|

市场调查报告书

商品编码

1687703

GDPR 服务 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)GDPR Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

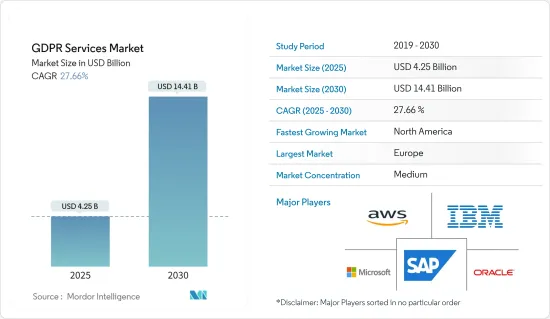

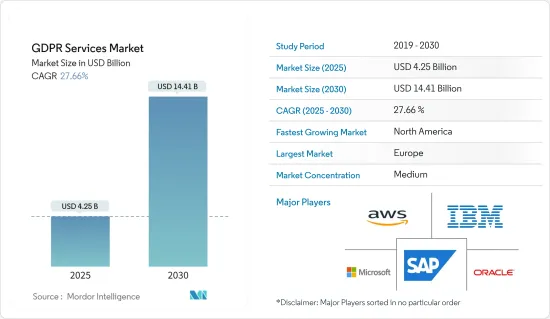

预计 2025 年 GDPR 服务市场规模为 42.5 亿美元,预计到 2030 年将达到 144.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 27.66%。

由于连结性数位化的提高,企业正在产生大量资料。当人们造访某个地点、网站,甚至打电话时,他们都会以资料的形式留下数位足迹,这是企业可以利用的宝贵资源,用于与客户互动并提供更好的用户体验。随着组织营运和品质监控对隐私性、安全性、真实性、合法性、可靠性、通用性和扩充性等特性的要求越来越高,GDPR服务业有着巨大的发展空间。

主要亮点

- 阿根廷公共资讯局已启动修改《个人资料保护法》的咨询程序。此次改革主要基于欧盟《一般资料保护条例》的规定。同样,澳洲第二大电信业者Optus 在 9 月遭遇重大资料洩露,导致议员去年通过了《隐私权法改革法案》。

- 针对企业用户的社交工程网路攻击正在增加。迄今为止,网路上发现的一些较引人注目且范围广泛的宣传活动包括冒充世界卫生组织 (WHO) 和美国疾病管制中心 (CDC) 的诈骗电子邮件。该网域与 CDC 官方网站相似,旨在窃取密码,甚至要求比特币「捐款」来资助假疫苗。此类案例增加了市场研究的需求。

- 此外,近年来连接设备的数量也在增加。据Cisco称,预计去年M2M连线数量将达21亿台。随着资料传输技术的不断进步,云端服务变得越来越容易取得。公有云已经登场。这项技术进步加速了网路钓鱼电子邮件、机器人和勒索软体的传输,凸显了它们所带来的漏洞。

- 为因应疫情并引发 GDPR 服务,网路安全预算变化增加。根据微软公司在疫情初期对800名企业领导人进行的调查,36%的受访者提案将网路安全预算增加1-25%,约22%的受访者表示已将预算增加25%以上以应对疫情。这场疫情让人们更加关注 GDPR 在个人权利和社会权利之间所取得的平衡。世界各地的当局正在改变其指导方针以解决资料保护和隐私问题。

- 另一方面,欧盟《一般资料保护规范》(GDPR)对云端服务供应商和客户提出了新的要求,例如删除权、更正权和可携性权,这不仅在技术角度,而且在实施和执行方面都带来了挑战。另一个新方面是整个云端供应链中保护个人资料的共享责任模型。简而言之,云端客户必须满足 GDPR 的要求,这使得他们对资料主体负有一定课责。

一般资料保护规范(GDPR)服务市场趋势

资料外洩后对资料安全和隐私的需求

- 据 SurfShark 称,去年第三季度,全球约有 1500 万笔资料记录遭到资料外洩。与上一季相比,这一数字成长了37%。不遵守法规的巨额罚款也推动了对资料管治、资料映射和资料管理服务的需求,以减少资料外洩的数量并保护敏感资讯。资料外洩事件的增加可能会推动 GDPR 服务市场的发展。

- 资料外洩可能导致成本急剧增加,并造成宝贵的客户资讯遗失。根据身分盗窃资源中心统计,2021年第三季美国银行业和金融业资料外洩受害者数量达到1.6亿,高于2021年第一季和第二季的总和1.21亿。网路攻击者正在寻求最明显的途径,对多个金融服务机构发动利润丰厚的攻击。

