|

市场调查报告书

商品编码

1642100

资料中心加速器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Data Center Accelerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

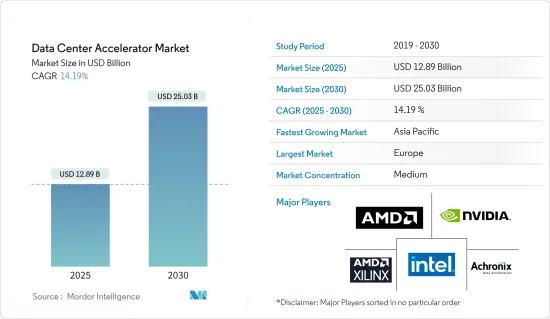

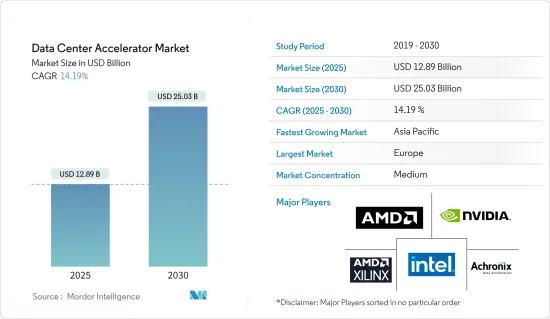

资料中心加速器市场规模预计在 2025 年为 128.9 亿美元,预计到 2030 年将达到 250.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.19%。

高效能运算资料中心对人工智慧的需求不断增长以及云端基础的服务的使用不断增加,可能会在未来几年推动资料中心加速器市场的发展。

主要亮点

- 从科学发现到人工智慧 (AI),现代资料中心对于解决世界上最大的挑战至关重要。这些先进的资料中心正在进行转型,以增加网路频宽并优化人工智慧等工作负载。资料中心管理人员也期望降低整体拥有成本、降低功耗和提供新服务。

- 随着对资料中心的需求不断增长,现有基础设施正被推向极限,推动对可适应解决方案的需求,这些解决方案可以优化各种工作负载的效能,延长现有基础设施的生命週期,并最终降低 TCO。为了满足这种需求并获得市场认可,公司正在积极扩大产品系列。

- 此外,运算系统的大部分成长是由云端处理资料中心对人工智慧应用的不断增长的需求所推动的。这些地方现在几乎所有的训练应用程式都使用 GPU。然而,随着 ASIC 进入市场,GPU 可能会进行客製化以满足深度学习 (DL) 的需求。除了ASIC和GPU之外,FPGA也有可能在未来的AI训练中发挥重要作用。它主要用于需要快速上市的专门资料中心应用程序,例如新 DL 应用程式的原型製作,或需要客製化的应用程式。

- 此类加速器不太可能被中小企业使用,其使用将仅限于中型和大型企业。

- 新冠肺炎疫情给整个经济、各行业带来了额外的压力。人们的关注点也正在转移到数位经济。中国顶级云端处理供应商之一阿里云正在投资数十亿美元建设下一代资料中心,以支援「后疫情世界」的数位转型需求。阿里云去年 4 月表示,未来三年将投资 2,000 亿元人民币(289.9 亿美元)用于核心技术和麵向未来的资料中心。

资料中心加速器市场趋势

FPGA 处理器类型预计将占据主要市场占有率

- 基于现场可编程闸阵列(FGPA) 的资料中心加速器市场预计将为市场提供有吸引力的成长机会。 FPGA(现场可编程闸阵列)是预製的硅元件,可程式设计(製造后),几乎成为任何数位系统。 FPGA 是由可程式互连连接的可配置逻辑区块 (CLB) 阵列,可在製造后重新编程以满足所需的应用要求。

- 现场可程式闸阵列(FPGA)是许多工业应用的首选数位实现平台之一,并且设备正在不断扩展和改进。虽然基于 FPGA 的加速器由于其在提高效能/功耗和易用性方面的优势而逐渐被主流运算所采用,但要支援向自适应加速资料中心的演进仍有许多工作要做。

