|

市场调查报告书

商品编码

1444856

全球网路切片市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Network Slicing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

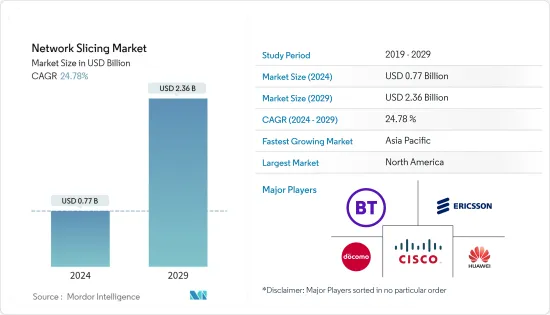

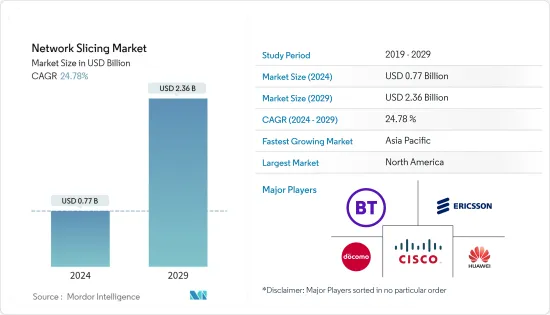

根据预测,2024年全球网路切片市场规模预计为7.7亿美元,2029年将达到23.6亿美元,在预测期内(2024-2029年)复合年增长率为24.78%。

据 GSMA 称,到 2025 年,网路切片与其他推动因素和功能相结合将使通讯业者能够抓住价值 3000 亿美元的商机。

主要亮点

- 将5G网路与网路切片结合将使企业客户能够享受根据其特定业务需求量身定制的连接和资料处理,并满足与行动电话营运商达成的服务等级协定(SLA)。可自订的网路功能包括资料速度、延迟、品质、安全性和服务。因此,随着高速网路覆盖需求的成长,市场将开闢新的途径。

- 然而,由于频宽低和基础设施缺乏,5G 在新兴国家正在努力追赶。例如,两年前启动的印度智慧城市计画一直难以取得太大进展。除了众多的当地监管和结构性挑战之外,实现智慧城市愿景还需要提供更多频谱,甚至更合适的频宽。

- 物联网的普及以及连接所有类型设备、系统和服务的机器对机器 (M2M)通讯网路的不断改进正在改变各个行业。 5G 透过网路切片实现的众多用例之一是物联网,它提供大量感测器和连结设备之间的通讯。高功耗、低延迟应用(例如行动视讯监控)和低功耗、低延迟、远距物联网应用是物联网应用需求(智慧城市和智慧工厂)的两大类。 5G技术预计将加速演进,以满足物联网应用成长的需求,物联网应用的特点是海量机器类通讯和关键任务应用。

- 然而,网路切片的安全性可能会为企业和服务供应商带来重大损失,也是CIO们最关心的问题。 SDN、NFV和云端原生架构都被用来建构新的网路基础架构。网路功能分布在本地、区域和中央资料中心,并与支援基础设施分离。基于云端的5G网路中的大部分网路服务将透过公共云端和私有云端基础设施来实现。

- 由于零售、通讯、IT 和医疗保健等许多行业行动网路和远端存取服务的扩展,此次疫情显着增加了对宽频服务的需求。此外,随着世界各地的企业开始重新开业,通讯服务供应商正在重新关注 5G 部署并加强网路切片。此外,COVID-19 增加了人们对机器人、远端医疗、远端教育和远端办公室等 5G 用例的兴趣,所有这些都为网路切片市场做出了贡献。

网路切片市场趋势

医疗保健产业主导市场

- 从家庭临床诊断医疗设备到医院价值数百万美元的影像处理系统,数以百万计的医疗设备越来越需要连接作为关键的付加功能。爱立信预计,希望透过 5G 实现医疗保健转型的通讯业者将在 2026 年看到 760 亿美元的商机。

