|

市场调查报告书

商品编码

1445463

物联网专业服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029)IoT Professional Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

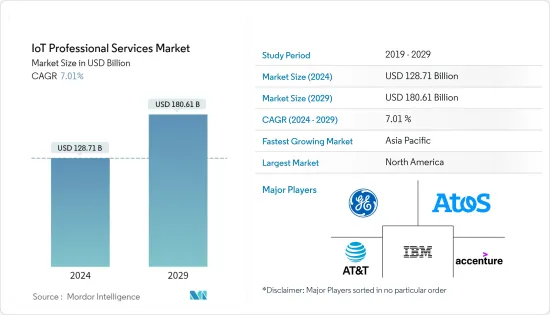

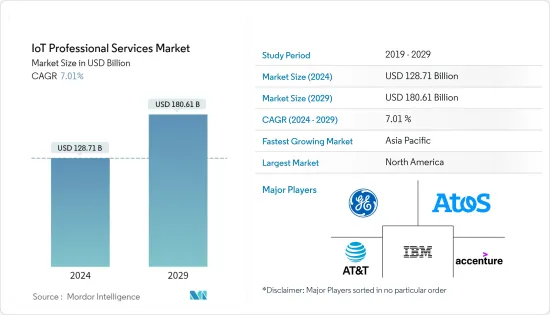

物联网专业服务市场规模预计到2024年为1,287.1亿美元,预计到2029年将达到1,806.1亿美元,在预测期内(2024-2029年)成长7.01%,复合年增长率成长。

主要亮点

- 智慧城市计画预计将在未来几年推动物联网的成长。作为交通、公共和基础设施的一部分,物联网设备和系统预计将增加。政府措施预计将提高物联网设备的采用率,更多组织依赖专业服务进行部署和进一步管理。

- 例如,欧盟指令要求所有欧盟成员国在 2020 年为 80% 的消费者部署智慧电錶。这些发展促使各国越来越多地采用智慧计量解决方案。例如,根据商业、能源和工业战略部的数据,截至 2021 年第三季末,英国各地的家庭和小型企业中有 2,640 万个智慧和先进电錶在运作,其中 2,160 个电錶据说有 10,000 个单位在智能模式下运作。这一因素显示对物联网设备部署服务的依赖程度增加。

- 各国政府的全球互联努力正在提高物联网的采用率。例如,「地平线2020」是欧盟最重要的研究和创新计画之一,2014年至2020年间资助了800亿欧元,对欧洲技术发展产生了重大影响。 e-sim计划推出的一部分包括开发与 Sigfox、LoRa、NB-IoT 和 LTE-M 等技术的互通性。政府措施将对物联网市场产生正面影响,创造对专业服务的辅助需求。

- 5G的出现预计将显着增加消费和工业领域的物联网数量,为物联网专业服务创造新的成长途径。爱立信预计,2020年5G设备数量将达到1.6亿台。到2025年,5G用户数预计将达到26亿,覆盖高达65%的人口,产生全球45%的行动资料流量。

- 增加多个设备(例如物联网)会增加网路的表面积,并在此过程中建立更多潜在的攻击向量。即使连接到网路的单一不安全设备也可以充当网路主动攻击的入口点。因此,随着公司努力赢得客户信任并加强其安全产品以防止洩露,资料安全问题已成为一项重大挑战。

- COVID-19 的传播扰乱了全球供应链和电子产品需求。因此,到2020年,物联网市场的硬体采用受到严重影响,直接影响与物联网设备安装相关的部署服务的需求。 2020年2月至3月,由于中国等国家停产,电子产业出现电子产品供不应求。

物联网专业服务市场趋势

全球连网型设备的激增推动市场成长

- 连接设备的激增产生了大量资料。物联网专业服务提供者帮助组织管理其资料,包括资料收集、储存、处理和分析。这些将帮助您制定资料分析策略并实施工具和技术,以从物联网产生的资料中获得可行的见解。组织可以利用高阶分析来做出明智的决策、优化流程并推动创新。