- FPGA 结合了基于处理器的系统和专用积体电路 (ASIC) 的最佳特性,这就是为什么 FPGA 晶片越来越多地被各行各业采用的原因。此外,对于小批量到中等批量生产,与需要更多时间和资本资源才能获得第一批设备的 ASIC 相比,FPGA 提供了更便宜的解决方案和更快的上市时间。

- 推动FPGA市场成长的另一个因素是广泛应用运算的需求,这为FPGA产业指明了新的方向。此外,云端处理和资料中心的资料处理也是FPGA的重要应用领域。 FPGA 可以提升大资料系统的效能。 FPGA 透过使用高频宽、低延迟连线来连接网路和储存系统,实现更快的资料处理。据Cisco称,去年云端资料中心的 IP 流量达到了 19.5 Zetta位元组。

- 巨量资料分析优化需求的不断成长是推动市场发展的因素之一。为了实现即时并行处理,Google和亚马逊等知名科技公司越来越依赖 FPGA 来获取消费者洞察并透过巨量资料分析做出商业决策。

亚太地区可望维持强劲市场成长

- 亚太地区预计将对全球资料中心加速器的需求做出重大贡献,因为该地区正在投入大量资金改善和加速IT基础设施。例如,根据Cisco,澳洲占全球资料中心市场的4%。 AirTrunk 和 Equinix 等大型跨国公司正在墨尔本和雪梨建造超大规模资料中心。预计这些发展将推动市场发展。

- 晶片製造商赛灵思表示,在政府推动跨国公司储存本地用户资料之际,印度似乎充满信心。预计这将为向印度伺服器製造商供应晶片的厂商创造巨大商机。为了满足这一高需求,除了 Alveo 之外,Xilinx 还在其位于海得拉巴的研发中心增加工程师。此资料中心加速卡可以提高广泛应用的效能,包括云端和本地资料中心以及人工智慧推理。

- 特别是,託管可程式协处理器的资料中心可以支援用于平行处理机器学习任务的图形晶片,从而进一步推动该地区的资料中心市场的发展。

- 市场参与者正在透过产品创新、新联盟、投资新生产设施、加强研发和开拓海外市场等各种成长策略来加强其竞争地位。

- 今年2月,富士通宣布入选日本新能源及产业技术发展组织(NEDO)营运的「绿色创新基金计画/下一代数位基础建设」下的「下一代绿色资料中心技术开发」计划。富士通集团旨在透过参与这项国家倡议,加强在社会数位基础设施中发挥重要作用的先进运算和网路技术的开发,并促进整体解决方案的全球传播,从而实现「透过创新实现永续的社会」的承诺。

资料中心加速器产业概览

由于全球参与者和中小型企业的存在,资料中心加速器市场更具凝聚力。市场的主要企业包括英特尔公司、NVIDIA 公司、超微半导体公司、Achronix 半导体公司、赛灵思公司(Advanced Micro Devices Inc.)等。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2022 年 5 月-AMD 宣布以约 19 亿美元完成对 Pensando Systems 的收购。 Pensando 的分散式服务平台为 AMD 的资料中心产品组合添加了高效能资料处理单元 (DPU) 和软体堆迭,目前正被高盛、IBM Cloud、Microsoft Azure 和Oracle Cloud 等云端和商业客户大规模使用。

- 2022 年 2 月 - 全球领先的技术基础设施高速连接供应商 Alphawave IP 宣布与英特尔代工服务 (IFS) 合作。 AlphaWave IP 已加入 IFS Accelerator-IP Alliance 为主要成员,为联合 IFS 客户提供先进的连线解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 高效能运算资料中心越来越多地采用人工智慧

- 增加资料中心设施和云端基础的服务的部署

- 市场限制

- 有限的人工智慧硬体专业知识和基础设施问题

第六章 技术简介

- 深度学习、公共云端介面和企业介面如何影响资料中心加速器

第七章 市场区隔

- 依处理器类型

- CPU(中央处理器)

- GPU(图形处理单元)

- FPGA(现场可程式化闸阵列)

- ASIC(专用积体电路)

- 按应用

- 高效能运算

- 人工智慧

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices Inc.

