|

市场调查报告书

商品编码

1445472

法律分析 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Legal Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

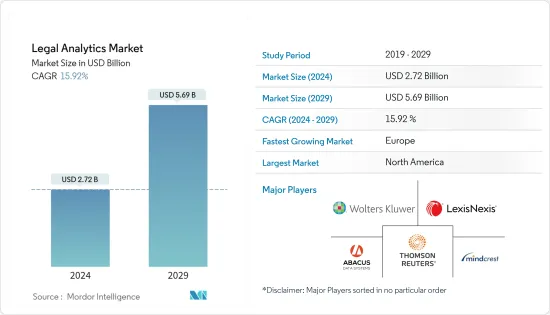

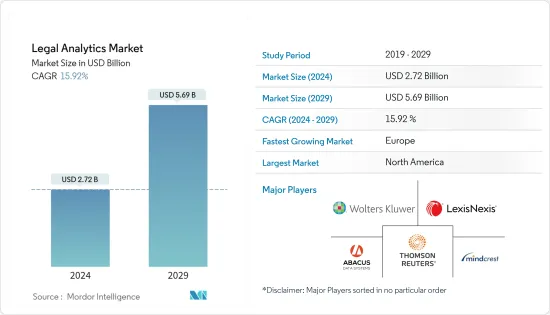

法律分析市场规模预计到 2024 年为 27.2 亿美元,预计到 2029 年将达到 56.9 亿美元,在预测期内(2024-2029 年)CAGR为 15.92%。

法律分析帮助律师分析长期收集的资料,为他们提供竞争优势的见解。人工智慧 (AI) 和机器学习彻底改变并简化了法律数位化流程。法律顾问可以使用分析工具来编译和分析大量资料,例如法庭记录、历史审判资料以及他们自己收集的信息,从而节省大量建设性时间,提高工作效率,提高执业效率和利润。

主要亮点

- 2022 年 6 月 - 法律咨询提供者 Consilio 宣布在印度的扩张计划,开设新设施。该策略显着扩大了法律专业人士的人才库,其中印度的员工人数增加了 70%。目前,Consilio 的所有营运职能部门拥有近 800 名员工,预计未来三年在印度的员工数量将增加至 2,000 人。

- 在 Covid-19 大流行期间最初放缓之后,法律行业继续保持发展势头。法律产业创纪录的营业额恰逢破产和併购活动激增,以及与疫情后经济影响相关的法律服务需求不断增加。

- 资料外洩是法律分析发展的主要障碍。有些客户只有在安全等级极高的情况下才愿意使用法律分析功能。

法律分析市场趋势

合约管理提供潜在成长

- 合约管理中人工智慧的采用正在创造对法律分析的需求。根据 World Commerce & Contracting 的预测,虽然基于人工的分析准确率接近 92%,但用于向受影响人员传播的基于人工智慧的合约解释和摘要的准确率高达 98%。根据德勤报告,公司透过采用智慧合约分析将合约管理成本降低了 60%。如果使用分析应用程序,合约评估的人工干预将减少 50%。

- 2022 年 10 月 - 总部位于纽约的律师事务所 Shearman & Sterling 推出了名为“Legal Operations by Shearman”的分析计划。该平台将提供资料分析、内部部门设计和法律技术援助等服务。还将引导业务支援人员创造额外收入,这些人员通常不收取费用,但拥有可以直接使客户受益的极其重要的知识。

- 法律顾问公司 Consilio 开发了一个名为 Talent Connect 的新门户,该门户将有助于为 Consilio 客户、公司法律部门和各种规模的律师事务所提供灵活的人才工作机会。 Consilio 的企业人才解决方案团队每天有超过 1,000 名律师积极与客户合作,每年安排超过 7,000 个法律和非法律职位。电子取证、文件审查、风险管理和法律咨询服务也将透过此入口网站提供。

