|

市场调查报告书

商品编码

1444888

智慧废弃物管理 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Smart Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

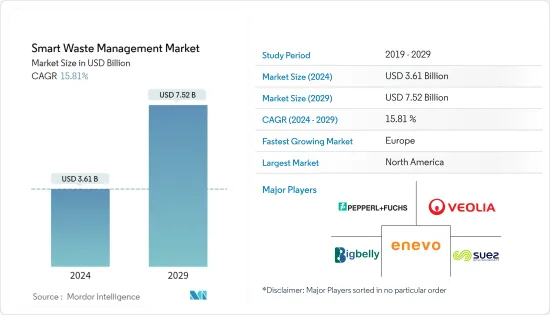

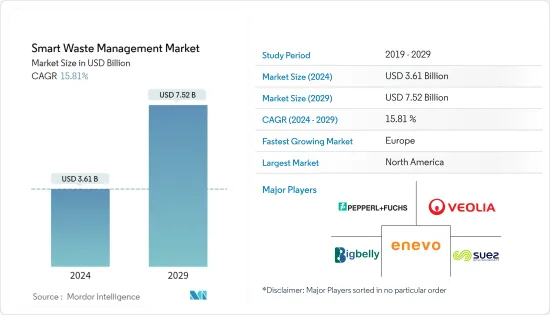

智慧废弃物管理市场规模预计到 2024 年为 36.1 亿美元,预计到 2029 年将达到 75.2 亿美元,在预测期内(2024-2029 年)CAGR为 15.81%。

根据世界银行的数据,全球每年产生约 13 亿吨废弃物。这一增长可归因于各地区快速的城市化和工业化。

主要亮点

- 智慧废弃物管理市场正变得越来越有吸引力,支持市场扩张。智慧废弃物管理市场的发展得到了包括即时废弃物管理系统的一次性标籤、容器和吸尘器等产品的帮助。废弃物管理系统的使用不断增加也是环境问题日益严重的结果。

- 智慧废弃物管理是发展智慧城市(以及水管理、能源管理、交通管理等)以改善城市地区生活方式的关键面向。各地区越来越多地采用智慧城市倡议,支持了智慧废弃物管理市场的成长。

- 废弃物管理行业涉及各种活动,例如收集、运输、处置和回收。该行业在废弃物管理的不同阶段一直面临效率问题。准确地说,营运成本与废弃物的收集和运输相对应,从而导致越来越多地采用智慧废弃物管理。

- 废弃物收集物流的日益复杂性以及遵守废弃物处理相关法规的需要需要更好的废弃物管理解决方案,而这些解决方案可以透过使用物联网感测器、RFID、GPS 等技术来实现。目前正处于起步阶段,由于商业上可行的技术和营运效益的存在,预计将实现健康成长。

- 由于阻止病毒传播所需的严格封锁和社会隔离,COVID-19 对智慧废弃物管理市场产生了不利影响。对与智慧废弃物管理技术结合使用的设备和仪器的需求受到不确定的经济环境、部分企业关闭和消费者信心不佳的影响。疫情期间,供应链和物流运作都受到阻碍。然而,由于政府持续采取的措施和监管的放鬆,预计智慧垃圾管理产业将在疫情后的环境中加速发展。

智慧废弃物管理市场趋势

透过物联网进行智慧垃圾收集,促进市场成长

- 推动智慧废弃物管理市场的关键因素之一是,由于智慧城市的创建,为城市地区提供了更好的生活质量,因此对智慧废弃物管理的需求不断增长——此外,市场受益于跨地区采用智慧城市倡议。

- 在智慧收集领域,物联网的出现彻底改变了废弃物处理公司的营运成本,并解决了这些问题。提供垃圾收集智慧解决方案的公司主要专注于三种解决方案—智慧监控、路线优化和分析。透过部署感测器、网路基础设施和资料视觉化平台,废弃物管理公司已经能够产生可行的见解,从而做出明智的决策。

- 透过在垃圾箱附近使用液位感测器(有时还有摄影机),公司能够根据垃圾箱中的垃圾量来规划车队卡车,从而减少不必要的车队燃料消耗,并有助于减少城市的碳排放。此外,使用物联网,车队营运可能比以往更有效率。例如,物联网支援的车队管理解决方案是 Evreka 的车队管理软体。此外,这种方法将为管理者和员工提供一个结构化的环境。

- 美国、阿拉伯联合大公国、英国等一些城市的市政当局与智慧垃圾管理创新者(如 Enevo、Smartbin、Bigbelly 等)合作,节省了约 30% 的垃圾收集成本。由于商业技术提供者的存在,加上智慧城市计画和物联网感测器成本的下降,市场正在被推动强劲成长。

