|

市场调查报告书

商品编码

1851756

人工智慧即服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Artificial Intelligence As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

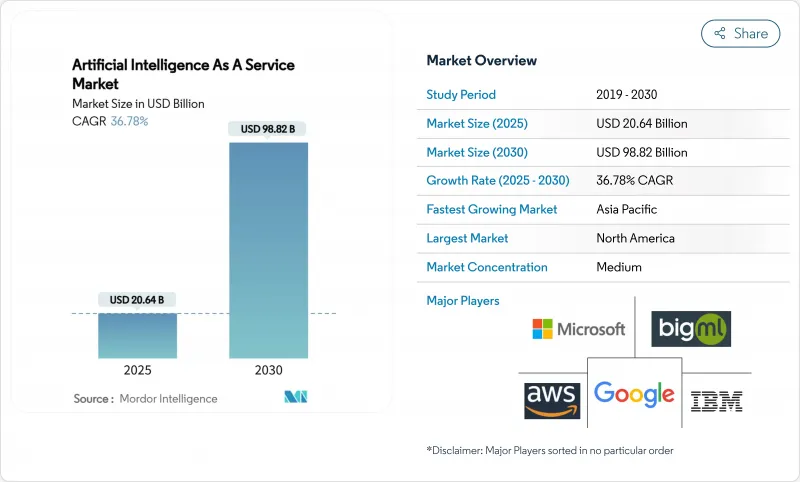

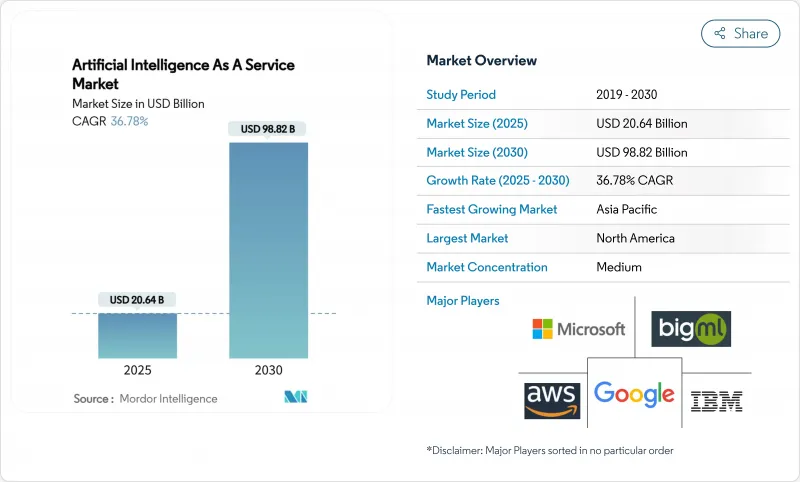

预计到 2025 年,人工智慧即服务市场规模将达到 206.4 亿美元,到 2030 年将达到 988.2 亿美元,预测期(2025-2030 年)复合年增长率为 36.78%。

企业将生成式人工智慧API整合到面向客户和后勤部门系统中,推动了人工智慧从先导计画向生产工作负载的快速过渡,从而促进了这一成长。订阅定价降低了小型企业的进入门槛,而客製化人工智慧加速器可将推理成本降低高达80%,从而扩大了服务提供者的净利率。日本650亿美元的人工智慧计画等政府奖励策略正在加速推进,儘管短期内电力供应紧张,但超大规模资料中心的建设仍在持续扩大运算能力。这些因素共同推动人工智慧即服务市场在各行各业得到广泛应用。

全球人工智慧即服务市场趋势与洞察

对预测性和规范性分析的需求日益增长

如今,企业更重视前瞻性而非后见之明。采用主导分析的製造商收入成长了61%,供应链优化使物流成本降低了15%。医疗系统透过放射科工作流程自动化,在五年内实现了451%的投资报酬率。银行利用人工智慧预测改进了诈欺侦测,预计到2028年将额外创造1700亿美元的利润。即时资料撷取和基于代理的人工智慧系统将保持这一发展势头,使预测分析成为人工智慧即服务市场的核心成长引擎。

订阅式人工智慧工具可降低中小企业的整体拥有成本

低门槛定价模式打破了以往的进入障碍。全球中小企业对生成式人工智慧工具的采用率已达18%。在美国,拥有四名员工的公司中,人工智慧的使用率在一年内从4.6%成长至5.8%。零售商已展现出切实的回报:塔吉特百货在400家门市推出了人工智慧员工辅助工具,在无需大量资本支出的情况下提高了生产力。订阅平台透过将人工智慧从资本支出转变为固定资产投资,拓展了面向微企业的「人工智慧即服务」市场。

