|

市场调查报告书

商品编码

1444889

双胍类 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Biguanides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

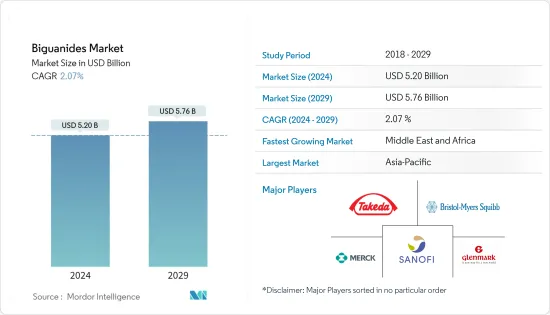

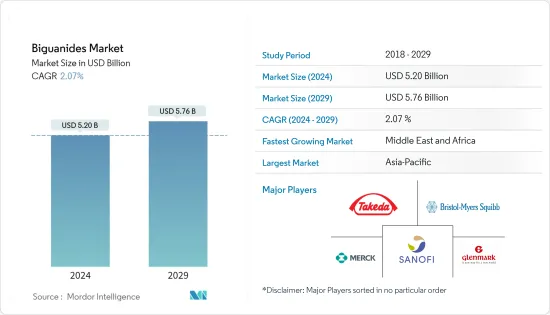

2024年双胍类市场规模预计为52.0亿美元,预计到2029年将达到57.6亿美元,在预测期内(2024-2029年)CAGR为2.07%。

COVID-19大流行对双胍类药物市场产生了重大影响。因COVID-19 感染而住院的患者中糖尿病的盛行率以及人们认识到改善血糖控制可能会改善SARS-CoV-2 患者的预后并缩短住院时间,这些都突显了口服抗糖尿病药物市场的重要性。糖尿病患者的免疫系统较弱,COVID-19併发症会加重病情,免疫系统会很快变弱。糖尿病和不受控制的高血糖是 COVID-19 患者预后不良的危险因素,包括增加重症或死亡的风险。因此,COVID-19 的爆发加速了全球双胍类市场的成长。

双胍类药物是一类用于治疗第 2 型糖尿病的药物。它们的作用是减少消化过程中葡萄糖的产生。二甲双胍是目前大多数国家可用于治疗糖尿病的唯一双胍类药物。 Glucophage(二甲双胍)和 Glucophage XR(二甲双胍缓释剂)是这些药物的知名品牌名称。其他包括 Fortamet、Glumetza 和 Riomet。二甲双胍也可以与其他几种类型的糖尿病药物(例如磺酰脲类药物)合併使用。

由于第 2 型糖尿病与 COVID-19 大流行期间较差的临床结果以及此类住院患者死亡风险的增加有关,因此强调血糖控制在改善预后方面的作用。二甲双胍是治疗 T2DM 高血糖的第一线选择。二甲双胍除了是一种重要的降血糖药物外,还具有显着的抗发炎作用。因此,二甲双胍一直是治疗受 COVID-19 感染的 2 型糖尿病患者的潜在候选药物,也是 COVID-19 大流行期间出色的抗糖尿病(降血糖)药物。

因此,由于上述因素,预计所研究的市场将在分析期间出现成长。

双胍类市场趋势

全球糖尿病盛行率上升

预计全球糖尿病人口在预测期内将增加 1.9% 以上。

根据国际糖尿病联盟的数据,2021年成人糖尿病人口约为5.37亿,预计到2030年这一数字将增加6.43亿。肥胖被认为是导致这种疾病(主要是2型糖尿病)的主要因素之一。糖尿病患者血糖值持续升高可能导致肾臟、神经和眼部损伤等进行性併发症。 2 型糖尿病越来越普遍,并且与心血管和肾臟疾病风险增加有关。随着生活方式的改变,二甲双胍通常是一线药物治疗。

世界卫生组织已将二甲双胍列入基本药物清单:「满足人口优先医疗保健需求的药物」。二甲双胍被归类为用于治疗第 2 型糖尿病的双胍类药物。它被规定用于患有胰岛素抗性等疾病的人的标籤外使用。自从二甲双胍引入 T2DM 治疗以来,大量患者已成功使用这种全球可用的药物进行治疗,该药物具有良好的风险效益,被 IDF 指南推荐为一线药物。因此,二甲双胍仍然是全世界最常使用的口服抗糖尿病药物。二甲双胍的长期积极使用经验、临床疗效和安全性的有力证据、高依从率、低成本、普遍可用性和成本效益是其高市场份额的促成因素。