- 工业领域采用连网型设备的成长趋势正在对所研究的市场产生正面影响。爱立信表示,大规模物联网连线数量预计将增加一倍,达到近2亿个联络人。据同一资讯来源称,到年终,40% 的蜂巢式物联网连接将是宽频物联网,其中大部分是 4G 连线。然而,随着在新旧频谱中引入 5G 新无线电 (NR),该领域的吞吐量资料速率预计将显着增加。

- 新的应用程式、经营模式和不断下降的设备成本正在推动物联网的采用,从而导致全球连网设备和端点数量的增加。大规模物联网技术NB-IoT和Cat-M1持续在全球部署。大规模物联网技术预计将占所有蜂巢式物联网联网连接的 51%,超过宽频物联网蜂窝连接。

- 连网型设备的普及并不局限于任何特定行业,而是扩展到各个行业,包括製造、医疗保健、交通、能源和农业。每个行业对物联网都有独特的要求和用例。具有特定产业知识的物联网专业服务提供者可以提供客製化解决方案,以应对每个行业独特的挑战和机会。他们了解特定产业物联网实施的复杂性,并可提供专家指导和支援。例如,根据GSMA行动报告2022,2021年物联网连接总数约为151亿,预计2025年将达到233亿。如此显着的成长率,各产业对物联网专业服务的需求将非常巨大。从而推动市场成长。

- 而且,在工业领域,它的引入在各个行业都很广泛。例如,据 Aruba Networks 称,物联网设备正变得越来越普及,预计 85% 的企业已部署该技术。

- 总体而言,连网型设备的激增带来了复杂性、整合挑战、可扩展性挑战、安全性问题和资料管理要求,从而推动了对物联网专业服务的需求。物联网专业服务提供者在帮助组织应对这些复杂性并最大限度地提高物联网投资价值方面发挥关键作用。

预计北美将占据最大的市场占有率

- 由于 AT&T、IBM 和通用电气等通讯业知名企业的存在,北美地区预计将占据重要的市场占有率,这些企业预计将跟上技术进步的步伐并建立其基础设施。不断投资于我们产品的开发和进步。预计这将在预测期内推动物联网专业服务的采用。

- 快速、安全的 5G 连线预计将加速物联网设备的采用,从而实现敏捷营运和灵活生产。该技术促进自动化组装、仓储、互联物流、包装、产品处理和自动推车。此外,北美产业对物联网和数位解决方案的认知度非常高。 Mendix 最近的一项研究显示,78% 的美国製造业员工欢迎数位化。此外,十分之八的製造员工有兴趣学习新的数位技能。

- 此外,随着智慧电网计画接管该国整个能源产业,物联网电力公司预计将在预测期内获得发展势头。例如,专门从事智慧电錶部署的 Landis+Gyr 和用于物联网的思科 Catalyst 路由器可协助企业管理电网并收集和理解大量资料。最新的 5G 工业路由器为公用事业公司提供支援未来 15 至 20 年端点生命週期的服务。

- 物联网设备的普及,加上税收优惠和住宅保险折扣,正在推动消费者和公共公司使其服务聪明化并适合新时代的住宅建筑商和业主。我们鼓励您在不断发展的市场中保持竞争力。能源效率研究所记录,到年终,美国将安装约1.24亿个智慧电錶,比2007年增加1.17亿个。随着智慧电錶安装量的增加,物联网服务的采用可能会在预测期内显着增加。

- 根据 CDW 加拿大的研究,几乎所有 (96%) 加拿大组织都专注于物联网和新技术,但超过三分之一 (37%) 尚未实施。人工智慧、物联网和ServiceNow等业务流程转型工具是投资最多的前三项新技术(分别为60%、59%和58%)。随着商业和工业中数位化和连网型设备的使用不断增加,该地区的物联网应用和销售预计将增加。随着公司转向数位化和基于物联网的产品,实施和咨询等专业服务将会增加。