- Achronix Semiconductor Corporation

- Xilinx Inc.(Advanced Micro Devices Inc.)

- NEC Corporation

- Dell Technologies Inc.

- IBM Corporation

- Cisco Systems Inc.

- Qualcomm Technologies, Inc.

第九章投资分析

第十章:市场的未来

The Data Center Accelerator Market size is estimated at USD 12.89 billion in 2025, and is expected to reach USD 25.03 billion by 2030, at a CAGR of 14.19% during the forecast period (2025-2030).

The growing demand for artificial intelligence in HPC data centers and the increasing usage of cloud-based services likely drive the data center accelerator market over the coming years.

Key Highlights

- From scientific discoveries to artificial intelligence (AI), modern data centers are crucial to solving some of the world's most critical challenges. These advanced data centers are transforming to increase networking bandwidth and optimize workloads like artificial intelligence. Datacenter administrators also expect a lower total cost of ownership, lower power, and new services.

- The ever-increasing demands on the data center are pushing existing infrastructure to its limit, driving the need for adaptable solutions that can optimize performance across a broad range of workloads and extend the lifecycle of existing infrastructure, thus, ultimately reducing TCO. Players have been actively expanding their product portfolio to capture this demand and gain market recognition.

- Further, most computing system growth would stem from higher demand for AI applications at cloud computing data centers. At these locations, GPUs are now used for almost all training applications. However, as ASICs enter the market, GPUs would likely become more customized to meet the demand for Deep Learning (DL). In addition to ASICs and GPUs, FPGAs would also have a crucial role in future AI training, primarily for specialized data center applications that must reach the market quickly or require customization, such as those for prototyping new DL applications.

- The lack of feasibility of providing to small businesses, limiting its utilization scope to medium and large organizations, and the increased cost of these accelerators are expected to act as market restraints.

- The COVID-19 pandemic has posed additional stress on the overall economy across sectors. It has also shifted focus towards a digital economy. One of China's top cloud computing providers, Alibaba Cloud, is investing billions in building next-generation data centers to support digital transformation needs in a 'post-pandemic world. In April last year, Alibaba Cloud announced it would invest RMB 200 billion (USD 28.99 billion) in core technologies and future-oriented data centers over the next three years.

Data Center Accelerator Market Trends

FPGA Processor Type Segemnt is Expected to Hold Significant Market Share

- The data center accelerator market for field-programmable gate arrays (FGPA)-based accelerators are expected to offer attractive growth opportunities for the market. FPGAs (field programmable gate arrays) are pre-fabricated silicon devices that can be programmed electrically (post-manufacturing) to become almost any digital system. They are an array of configurable logic blocks (CLBs) connected with programmable interconnects and can be reprogrammed to the desired application requirements after manufacturing.

- Field programmable gate arrays (FPGAs) are one of the preferred digital implementation platforms in a profusion of industrial applications, and extensions and improvements are continuously included in devices. Also, while FPGA-based accelerators are slowly being adopted in mainstream computing owing to the benefits of performance/consumption and enhanced ease of use, a lot of work is still being processed to support the evolution toward an adaptive-acceleration data center.

- FPGAs combine the best parts of processor-based systems and application-specific integrated circuits (ASICs), which drives the adoption of FPGA chips across all industries. Additionally, for low-to-medium volume productions, FPGAs provide cheaper solutions and faster time to market, compared to ASIC, which usually requires a lot of time and capital resources to obtain the first device.

- Another factor driving the growth of the FPGA market is the demand for extensive application computation, which gives a new direction to the FPGA industry. Moreover, cloud computing and data processing in data centers are significant application areas for FPGAs. FPGAs can improve the performance of large-scale data systems. FPGAs offer faster data processing by connecting network and storage systems with tailored high-bandwidth, low-latency connections. According to Cisco Systems, In the last year, the cloud data center IP traffic reached 19.5 zettabytes.

- The rise in the demand for optimization in big data analytics is one of the primary drivers for the market. To execute operations in parallel for real-time performance, prominent tech companies like Google and Amazon, which derive consumer insights through big data analytics, increase their dependence on FPGAs to make business decisions.

