|

市场调查报告书

商品编码

1444855

NLP - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)NLP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

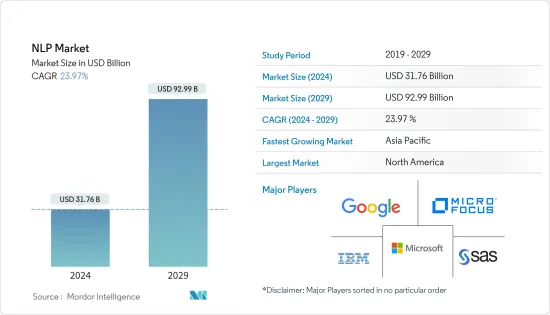

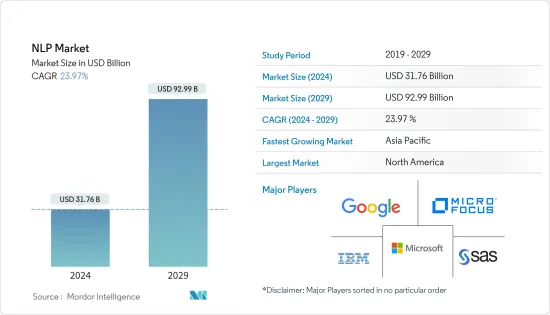

NLP 市场规模预计 2024 年为 317.6 亿美元,预计到 2029 年将达到 929.9 亿美元,预测期内(2024-2029 年)CAGR为 23.97%。

主要亮点

- 在过去的几年里,深度学习架构和演算法在影像辨识和语音处理方面取得了令人印象深刻的进展。自然语言处理(NLP)的应用做出了重大贡献,为一些复杂的 NLP 应用任务产生了最先进的结果。由于经济实惠、可扩展、运算能力强、资料数位化程度提高以及 NLP 与深度学习 (DL) 和机器学习 (ML) 的融合,NLP 在过去几年中取得了长足的发展。

- NLP 在医疗保健和呼叫中心中的使用不断增加、对高级文字分析的需求不断增长以及机器对机器技术的不断发展是该市场研究的主要因素。

- 随着许多组织使用该技术来摄取和分析大量患者资料,NLP 正在见证医疗中心的成长。此外,网路和连接设备的日益使用,以及大量的患者资料,正在推动所研究市场的成长。除此之外,迅速增加的资料安全问题,以及组织之间基于 NLP 的软体的可近性极低,正在阻碍产业扩张。

- 疫情期间,医疗保健产业市场快速成长。例如,为了因应 COVID-19 大流行,白宫和领先研究小组联盟准备了 COVID-19 开放研究资料集 (CORD-19)。 CORD-19 是一个包含超过 200,000 篇学术文章的资源,其中包括超过 100,000 篇关于 COVID-19、SARS-CoV-2 和相关冠状病毒的全文。这个免费提供的数据集已提供给全球研究界,以应用自然语言处理和其他人工智慧技术的最新进展,以产生支持对抗这种传染病的新见解。

自然语言处理市场趋势

大型组织预计将显着成长

- 大型组织是 NLP 市场的主要推动者和投资者之一。随着这些组织越来越多地在各种应用中采用深度学习以及监督和无监督机器学习技术,NLP 的采用可能会增加。成本和风险是推动大型组织采用这些技术的一些主要因素。

- 各行业的大多数大型最终用户组织主要利用这些技术来增强其内部和外部营运。而且,科技的投资报酬率有时只是以货币形式体现;因此,大多数小型组织发现投资有风险。

- 此外,大型社群媒体平台还利用文字分析和自然语言处理技术来监控和追踪社群媒体活动,例如政治评论和仇恨言论。 Facebook 和 Twitter 等平台正在这些工具的帮助下管理已发布的内容。由于网路资料对于有效行销和决策的重要性日益增加,因此预计对资讯撷取产品应用的需求也会增加。在未来几年内,行动聊天机器人预计将彻底改变行销和商业领域。

- 2022 年 9 月,语言内容提供者 Lexicala 为语言科技领域和学术研究推出了新的多语言词彙资料解决方案。自然语言处理 (NLP) 应用解决方案中包含领域分类、文本註释、专家平行语料库、形态学和其他优质跨语言资源。

北美将见证最高的市场成长

- 根据 RichRelevance 的数据,与其他平台相比,美国的线上购物者更倾向于使用 Google Assistant。此外,利用智慧扬声器在不同主题上获得结果越来越受欢迎,这反过来又有望迫使公司投资该技术。这为其他应用程式开发人员瞄准潜在客户创造了巨大的机会。