物联网专业服务概览

由于各种全球和本地公司的存在,物联网专业服务市场中竞争公司之间的敌对关係仍然很激烈。着名公司包括 IBM 公司、通用电气公司、AT&T 公司和 GE。透过策略合作伙伴关係、併购和收购,市场上的公司正在积极扩大影响力。

2023年4月,瑞典通讯设备製造商爱立信完成了将其物联网加速器(IoT-A)和连网汽车云端(CVC)业务转让给着名物联网解决方案供应商Aeris。两家公司相信,这些综合能力将使世界能够以新的规模、可靠性和安全性部署和管理物联网专案。

2023年1月,总部位于英国曼彻斯特的物联网软体工程服务供应商Mobica同意被美国着名IT服务公司Cognizant收购。 Mobica 的服务涵盖整个软体开发生命週期,重点关注客户的策略性内部研发倡议以及开发、实施、测试和部署嵌入式内建软体的核心专业知识。此次收购显着扩展了 Cognizant 的物联网内建软体工程能力,并为客户提供更广泛的端到端支持,以加速其数位转型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 监管状况

- 物联网生态系统

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 世界各地的连网型设备正在迅速增加

- 企业对物联网数位转型的需求不断增长

- 市场限制因素

- 资料隐私和安全问题

- 缺乏物联网部署的标准化通讯协定和框架

- 提供物联网专业服务

- 物联网咨询

- 实施服务

- 管理服务

- 大型企业和小型企业物联网咨询和实施的趋势

第六章市场区隔

- 按服务类型

- 物联网咨询

- 物联网基础设施

- 系统设计与集成

- 支援与维护

- 教育和培训

- 按组织规模

- 中小企业 (SME)

- 大公司

- 依部署类型

- 云端基础

- 本地

- 按最终用户产业

- 製造业

- 零售

- 卫生保健

- 能源和公共

- 运输和物流

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- General Electric Company

- AT&T Inc.

- Atos SE

- Accenture PLC

- Oracle Corporation

- Cognizant Technology Solutions Corporation

- Capgemini SE

- DXC Technology Company

- Tata Consultancy Services Limited

- Virtusa Corporation

- Wipro Technologies

第八章投资分析

第九章市场机会与未来趋势

The IoT Professional Services Market size is estimated at USD 128.71 billion in 2024, and is expected to reach USD 180.61 billion by 2029, growing at a CAGR of 7.01% during the forecast period (2024-2029).

Key Highlights

- Smart city initiatives are expected to spearhead IoT growth over the coming years. IoT devices and systems are expected to increase as part of transportation, utilities, and infrastructure. Government initiatives are expected to boost the adoption rates of IoT devices, leading to more organizations relying on professional services for deployment and further management.

- For instance, the European Union's directive required all EU member states to roll out smart electricity meters to 80% of consumers by 2020. Due to such developments, countries are increasingly adopting smart metering solutions. For instance, according to the Department for Business, Energy & Industrial Strategy, at the end of Q3 2021, 26.4 million smart and advanced meters were operating in homes and small businesses across Great Britain, with 21.6 million of all meters operating in smart mode. This factor indicates the increasing dependency on deployment services for IoT devices.

- Global connectivity initiatives by various governments are pushing the adoption rates of IoT. For instance, Horizon 2020, one of the most significant EU research and innovation programs, with EUR 80 billion in funding between 2014 and 2020, significantly impacted technological developments in Europe. As part of the project launch of e-sim, developing interoperability with technologies such as Sigfox, LoRa, NB-IoT, and LTE-M was undertaken. Government initiatives positively influence the IoT market, creating an ancillary demand for professional services.

- With the advent of 5G, the global number of IoT in consumer and industrial space is expected to increase significantly, creating new avenues of growth for IoT professional services. According to Ericsson, in 2020, the 5G device volumes are expected to reach 160 million. By 2025, the 5G subscription base will reach 2.6 billion and cover up to 65% of the population, generating 45% of global mobile data traffic.

