|

市场调查报告书

商品编码

1642104

媒体、广告和娱乐领域的区块链:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Blockchain in Media, Advertising, and Entertainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

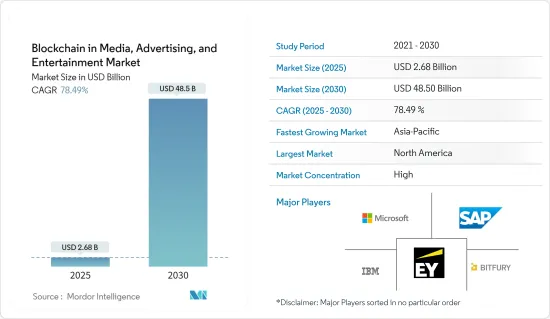

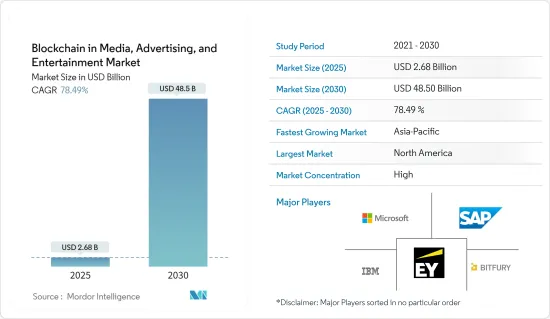

预计 2025 年媒体、广告和娱乐领域的区块链市场规模为 26.8 亿美元,预计到 2030 年将达到 485 亿美元,预测期内(2025-2030 年)的复合年增长率为 78.49%。

区块链不仅颠覆了现有的经营模式,而且还促进了新经营模式的发展,尤其是在媒体产业。数位技术正在深刻地改变全球媒体和娱乐产业,特别是在内容创作和发行方面,其中区块链是最突出的技术颠覆者。

主要亮点

- 内容的商品化和智慧财产权(IP)的猖獗盗版正在推动媒体和娱乐产业对区块链的需求。推动市场发展的主要因素包括:内容创作者和最终用户之间消除中间人的需求日益增长、对安全快捷交易的需求日益增加以及媒体和娱乐行业资料盗版案例日益增多。

- 此外,由于媒体和娱乐产业是一种基于合约的业务,非常重视保护智慧财产权,因此媒体使用者习惯于免费存取各种各样的内容。此外,所有媒体行业都受到数位化的严重影响,因为内容可以在不影响品质的情况下快速复製和分发。仍然需要数位版权管理系统来减少盗版。

- 区块链的出现可能会极大地改变这个行业结构。区块链技术可以很大程度上绕过内容聚合器、平台提供者和版税收集机构。因此,市场力量转移到版权所有者手中。区块链技术可以为具有不可变状态和数位身分的资产提供即时的、基于消费的定价,从而增加内容创作者和媒体公司的利润。付款应用程式是一个特别关键的部分,因为该解决方案可将交易成本降低 40-80%。

- 后疫情时代,全球各地的人们都希望参与音乐节、电影节、体育赛事等实体娱乐活动,同时数位化的采用也显着增加。分析认为,NFT的普及正在推动市场成长率。

- 例如,根据 Dapper Labs 于今年 8 月发布的数位参与第 1 层区块链 Flow,Live Nation 的子公司 Ticketmaster 最近宣布在其区块链上为活动组织者铸造非同质化代币(NFT) 门票。 NFT 票证的主要用途是其檔案价值。但它不仅仅是一件纪念品;它还可以作为您参加过一场着名音乐会的证明。

- 此外,透过 Ticketmaster,Flow 区块链上已铸造了超过 500 万个 NFT。 Meta 在 8 月透露,Instagram 现已支援 100 多个国家的 NFT。 Instagram 上共用的所有 NFT 收藏品都将在 Flow 区块链上创建。此外,Meta 还透过 Facebook 用户的数位钱包引入了新的 NFT 连线。

- 该技术消除了中间人,减少了供应商和付款人的管理成本和时间。然而,缺乏标准化在一定程度上阻碍了市场的成长。此外,采用新技术的过程成本高且耗时,这限制了市场的成长。

