|

市场调查报告书

商品编码

1445419

生物基聚合物 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Bio-based Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

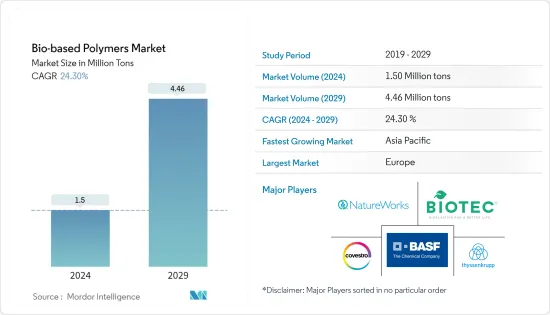

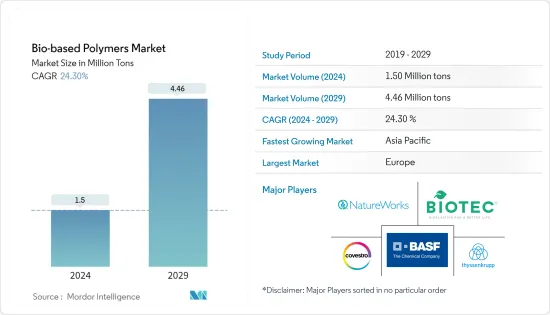

生物基聚合物市场规模预计到2024年为150万吨,预计2029年将达到446万吨,在预测期内(2024-2029年)CAGR为24.30%。

COVID-19 影响了生物基聚合物市场的成长。然而,疫情期间和疫情后对包装食品和线上食品配送的需求增加推动了包装涂料的消费,从而导致了生物基聚合物的消费。

短期内,对永续塑胶的需求不断增加是推动市场需求的主要因素之一。

另一方面,生物塑胶的性能问题以及与石油基聚合物相比生物基聚合物的高价格预计将阻碍所研究市场的成长。

可生物降解塑胶的应用不断增加可能会在未来带来机会。

此外,包装行业主导市场,预计在预测期内将成长。

欧洲主导了全球市场,最大的消费来自法国和英国等国家。

生物基聚合物市场趋势

包装产业需求不断增加

- 包装是生物基聚合物的最大市场之一。这些聚合物表现出优异的透明度和光泽度、耐食品脂肪和油性以及芳香屏障。此外,它们还为包装提供刚性、扭曲保持力和适印性。

- 生物基聚合物主要用于超市的水果和蔬菜包装、麵包袋和麵包盒、瓶子、信封、展示纸盒窗户以及购物袋或手提袋等。例如,根据印度商务部的数据,2022财年印度新鲜蔬菜的出口额约为8.02亿美元。加工蔬菜的出口额则接近4.25亿美元。与2020年相比,新鲜蔬菜增长了10.87%,加工蔬菜成长了0.21%。因此,新鲜和加工蔬菜出口的增加预计将创造该国对生物基聚合物的需求。

- 欧洲和北美地区的生物基聚合物包装市场正在快速成长。 FDA和相关组织在食品安全方面日益加强的干预,很大程度上促进了可生物降解和食品级塑胶在饮料和零食消费中的使用。

- 连锁餐厅和食品加工行业越来越多地采用可生物降解材料进行食品包装。消费者在食品安全方面的意识也迅速提高,特别是在新兴经济体,因为一些塑胶被证明具有致癌性。

- 由于各个食品和安全组织不断提高食品包装标准,亚太地区、南美和中东等发展中地区的成长预计在不久的将来将会增加。

- 此外,可生物降解聚合物更易于处理,进一步增加了包装行业对它们不断增长的需求。

欧洲地区将主导市场

- 欧洲拥有最大的生物基聚合物份额并主导全球市场。

- 该地区的公众意识和政府措施支持在购物袋、食品包装、食品服务(餐具等)和有机废物盒内衬等中使用可生物降解聚合物。

- 该地区的各个国家一直致力于提供更环保的包装。这增加了包装领域对聚乳酸的需求。

- 英国(UK)是欧洲领先的国家之一,对生物基聚合物包装的需求一直在增加。对包装产品永续性因素的更高认识,以及最近的政府倡议,正在为该国研究市场的成长创造有利的市场前景。

- 一次性塑胶的禁令是直接影响生物基聚合物包装产品需求的主要因素之一。例如,2021年,英国政府宣布计划在英格兰禁止使用一次性塑胶餐具、盘子和聚苯乙烯杯子,以解决塑胶污染问题。