预计欧洲市场将显着成长

- 欧洲客户选择律师事务所,因为他们认为律师事务所是一流的合作伙伴,可以根据客户的要求展示专业知识和技术适用性。 2022 年,贝克麦坚时连续第四年位居榜首,客户称讚该公司在该领域的实力及其将客户与世界其他地区联繫起来的能力。

- 英国的组织对仲裁作为一种争议解决方法表现出越来越大的兴趣。英国司法机构选择了一种通常被视为「仲裁友善」的非干预方法。一些世界上最大的律师事务所的总部设在该国。根据英国国家统计局 (ONS) 公布的资料,2022 年 3 月英国法律行业的总营业额为 43 亿美元。

- 根据 TheCityUK 关于英国法律服务的年度报告,该行业的收入在 2021-2022 年增长了 12.5%,达到 436 亿美元。法律部门共有37万名员工,其中三分之二在伦敦工作。

- 欧盟政策制定者提出了欧洲司法合作数位化的提案。已製定法规强制要求使用数位通讯手段。由法律分析等技术资源支持的法律指南以及法律专业人员的培训将为欧盟建立更加一体化、持久和安全的电子司法系统铺平道路。

法律分析产业概述

法律分析市场竞争适中,新创公司正试图利用最新技术颠覆法律产业。然而,该市场由 LexisNexis Group Inc.、AbacusNext、Wipro Group 等全球企业主导。这些企业在激烈竞争中生存的主要成长策略包括产品发布、大量研发投资、合作和收购。

- 2023 年 1 月 - Legal IT Insider 平台 Kim 为企业法律团队推出了预先包装解决方案,可快速实现工作环境核心流程的自动化,从分流到培训外部法律顾问,无需任何技术援助。企业法务团队可以存取文件自动化平台,下载所需的模板,30分钟内即可完成流程。

- 2022 年 6 月 - 印度科技新创公司 Legalkart 透过提供音讯和视讯法律咨询迈向数位化。律师可以在这个单一平台上处理所有案件、客户、团队和财务。论坛上的其他服务包括财产验证、线上文件验证和法律咨询。据该新创公司称,印度有超过 10,000 名註册律师,遍布近 900 个城市、地区和地区。

- 2022 年 4 月 - 法律与监管公司 Wolters Kluwer 与 Microsoft 合作,采用人工智慧驱动的法律研究方法。他们为德国客户开发了一个在 MS Word 中工作的原型。律师将从多个资料来源获得相关的高品质内容,而无需离开其常规工作流程。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 技术简介

- 按业务领域

- 资本市场与公司治理

- 金融文件服务

- 智慧财产管理

- 个案管理

- 併购与环境法

- 其他地区

第 5 章:市场动态

- 市场驱动因素

- 数据驱动决策的法律分析自动化需求不断增长

- 提高律师事务所的生产力和收入

- 市场挑战

- 诉讼律师和法学院缺乏意识

第 6 章:市场细分

- 工具

- 预测性

- 描述性的

- 部署方式

- 云

- 本地部署

- 产业

- 律师事务所

- 法人企业

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- Wolters Kluwer NV

- Thomson Reuters Corporation

- Mindcrest Inc.

- Lexisnexis ( RELX plc )

- Abacus Data Systems

- Everlaw Inc.

- Proofpoint Inc.

- CS Disco Inc.

- Brainspace Corporation

- IBM Corporation

- Wipro Technologies

- UnitedLex Corporation

- Argopoint LLC

- Premonition LLC

- Analytics Consulting LLC

- CPA Global

第 8 章:投资分析

第 9 章:市场的未来

The Legal Analytics Market size is estimated at USD 2.72 billion in 2024, and is expected to reach USD 5.69 billion by 2029, growing at a CAGR of 15.92% during the forecast period (2024-2029).