- Adding several devices, like IoT, increases the surface area of a network, thereby creating more potential attack vectors in the process. Even a single unsecured device connected to a network may serve as a point of entry for an active attack on the web. Data security concern has, thus, presented themselves as a significant challenge as players navigate to strengthen their security offering to gain customer confidence and prevent breaches.

- During the COVID-19 outbreak, the global supply chain and demand for electronics were disrupted. Thus, the IoT market's hardware adoption was severely influenced by 2020, directly impacting the demand for deployment services connected to the installation of IoT devices. Due to the production shutdown in countries like China, the electronics industry observed a shortage of electronics supply during February and March of 2020.

IoT Professional Services Market Trends

The Proliferation of Connected Devices across the World to Drive the Market Growth

- The proliferation of connected devices generates massive amounts of data. IoT professional services providers help organizations manage data, including data collection, storage, processing, and analysis. They assist in developing data analytics strategies and implementing tools and technologies to derive actionable insights from IoT-generated data. Organizations can make informed decisions, optimize processes, and drive innovation by leveraging advanced analytics.

- The growing trend of adopting connected devices in the industrial sectors positively influences the market studied. According to Ericsson, the number of massive IoT connections is expected to have doubled, reaching nearly 200 million contacts. According to the same source, by the end of 2027, 40% of cellular IoT connections will be broadband IoT, with 4G connecting the majority. However, with the introduction of 5G New Radio (NR) in the old and new spectrum, this segment's throughput data rates are expected to increase substantially.

- Emerging applications, business models, and falling device costs have been instrumental in driving IoT adoption, consequently increasing the number of connected devices and endpoints globally. The massive IoT technologies NB-IoT and Cat-M1 continue to be rolled out globally. The massive IoT technologies are anticipated to comprise 51% of all cellular IoT connections overtaking broadband IoT cellular connections.

- The proliferation of connected devices is not limited to a specific industry but spans various sectors, including manufacturing, healthcare, transportation, energy, and agriculture. Each industry has unique requirements and uses cases for IoT. IoT professional services providers with industry-specific expertise can offer tailored solutions to address each sector's specific challenges and opportunities. They understand the intricacies of industry-specific IoT implementations and can provide specialized guidance and support. For instance, as per GSMA Mobility Report 2022, the total number of IoT connections in 2021 was recorded at around 15.1 billion, and these connections are anticipated to reach 23.3 billion by 2025. Such significant growth rates would considerably necessitate IoT professional services across various industries, thereby driving the market growth.

- Moreover, in the industrial sector, the adoption has penetrated across industries. For instance, according to Aruba Networks, IoT devices have become increasingly pervasive, with 85% of businesses expected to have implemented the technology.

- Overall, the proliferation of connected devices fuels the demand for IoT professional services by introducing complexity, integration challenges, scalability needs, security concerns, and data management requirements. IoT professional services providers play a critical role in helping organizations navigate these complexities and maximize the value of their IoT investments.

North America is Expected to Hold the Largest Market Share

- The North America region is expected to hold significant market shares owing to the presence of prominent players in the telecom industry, such as AT&T, IBM, and General Electric, which continuously invest in building up and advancing their infrastructure to keep pace with technological advancements. This is expected to boost the adoption of IoT professional services over the forecast period.

- Fast and secure 5G connectivity is expected to accelerate the adoption of IoT devices, allowing agile operations and flexible production. This technology will facilitate automated assembly, warehouses, connected logistics, packing, product handling, and autonomous carts. Moreover, North America's awareness of IoT and digital solutions in industries is significantly higher. According to a recent study by Mendix, 78% of US manufacturing workers welcome digitalization. In addition, eight in 10 manufacturing workers are interested in learning new digital skills.

- Additionally, with smart grids planning to take over the entire energy industry in the country, IoT utilities are expected to gain traction over the forecast period. For instance, Landis+Gyr, which specializes in smart meter deployments, and Cisco's Catalyst routers for IoT are helping companies manage their grids and collect and make sense of large volumes of data. The latest 5G industrial routers will give utilities an offering to support the next 15-20 years of an endpoint's life.