- NLP 还可以透过各种附加好处来增强客户体验计划,从而吸引更多的消费者,进而预计将对该国的市场成长产生积极影响。总部位于美国的全球参与者研究的市场中不断增长的创新正在推动 NLP 市场的进步,并推动该地区的产品发布速度。

- 例如,IBM Research AI 正在探索 NLP 在企业领域的各种应用。为此,该公司开发了三个项目,第一个是高级人工智慧,系统可以从更少的资料中学习,利用外部知识,并使用包括神经符号语言方法在内的技术,这些方法结合了神经和符号处理。第二个程式是一个分析人工智慧,重点是系统如何做出决策。第三是扩展AI,能够持续适应,更好地监控和测试系统,以支援企业严格期望下的语言系统部署。

- 2022 年 10 月,IBM 宣布与美国专利商标局 (USPTO) 合作,测试人工智慧驱动的智慧财产权 (IP) 分析工具,即带有 Watson 演示系统的 IBM IP Advisor。该演示系统将透过 IBM Watson Discovery 技术对查询进行自然语言处理,从而帮助客户利用自己的术语存取有用的信息,从而消除对特定单字和复杂程式的需求。

自然语言处理产业概述

自然语言处理市场竞争非常激烈,并由几家一直试图获得更大份额的主要参与者组成。这些在市场上占有显着份额的主要参与者一直致力于扩大其在国外的客户群。他们提供新的创新解决方案以及交易和合併,以增加市场份额和获利能力。主要参与者包括谷歌公司和微软公司。

2022 年 10 月,红帽和 IBM 启动了 Project Wisdom,该专案将自然语言处理 (NLP) 整合到开源 Ansible IT 营运自动化平台中。目标是让更多缺乏使用 YAML 檔案实现 IT 操作自动化所需的声明性程式设计技能的最终使用者和 IT 专业人员更容易实现 IT 自动化。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代产品的威胁

- COVID-19 对市场的影响

- 市场驱动因素

- 趋势从以产品为中心转向以客户为中心的体验

- 工业物联网 (IIoT) 对智慧型设备的需求不断增长

- 市场限制

- 整个行业缺乏熟练的专业人才

第 5 章:市场细分

- 按部署

- 本地部署

- 云

- 按组织规模

- 大型组织

- 中小型组织

- 按类型

- 硬体

- 软体

- 服务

- 按加工类型

- 文字

- 语音/声音

- 影像

- 按最终用户产业

- 教育

- BFSI

- 卫生保健

- 资讯科技和电信

- 零售

- 製造业

- 媒体和娱乐

- 其他最终用户产业

- 按地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 公司简介

- NVIDIA Corporation

- Intel Corporation

- Baidu Inc.

- Qualcomm Incorporated

- Texas Instrument

- Google Inc.

- Microsoft Corporation

- SAS Institute Inc.

- Verint System Inc.

- Adobe Inc.

第 7 章:投资分析

第 8 章:市场的未来

The NLP Market size is estimated at USD 31.76 billion in 2024, and is expected to reach USD 92.99 billion by 2029, growing at a CAGR of 23.97% during the forecast period (2024-2029).

Key Highlights

- Over the past few years, deep learning architectures and algorithms have made impressive advances in image recognition and speech processing. The application of natural language processing (NLP) has made significant contributions, yielding state-of-the-art results for some complex NLP application tasks. NLP has witnessed considerable growth over the past few years, owing to the affordable, scalable, and computational power, increased digitization of data, and the merger of NLP with deep learning (DL) and machine learning (ML).

- The increasing use of NLP in healthcare and call centers, rising demand for advanced text analytics, and growing machine-to-machine technology are the primary factors responsible for the market studied.

- NLP is witnessing growth in healthcare centers, as many organizations use the technology to ingest and analyze massive amounts of patient data. Additionally, the growing use of the internet and connected devices, along with the enormous volume of patient data, is driving the growth of the market studied. Apart from this, the rapidly increasing data security issues, along with the minimal accessibility of NLP-based software among organizations, are hampering industry expansion.

- During the pandemic, the market witnessed high growth in the healthcare sector. For instance, in response to the COVID-19 pandemic, the White House and a coalition of leading research groups prepared the COVID-19 Open Research Dataset (CORD-19). CORD-19 is a resource of over 200,000 scholarly articles, including over 100,000 with full text, about COVID-19, SARS-CoV-2, and related coronaviruses. This freely available dataset was provided to the global research community to apply recent advances in natural language processing and other AI techniques to generate new insights supporting the fight against this infectious disease.