- 这使得医疗保健领域在影像、诊断和资料分析方面出现了许多新方法。例如,医院可以透过客製化的 5G 网路切片使用虚拟实境来安排远端机器人手术,就好像外科医生就在患者旁边一样。

- 它还可用于医疗资料管理,例如维护电子健康记录和引入救护无人机。医疗设备製造商可以利用5G即时监控产品功能,提供预防性和预测性维护协助,并防止设备故障带来的负面后果。医疗保健领域的某些关键应用需要非常低的延迟和非常稳定的频宽。

- 欧洲电讯网路营运商协会预测,到 2025 年,医疗保健领域的物联网连线数量将达到 103.4 亿个。这是透过医疗物联网 (IoMT) 实现的,医疗物联网是一个由互连的医疗设备、软体程式和医疗系统组成的网路。使用边缘运算和 5G 无线技术在更靠近来源的位置处理资料。

- 根据 ETNO(欧洲电讯网路营运商协会)的一项研究,活跃的物联网医疗保健连接数量预计将逐年增加。 2016年连线数为87万,预计到2025年将达到1034万。

亚太地区将经历最高的成长

- 网路切片产业预计将在中国、印度和日本等亚太地区新兴经济体迅速扩张。这些国家一贯鼓励和支持工业和技术进步。它还拥有先进的技术基础设施,有助于在各个业务领域采用网路切片解决方案。越来越多地使用云端基础的解决方案、物联网、巨量资料分析和行动性等尖端技术正在推动亚太地区网路产业的发展。亚太地区是连网型设备最大的市场之一。

- 由于网路基础设施的发展和最大的通讯趋势5G,亚太地区预计将以最快的速度成长。据GSMA称,亚太地区行动电话计划在2022年至2025年间花费2,270亿美元用于5G部署。这是一笔金额,而且有望产生巨大影响。这些新网路不仅将实现创新的新消费服务,还将支持商业和製造业转型并推动经济成长。

- 随着亚太地区从疫情中恢復过来,互联互通对于重组亚太地区经济并提高其抵御未来衝击的能力至关重要。 5G网路、云端服务、边缘运算、人工智慧(AI)、巨量资料和物联网对于充分发挥疫情后数位经济的潜力至关重要。

- 5G的网路切片功能将使电信业者能够为关键服务供应商提供自己的私人5G网络,以提供安全、即时的云端连接,满足不断变化的基础设施需求,并可以提高营运效率。

- 将 5G 网路切片添加到目前的技术堆迭中,即与专用网路和多接取边缘运算(MEC) 等技术相结合,预计将增加其使用量并获得收益。随着5G进入大众市场阶段,收益将进一步提高。凭藉更具适应性的即时营运和业务支援系统(OSS/BSS)功能,行动电话营运商的可能性开始显现。

网路切片产业概况

网路切片市场是分散的,各公司共同努力提供所需的可用性、指定的延迟、资料速率和安全性。网路切片管理解决方案还可协助通讯业者在5G准备过程中实现网路切片生命週期管理。主要企业包括爱立信公司、华为技术公司、思科系统公司和英国电信集团有限公司。

- 2022 年 11 月 - 为了将安全性、SD-WAN 和零信任融入无线 WAN架构中,Cradlepoint 推出了新的「支援网路切片」的5G 最佳化解决方案,作为其今年早些时候宣布的NetCloud Exchange 解决方案的一部分,宣布推出完全整合的SD-WAN 。组织现在可以使用 NetCloud Exchange 建置「编排到 5G 独立 (SA) 网路定义的切片实例中的众多调变解调器 WAN 介面」。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 对高速和大网路覆盖的需求不断增长是主要驱动力

- 市场限制因素

- 新兴国家5G普及率低对市场成长构成挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按用途

- 即时监控

- 网路功能虚拟

- 按服务

- 专业的

- 管理

- 按最终用途行业

- 卫生保健

- 车

- 电力和能源

- 航空

- 媒体和娱乐

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Ericsson Inc.