北美将占据最大市场份额

- 美国智慧城市越来越频繁地使用智慧废弃物管理解决方案来解决废弃物收集和处置问题,预计将促进市场销售。此外,北美地区减少碳排放的严格规定预计将在未来几年推动市场销售。政府加大力度促进永续发展和实现净零废弃物,将继续推动该地区的需求。

- 美国和加拿大约 22% 的城市已经实施了战略计划,而全球这一比例仅为 7%。光是美国就占了每年产生的垃圾的大部分,大约有 2.3 亿吨垃圾,其中很大一部分是由私人实体处理的。由于政府提倡永续发展、到 2020 年实现零废弃物的倡议,以及智慧城市倡议在城市高度集中地区的渗透,预计北美将占据智慧废弃物管理市场的最大份额。

智慧废弃物管理产业概述

由于少数参与者占据主要市场份额,智慧废弃物管理市场得到整合。此外,人们需要提高认识,这使得参与者进入市场变得具有挑战性。市场上一些主要的参与者包括苏伊士环境服务公司、威立雅环境服务公司、Enevo、倍加福有限公司、Smartbin (OnePlus Systems Inc.)、IBM公司、Bigbelly Inc.、Covanta Holding Corporation等。

- 2022 年 2 月 - 永续废弃物和能源解决方案供应商卡万塔 (Covanta) 与李县固体废弃物资源回收设施之间的公私关係将持续到 2031 年。

- 2022 年 9 月 - Smarter Sorting 新创公司与 Republic Services, Inc. 合作,进入废弃物管理市场并提高其产品的可持续性。使用资料库对废弃物进行正确分类并根据其类别进行分类。因此,进一步废弃物管理所需的时间和金钱都减少了。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 市场定义和范围

- 研究假设

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业利害关係人分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场动态

- 市场驱动因素

- 增加废弃物量以提振市场

- 智慧城市的不断采用促进市场繁荣

- 市场挑战

- 实施成本高昂

- Covid-19 对全球智慧废弃物管理整体市场的影响

第 6 章:技术概览

- 技术概览

- 智慧废弃物管理阶段

- 智慧收藏

- 智慧处理

- 智慧能源回收

- 智慧处置

第 7 章:市场细分

- 按解决方案

- 车队的管理

- 远端监控

- 分析

- 依废物类型

- 工业废料

- 生活垃圾

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 澳洲

- 日本

- 亚太其他地区

- 世界其他地区

- 北美洲

第 8 章:竞争格局

- 公司简介

- Suez Environmental Services

- Veolia Environmental Services

- Enevo

- Smartbin (OnePlus Systems Inc.)

- Bigbelly Inc.

- Covanta Holding Corporation

- Evoeco

- Pepperl+Fuchs GmbH

- IBM Corporation

- BIN-e

第 9 章:投资分析

第 10 章:市场机会与未来趋势

The Smart Waste Management Market size is estimated at USD 3.61 billion in 2024, and is expected to reach USD 7.52 billion by 2029, growing at a CAGR of 15.81% during the forecast period (2024-2029).

According to the World Bank, across the globe, about 1.3 billion metric tons of waste is generated every year. This increase can be attributed to rapid urbanization and industrialization across regions.

Key Highlights

- The Smart Waste Management Market is becoming more appealing, supporting market expansion. The development of the smart waste management market has been aided by products like disposable tags, containers, and vacuum cleaners that include real-time waste management systems. The rising use of waste management systems also results from growing environmental concerns.

- Smart waste management is a key aspect in developing smart cities (along with water management, energy management, traffic management, etc.) to provide improved lifestyles in urban areas. The increasing adoption of smart city initiatives across regions supports the growth of the smart waste management market.

- The waste management industry involves various activities, such as collection, transportation, disposal, and recycling. The industry has been facing efficiency issues at different stages of waste management. Precisely, the operational costs correspond to the collection and transport of the waste, thereby leading to the increasing adoption of smart waste management.

- The growing complexity in the logistics of waste collection and the need to comply with regulations pertaining to waste processing demand better waste management solutions, which are made possible by using technologies such as IoT sensors, RFID, GPS, etc. Although the smart waste management market is at a nascent phase, it is expected to witness healthy growth, owing to the availability of commercially viable technologies and operational benefits.

- Due to the tight lockdowns and social isolation necessary to stop the virus's transmission, COVID-19 had a detrimental effect on the market for smart waste management. The demand for equipment and instruments used in conjunction with smart waste management technologies was influenced by the uncertain economic climate, the partial corporate shutdown, and poor consumer confidence. During the epidemic, the supply chain was impeded along with logistics operations. However, due to the government's ongoing measures and relaxation of the regulations, the smart waste management industry is anticipated to pick up steam in the post-pandemic environment.