云端处理成本不断上涨

人工智慧工作负载对基础设施经济带来巨大压力。到2030年,资料中心可能消耗美国9%的电力。到2025年,人工智慧的能源需求将超过比特币挖矿,达到23吉瓦。目前,财富2000强企业中有47%选择在企业内部开发生成式人工智慧,以避免不断上涨的电费。电价上涨和晶片供应紧张将在短期内降低人工智慧的可负担性,并限制人工智慧即服务市场的成长。

细分市场分析

2024年,公共云端将维持78%的市场份额,人工智慧即服务(AIaaS)市场仍将以超大规模基础设施为核心。然而,混合云才是明显的成长引擎,预计2025年至2030年的复合年增长率将达到32.1%。许多财富2000强企业选择在云端训练大型模型,同时在本地运行推理,从而在规模和自主性之间取得平衡。

混合部署正在改变采购方向。医院正在采用云端爆发架构,将个人识别医疗资料保存在本地伺服器上,同时利用弹性运算能力进行模型训练,从而在不影响价值实现时间的前提下遵守 HIPAA 法规。製造商也正在效仿这种模式,将边缘节点用于对延迟敏感的视觉任务,同时将大量分析任务推送到区域云区域。因此,合规性和预算确定性的双重优先性,使得混合模式成为人工智慧即服务 (AIaaS) 市场格局的核心。

到2024年,机器学习平台将占总收入的42%,而人工智慧基础设施服务将以44.5%的复合年增长率加速成长。这项转变使得运算优化型丛集和网路架构成为不断扩展的人工智慧即服务(AIaaS)市场的核心,为骨干工作负载提供支援。客製化晶片的普及也推动了这一趋势:Google的TPU和亚马逊的Trainium晶片在性价比方面实现了数倍提升,因此客户更倾向于选择提供此类晶片的供应商。

软体层也将同步演进。託管分发包现在将优化的核心与编配工具结合,以促进多重云端扩展。供应商正在整合自癒功能、自动修补程式和效能仪表板,以减少运维工作量。这些增强功能加强了底层基础设施与开发人员生产力之间的联繫,从而推动了人工智慧即服务市场这一细分领域的收入成长。

AI 即服务市场按部署模式(公共云端、私有云端、混合云端)、服务类型(机器学习平台服务、认知服务(自然语言处理、电脑视觉、语音)、其他)、组织规模(中小企业、大型企业)、最终用户业(银行、金融服务和保险、零售/电子商务、製造业、其他)和地区进行细分。

区域分析

北美拥有庞大的超大规模资料中心和深厚的新兴企业生态系统,预计2024年将占全球营收的38%。云端服务巨头承诺在2025年新增超过2,500亿美元的容量,但电网瓶颈日益凸显,预计到2030年,美国资料中心的电力消耗将占全国总电力供应的9%。此外,美国联邦贸易委员会(FTC)对云端运算和人工智慧协定的调查也可能重塑竞争格局。

亚太地区以27.9%的复合年增长率 (CAGR) 实现了最快成长。日本在人工智慧和晶片领域累计了650亿美元,而Softbank Corporation投资了9.6亿美元用于生成式人工智慧的基础架构。中国的阿里巴巴向云端模型服务投入了3800亿元人民币,位元组跳动的火山引擎处理了中国近一半的公共模型呼叫。一项企业调查发现,亚太地区54%的企业目前已製定了长期人工智慧支付目标,显示人工智慧的应用已超越了试点阶段。

在拟议的人工智慧监管框架下,欧洲正经历稳定成长,在创新与严格监管之间寻求平衡。中东和非洲正积极推行自主的人工智慧策略:微软向G42国家注资15亿美元,而阿联酋预计到2030年,该产业的市场规模将达到463.3亿美元。沙乌地阿拉伯设立的1,000亿美元人工智慧基金凸显了该地区的雄心壮志,海湾合作委员会(GCC)成员国中75%的企业已部署生成式模型,高于全球平均。便利的能源供应和积极的政策框架使该地区成为连接欧洲、非洲和南亚的桥樑市场,非常适合部署人工智慧即服务(AIaaS)。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对预测性和规范性分析的需求日益增长