- 近年来,医疗保健产业已成为网路犯罪分子最感兴趣的目标。这些宝贵资料的产生使得医疗保健系统近年来容易受到网路攻击。根据 HIPAA 杂誌的报告,2021 年医疗保健机构发生了 56 起资料外洩事件,涉及资料超过 500 则。此外,报告发现,暴露或未经授权披露的记录数量增加了约 24.5%,截至 2021 年 12 月,由于资料洩露,暴露或未经授权披露的记录数量为 295 万笔。

- 根据律师事务所 DLA Piper 的报告,GDPR 罚款上涨了近 40%,GDPR 罚款总额达到 1.915 亿美元。此外,资料保护机构记录了 121,165 起资料外洩报告,比去年同期成长了 19%。疫情期间,数位转型的支出增加,这推动了对隐私的需求。根据为全球企业提供企业软体的开发商工业金融系统公司(IFS)的一项调查显示,70%的企业在疫情期间增加或维持了在数位转型方面的支出。

- 在能源和石油等受到严格监管的行业中,资料外洩的成本很高。根据Leidos的资料,能源产业每笔记录的成本为237美元,明显高于平均的201美元。监控石油和天然气分配和生产中的数量、速度、位置和其他关键活动的操作技术(OT) 系统不仅会产生大量敏感和专有信息,而且对公司、设施和员工的经济健康和人身安全也至关重要。

预计欧洲将占大部分市场份额

- 欧洲对 GDPR 的接受度越来越高,因此 GDPR 服务预计将占据很大的市场份额。随着该地区努力发展成为资料驱动型地区,对 GDPR 的高度接受度已使各个组织广泛采用 GDPR 服务。该法规要求这些国家的公司遵守GDPR。

- 自欧盟新资料保护法生效以来,欧洲资料保护机构已收到约 65,000 份资料外洩通知。此外,欧洲11个国家的监管机构已根据GDPR规定处以总计6,300万美元的罚款。据年利达律师事务所称,向资料保护机构发出的资料外洩通知大幅增加,与欧盟 GDPR 实施第一年相比平均成长了 66%。

- 随着资料收集和共用加速利用人工智慧和其他新兴技术,政府、企业和其他组织面临着探索和采用完善的资料管理工具的需要,以在努力实现通用目标的同时保护资料所有者的权利。因此,各国政府正在探索新的途径,以促进各资料生态系统相关人员之间的道德和公平资料共用。

- 该地区对物联网汽车的需求日益增长。它包含可追溯到个人的个人资料。此外,还有利用家庭能源消耗模式的个人资料的智慧电錶。随着 GDPR 在该地区生效,拥有一系列部署互联解决方案的最终用户的公司将需要保护其用户的资料。预计这将增加对 GDPR 服务的需求。

- 去年 2 月,Google分析 (Google Analytics) 在法国被判定违反了欧盟资料保护法,此前奥地利也做出了类似的裁决。法国资料保护监管机构 CNIL 表示,这家未具名的本地网站对 Google Analytics 的使用违反了欧盟《一般资料保护规范》(GDPR),特别是第 44 条,该条款涵盖将个人资料传输到欧盟以外的所谓第三国,而这些第三国本身并不具有同等的隐私权保护。

一般资料保护规范 (GDPR) 服务业概览

GDPR 服务市场相当集中,主要企业包括 IBM、微软和 AWS 等。此类参与者的市场渗透率很高。市场参与者正在创新,提供策略解决方案,以扩大其市场占有率和基本客群。这将使您能够赢得新契约并开拓新市场。市场的一些关键发展包括:

- 2022 年 9 月:Anritsu A/S 宣布与 SecuPi 进行最新合作,为客户提供全球资料保护和 GDPR 合规性。最先受益于这项新联盟的将是全球拥有最严格资料保护要求的一级通讯业者。安立与 SecuPi 合作,以市场领先的效率和灵活性满足安全性和合规性要求。此次合作将使营运商能够节省成本、简化安装并与安立的服务保障技术整合。

- 2022 年 4 月:Transcend 是一个一站式隐私平台,可以轻鬆地在公司的整个 IT 堆迭中对隐私进行编码,并宣布资料映射将成为隐私程式的实用补充。 Transcend 的资料映射透过自动扫描、资料孤岛发现和进阶内容分类为现代企业实现统一资料管理。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对 GDPR 服务市场的影响

第五章市场动态

- 市场驱动因素

- 市场限制

第六章市场区隔

- 依实施类型

- 本地

- 云

- 透过提供

- 资料管理

- 资料发现和映射

- 资料管治

- API 管理

- 按组织规模

- 大型企业

- 中小企业

- 按最终用户

- 银行、金融服务和保险(BFSI)

- 通讯和 IT

- 零售和消费品

- 医疗保健和生命科学

- 製造业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- IBM Corporation

- Veritas Technologies LLC

- Amazon Web Services Inc.

