|

市场调查报告书

商品编码

1445421

进阶分析:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Advanced Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

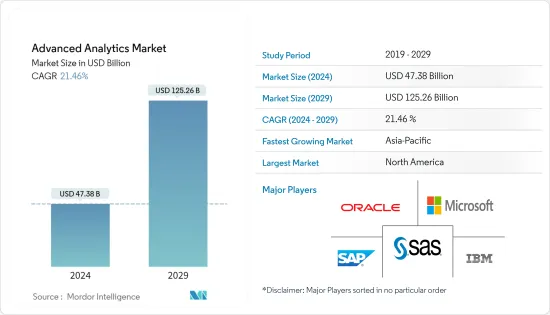

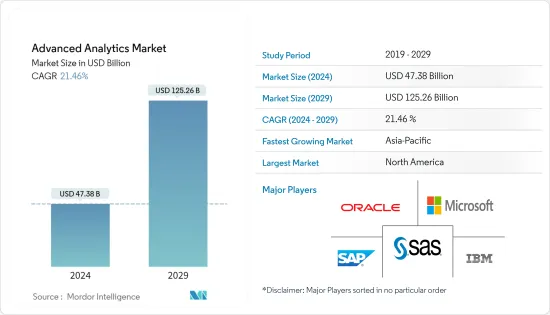

高级分析市场规模预计 2024 年为 473.8 亿美元,预计到 2029 年将达到 1252.6 亿美元,在预测期内(2024-2029 年)增长 21.46%,复合年增长率增长。

进阶分析使用资料主导、基于事实的资讯来帮助企业识别趋势和模式、解决问题、做出准确的未来预测并推动改进。它超越了商业智慧,为组织提供了复杂的演算法和分析技术,以提供更细緻和详细的答案,使他们能够做出更具创造性和明智的决策。Masu。

主要亮点

- 推动市场成长的主要因素是使用机器学习和人工智慧(AI)为客户提供更个人化的体验、网路购物的兴起以及社交网路平台的普及。

- 使用高阶分析进行需求预测可以帮助企业做出更盈利的决策。政府机构和银行、製造业和专业服务其他部门最近在巨量资料分析方面投入了大量资金。

- 社会渗透率提高所产生的资料包含使用传统分析方法无法发现的隐藏模式。如果使用得当,进阶分析解决方案可以帮助企业找到重要的隐藏资料,并利用这些数据为客户量身定制服务。

- 然而,对资料隐私和与第三方高阶分析平台共用的担忧可能会阻碍市场的预测期。

由于最近的 COVID-19感染疾病导致需求突然增加,高级分析市场在过去几年中经历了巨大的发展。这是因为企业希望利用客户不断增长的线上影响力,从而导致对尖端技术和资料分析解决方案的需求显着增加。

进阶分析市场趋势

扩大数位化趋势和增加数位资料生产推动市场成长

- 过去几十年来,数位资料创建急剧增加。数位资料产生激增的主要原因之一是一般人日常生活中智慧型手机和电脑等数位装置的使用增加。

- 物联网 (IoT) 的日益普及以及许多物联网设备创建的资料也促进了资料的繁荣。

- 此外,数位化营运的采用促进了高阶分析解决方案的发展。这为应对不断变化的挑战提供了新的方法,零售和电子商务业务中数位转型的采用正在降低营运成本,对市场成长产生积极影响。

- 必须使用先进的分析和资料探勘来对这些大量资料进行排序,并找到可以帮助公司在各个领域做出更好决策的趋势。

- 随着越来越多的组织在其基础设施中添加巨量资料工具和分析解决方案,进阶分析市场也可能进一步成长。

北美预计将占据很大份额

- 预计北美市场占有率最大,其中美国在该领域占据主导地位。来自低成本地区公司的竞争使该地区对尖端技术更加开放,因为它们拥有支援这些技术的基础设施并希望儘早采用它们。它已经成为主导。

- 此外,该地区有大量先进的分析解决方案供应商,预计将推动市场成长。该领域的供应商包括 IBM Corporation、Oracle Corporation、SAS Institute Inc. 和 Microsoft Corporation。

- 由于公司希望了解持有的资料并发现不同行业的模式,因此预计该地区在预测期内将具有较高的市场收益。

- 该领域社交媒体的采用也显着增加,有助于高级分析行业的扩张。该行业拥有完善的基础设施,有助于新技术的快速采用,使其成为高级分析发展的重要市场。

高阶分析产业概述

高阶分析市场高度整合,少数大公司控制大部分市场,特别是在企业采用方面。该公司参与资料处理价值链的各个阶段,巩固了其市场地位。大公司在这一领域具有优势,因为它们可以大规模地提供创新、高品质的服务,并根据每个客户的需求进行客製化。

2022 年 8 月,SAS 和 SingleStore 宣布建立合作伙伴关係,透过 SAS Viya 提供下一代资料和分析架构。这使您能够对 SingleStore 云端原生即时资料库中储存的资料使用 SAS 分析和 AI 技术。这种整合提供了对精选资料的灵活、开放的访问,以加速云端、混合和本地部署的价值。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 防止诈欺的需求日益增长

- 应对巨量资料挑战的需求不断增长

- 扩大数位化趋势并增加数位资料生成

- 高阶分析解决方案的技术开发

- 市场限制因素

- 缺乏资料整合和连接

第六章市场区隔

- 类型

- 统计分析

- 文字分析

- 风险分析

- 预测分析

- 其他类型

- 最终用户产业

- BFSI

- 零售和消费品

- 卫生保健

- 资讯科技和通讯

- 运输和物流

- 政府和国防

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- SAS Institute Inc.