- 几家现有供应商以及包装行业的新创公司也主动在该国推广生物基聚合物包装。例如,2022 年 6 月,英国公司 Magical Mushroom Company 为其基于植物的可持续包装获得了 340 万欧元(331 万美元)的资金。

- 目前,英国包装业年销售额达110亿英镑,员工超过85,000人。

- 欧盟 (EU) 正在努力实现 2050 年净零排放目标,并透过实施《欧洲绿色协议》来应对日益严重的环境和永续发展危机。对更永续发展的社会的倾向与欧洲经济的塑胶生产、使用和处置交织在一起。

- 对小尺寸包装不断增长的需求以及与生活方式改变相关的不断增长的消费习惯预计将在预测期内推动对生物基聚合物的需求。

生物基聚合物产业概况

生物基聚合物市场本质上是部分整合的。市场上的一些主要参与者(排名不分先后)包括 BASF SE、Covestro AG、BIOTEC Biologische Naturverpackungen GmbH & Co. KG.、thyssenkrupp AG 和 NatureWorks LLC 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 偏好环保聚合物以保护环境

- 多国对不可降解聚合物的法规

- 提高已开发国家和发展中国家的消费者意识

- 可生物降解聚合物的无毒性

- 限制

- 与石油基聚合物相比价格较高

- 低收入国家的意识低下

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场细分

- 类型

- 淀粉基塑料

- 聚乳酸 (PLA)

- 聚羟基链烷酸酯 (PHA)

- 聚酯(PBS、PBAT 和 PCL)

- 纤维素衍生物

- 应用

- 农业

- 纺织品

- 电子产品

- 包装

- 卫生保健

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 世界其他地区

- 巴西

- 沙乌地阿拉伯

- 世界其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- BASF SE

- Biologische Naturverpackungen GmbH & Co. KG.

- Cardia Bioplastics

- Covestro AG

- Corbion

- Cortec Group Management Services, LLC

- DuPont de Nemours, Inc.

- FKuR

- FP International

- Innovia Films

- Merck KGaA

- YIELD10 BIOSCIENCE, INC. (Metabolix Inc.)

- NatureWorks LLC

- Novamont SpA

- Rodenburg Biopolymers

- SHOWA DENKO KK

- thyssenkrupp AG

第 7 章:市场机会与未来趋势

- 生物降解塑胶的应用不断增加

- 加强药物传输研究

- 新兴国家不断加强的法规

The Bio-based Polymers Market size is estimated at 1.5 Million tons in 2024, and is expected to reach 4.46 Million tons by 2029, growing at a CAGR of 24.30% during the forecast period (2024-2029).

COVID-19 impacted the bio-based polymer market's growth. However, the increased demand for packaged food and online food deliveries during the pandemic and post-pandemic propelled the consumption of packaging coatings, which resulted in the consumption of bio-based polymers.

Over the short term, increasing demand for sustainable plastics is one of the major factors driving market demand.

On the flip side, the performance issue with bioplastics and the high prices associated with bio-based polymers compared to petroleum-based polymers are expected to hinder the growth of the market studied.

The increasing applications of biodegradable plastics are likely to present an opportunity in the future.

Moreover, the packaging industry dominates the market and is expected to grow during the forecast period.

Europe dominated the market across the world, with the largest consumption coming from countries such as France and the United Kingdom.

Bio-based Polymers Market Trends

Increasing Demand from Packaging Industry

- Packaging is one of the largest markets for bio-based polymers. These polymers exhibit excellent clarity and gloss, resistance to food fats and oils, and an aroma barrier. Additionally, they also provide stiffness, twist retention, and printability to the packaging.

- Bio-based polymers are mostly used in fruit and vegetable packaging in supermarkets, for bread bags and bakery boxes, bottles, envelopes, display carton windows, and shopping or carrier bags, among others. For instance, according to the Department of Commerce (India), the export value of fresh vegetables from India amounted to about USD 802 million in the fiscal year 2022. For processed vegetables, the value stood at nearly USD 425 million in the same year, which shows an increase of 10.87% from the fresh vegetable segment and 0.21% from processed vegetables compared with 2020. Therefore, an increase in the exports of fresh and processed vegetables is expected to create demand for bio-based polymers in the country.