媒体、广告和娱乐领域的区块链市场趋势

付款应用可望主导市场

- 媒体用户现在已经非常习惯免费存取各种各样的内容。这主要是因为媒体和娱乐产业是一个基于合约的业务,非常重视保护智慧财产权。此外,各种媒体都受到了数位化的沉重打击,因为现在更容易快速复製和共用内容而不影响品质。

- 区块链技术为具有不可变状态和数位身分的资产提供即时的、基于消费的定价。付款应用是此解决方案的关键领域之一,可将交易成本降低 40% 至 80%,具体取决于产业的采用和渗透程度。另一个流行的应用程式是加密货币,它为内容提供者提供小额支付便利。公司利用这项服务允许客户购买和播放单首歌曲或视频,或购买阅读新闻报导的权限。

- 此外,基于区块链的微支付使得按使用付费消费成为可能。区块链全面记录资料的能力可以让我们更精确地追踪受版权保护的内容的消费时间和方式。

- 许多内容提供者正在使用该技术接受加密货币付款。例如,今年 11 月,总部位于德克萨斯州的金融科技公司 Oveit 与瑞士Start-UpsUtrust 合作,提供加密货币付款服务。透过向娱乐产业引入新的付款机制,这些公司希望让活动策划者更容易接受和使用加密货币付款并覆盖更大的市场。两家公司将为全球多达 10 亿的活动、主题乐园和旅游套装游客提供加密货币付款服务。

- 今年 10 月,领先的 B2B 和 B2C 公司首选的全球付款编配平台 BlueSnap 宣布与着名的比特币和加密货币付款服务提供商 BitPay 建立新的合作。该产品合作伙伴关係支持 BlueSnap 的使命,透过支持全球 15 种最大的加密货币和 7 种法定货币的接受和支付,帮助世界各地的企业增加收益并降低成本。

预计北美将占据最大市场占有率

- 媒体用户现在已经习惯免费存取各种各样的内容。这主要是因为媒体和娱乐产业是一个基于合约的业务,非常重视保护智慧财产权。此外,各种媒体都受到了数位化的沉重打击,因为现在更容易快速复製和共用内容而不影响品质。

- 区块链技术为具有不可变状态和数位身分的资产提供即时的、基于消费的定价。付款应用是此解决方案的关键领域之一,可将交易成本降低 40% 至 80%,具体取决于产业的采用和渗透程度。另一个流行的应用程式是加密货币,它为内容提供者提供小额支付便利。公司利用此功能允许客户购买和播放单首歌曲或视频,或购买阅读新闻报导的权限。

- 此外,基于区块链的微支付使得按使用付费消费成为可能。区块链全面记录资料的能力可以让我们更精确地追踪受版权保护的内容的消费时间和方式。

- 许多内容提供者正在使用该技术接受加密货币付款。例如,今年 11 月,总部位于德克萨斯州的金融科技公司 Oveit 与瑞士Start-UpsUtrust 合作,提供加密货币付款服务。透过向娱乐产业引入新的付款机制,这些公司希望让活动策划者更容易接受和使用加密货币付款并覆盖更大的市场。两家公司将为全球多达 10 亿的活动、主题乐园和旅游套装游客提供加密货币付款服务。

- 今年 10 月,领先的 B2B 和 B2C 公司首选的全球付款编配平台 BlueSnap 宣布与着名的比特币和加密货币付款服务提供商 BitPay 建立新的合作伙伴关係。此次产品合作将使 BlueSnap 实现其目标,即透过支援多达 15 种加密货币和 7 种法定货币进行支付,帮助世界各地的企业增加收益并降低成本。

媒体、广告和娱乐领域区块链概述

全球媒体、广告和娱乐领域的区块链竞争格局中等集中,只有少数参与者提供区块链解决方案,尤其是在媒体和娱乐产业。供应商正在采用联盟、合作、收购和新产品发布等各种策略来扩大其在全球市场的影响力并增加市场占有率。

2022年10月,领先的区块链生态系统和加密货币基础设施供应商币安宣布与韩国顶级全球娱乐公司YG娱乐(YG)签署谅解备忘录,达成策略合作。作为策略合作的一部分,币安和YG将合作进行各种区块链计划,包括NFT领域的计划。 Binance 将提供 NFT 平台和技术基础设施,而 YG 将提供 NFT 内容和游戏资产。除此之外,两家公司计划开发基于币安智能链的游戏,共同建立元宇宙,并积极探索其他数位资产机会,为客户创造独特的产品和服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 内容商品化与智慧财产权盗版猖獗

