|

市场调查报告书

商品编码

1445454

行动保护壳 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Mobile Protective Cases - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

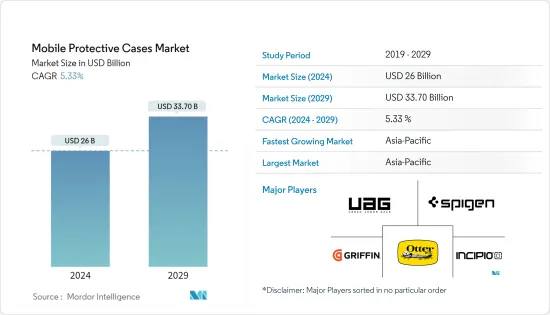

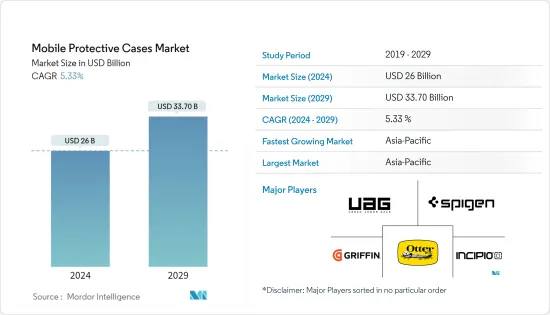

预计2024年行动保护套市场规模将达260亿美元,预计2029年将达到337亿美元,在预测期间(2024-2029年)CAGR为5.33%。

产品线在防震外壳等额外保护功能方面的创新预计将为未来的全球市场创造机会。年轻人对设计引人注目的手机壳和保护套的需求不断增长,是推动市场需求的关键因素。许多智慧型手机品牌都专注于具有高防护强度的设计功能,因为千禧世代更喜欢设计外壳。在中国、日本和印度等亚洲国家,订製箱子很流行。市场参与者正在根据消费者的需求推出案例。例如,2022 年 4 月,OtterBox 推出了适用于 iPad Air(第五代)的新保护壳。这些保护壳是作为 Symmetry Series 360 Elite 的一部分推出的。这些保护壳采用橙色和粉红色等春天风格的颜色製成。

智慧型手机平均售价大幅下降推动了市场的发展,这为消费者提供了不同价格范围内不同型号智慧型手机的更多选择。此外,由于手机製造商采用开源作业系统(OS),竞争对手正在降低价格以获取销售量。由于售价较低,影响了更多消费者购买手机,最终增加了保护套的销售量。此外,亚马逊、Flipkart、雅虎等线上网站也有多种手机壳可供选择,以及产品的折扣和优惠,这就是人们以便宜的价格购买材质优良的手机壳的原因。

手机保护套市场趋势

坚固的外壳见证重大需求

随着智慧型手机的日益普及,目前对能够帮助保护手机免受撞击和碰撞并防止萤幕破裂的坚固手机壳的需求越来越大。随着美国智慧型手机销售的增加,对手机保护的坚固保护壳的需求不断增加,尤其是iPhone用户,许多iPhone保护壳製造商提供了具有360度防御的坚固保护壳系列。其中一种保护壳可能包括气垫角、弹性塑胶外层以及透明的触控萤幕保护贴。例如,2022年11月,OtterBox首次推出iPhone防水壳,该产品属于Fre系列,是第一款产品。美国第一防水壳系列。 Fr 系列全方位覆盖您的手机,跟上您的每项活动,并能承受一路上的剧烈跌落。 Fr 系列具有防水、防摔、防尘、防污保护,让 iPhone 保持原始状态。它经过了两米(6.6 英尺)深的防水测试长达一小时,防跌落两米,并且完全密封,免受灰尘、污垢和雪的影响。

亚太地区市场可望显着成长

由于亚太地区行动装置用户群的不断增长以及智慧型手机和平板电脑的普及率大幅增长,行动保护壳市场为此类设备的製造商提供了巨大的机会。中国、印尼和印度等国家的智慧型手机采用率正在扩大,这与这些国家的网路普及率和社交网路的普及、可支配收入的增加和全球人口的成长有关。由于可支配收入的增加,消费者对高品质手机壳的需求不断增加。市场参与者正在该地区推出新的手机壳。 2022 年 6 月,CG Mobile Brand and Company 在印度推出了 iPhone、iPad 和 Macbook 保护壳。该公司获得了法拉利、梅赛德斯-奔驰、宝马、Mini Cooper、Guess、Karl Lagerfeld、Lacoste 和 US Polo Assn 等奢侈品牌的授权。

手机保护套产业概况

手机保护壳市场高度分散,成熟区域市场及新兴区域市场参与者众多,市场竞争激烈。该市场的主要参与者包括 Spigen Inc.、Urban Armor Gear、OtterBox、Incipio LLC 和 Griffin Technology。研究和开发也是智慧型手机产业竞争优势的重要来源。因此,主要参与者正大力投资研发活动,以满足客户需求。市场主要参与者致力于透过多元化的併购来增强自己的影响力并扩大市场份额。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 产品类别

- 黑盘箱

- 对开式案例

- 其他案例类型

- 类别

- 大量的

- 优质的

- 配销通路

- 网路零售

- 线下零售

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- Most Adapted Stratagies

- 市占率分析

- 公司简介

- Spigen Inc.

