将业务系统迁移到云端平台。

- 资料安全、租户隔离和存取控制问题已逐渐成为这些企业关注的首要问题。这些原因使得云端交付网路解决方案的增加成为可能。

- 此外,社交媒体企业和云端服务供应商应用程式的扩展以及资料中心利用率的提高。同时,更多公司转向云端服务将有助于该地区 ADN 市场的扩张。

- 此外,视讯、语音、ERP 和非结构化资料中不断变化的网路流量模式将为重要参与者提供在整个地区扩展其应用资料网路 (ADN) 并为其客户提供高品质服务的机会。

- 推动应用程式交付网路市场成长的主要因素之一是中国和印度对巨量资料、云端运算和虚拟化的需求不断增长,这增加了对有效、可靠的网路解决方案的需求。

- 随着其他金融机构采用这一趋势,对基于云端的应用程式交付服务的需求预计将会增加。同样,政府法律也促进了云端服务的扩展。

应用程式交付网路产业概况

应用程式交付市场竞争非常激烈,许多大大小小的参与者总是相互竞争。市场上的主要参与者正在利用技术创新来保持竞争优势。许多参与者正在采取併购等策略来维持自己的市场地位。一些主要参与者包括思科系统、Citrix 系统、赛门铁克公司和戴尔公司等。

- 2023 年 2 月 - 思科系统公司宣布了云端管理网路的创新,兑现了帮助客户简化 IT 营运的承诺。凭藉适用于工业物联网应用的强大的新型云端管理工具、用于融合IT 和OT 运营的简化仪表板以及用于查看和保护所有工业资产的灵活网络智能,思科提供了可提供真正业务敏捷性的统一体验。

- 2022 年 12 月 - A10 Networks, Inc 推出了 A10 Defend,这是一款试用软体即服务 (SaaS) 产品,它将威胁洞察与对网路资料的深入了解以及对攻击中使用的妥协指标的检查相结合。 A10 透过将与广泛的全球客户群打交道所获得的内部网路专业知识与网路安全研究相结合,对其客户的用例需求形成了独特且有用的见解。

- 2022 年 12 月 - 瞻博网路公司宣布与 Indonet 合作,帮助其网路基础设施实现自动化、现代化并促进体验优先的扩展。 Indonet 利用 Apstra 验证其最新资料中心的 EVPN/VXLAN 覆盖层和 IP 结构底层的设计、部署和操作,这两个资料中心均基于瞻博网路 QFX 系列交换机构建置。使用经过验证的范本和零接触配置可以减少部署时间并实现可靠的资料中心运营,从而使 Indonet 能够显着简化其资料中心网路的日常管理,并将它们无缝地统一在虚拟环境中。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 对应用程式效能扩展和安全性的需求不断增长

- 越来越多地采用基于云端的应用程式

- BYOD 趋势不断增加

- 市场限制

- 与云端相关的安全性问题

第 6 章:市场细分

- 依部署类型

- 本地部署

- 云

- 按企业规模

- 中小企业 (SME)

- 大型企业

- 按最终用户垂直领域

- BFSI

- 资讯科技和电信

- 卫生保健

- 政府

- 媒体与娱乐

- 其他最终用户垂直领域

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- Array Networks

- A10 Networks, Inc.

- Broadcom Inc. (Symantec Corporation)

- Cisco Systems Inc.

- Citrix Systems Inc.

- F5 Networks Inc.

- Kemp Technologies

- Avi Networks (Vmware)

- Radware Corporation

- Akamai Technologies

- Barracuda Networks Inc.

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Application Delivery Network Market size is estimated at USD 8.67 billion in 2024, and is expected to reach USD 14.56 billion by 2029, growing at a CAGR of 10.92% during the forecast period (2024-2029).

An Application Delivery Network refers to the collection of services deployed simultaneously over a network to offer application availability, security, visibility, and acceleration from application servers to application end users. Application delivery networking comprises WAN optimization controllers (WOCs) and application delivery controllers (ADCs).

Key Highlights

- The demand for performing various tasks, such as load balancing, complex traffic management, SSL encryption, web application firewall, DDoS protection, authentication, and SSL VPN, are now integral elements to application delivery. Thus, the application delivery network has gained vital importance across the end-user industries undergoing rapid digital transformation.

- A significant driver for the market is the explosive growth in the number of applications hosted in the cloud, which poses the challenges of deployment and management for organizations with a vast portfolio of applications in multi-cloud environments.

- Virtualization is another prominent trend augmenting the market for ADN. As enterprises seek to assert consumer and employee-friendly interfaces while maintaining uniformity, security, and control across various devices, the application delivery network plays a critical role. The growing adoption of desktop virtualization, web-based applications, and virtualized mobile applications is increasing the importance of ADN, particularly across the BFSI, IT and Telecom, and government sectors that have registered the highest adoption of digitization across their data-centric operations.