- Microsoft Corporation

- Micro Focus International PLC

- Oracle Corporation

- SAP SE

- Capgemini SE

- SecureWorks Inc.

- Wipro Limited

- DXC Technology Company

- Accenture PLC

- Atos SE

- Tata Consultancy Services Limited

- Larsen & Toubro Infotech Limited

- Infosys Limited

第八章投资分析

第九章:市场的未来

The GDPR Services Market size is estimated at USD 4.25 billion in 2025, and is expected to reach USD 14.41 billion by 2030, at a CAGR of 27.66% during the forecast period (2025-2030).

As a result of increased connection and ongoing digitization, businesses are producing an exponential amount of data. People who visit places and websites or even make phone calls leave a digital footprint as data, a valuable resource businesses can utilize to engage with customers and provide a better user experience. Because of the increased demand for characteristics such as privacy, security, authenticity, legality, trust, universality, and scalability in organizational operations and quality monitoring, the GDPR services industry has a lot of room to develop.

Key Highlights

- Argentina's Access to Public Information Agency has begun the consultation process to update its Personal Data Protection Law. The reforms are heavily based on the rules of the EU General Data Protection Regulation. Similarly, in September, Australia's second-largest telecommunications firm, Optus, had a significant data breach, prompting MPs to pass the Privacy Legislation Amendment Bill of the last year, which boosts fines to AUD 50 million when companies suffer repeated data breaches.

- Socially engineered cyber attacks targeting enterprise users are growing significantly. Among some of the significantly widespread campaigns spotted on the internet to date have been fraudulent emails indicated to be coming from the World Health Organization (WHO) and the US Center for Disease Control (CDC). The building domain names that look similar to the CDC's official web address aim at stealing passwords and even request bitcoin "donations" to fund a fake vaccine. Such instances have been increasing the demand for market studies.

- Further, there has been a rise in connected devices over the last few years. According to Cisco Systems, M2M connections are expected to reach 2.1 billion units in the last year. Cloud services are becoming more familiar with technological advancements in data transfers. The public cloud has been emerging. This technological advancement has resulted in the faster transfer of phishing emails, bots, and ransomware, indicating the vulnerabilities that they bring in.

- There has been a rise in the cybersecurity budget changes in response to the pandemic, triggering GDPR services. According to a survey by Microsoft Corporation of 800 business leaders during a pandemic, 36% of the respondents suggested an increase in the cybersecurity budget by 1-25%, and about 22% said that the budget increased by over 25% to combat the pandemic. The pandemic has brought a sharp focus to the balance that GDPR strikes between the rights of individuals and society. The global authorities are changing their guidelines to deal with data protection and privacy.

- On the flip side, the European Union General Data Protection Regulation (GDPR) confronts cloud service providers and customers with new requirements, such as the right to erasure, rectification, and portability, which is challenging to implement and implement not only from a technical perspective. Another new aspect appears with the model for shared responsibility regarding protecting personal data along the whole cloud supply chain. In a nutshell, the cloud customer remains accountable towards the data subject to an extent as they must fulfill the GDPR requirements.

General Data Protection Regulation (GDPR) Services Market Trends

Need for data security and privacy in the wake of a data breach

- According to SurfShark, Approximately 15 million data records were exposed globally due to data breaches in the third quarter of last year. Compared to the previous quarter, this amount had climbed by 37%. The rise in the need for data governance, data mapping, and data management services to mitigate the number of breaches and protect sensitive information has also been due to the significant fines levied for non-compliance with the regulation. Such a rise in data breaches would drive the GDPR service market.

- Data breaches lead to an exponential cost increase and loss of valuable customer information. According to Identity Theft Resource Center, the number of data breaches in the banking and financial sector of the United States the number of data compromise victims increased to 160 million in Q3 2021, which increased from Q1 and Q2 2021 combined (121 million). Cyber attackers pursue the most straightforward path possible to engineer a financial gain attack targeting several financial services organizations.

- Over the past few years, the healthcare sector has become a target of significant interest among cybercriminals. Due to its generation of valuable data, healthcare has recently become vulnerable to cyber-attacks. Per a HIPAA Journal report, healthcare institutions had 56 data breaches of 500 or more records in 2021. Moreover, the report also stated that the number of records exposed or impermissibly disclosed increased by approximately 24.5%, and data breaches left 2.95 million records exposed or impermissibly disclosed as of December 2021.