- 为中小企业降低整体拥有成本的订阅式人工智慧工具

- 客製化AI加速器(TPU/Trainium)可降低推理成本

- 受监管产业的AIaaS套餐垂直化

- 内建于低程式码平台中的生成式人工智慧 API

- 市场限制

- 云端处理成本不断上涨

- MLOps人才持续短缺

- 加强对模型来源的监管审查

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按部署模式

- 公有云

- 私有云端

- 混合云

- 按服务类型

- 机器学习平台服务

- 认知服务(自然语言处理、电脑视觉、语音辨识)

- AI基础设施服务(GPU/TPU)

- 託管式及专业人工智慧服务

- 按公司规模

- 小型企业

- 大公司

- 按最终用户行业划分

- BFSI

- 零售与电子商务

- 医疗保健和生命科学

- 资讯科技/通讯

- 製造业

- 能源与公用事业

- 其他(媒体、农业、公共)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲、纽西兰

- 东南亚

- 中东和非洲

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services(AWS)

- Microsoft Corporation

- Google LLC(Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp.(DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI

第七章 市场机会与未来展望

The Artificial Intelligence As A Service Market size is estimated at USD 20.64 billion in 2025, and is expected to reach USD 98.82 billion by 2030, at a CAGR of 36.78% during the forecast period (2025-2030).

Rapid migration from pilot projects to production workloads fuels this rise as enterprises embed generative-AI APIs in customer-facing and back-office systems. Subscription pricing lowers entry costs for small firms, while custom AI accelerators cut inference expenses by up to 80%, widening margins for providers. Government stimulus packages, such as Japan's USD 65 billion AI plan, add momentum, and hyperscale data-center build-outs keep compute capacity expanding despite near-term power constraints. Together, these forces push the Artificial Intelligence as a Service market toward broad, cross-industry penetration.

Global Artificial Intelligence As A Service Market Trends and Insights

Growing Demand for Predictive & Prescriptive Analytics

Enterprises now prize foresight over hindsight. Manufacturers using AI-driven analytics posted 61% revenue premiums, while supply-chain optimization shaved 15% off logistics costs. Healthcare systems gained 451% ROI over five years by automating radiology workflows. Banks boosted fraud-detection accuracy and see USD 170 billion additional profits by 2028 through AI forecasting. Real-time data ingestion plus agentic AI systems sustain this momentum, positioning predictive analytics as a core growth engine for the Artificial Intelligence as a Service market.

Subscription-Based AI Tools Lowering TCO for SMEs

Low-commitment pricing dismantles historic entry barriers. Global SME adoption of generative-AI tools reached 18%. In the United States, AI usage among firms with four workers rose from 4.6% to 5.8% in a single year. Retailers illustrate practical returns: Target deployed AI employee-assistance tools across 400 stores to raise productivity without large capital outlays. By turning AI from capex to opex, subscription platforms broaden the Artificial Intelligence as a Service market across micro-enterprise segments.

Escalating Cloud-Compute Cost Inflation

AI workloads strain infrastructure economics. Data centers may draw 9% of the United States' electricity by 2030. AI energy needs are set to top Bitcoin mining in 2025, reaching 23 GW. Forty-seven percent of Fortune 2000 firms now develop generative AI on-premises to tame runaway bills. Rising power prices plus tight chip supply lower near-term affordability and clip growth in the Artificial Intelligence as a Service market.

Other drivers and restraints analyzed in the detailed report include:

- Custom AI Accelerators Slashing Inference Cost

- Verticalised AIaaS Bundles for Regulated Sectors

- Persistent MLOps Talent Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud delivery retained 78% share in 2024, ensuring the Artificial Intelligence as a Service market remains anchored to hyperscale infrastructure. Hybrid cloud, however, is the clear growth engine, registering a 32.1% CAGR for 2025-2030 as boards demand tighter cost control and regulators press for data residency safeguards. Many Fortune 2000 firms now train large models in the cloud yet run inference on-premises, balancing scale with sovereignty.

Hybrid uptake redirects procurement. Hospitals adopt cloud-burst architectures to keep personally identifiable health data within local servers while exploiting elastic compute for model training, meeting HIPAA rules without losing time-to-value. Manufacturers mirror this pattern, reserving edge nodes for latency-sensitive vision tasks while pushing bulk analytics to regional cloud zones. The twin priorities of compliance and budget certainty thus keep hybrid models central to the Artificial Intelligence as a Service market outlook.