- Huawei Technologies Co. Ltd

- Cisco Systems Inc.

- BT Group PLC

- NTT DOCOMO Inc.

- NEC Corporation

- ZTE Corporation

- CloudStreet Ltd(Nokia Networks)

- Mavenir Inc.

- Affirmed Networks Inc.

- Argela Technologies

- Aria Networks Ltd

第七章 投资分析

第八章市场机会及未来趋势

The Network Slicing Market size is estimated at USD 0.77 billion in 2024, and is expected to reach USD 2.36 billion by 2029, growing at a CAGR of 24.78% during the forecast period (2024-2029).

According to GSMA, network slicing, in combination with other enablers and capabilities, will aid operators in addressing a revenue opportunity worth USD 300 billion by 2025.

Key Highlights

- 5G networks, in combination with network slicing, allow business customers to enjoy connectivity and data processing that are tailored to the specific business requirements and adhere to a Service Level Agreement (SLA) as agreed with the mobile operator. Customizable network capabilities include data speed, latency, quality, security, and services. Thus as the demand for high-speed network coverage is progressing, it will open new avenues for the market.

- However, 5G is struggling to keep pace in emerging economies due to low bandwidth and a lack of infrastructure. For instance, India's smart city initiative launched two years ago has struggled to make significant progress. Beyond the numerous local regulatory and structural challenges, there needs to be more spectrum or even the right spectrum bands available for the smart city vision to be realized.

- Various industries are being transformed by the widespread use of IoT and ongoing improvements in Machine-to-Machine (M2M) communication networks, which are connecting all different kinds of equipment, systems, and services. One of the many use cases that network slicing-enabled 5G will allow is the Internet of Things, which would provide communication between a significant number of sensors and linked devices. High-power, low-latency applications (such as mobile video surveillance) and low-power, low-latency, long-range IoT applications are two categories of IoT application requirements (smart cities and smart factories). To meet these needs for growing IoT applications, which are characterized as huge machine-type communication and mission-critical applications, the evolution of 5G Technology is anticipated to pick up speed.

- However, Network slicing security, which may cause significant losses for enterprises and service providers, is a major worry for CIOs. SDN, NFV, and cloud-native architecture have all been used to construct the new network infrastructure. Network functions are spread across local, regional, and central data centers and are decoupled from supporting infrastructure. The vast majority of network services in a 5G network based on the cloud are implemented through public and private cloud infrastructure.

- With the aid of expanding mobile networking and remote access services in a number of industries, including retail, telecom, IT, and healthcare, the pandemic has considerably driven demand for broadband services. Additionally, as businesses all around the world have begun to reopen, communications service providers are refocusing on 5G rollouts and stepping up their network-slicing efforts. Additionally, COVID-19 has increased interest in 5G use cases, including robotics, telemedicine, remote education, and remote offices, all contributing to the network-slicing market.

Network Slicing Market Trends

Healthcare Sector to Dominate the Market

- Millions of medical devices, from at-home clinical diagnostic equipment to hospital-based multimillion-dollar imaging systems, increasingly demand connectivity as a key value-added feature. Ericsson estimates a USD 76 billion revenue opportunity in 2026 for operators addressing healthcare transformation with 5G.

- It will enable many new approaches in the healthcare sector in terms of imaging, diagnosis, and data analytics. For instance, hospitals could arrange remote robotic surgeries, as if the surgeon is right next to the patient, using virtual reality via a customized 5G network slice.

- Also, it can be used in medical data management by maintaining electronic health records or introducing ambulance drones. Medical device makers can utilize 5G to monitor their products' functionality in real-time, providing proactive and predictive maintenance assistance and preventing negative outcomes brought on by faulty equipment. Certain crucial applications in healthcare demand extremely low latency and highly stable bandwidth.