- Oracle Coporation

- SAP SE

- Microsoft Corporation

- KNIME AG

- RapidMiner Inc.

- Alteryx Inc.

- Avanade Inc.

- Fair Isaac Corporation(FICO)

- TIBCO Software Inc.

- Altair Engineering Inc.

第八章投资分析

第9章 未来的机会

The Advanced Analytics Market size is estimated at USD 47.38 billion in 2024, and is expected to reach USD 125.26 billion by 2029, growing at a CAGR of 21.46% during the forecast period (2024-2029).

Advanced Analytics uses data-driven, fact-based information to assist businesses in identifying trends and patterns, resolving issues, making precise future predictions, and driving improvements. It goes beyond business intelligence by giving an organization complex algorithms and analytical techniques that let them give more nuanced, detailed answers and make more original, well-informed decisions.

Key Highlights

- The main things that are driving the growth of the market are the use of machine learning and artificial intelligence (AI) to give customers more personalized experiences, the rise of online shopping, and the spread of social networking platforms.

- Utilizing sophisticated analytics in demand forecasting can support businesses in making profitable decisions. Governmental organizations and other sectors, including banking, manufacturing, and professional services, have recently invested significantly in big data analytics.

- The data produced due to rising social penetration contains hidden patterns that cannot be discovered using conventional analytics methods. When used correctly, advanced analytics solutions can help companies find important hidden data that can be used to tailor their services to customers.

- However, concerns about data privacy and sharing with third-party advanced analytics platforms may stymie the market forecast period.

Due to the COVID-19 pandemic's abrupt rise in demand during that time, the advanced analytics market experienced tremendous development over the last few years. This was because companies wanted to take advantage of their customers' growing online presence, which led to a big rise in demand for cutting-edge technologies and data analytics solutions.

Advanced Analytics Market Trends

Growing Digitization Trends and Increased Digital Data Production to Drive the Market Growth

- Digital data creation has increased dramatically during the last few decades. One of the leading causes of this surge in the generation of digital data is the increased use of digital devices, such as smartphones and computers, in the daily lives of ordinary people.

- The growing popularity of the Internet of Things (IoT) and the data made by many IoT devices have also contributed to the data boom.

- Moreover, the adoption of digital operations facilitates advanced analytics solutions. It provides new ways to tackle evolving challenges, and the adoption of digital transformation in retail and e-commerce businesses has reduced operating costs, positively impacting market growth.

- Advanced analytics and data mining must be used to sort through these huge amounts of data to find trends that can help companies make better decisions in many areas.

- The market for advanced analytics is also likely to grow even more as more organizations add big data tools and analysis solutions to their infrastructure.

North America is Expected to Hold a Significant Share

- The largest market share is anticipated in North America, with the United States dominating the sector. Due to competition from companies that operate in low-cost areas, the region has become dominant because it is becoming more open to cutting-edge technologies, has the infrastructure to support them, and wants to adopt them early.

- Additionally, there is a significant presence of advanced analytics solution providers in the area, which is likely to boost market growth there. The vendors in the area are IBM Corporation, Oracle Corporation, SAS Institute Inc., and Microsoft Corporation.

- During the period of projection, this region is expected to have a high market's ability to bring in money because businesses want to understand the data they have and find patterns in different fields.

- The adoption of social media has also increased significantly in the area, which has helped the advanced analytics industry expand. This area has become an important market for the growth of advanced analytics because it has a well-established infrastructure that makes it easier for new technologies to be adopted quickly.

Advanced Analytics Industry Overview

The market for advanced analytics is pretty consolidated, with a few big companies controlling a big chunk of it, especially when it comes to enterprise adoption.Their participation at all stages of the value chain for data handling strengthens their market positions. Large businesses dominate this sector because they can offer innovative, high-quality services on a wide range of scales and customize them to meet the needs of each customer.

In August 2022, SAS and SingleStore announced their collaboration to deliver next-generation data and analytics architectures with SAS Viya, which enables the use of SAS analytics and AI technology on data stored in SingleStore's cloud-native real-time database. The integration provides flexible, open access to curated data to help accelerate value for cloud, hybrid, and on-premises deployments, and through SAS' analytic performance, the companies aim to reduce the complexity of data management and integration as well as the computational time required to train sophisticated models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need to Prevent Fraudulent Activities

- 5.1.2 Increasing Demand to Counter Big Data Challenges

- 5.1.3 Growing Digitization Trends and Increased Digital Data Production

- 5.1.4 Technological Developments of Advanced Analytics Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Data Integration and Connectivity

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Statistical Analysis

- 6.1.2 Text Analytics

- 6.1.3 Risk Analytics

- 6.1.4 Predictive Analytics

- 6.1.5 Other Types

- 6.2 End-user Industry

- 6.2.1 BFSI

- 6.2.2 Retail and Consumer Goods

- 6.2.3 Healthcare

- 6.2.4 IT & Telecommunication

- 6.2.5 Transportation & Logistics

- 6.2.6 Government & Defense

- 6.2.7 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 SAS Institute Inc.

- 7.1.3 Oracle Coporation

- 7.1.4 SAP SE

- 7.1.5 Microsoft Corporation

- 7.1.6 KNIME AG

- 7.1.7 RapidMiner Inc.

- 7.1.8 Alteryx Inc.

- 7.1.9 Avanade Inc.

- 7.1.10 Fair Isaac Corporation (FICO)

- 7.1.11 TIBCO Software Inc.

- 7.1.12 Altair Engineering Inc.