- The bio-based polymer market for packaging is growing rapidly in the European and North American regions. The increasing intervention of the FDA and related organizations in terms of food safety is largely promoting the usage of biodegradable and food-grade plastics for beverage and snack consumption.

- The restaurant chains and food processing industries are increasingly adapting biodegradable materials for food packaging. Consumer awareness is also rising rapidly, especially in emerging economies, in terms of food safety, as some plastics are proven carcinogenic.

- The growth in developing regions, like Asia-Pacific, South America, and the Middle East, is expected to increase in the near future due to the improving food packaging standards of various food and safety organizations.

- Moreover, the higher ease of disposing of biodegradable polymers has further added to their growing demand from the packaging industry.

Europe Region to Dominate the Market

- Europe holds the largest share of bio-based polymers and dominates the global market.

- Public awareness and government initiatives in the region have supported the use of biodegradable polymers in carrier bags, food packaging, food services (cutlery, etc.), and organic waste caddy liners, among others.

- Various countries in the region have been focusing on offering more eco-friendly packaging. This has increased the demand for polylactic acid in the packaging sector.

- The United Kingdom (UK) is among the leading countries in Europe, where the demand for bio-based polymer packaging has been increasing. The higher awareness about the sustainability factors of packaging products, along with recent government initiatives, are creating a favorable market scenario for the growth of the studied market in the country.

- The ban on single-use plastics is among the primary factors that will directly impact the demand for bio-based polymer packaging products. For instance, in 2021, the UK government announced plans to ban single-use plastic cutlery, plates, and polystyrene cups in England to tackle plastic pollution.

- Several existing vendors, as well as startups operating in the packaging industry, are also taking the initiative to promote bio-based polymer packaging in the country. For instance, in June 2022, Magical Mushroom Company, a UK-based company, secured funding of EUR 3.4 million (USD 3.31 million) for its plant-based sustainable packaging.

- Currently, the packaging sector in the United Kingdom has annual sales of GBP 11 billion, and it employs more than 85,000 people.

- The European Union (EU) is working towards the 2050 net-zero emissions goal and tackling the increasing environmental and sustainability crises by implementing the European Green Deal. The inclination towards a more sustainable society is intertwined with the European economy's production, use, and disposal of plastic.

- The growing need for small-size packaging and the growing consumption habits associated with the change in lifestyles are anticipated to propel the demand for bio-based polymers over the forecast period.

Bio-based Polymers Industry Overview

The bio-based polymer market is partially consolidated by nature. Some of the major players in the market (not in any particular order) include BASF SE, Covestro AG, BIOTEC Biologische Naturverpackungen GmbH & Co. KG., thyssenkrupp AG, and NatureWorks LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Preference toward Eco-friendly Polymers to Preserve Environment

- 4.1.2 Regulation on Non-degradable Polymers in Many Countries

- 4.1.3 Increasing Consumer Awareness in Developed and Developing Nations

- 4.1.4 Non-toxic Nature of Biodegradable Polymers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to Petroleum-based polymers

- 4.2.2 Low Awareness in Low Income Countries

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Starch-based Plastics

- 5.1.2 Poly Lactic Acid (PLA)

- 5.1.3 PolyHydroxy Alkanoates (PHA)

- 5.1.4 Polyesters (PBS, PBAT, and PCL)

- 5.1.5 Cellulose Derivatives

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Textile

- 5.2.3 Electronics

- 5.2.4 Packaging

- 5.2.5 Healthcare

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of World

- 5.3.4.1 Brazil

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.3 Cardia Bioplastics

- 6.4.4 Covestro AG

- 6.4.5 Corbion

- 6.4.6 Cortec Group Management Services, LLC

- 6.4.7 DuPont de Nemours, Inc.

- 6.4.8 FKuR

- 6.4.9 FP International

- 6.4.10 Innovia Films

- 6.4.11 Merck KGaA

- 6.4.12 YIELD10 BIOSCIENCE, INC. (Metabolix Inc.)

- 6.4.13 NatureWorks LLC

- 6.4.14 Novamont SpA

- 6.4.15 Rodenburg Biopolymers

- 6.4.16 SHOWA DENKO K.K.

- 6.4.17 thyssenkrupp AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Bio-degradable Plastics

- 7.2 Increasing Research in Drug Delivery

- 7.3 Rising Regulations in Emerging Countries