Natural Language Processing Market Trends

Large Organizations Expected to Register Significant Growth

- Large organizations are one of the primary drivers and investors in the NLP market. As these organizations were increasingly adopting deep learning and supervised and unsupervised machine learning technologies for various applications, the adoption of NLP is likely to increase. Cost and risk are some of the major factors driving the adoption of these technologies among large organizations.

- Most large end-user organizations across various industries mainly utilize these technologies to enhance their internal and external operations. Moreover, the ROI of the technology is only sometimes in the monetary form; hence, most small organizations find it risky to invest.

- Moreover, large-scale social media platforms also utilize text analytics and NLP technologies to monitor and track social media activities, such as political reviews and hate speeches. Platforms like Facebook and Twitter are managing published content with the help of these tools. The demand for information extraction product applications is also anticipated to increase due to the growing importance of web data for effective marketing and decision-making. Within the next few years, mobile chatbots are anticipated to revolutionize the marketing and commerce sectors.

- In September 2022, Lexicala, a language content provider, introduced new multilingual lexical data solutions for the Language Technology sector and academic research. Domain categorization, text annotation, expert parallel corpora, morphology, and other premium cross-lingual resources are included in the solutions for natural language processing (NLP) applications.

North America to Witness the Highest Market Growth

- According to RichRelevance, online shoppers in the United States are more inclined to use Google Assistant than other platforms. Additionally, the utilization of smart speakers to obtain results on diverse topics is gaining increasing popularity, which, in turn, is expected to compel companies to invest in the technology. This creates an immense opportunity for other application developers to target potential customers.

- NLP may also enhance the customer experience programs with various added benefits, thereby attracting more consumers, which, in turn, is projected to have a positive impact on the market growth in the country. The growing innovations in the market studied by the global players based in the United States are bringing advancement into the NLP market and fueling the rate of product launches in the region.

- For instance, IBM Research AI is exploring various applications of NLP for enterprise domains. For this, the company developed three programs, the first being advanced AI, where systems can learn from fewer amounts of data, leverage external knowledge, and use techniques that include neuro-symbolic approaches to language, which combine neural and symbolic processing. The second program is an analyzing AI, which focuses on how a system reaches a decision. The third is scaling AI, which enables continuous adaptation, and better monitoring and testing of systems, in order to support the deployment of language systems under the rigorous expectations of enterprises.

- In October 2022, IBM announced a collaboration with the United States Patent and Trademark Office (USPTO) to test AI-driven intellectual property (IP) analysis tool, the IBM IP Advisor with Watson Demonstration System. The Demonstration System would assist customers in accessing useful information utilizing their own terminology by allowing natural language processing of queries with IBM Watson Discovery technology, eliminating the need for specific words and complex procedures.

Natural Language Processing Industry Overview

The Natural Language Processing Market is highly competitive and consists of several major players who have been trying to gain larger shares. These major players with prominent shares in the market have been focusing on expanding their customer base across foreign countries. They are providing new innovative solutions, along with deals and mergers, to increase their market shares and profitability. Key players include Google Inc. and Microsoft Corporation.

In October 2022, Red Hat and IBM launched Project Wisdom, a project to integrate natural language processing (NLP) into the open-source Ansible IT operations automation platform. The objective is to make IT automation more accessible to a larger spectrum of end users and IT professionals who lack the declarative programming skills required to automate IT operations using YAML files.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Shifting Trend from Product-centric to Customer-centric Experience

- 4.5.2 Increasing Demand for Smart Devices Across Industrial Internet of Things (IIoT)

- 4.6 Market Restraints

- 4.6.1 Lack of Skilled Professionals Across the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Organizations

- 5.2.2 Small and Medium Organizations

- 5.3 By Type

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Processing Type

- 5.4.1 Text

- 5.4.2 Speech/Voice

- 5.4.3 Image

- 5.5 By End-user Industry

- 5.5.1 Education

- 5.5.2 BFSI

- 5.5.3 Healthcare

- 5.5.4 IT and Telecom

- 5.5.5 Retail

- 5.5.6 Manufacturing

- 5.5.7 Media and Entertainment

- 5.5.8 Other End-User Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia-Pacific

- 5.6.4 Latin America

- 5.6.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NVIDIA Corporation

- 6.1.2 Intel Corporation

- 6.1.3 Baidu Inc.

- 6.1.4 Qualcomm Incorporated

- 6.1.5 Texas Instrument

- 6.1.6 Google Inc.

- 6.1.7 Microsoft Corporation

- 6.1.8 SAS Institute Inc.

- 6.1.9 Verint System Inc.

- 6.1.10 Adobe Inc.