- The popularity of IoT devices, combined with tax incentives and home insurance discounts, has encouraged consumers and utility companies to make their services intelligent and suitable for the new age of home builders and owners and remain competitive in such an evolving market. According to the Institute for Electric Efficiency, by the end of 2022, around 124 million smart meters were recorded to be installed in the United States, an increase of 117 million units compared to 2007. With the increasing installation of smart meters, the tendency for IoT services adoption might increase significantly during the forecast period.

- Nearly all (96%) Canadian organizations value IoT and new technologies, according to a CDW Canada survey, yet more than one-third (37%) are not implementing them. Artificial intelligence, the Internet of Things, and business process transformation tools like ServiceNow were the top three most heavily invested new technologies (60 percent, 59 percent, and 58 percent, respectively). With the growing digitalization and usage of connected devices in business and industry, IoT applications and sales are anticipated to increase in the region. As the company moves toward digitalization and IoT-based products, professional services such as deployment and consulting will increase.

IoT Professional Services Industry Overview

The competitive rivalry in the IoT professional services market remains high due to the presence of various global and local players. A few of the prominent players include IBM Corporation, General Electric Company, AT&T Inc., and GE. Through strategic partnerships, mergers, and acquisitions, the players in the market are actively gaining a more substantial footprint.

In April 2023, Ericsson, a Swedish telecom equipment manufacturer, finished transferring its IoT Accelerator (IoT-A) and Connected Vehicle Cloud (CVC) operations to Aeris, a prominent IoT solution provider. The firms believe that the combined capabilities allow for the global deployment and management of IoT programs at a new level of scale, reliability, and security.

In January 2023, Mobica, a provider of IoT software engineering services with its headquarters in Manchester, United Kingdom, agreed to be acquired by Cognizant, a prominent American IT services firm. Mobica's services include the whole software development life cycle, focusing on clients' strategic internal research and development initiatives and core expertise in embedded software development, implementation, testing, and deployment. This acquisition considerably broadens Cognizant's IoT-embedded software engineering capabilities and offers clients a broader range of end-to-end support to facilitate digital transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Regulatory Landscape

- 4.4 IoT Ecosystem (Coverage on Pure, Dual, and Triple Play Vendor Landscape across Service Providers for IoT Development Services, IoT Edge Technologies, IoT Cloud Backend-as-a-service, and IoT Telco Stacks)

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Connected Devices Across the Globe

- 5.1.2 Increasing Demand for IoT-enabled Digital Transformation of Enterprises

- 5.2 Market Restraints

- 5.2.1 Concerns Associated With Data Privacy And Security

- 5.2.2 Lack of Standardized Protocols and Frameworks for IoT Deployments

- 5.3 IoT Professional Service Offerings (Qualitative Information Covering What Each Service Entails, Trends Across Industries, and Strategic Developments by Service Providers)

- 5.3.1 IoT Consulting

- 5.3.2 Deployment Services

- 5.3.3 Managed Services

- 5.4 Trend across Large Enterprise and SMEs vis-a-vis IoT Consulting and Implementation

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 IoT Consulting

- 6.1.2 IoT Infrastructure

- 6.1.3 System Designing and Integration

- 6.1.4 Support and Maintenance

- 6.1.5 Education and Training

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By Deployment Type

- 6.3.1 Cloud-based

- 6.3.2 On-premises

- 6.4 By End-user Industry

- 6.4.1 Manufacturing

- 6.4.2 Retail

- 6.4.3 Healthcare

- 6.4.4 Energy and Utilities

- 6.4.5 Transportation and Logistics

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 General Electric Company

- 7.1.3 AT&T Inc.

- 7.1.4 Atos SE

- 7.1.5 Accenture PLC

- 7.1.6 Oracle Corporation

- 7.1.7 Cognizant Technology Solutions Corporation

- 7.1.8 Capgemini SE

- 7.1.9 DXC Technology Company

- 7.1.10 Tata Consultancy Services Limited

- 7.1.11 Virtusa Corporation

- 7.1.12 Wipro Technologies