Asia-Pacific is Expected to Hold Significant Market Growth

- Asia-Pacific is anticipated to be the principal contributor of data center accelerator to global demand as the region undergoes vast investments for better and quicker IT infrastructure. For instance, according to Cisco Systems, Australia creates up to 4% of the global data center market. Big multinational players, like AirTrunk and Equinix, build hyper-scale data centers in Melbourne and Sydney. Such developments are anticipated to drive market growth.

- According to Xilinx, a chip maker, India seems confident with the government's push to get global companies to store local user data. This is expected to provide a huge business opportunity to players offering chips to server makers in India. In addressing this high demand, Xilinx hires more engineers at its R&D facility in Hyderabad, in addition to Alveo. This data center accelerator card can increase performance in cloud and on-premise data centers and a broad range of applications, including AI inference.

- Emerging AI workloads further propel the data center market in the region, particularly those data centers hosting programmable co-processors that can support graphic chips used for parallel processing of machine learning tasks.

- Players in the market strengthen their competitiveness through various growth strategies, such as the innovation of products, new collaborations, investments into new production facilities, increased R&D, and exploration of overseas markets.

- In February this year, Fujitsu announced that it had been selected by Japan's new energy and industrial technology development organization for the "Green Innovation Fund Project/Construction of Next Generation Digital Infrastructure" project in the field of "Technology Development of the Next Generation Green Data Center" (NEDO). The Fujitsu Group's contribution to this national initiative aims to strengthen the development of advanced computing and network technologies that play an essential role in society's digital infrastructure, as well as to promote the use of total solutions globally, with the ultimate goal of achieving its commitment to delivering a more sustainable society through innovation.

Data Center Accelerator Industry Overview

The Data Center Accelerator Market could be more cohesive due to the presence of both global players and small and medium-sized enterprises. The major players in the market are Intel Corporation, NVIDIA Corporation, Advanced Micro Devices Inc., Achronix Semiconductor Corporation, and Xilinx Inc. (Advanced Micro Devices Inc.), among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022 - AMD has announced the completion of its acquisition of Pensando Systems for about USD 1.9 billion. Pensando's distributed services platform would add a high-performance data processing unit (DPU) and software stack to AMD's data center product range, which is currently being used at scale by cloud and business clients such as Goldman Sachs, IBM Cloud, Microsoft Azure, and Oracle Cloud.

- February 2022 - Alphawave IP, one of the leading global providers of high-speed connection for the global technological infrastructure, announced a collaboration with Intel Foundry Services ("IFS"). Alphawave IP has joined the IFS Accelerator - IP Alliance as an anchor member to offer advanced connectivity solutions for joint clients using IFS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Deployment of AI in HPC Data Centers

- 5.1.2 Increasing Deployment of Data Center Facilities and Cloud-Based Services

- 5.2 Market Restraints

- 5.2.1 Limited AI Hardware Experts Coupled with Infrastructural Concerns

6 TECHNOLOGY SNAPSHOT

- 6.1 Impact of Deep Learning, Public Cloud Interface, and Enterprise Interface on Data Center Accelerators

7 MARKET SEGMENTATION

- 7.1 By Processor Type

- 7.1.1 CPU (Central Processing Unit)

- 7.1.2 GPU (Graphics Processing Unit)

- 7.1.3 FPGA (Field-Programmable Gate Array)

- 7.1.4 ASIC (Application-specific Integrated Circuit)

- 7.2 By Application

- 7.2.1 High-performance Computing

- 7.2.2 Artificial Intelligence

- 7.2.3 Other Applications

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 NVIDIA Corporation

- 8.1.3 Advanced Micro Devices Inc.

- 8.1.4 Achronix Semiconductor Corporation

- 8.1.5 Xilinx Inc. (Advanced Micro Devices Inc.)

- 8.1.6 NEC Corporation

- 8.1.7 Dell Technologies Inc.

- 8.1.8 IBM Corporation

- 8.1.9 Cisco Systems Inc.

- 8.1.10 Qualcomm Technologies, Inc.