由于上述因素及其日益普遍,市场可能会继续增长。

亚太地区在本年度双胍类市场占有率最高

亚太地区今年在双胍类药物市场中占有最高的市场份额,约37.9%。

近年来,亚太地区糖尿病盛行率急剧上升。在中国和印度等发展中国家,糖尿病发生率处于历史最高水平,这主要是由于生活方式的改变。根据国际糖尿病联盟的数据,2021 年,IDF 东南亚地区有9,000 万成年人患有糖尿病。预计到2045 年,这一数字将增加到1.52 亿,而IDF 西太平洋地区有2.06 亿成年人患有糖尿病。到 2021 年,该地区的人口预计到 2045 年将增加到 2.6 亿。糖尿病与许多健康併发症有关。糖尿病患者需要全天进行多次调整以维持正常的血糖水平,例如口服抗糖尿病药物、注射胰岛素或透过监测血糖水平来摄取额外的碳水化合物。

根据印度政府卫生与家庭福利部统计,2021年,印度所有死亡病例中,60%与糖尿病、心血管疾病、癌症、慢性呼吸道疾病等非传染性疾病有关。为控制主要慢性病,国家癌症、糖尿病、心血管疾病和脑中风防治规划(NPCDCS)已启动。该计划包括医学教育、学校健康意识以及糖尿病城市规划。

由于肥胖率的上升、第2型糖尿病遗传因素的增加、盛行率的增加以及上述因素,市场可能会持续成长。

双胍类药物行业概况

双胍类药物市场较为分散,武田、默克、赛诺菲、葛兰素史克、百时美施贵宝、勃林格殷格翰等生产商遍布全球市场,且由于仿製药生产商的存在,市场竞争激烈。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 双胍

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 西班牙

- 义大利

- 法国

- 英国

- 俄罗斯

- 欧洲其他地区

- 亚太

- 日本

- 中国

- 澳洲

- 印度

- 韩国

- 马来西亚

- 印尼

- 泰国

- 菲律宾

- 越南

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿曼

- 埃及

- 伊朗

- 中东和非洲其他地区

- 北美洲

第 6 章:市场指标

- 1 型糖尿病族群

- 2 型糖尿病族群

第 7 章:竞争格局

- 公司简介

- Teva

- Merck

- Takeda

- GlaxoSmithKline

- Sanofi

- Boehringer Ingelheim

- Glenmark

- Zydus

- Bristol-Myers Squibb

- 市占率分析

- Merck

- Takeda

- Sanofi

- 其他市占率分析

第 8 章:市场机会与未来趋势

The Biguanides Market size is estimated at USD 5.20 billion in 2024, and is expected to reach USD 5.76 billion by 2029, growing at a CAGR of 2.07% during the forecast period (2024-2029).

The COVID-19 pandemic has had a substantial impact on the biguanides market. The prevalence of diabetes in people hospitalized with COVID-19 infection and the recognition that improved glycemic control might improve outcomes and reduce the length of stay in patients with SARS-CoV-2 have underlined the importance of the oral anti-diabetic drugs market. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. Thus, the COVID-19 outbreak increased the biguanides market's growth globally.

Biguanides are a class of medications used to treat type 2 diabetes. They work by reducing the production of glucose that occurs during digestion. Metformin is the only biguanide currently available in most countries for treating diabetes. Glucophage (metformin) and Glucophage XR (metformin extended release) are well-known brand names for these drugs. Others include Fortamet, Glumetza, and Riomet. Metformin is also available in combination with several other types of diabetes medications, such as sulfonylureas.

As Type 2 diabetes is associated with both poorer clinical outcomes during the COVID-19 pandemic and an increased risk of death in such hospitalized patients, the role of glucose control has been emphasized to improve the prognosis. Metformin is the first-line choice for the management of hyperglycemia in T2DM. Besides being an important glucose-lowering agent, metformin also has significant anti-inflammatory. Therefore, metformin has been a potential candidate for treating patients affected by COVID-19 infection, with type 2 diabetes, as well as an excellent antidiabetic (glucose-lowering) agent during COVID-19 pandemic times.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Biguanides Market Trends

Rising diabetes prevalence globally

The global diabetes population is expected to rise by more than 1.9% over the forecast period.