- 消除内容创作者和最终用户之间的中间人的需求日益增长

- 安全、快速交易的需求日益增加

- 市场限制

- 缺乏标准化

- 实施成本高且耗时

第六章 市场细分

- 按区块链类型

- 民众

- 私人的

- 按公司规模

- 中小型企业

- 大型企业

- 按应用

- 授权和权利管理

- 数位广告

- 智能合约

- 支付

- 线上游戏

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Ernst & Young Global Limited

- Bitfury Group Limited

- SAP SE

- Accenture

- Amazon Web Services, Inc.

- Oracle Corporation

- Infosys Limited

- Ujo Music

第八章投资分析

第九章 市场机会与未来趋势

The Blockchain in Media, Advertising, and Entertainment Market size is estimated at USD 2.68 billion in 2025, and is expected to reach USD 48.50 billion by 2030, at a CAGR of 78.49% during the forecast period (2025-2030).

Blockchain is disrupting not only the existing business models but is also enabling the development of new business models, especially in the media industry. Digital technologies are substantially transforming the global media and entertainment industries, especially in content production and distribution, with blockchain being the most prominent technological disruptor.

Key Highlights

- The need for blockchain in media and entertainment is increasing owing to the subsequent commoditization of content and widespread piracy of intellectual property (IP). The increasing need for eliminating intermediaries between content creators and end-users, the growing demand for secure and faster transactions, and the growing instances of data piracy in the media and entertainment industries are some key factors driving the market.

- Further, media users are accustomed to having free access to a wide variety of content, as the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all media segments have suffered significantly from digitization since content can be copied and distributed quickly without losing quality. This is because digital rights management systems still need to reduce copyright infringements.

- With the advent of blockchain, this industry structure could change significantly. Blockchain technology permits bypassing content aggregators, platform providers, and royalty collection associations to a large extent. Thus, market power shifts to the copyright owners. Blockchain technology can increase profits for content creators and media companies by providing real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40-80%, thus making payment applications the leading segment amongst others.

- After the pandemic, people across the globe are interested in attending physical entertainment events such as music and movie festivals and sports, along with the significant adoption of digitalization. NFT penetration is analyzed to contribute to the market growth rate.

- For instance, in August this year, Ticketmaster, a Live Nation subsidiary, recently announced non fungible tokens (NFTs) tickets for event organizers minted on its blockchain, according to Flow, a digital engagement layer-1 blockchain established by Dapper Labs. The NFT tickets' main use will be for their archival value. But in addition to serving as souvenirs, they can be used as evidence of attendance at prominent concerts.

- Additionally, through Ticketmaster, more than 5 million NFTs have been created on the Flow blockchain. Meta revealed in August that Instagram now supports NFT in more than 100 nations. All NFT collectibles shared on Instagram are created on the Flow blockchain. Additionally, Meta introduced a new NFT connection through users' digital wallets on Facebook.

- This technology eliminates the need for intermediaries and reduces administrative costs and time for providers and payers. However, lack of standardization hinders the market's growth to a certain extent. Also, the process of implementing new technology is expensive and time-consuming, which restrains market growth.

Blockchain in Media, Advertisement and Entertainment Market Trends

Payments Application is Expected to Dominate the Market

- Media users are nowadays highly accustomed to having free access to a wide variety of content. This is primarily because the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all types of media have been hurt by digitization because it makes it easy to copy and share content quickly without losing quality.

- Blockchain technology provides real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40% to 80%, depending upon the level of adoption and extension in the industry, thus making payment applications the leading segment amongst others. Another popular application, cryptocurrency, facilitate micropayments to content providers. Companies use it to enable customers to buy and play single songs or videos, for instance, or to purchase permission to read a news article.

- Further, pay-per-use consumption has become feasible due to blockchain-powered micropayments. Blockchain's ability to record its data comprehensively could allow for more accurate tracking of when and how copyrighted content is consumed.