Smart Waste Management Market Trends

Smart Waste Collection Through IoT to Contribute to the Market Growth

- One of the key factors propelling the smart waste management market is the rise in demand for smart waste management due to the creation of smart cities that offer a better quality of life in urban areas-additionally, the market benefits from adopting smart city initiatives across regions.

- In the smart collection segment, the emergence of IoT has revolutionized and addressed operational costs for waste-handling companies. The companies that offer smart solutions for waste collection primarily focus on three solutions - intelligent monitoring, route optimization, and analytics. By deploying sensors, network infrastructure, and data visualization platforms, waste management companies have been able to generate actionable insights, to make informed decisions.

- By using fill-level sensors (sometimes also cameras) near the trash bins, companies have been able to plan the fleet trucks following the volume of trash in bins, thus reducing unnecessary fleet fuel consumption and contributing to reducing carbon emissions in cities. Also, fleet operations may be more productive than ever using IoT. For instance, a Fleet Management Solution backed by IoT is Evreka's Fleet Management Software. Additionally, this approach will give managers and workers a structured environment.

- The municipalities of a few cities across the United States, United Arab Emirates, United Kingdom, etc., in collaboration with smart waste management innovators (such as Enevo, Smartbin, Bigbelly, etc.), are saving around 30% of waste collection costs. Due to the presence of commercially available technology providers, coupled with smart city initiatives and decreasing cost of IoT sensors, the market is being pushed toward robust growth.

North America to Account for the Largest Market Share

- Smart waste management solutions are being used more frequently by smart cities in the U.S. to solve issues with waste collection and disposal, which is anticipated to boost market sales. Additionally, strict rules governing reducing carbon emissions across North America are expected to drive market sales in the following years. The government's increasing efforts to promote sustainability and achieve net-zero waste will keep driving up demand in the area.

- Approximately 22% of the cities in the United States and Canada have already been implementing strategic programs, compared to just 7% of cities worldwide. The United States alone contributes the majority of the annual waste produced, with approximately 230 million metric tons of trash, a significant chunk of which is handled by private entities. Owing to government initiatives that promote sustainability, to achieve zero waste by 2020, and the penetration of smart city initiatives across the high urban concentration region, North America is expected to account for the lion's share in the Smart Waste Management Market.

Smart Waste Management Industry Overview

The Smart Waste Management Market is consolidated due to a few players having a major market share. Moreover, the need for more awareness among the people is making it challenging for the players to enter the market. Some of the key players in the market are Suez Environmental Services, Veolia Environmental Services, Enevo, Pepperl+Fuchs GmbH, Smartbin (OnePlus Systems Inc.), IBM Corporation, Bigbelly Inc., Covanta Holding Corporation, among others.

- February 2022 - The public-private relationship between Covanta, a sustainable waste and energy solutions provider, and the Lee County Solid Waste Resource Recovery Facility will last until 2031.

- September 2022 - Smarter Sorting start-up teams up with Republic Services, Inc. to enter the waste management market and increase the sustainability of its products. The waste is sorted correctly and classified based on its category using a database. Consequently, the time and money required for further waste management are reduced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes Of Waste to boost the market

- 5.1.2 Rising Adoption of Smart Cities to flourish the market

- 5.2 Market Challenges

- 5.2.1 High Costs of Implementation

- 5.3 Impact of Covid-19 on overall global smart waste management market

6 Technology Snapshot

- 6.1 Technology Overview

- 6.2 Smart Waste Management Stages

- 6.2.1 Smart Collection

- 6.2.2 Smart Processing

- 6.2.3 Smart Energy Recovery

- 6.2.4 Smart Disposal

7 MARKET SEGMENTATION

- 7.1 By Solution

- 7.1.1 Fleet Management

- 7.1.2 Remote Monitoring

- 7.1.3 Analytics

- 7.2 By Waste Type

- 7.2.1 Industrial Waste

- 7.2.2 Residential Waste

- 7.3 Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 UK

- 7.3.2.3 France

- 7.3.2.4 Spain

- 7.3.2.5 Italy

- 7.3.2.6 Rest of Europe

- 7.3.3 Asia Pacific

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Australia

- 7.3.3.4 Japan

- 7.3.3.5 Rest of Asia-Pacific

- 7.3.4 Rest of the World

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Suez Environmental Services

- 8.1.2 Veolia Environmental Services

- 8.1.3 Enevo

- 8.1.4 Smartbin (OnePlus Systems Inc.)

- 8.1.5 Bigbelly Inc.

- 8.1.6 Covanta Holding Corporation

- 8.1.7 Evoeco

- 8.1.8 Pepperl+Fuchs GmbH

- 8.1.9 IBM Corporation

- 8.1.10 BIN-e