- Urban Armor Gear LLC

- OtterBox Holdings Inc.

- Incipio LLC

- Griffin Technology Inc.

- Reiko Wireless Inc.

- Moshi Group

- Belkin International Inc.

- Ringke Inc.

- Poetic Cases LLC

第 7 章:市场机会与未来趋势

The Mobile Protective Cases Market size is estimated at USD 26 billion in 2024, and is expected to reach USD 33.70 billion by 2029, growing at a CAGR of 5.33% during the forecast period (2024-2029).

Innovation in the product line in terms of extra protective features such as shockproof cases is anticipated to create an opportunity for the global market in the future. Rising demand from youth for mobile cases and covers with striking designs is a key factor fueling demand in the market. Many smartphone brands are focusing on design features with high protective strength as millennials are more attracted to design covers. In Asian countries like China, Japan, and India, customized cases are in vogue. The market players are launching cases according to consumer requirements. For instance, in April 2022, OtterBox launched new cases for the iPad Air (5th generation). The cases were introduced as part of the Symmetry Series 360 Elite.The cases were made of spring-inspired colors like orange and pink.

The market is being driven by a big drop in the average selling price of smartphones, which gives consumers more options in the form of different smartphone models in different price ranges. Furthermore, due to the adoption of an open-source operating system (OS) by mobile phone makers, competitors are reducing their prices to gain sales. With a low selling price, more customers are being influenced to purchase a phone, eventually increasing the sale of protective covers. Furthermore, online websites like Amazon, Flipkart, Yahoo, and many other shopping sites also have multiple options for mobile cases, as well as discounts and offers on the products, which is why people are buying the cases at cheap prices with good quality material.

Mobile Phone Protective Cover Market Trends

Rugged Case to Witness a Significant Demand

With the increasing adoption of smartphones, rugged phone cases that can help protect the handset from knocks and bumps and also prevent a cracked screen are currently in higher demand. With the increase in sales of smartphones in the United States, the demand for rugged cases for mobile protection is increasing, especially for iPhone users, and many iPhone case manufacturers offer a rugged case series with 360 degrees of defense. One of these cases may include air-cushioned corners, resilient outer layers of plastic, and a clear, touch-sensitive screen protector. For instance, in November 2022, OtterBox launched waterproof cases for the iPhone for the first time, which are from the Fre Series, the no. 1 waterproof case series in the United States. The Fr Series covers your phone on all sides, keeps up with every activity, and survives hard falls along the way. The Fr Series has waterproof, drop-proof, dust-proof, and dirt-proof protection to keep iPhones in pristine condition. It is water-tested to two meters (6.6 feet) for up to an hour, drop-proof to two meters, and completely sealed from dust, dirt, and snow.

Asia-Pacific Poised for a Significant Market Growth

Due to an ever-increasing mobile device user base and a substantial growth in the adoption of smartphones and tablets in the Asia-Pacific region, the mobile protective case market offers a huge opportunity to the manufacturers of such devices. The rate of smartphone adoption is expanding across countries such as China, Indonesia, and India, and this is associated with increasing internet penetration and the popularity of social networking in these countries, along with increasing disposable income and the growing global population. Due to rising disposable income, consumer demand for high-quality mobile cases is increasing. The market players are launching new mobile cases across the region. In June 2022, CG Mobile Brand and Company launched cases for iPhones, iPads, and Macbooks in India. The company is licensed for luxury brands like Ferrari, Mercedes-Benz, BMW, Mini Cooper, Guess, Karl Lagerfeld, Lacoste, and the U.S. Polo Assn.

Mobile Phone Protective Cover Industry Overview

The mobile protective case market is highly fragmented in nature, and there are a large number of players present in mature and emerging regional markets, which shows intense rivalry in the market. Key players in the market include Spigen Inc., Urban Armor Gear, OtterBox, Incipio LLC, and Griffin Technology. Research and development are also critical sources of competitive advantage in the smartphone industry. Therefore, key players are investing heavily in R&D activities to meet customer demand. Major players in the market are focused on enhancing their presence and expanding their market share through diverse mergers and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Black Plate Cases

- 5.1.2 Folio Cases

- 5.1.3 Other Case Types

- 5.2 Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 Distribution Channel

- 5.3.1 Online Retail

- 5.3.2 Offline Retail

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adapted Stratagies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Spigen Inc.

- 6.3.2 Urban Armor Gear LLC

- 6.3.3 OtterBox Holdings Inc.

- 6.3.4 Incipio LLC

- 6.3.5 Griffin Technology Inc.

- 6.3.6 Reiko Wireless Inc.

- 6.3.7 Moshi Group

- 6.3.8 Belkin International Inc.

- 6.3.9 Ringke Inc.

- 6.3.10 Poetic Cases LLC