- The factors such as a lack of skilled workforce and the absence of standards and protocols limit the market growth. Also, complex integrated systems and the integration AND into the existing systems is a difficult task that confines the growth.

- Due to COVID-19, Digital transformation initiatives worldwide are driving rapid adoption of multi-cloud and hybrid environments to serve customers and facilitate workforce transformation, particularly with the recent surge in work-from-home (WFH) requirements.

Application Delivery Network Market Trends

Cloud-based Delivery to Witness the Highest Growth

- Complex business models are being improved by cloud platforms, which are also controlling more global integration networks. Cloud platforms are particularly adaptable to changing business needs and offer the same features as an on-premises solution.

- The popularity of cloud-based application delivery networking has been fueled by ongoing trends in cloud computing, SaaS platforms, and the use of public and private clouds, even though traditional on-premise delivery network solutions still have a sizable market share.

- Because cloud storage is only viable with a strong application delivery network, the migration of end users and businesses to cloud storage is anticipated to open up enormous market prospects.

- Moreover, By allowing enterprise IT teams, who frequently lack the necessary security expertise, to offload security management to the cloud, cloud adoption for application delivery improves the capacity to meet bandwidth surges while saving time and resources for the organization.

- The market for application delivery networks is anticipated to experience significant growth throughout the projected period due to the rapid expansion of cloud-based apps and the growing trend of BYOD in many companies.

Asia-Pacific is the Fastest Growing Region

- The BYOD trend and expanding cloud computing adoption are anticipated to fuel the market in this area. As public cloud computing becomes more widely used in China, many businesses are moving their business systems to cloud platforms.

- Data security, tenant isolation, and access control issues have steadily risen to the forefront of these businesses' concerns. Increased cloud delivery network solutions have been made possible by these causes.

- Moreover, the expansion of applications and the increased utilization of data centers by social media businesses and cloud service providers. Together with this, the expansion of the ADN market in this region would be aided by more companies switching to cloud services.

- Additionally, the constantly shifting web traffic patterns in video, voice, ERP and unstructured data would present opportunities for essential players to expand their application data networks (ADN) across the region and offer their clients high-quality services.

- One of the primary factors propelling the growth of the application delivery network market is the rising need for big data, cloud computing, and virtualization in China and India, which raises the need for effective and dependable web solutions.

- The need for cloud-based application delivery services is anticipated to rise as other financial institutions adopt the trend. Similarly, government laws have catalyzed expanding cloud services.

Application Delivery Network Industry Overview

The application delivery market is highly competitive, with many big and small players always competing against each other. The major players in the market are using technological innovations to stay ahead of the competition. Many players are adopting strategies like mergers and acquisitions to retain their position in the market. Some major players are Cisco systems, Citrix systems, Symantec Corp, and Dell Inc., among others.

- February 2023 - Cisco Systems Inc. announced innovations in cloud-managed networking, delivering on its promise to help customers simplify their IT operations. With powerful new cloud management tools for industrial IoT applications, simplified dashboards to converge IT and OT operations, and flexible network intelligence to see and secure all industrial assets, Cisco delivers a unified experience that provides true business agility.

- December 2022 - A10 Networks, Inc has launched A10 Defend, a trial software-as-a-service (SaaS) offering that combines threat insights with in-depth knowledge of network data with examinations of indicators of compromise used in attacks. A10 develops distinctive and useful insights into the use case requirements of its customers by combining internal networking expertise gained from dealing with a wide global customer base with cybersecurity research.

- December 2022 - Juniper Networks Inc has announced a collaboration with Indonet to help automate, modernize, and facilitate an experience-first expansion of its network infrastructure. Indonet utilized Apstra to validate the design, deployment, and operation of the EVPN/VXLAN overlay and IP fabric underlay of its latest data center, both built on Juniper QFX Series Switches. Using validated templates and zero-touch provisioning has resulted in reduced deployment times and reliable data center operations, allowing Indonet to significantly streamline the day-to-day management of its data center networks and unify them in a virtual environment seamlessly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Application Performance Scaling and Security

- 5.1.2 Growing Adoption of Cloud Based Applications

- 5.1.3 Increasing BYOD Trend

- 5.2 Market Restraints

- 5.2.1 Security Issues Associated with Cloud

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By Size of Enterprises

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunications

- 6.3.3 Healthcare

- 6.3.4 Government

- 6.3.5 Media & Entertainment

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Array Networks

- 7.1.2 A10 Networks, Inc.

- 7.1.3 Broadcom Inc. (Symantec Corporation)

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Citrix Systems Inc.

- 7.1.6 F5 Networks Inc.

- 7.1.7 Kemp Technologies

- 7.1.8 Avi Networks (Vmware)

- 7.1.9 Radware Corporation

- 7.1.10 Akamai Technologies

- 7.1.11 Barracuda Networks Inc.