- According to a report from a law firm, DLA Piper, the GDPR fines rose by nearly 40%, and penalties under GDPR totaled USD 191.5 million. Also, allied data protection authorities recorded 121,165 breach notifications (19% more than the previous 12-month period). The spending on digital transformation increased during the pandemic, which has propelled a need for privacy. According to a survey conducted by Industrial and Financial Systems (IFS), a developer of enterprise software for companies worldwide, 70% of businesses have increased or maintained digital transformation spending during the pandemic.

- Costs of data breaches in heavily regulated industries, including energy and oil, have higher costs. The energy sector's USD 237 per record is significantly above the USD 201 average, according to Leidos data. The Operational Technology (OT) systems that oversee the volume, velocity, location, and other vital activities in the distribution and production of oil and gas not only produce a wealth of sensitive and proprietary information but are also essential to the economic health and physical safety of the company, its facilities, and its people.

Europe is Expected to Hold Major Share of the Market

- Europe is anticipated to witness a significant share of GDPR services due to the region's high acceptance of the GDPR. The region strives to develop as a data-driven region and exhibit significant adoption of GDPR services across organizations, owing to high acceptance of the GDPR. The regulation mandates the companies in these countries to comply with the GDPR.

- European privacy authorities have received nearly 65,000 data breach notifications since the EU's new privacy law was implemented. Also, regulators in 11 European countries imposed USD 63 million in GDPR fines. According to Linklaters, there has been a significant increase in data breach notifications to data protection authorities, with an average increase of 66% compared to the first year of the EU GDPR.

- In accelerating data collection and sharing to harness artificial intelligence and other emerging technologies, governments, businesses, and other organizations face the increasing need to explore and deploy sound data management tools to protect data owners' rights while addressing common goals. Therefore, governments are exploring new instruments to facilitate ethical and fair data sharing between different data ecosystem actors.

- The region is witnessing an increased demand for IoT-connected cars. This consists of individual data using which a person can be tracked. Then there is smart metering, whereby personal data on household energy consumption patterns is leveraged. With the GDPR being effect in the region, it has become necessary to secure the user's data for the companies with various end-users which deploy connected solutions. This is anticipated to drive the demand for GDPR services.

- In February last year, Google Analytics was found to violate European Union privacy legislation in France, following a similar ruling in Austria. The French data protection watchdog, the CNIL, stated that an unnamed local website's use of Google Analytics violates the EU's General Data Protection Regulation (GDPR) - specifically, Article 44, which covers personal data transfers outside the EU to so-called third countries that do not have essentially equivalent privacy protections.

General Data Protection Regulation (GDPR) Services Industry Overview

The GDPR Services Market is moderately consolidated, with some major players such as IBM, Microsoft, AWS, and others. The level of market penetration is high for such players. The players in the market are innovating in providing strategic solutions to increase their market presence and customer base. This enables them to secure new contracts and tap new markets. Some of the key developments in the market are:

- September 2022: Anritsu A/S has announced its latest collaboration with SecuPi to provide customers with global data protection and GDPR compliance. The first to benefit from this new alliance is a Tier-1 telecoms provider with some of the most demanding data protection requirements of any operator globally. Anritsu has teamed with SecuPi to fulfill security and compliance requirements with market-leading efficiency and flexibility. The collaboration will also provide operators with cost savings, ease of installation, and integration with Anritsu's Service Assurance technologies.

- April 2022: Transcend, the one-stop privacy platform that makes it simple to encode privacy across a company's IT stack has unveiled Data Mapping as an actionable addition to a privacy program. Transcend Data Mapping enables unified data management for modern businesses through automated scanning, data silo discovery, and advanced content classification-all in an easy-to-use and collaborative platform where users can easily assign system owners, delegate tasks, and generate compliance records.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/ Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Of COVID-19 On the GDPR Services Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By Type of Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Offering

- 6.2.1 Data Management

- 6.2.2 Data Discovery and Mapping

- 6.2.3 Data Governance

- 6.2.4 API Management

- 6.3 By Organization size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium-sized Enterprises

- 6.4 By End User

- 6.4.1 Banking, Financial Services, and Insurance (BFSI)

- 6.4.2 Telecom and IT

- 6.4.3 Retail and Consumer Goods

- 6.4.4 Healthcare and Life Sciences

- 6.4.5 Manufacturing

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Veritas Technologies LLC

- 7.1.3 Amazon Web Services Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Micro Focus International PLC

- 7.1.6 Oracle Corporation

- 7.1.7 SAP SE

- 7.1.8 Capgemini SE

- 7.1.9 SecureWorks Inc.

- 7.1.10 Wipro Limited

- 7.1.11 DXC Technology Company

- 7.1.12 Accenture PLC

- 7.1.13 Atos SE

- 7.1.14 Tata Consultancy Services Limited

- 7.1.15 Larsen & Toubro Infotech Limited

- 7.1.16 Infosys Limited