- Many content providers are using technology to accept payments through cryptocurrency. For instance, in November this year, the Austin, Texas-based fintech business Oveit collaborated with the Swiss start-up Utrust to provide cryptocurrency payment services. They want to introduce a new payment mechanism to the entertainment industry so that event planners may more readily accept and use cryptocurrency payments and reach a larger market. The businesses will act as an intermediary for cryptocurrency payments made by up to 1 billion visitors globally to events, theme parks, and travel packages.

- In October of this year, BlueSnap, the preferred worldwide payment orchestration platform for major B2B and B2C companies, announced a new collaboration with BitPay, the prominent provider of Bitcoin and cryptocurrency payment services. This product collaboration supports BlueSnap's objective to assist businesses all over the world in growing their revenue and decreasing their costs by enabling them to accept and be paid out in up to 15 different cryptocurrencies and seven fiat currencies globally.

North America Expected to Hold the Largest Market Share

- Media users are nowadays highly accustomed to having free access to a wide variety of content. This is primarily because the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all types of media have been hurt by digitization because it makes it easy to copy and share content quickly without losing quality.

- Blockchain technology provides real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40% to 80%, depending upon the level of adoption and extension in the industry, thus making payment applications the leading segment amongst others. Another popular application, cryptocurrency, facilitates micropayments to content providers. Companies use it to enable customers to buy and play single songs or videos, for instance, or to purchase permission to read a news article.

- Further, pay-per-use consumption has become feasible due to blockchain-powered micropayments. Blockchain's ability to record its data comprehensively could allow for more accurate tracking of when and how copyrighted content is consumed.

- Many content providers are using technology to accept payments through cryptocurrency. For instance, in November this year, the Austin, Texas-based fintech business Oveit collaborated with the Swiss start-up Utrust to provide cryptocurrency payment services. They want to introduce a new payment mechanism to the entertainment industry so that event planners may more readily accept and use cryptocurrency payments and reach a larger market. The businesses will act as an intermediary for cryptocurrency payments made by up to 1 billion visitors globally to events, theme parks, and travel packages.

- In October of this year, BlueSnap, the preferred worldwide payment orchestration platform for major B2B and B2C companies, announced a new collaboration with BitPay, the prominent provider of Bitcoin and cryptocurrency payment services. This product partnership helps BlueSnap reach its goal of helping businesses around the world make more money and cut costs by letting them accept and be paid in up to 15 different cryptocurrencies and seven fiat currencies.

Blockchain in Media, Advertisement and Entertainment Industry Overview

The competitive landscape of the global blockchain in the media, advertising, and entertainment industries is moderately concentrated, as only a few players offer blockchain solutions, especially in the media and entertainment industries. The vendors have adopted different strategies, such as partnerships, collaborations, acquisitions, and new product launches, to expand their presence in the global market and increase their market share.

In October 2022, Binance, a major blockchain ecosystem and cryptocurrency infrastructure provider, announced signing a Memorandum of Understanding (MOU) to form a strategic cooperation with YG Entertainment Inc. (YG), one of South Korea's top global entertainment businesses. Binance and YG will work on various blockchain projects as part of their strategic cooperation, including projects in the NFT sector. Binance will provide the NFT platform and technological infrastructure, and YG will offer the NFT content and gaming assets. Additionally, the two businesses intend to create games based on the Binance Smart Chain, work together to establish the Metaverse, and actively explore other digital asset opportunities to create distinctive products and services for customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Subsequent Commoditization of Content and Widespread Piracy of Intellectual Property

- 5.1.2 The Increasing Need for Eliminating Intermediaries Between Content Creators and End-Users

- 5.1.3 The Growing Demand for Secure and Faster Transactions

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization

- 5.2.2 Expensive and Time Consuming Deployment

6 MARKET SEGMENTATION

- 6.1 By Type of Blockchain

- 6.1.1 Public

- 6.1.2 Private

- 6.2 By Size of the Enterprise

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Application

- 6.3.1 Licensing and Rights Management

- 6.3.2 Digital Advertising

- 6.3.3 Smart Contracts

- 6.3.4 Payments

- 6.3.5 Online Gaming

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Ernst & Young Global Limited

- 7.1.4 Bitfury Group Limited

- 7.1.5 SAP SE

- 7.1.6 Accenture

- 7.1.7 Amazon Web Services, Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Infosys Limited

- 7.1.10 Ujo Music