According to the International Diabetes Federation, the adult diabetes population in 2021 was approximately 537 million, and this number is expected to increase by 643 million in 2030. Obesity is considered one of the major factors contributing to the disease, primarily type-2 diabetes. Continued elevation in blood glucose levels in diabetes patients can contribute to progressive complications such as renal, nerve, and ocular damage. Type-2 diabetes is increasingly prevalent and associated with an increased risk for cardiovascular and renal disease. Along with lifestyle changes, metformin is usually the first-line pharmacotherapy.

The World Health Organization has put metformin on the list of essential medicines: "medicines that satisfy the priority health care needs of the population". Metformin is classified as a biguanide used for the treatment of type-2 diabetes. It is prescribed for its off-label use in people with conditions such as insulin resistance. Since the introduction of metformin in T2DM therapy, a huge number of patients have been treated successfully with this globally available medication, which has a favorable risk-benefit profile recommended by IDF guidelines as a first-line drug. Hence, metformin is still the most prescribed oral antidiabetic medication worldwide. Long-term positive experience with the use of metformin, strong evidence of clinical efficacy and safety, a high adherence rate, low cost, general availability, and cost-effectiveness are the contributing factors to the high market share.

Owing to the aforementioned factors and their increasing prevalence, it is likely that the market will continue to grow.

Asia-Pacific region holds the highest market share in the Biguanides Market in the current year

The Asia-Pacific region holds the highest market share of about 37.9% in the biguanides market in the current year.

The Asia-Pacific region has witnessed an alarming increase in the prevalence of diabetes in recent years. In developing countries such as China and India, the rate of diabetes is at an all-time high, mainly due to lifestyle changes. According to the International Diabetes Federation, 90 million adults were living with diabetes in the IDF South-East Asia Region in 2021. This figure is estimated to increase to 152 million by 2045, and the 206 million adults living with diabetes in the IDF Western Pacific Region in 2021, are estimated to increase to 260 million by 2045. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day for maintaining normal blood glucose levels, such as oral anti-diabetic medication, insulin administration, or the ingestion of additional carbohydrates by monitoring their blood glucose levels.

According to the Ministry of Health and Family Welfare of the Government of India, in 2021, out of all deaths in India, 60% were related to non-communicable diseases like diabetes, cardiovascular diseases, cancer, chronic respiratory diseases, etc. To prevent and control major NCDs, the National Program for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) has been launched. This program includes medical education, health awareness in schools, and urban planning for diabetes.

Owing to the rising rate of obesity, the growing genetic factors for type-2 diabetes, the increasing prevalence, and the aforementioned factors, it is likely that the market will continue to grow.

Biguanides Industry Overview

The biguanides market is fragmented, with manufacturers like Takeda, Merck, Sanofi, GlaxoSmithKline, Bristol-Myers Squibb, Boehringer Ingelheim Pharmaceuticals, etc. having a global market presence, and the market is highly competitive due to generic drug manufacturers' presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Biguanide

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 Spain

- 5.2.2.3 Italy

- 5.2.2.4 France

- 5.2.2.5 United Kingdom

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Japan

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 India

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Indonesia

- 5.2.3.8 Thailand

- 5.2.3.9 Philippines

- 5.2.3.10 Vietnam

- 5.2.3.11 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Oman

- 5.2.5.4 Egypt

- 5.2.5.5 Iran

- 5.2.5.6 Rest of Middle East and Africa

- 5.2.1 North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Teva

- 7.1.2 Merck

- 7.1.3 Takeda

- 7.1.4 GlaxoSmithKline

- 7.1.5 Sanofi

- 7.1.6 Boehringer Ingelheim

- 7.1.7 Glenmark

- 7.1.8 Zydus

- 7.1.9 Bristol-Myers Squibb

- 7.2 MARKET SHARE ANALYSIS

- 7.2.1 Merck

- 7.2.2 Takeda

- 7.2.3 Sanofi

- 7.2.4 Other Market Share Analyses