Machine-learning platforms supplied 42% of 2024 revenue, but AI infrastructure services are growing faster at 44.5% CAGR. This shift places compute-optimized clusters and networking fabrics at the heart of the Artificial Intelligence as a Service market size expansion for backbone workloads. Custom chip adoption underpins the trend: Google's TPUs and Amazon's Trainium deliver multi-fold price-performance gains, prompting clients to favor providers offering such silicon.

Software layers evolve in lockstep. Managed distribution bundles now pair optimized kernels with orchestration tooling to ease multi-cloud scaling. Vendors embed self-healing functions, automated patching, and performance dashboards to shrink operational toil. Together, these enhancements tighten the nexus between raw infrastructure and developer productivity, reinforcing the revenue trajectory in this segment of the Artificial Intelligence as a Service market.

The Artificial Intelligence As A Service Market is Segmented by Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Service Type (Machine-Learning Platform Services, Cognitive Services (NLP, CV, Speech) and More), Organisation Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, Manufacturing and More) and Geography

Geography Analysis

North America held 38% of global revenue in 2024, buoyed by an installed base of hyperscale data centers and a deep startup ecosystem. Cloud majors pledged more than USD 250 billion in fresh capacity during 2025, yet grid constraints loom as US data-center power draw may hit 9% of national supply by 2030. FTC probes into cloud-AI pacts could also recalibrate competitive boundaries.

Asia-Pacific charts the fastest ascent with a 27.9% CAGR. Japan earmarked USD 65 billion for AI and chips, and SoftBank invested USD 960 million in a generative-AI backbone. China's Alibaba allocated 380 billion yuan to cloud model services, while ByteDance's Volcano Engine processed nearly half of the country's public model calls. Corporate surveys show 54% of APAC firms now target long-term AI payouts, signalling depth beyond pilot activity.

Europe grows steadily, balancing innovation with strict oversight under draft AI regulations. The Middle East and Africa ride sovereign-AI strategies: the UAE expects USD 46.33 billion in sector value by 2030 as Microsoft injects USD 1.5 billion into G42. Saudi Arabia's USD 100 billion AI fund underscores regional ambition, and 75% of GCC enterprises deploy generative models, eclipsing global averages. Access to affordable energy and proactive policy frameworks position the region as a bridge market linking Europe, Africa, and South-Asia for Artificial Intelligence as a Service market rollouts.

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC (Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp. (DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study AssumptionsandMarket Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for predictiveandprescriptive analytics (mainstream)

- 4.2.2 Subscription-based AI tools lowering TCO for SMEs (mainstream)

- 4.2.3 Custom AI accelerators (TPU/Trainium) slashing inference cost (under-radar)

- 4.2.4 Verticalised AIaaS bundles for regulated sectors (under-radar)

- 4.2.5 Generative-AI APIs embedded in low-code platforms (mainstream)

- 4.3 Market Restraints

- 4.3.1 Escalating cloud-compute cost inflation (mainstream)

- 4.3.2 Persistent MLOps talent shortage (under-radar)

- 4.3.3 Heightened regulatory scrutiny on model provenance (mainstream)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Machine-Learning Platform Services

- 5.2.2 Cognitive Services (NLP, CV, Speech)

- 5.2.3 AI Infrastructure Services (GPU/TPU)

- 5.2.4 ManagedandProfessional AI Services

- 5.3 By Organisation Size

- 5.3.1 SmallandMedium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 RetailandE-commerce

- 5.4.3 HealthcareandLife Sciences

- 5.4.4 ITandTelecom

- 5.4.5 Manufacturing

- 5.4.6 EnergyandUtilities

- 5.4.7 Others (Media, Agriculture, Public)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 AustraliaandNew Zealand

- 5.5.4.6 South-East Asia

- 5.5.5 Middle EastandAfrica

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, ProductsandServices, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS)

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC (Google Cloud)

- 6.4.4 IBM Corporation

- 6.4.5 Oracle Corporation

- 6.4.6 Salesforce Inc.

- 6.4.7 SAS Institute Inc.

- 6.4.8 H2O.ai Inc.

- 6.4.9 DataRobot Inc.

- 6.4.10 Dataiku SAS

- 6.4.11 BigML Inc.

- 6.4.12 OpenAI LP

- 6.4.13 Anthropic PBC

- 6.4.14 C3.ai Inc.

- 6.4.15 NVIDIA Corp. (DGX Cloud)

- 6.4.16 Alibaba Cloud

- 6.4.17 Tencent Cloud

- 6.4.18 Baidu AI Cloud

- 6.4.19 Huawei Cloud

- 6.4.20 Craft AI

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-spaceandUnmet-need Assessment