- European Telecommunications Network Operator's Association forecasts that the number of IoT connections in healthcare will reach 10.34 billion by 2025. This is made feasible by the Internet of Medical Things (IoMT), a network of interconnected medical equipment, software programs, and health systems that use edge computing and 5G wireless technology to process data close to the source.

- According to an ETNO-European Telecommunications Network Operators' Association survey, the number of IoT healthcare active connections was expected to increase through the years. It was at 0.87 million connections in 2016 and is expected to reach 10.34 million by 2025.

Asia-Pacific to Witness the Highest Growth

- Several developing economies in APAC, including China, India, and Japan, are anticipated to have rapid expansion in the network-slicing industry. These nations have consistently encouraged and supported the advancement of industry and technology. They also have a sophisticated technological infrastructure that is encouraging the adoption of network-slicing solutions in various business sectors. The increased use of cloud-based solutions, cutting-edge technologies like the IoT, big data analytics, and mobility are what is driving the network industry in APAC. One of the largest markets for connected devices is in APAC.

- APAC is expected to grow at the fastest rate owing to the development of network infrastructure and 5G being the biggest telecom trend. According to GSMA, the Asia Pacific area mobile operators plan to spend USD 227 billion between 2022 and 2025 on 5G deployments. That is a significant sum of money and will have a significant effect. In addition to enabling innovative new consumer services, these new networks are assisting in the transformation of business and manufacturing as well as promoting economic growth.

- Connectivity will be essential to rebuilding Asia-economies Pacific and making them more resilient to future shocks as the region attempts to recover from the pandemic. In order to fully realize the potential of a post-pandemic digital economy, 5G networks, cloud services, edge computing, artificial intelligence (AI), big data, and the Internet of Things will all be crucial.

- 5G's network slicing capabilities will allow telcos to offer critical service providers their own private 5G networks for secure and real-time connectivity to the cloud, helping to meet their ever-evolving infrastructure needs and improve operational efficiency.

- It is expected to increase and will profit from the addition of 5G network slicing to the current technology stack, i.e., together with private networks, Multi-access Edge Computing (MEC), etc. As 5G enters the mass-market phase, the monetization potential for mobile operators is beginning to take shape along with more adaptable and real-time Operations Support System and Business Support System (OSS/BSS) capabilities.

Network Slicing Industry Overview

The Network Slicing Market is fragmented, with players collaborating to provide the required availability, a specified latency, data rate, and security. Network slice management solutions can also help carriers implement network slice lifecycle management in the preparation of 5G. Some major players are Ericsson Inc., Huawei Technologies Co. Ltd, Cisco Systems Inc., and BT Group PLC.

- November 2022 - To include security, SD-WAN, and zero trust into a wireless WAN architecture, Cradlepoint unveiled a new "network slicing-ready" 5G-optimized SD-WAN as part of the company's NetCloud Exchange solution it unveiled earlier this year. Organizations can now construct "many modem WAN interfaces aligned to slice instances defined by 5G standalone (SA) networks" using NetCloud Exchange.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand For High-speed And Large Network Coverage is Major Driving Force

- 4.4 Market Restraints

- 4.4.1 Low 5G Penetration in Emerging Economies is Challenging the Market Growth

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Real-Time Surveillance

- 5.1.2 Network Function Virtualization

- 5.2 By Service

- 5.2.1 Professional

- 5.2.2 Managed

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Automotive

- 5.3.3 Power & Energy

- 5.3.4 Aviation

- 5.3.5 Media & Entertainment

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ericsson Inc.

- 6.1.2 Huawei Technologies Co. Ltd

- 6.1.3 Cisco Systems Inc.

- 6.1.4 BT Group PLC

- 6.1.5 NTT DOCOMO Inc.

- 6.1.6 NEC Corporation

- 6.1.7 ZTE Corporation

- 6.1.8 CloudStreet Ltd (Nokia Networks)

- 6.1.9 Mavenir Inc.

- 6.1.10 Affirmed Networks Inc.

- 6.1.11 Argela Technologies

- 6.1.12 Aria Networks Ltd