Legal Analytics helps lawyers analyze data collected over a long period, giving them insights for a competitive advantage. Artificial Intelligence (AI) and machine learning revolutionized and streamlined the process of Legal digitalization. Legal consultants can use analytics tools to compile and analyze massive amounts of data, like court records, historical trial data, and their own collected information, thereby saving a lot of constructive time and making them more productive and their practice more efficient and profitable.

Key Highlights

- June 2022 - Consilio, a provider of legal consulting, announced its expansion plans in India with the opening of new facilities. This strategy has significantly expanded the talent pool for legal professionals, including a 70% headcount increase in India. Currently employing almost 800 individuals across all Consilio operational functions, the company anticipates expansion to 2,000 people in India over the next three years.

- The Legal Industry kept its stride after the initial slowdown during the Covid-19 pandemic. The record turnovers in the legal sector coincide with a surge in bankruptcies and M&A activity and a rising need for legal services related to the economic effects post-pandemic.

- Data breaching is the main hurdle in the growth of Legal Analytics. Some clients are only willing to use legal analytics capabilities if it has an extremely high level of security.

Legal Analytics Market Trends

Contract Management Offers Potential Growth

- Adoptation of AI in Contract Mangement is creating the demand for Legal Analytics. While human-based analysis is nearly 92% accurate, AI-based contract interpretation and summary for dissemination to affected personnel have 98% accuracy, as predicted by World Commerce&Contracting. According to Deloitte report , companies cut their contract management costs by 60% by adopting intelligent contract analytics. The manual intervention for contract evaluation will be reduced by 50%, if analytics applications are used.

- October 2022 - New York based law firm, Shearman & Sterling, launched analytics program called "Legal Operations by Shearman''.Services, such as data analytics, in-house department design, and legal technology assistance will be available on this platform. It will also guide towards generating additional revenue from business support personnel who do not typically earn a fee but instead possess extremely important knowledge that can benefit the clients directly.

- Consilio, a legal consulting, developed a new portal called Talent Connect, that will help provide flexible talent job opportunities serving Consilio clients, corporate law departments and law firms of all sizes. Consilio's Enterprise Talent Solutions team has over 1,000 attorneys actively engaged by clients each day and places over 7,000 legal and non-legal positions annually. eDiscovery, document review, risk management, and legal consulting services will also be available through this portal.

Europe is Expected to Witness the Significant Growth in the Market

- European clients choose legal firms, that they see as best-in-class partners who can demonstrate the expertise and technical applicability as per client requirement. In 2022 , Baker McKenzie took the top rank for the fourth year in a row, as clients cited the firm's strength in the area and its capacity to connect them with the rest of the world.

- Organizations in the UK are showing increasing interest in arbitration as a dispute resolution method.The UK judiciary has chosen a non-interventionist approach that is typically seen as "arbitration-friendly." Some of the world's biggest law firms are headquartered in the country. The UK legal sector's total turnover stood at USD 4.3 billion in March 2022, according to data published by Office of National Statistics (ONS).

- According to TheCityUK annual report on the UK's legal services, revenues generated by the sector rose 12.5%, accointing for 43.6 billion USD in 2021-2022. With total 0.37 million employees in legal sector, two-thirds of them are working in London.

- Eeropean Union policy makers, presented a proposal for Digitalisation of Judicial Cooperation in Europe. Regulation have been formed making digital means of communication compulsory. Legal guidelines supported by technological resources like legal analytics, alongwith training of legal professionals will pave the way for a more integrated, long-lasting, and safe e-justice system in the EU.

Legal Analytics Industry Overview

The legal analytics market is moderately competitive, and startups are trying to disrupt the legal industry using the latest technology. However, the market is dominated by global players such as LexisNexis Group Inc., AbacusNext, Wipro Group, etc. These businesses' primary growth tactics to survive the fierce competition include product releases, substantial investment in research and development, collaborations, and acquisitions.

- January 2023 - Kim, the Legal IT Insider platform, launched pre-packaged solutions for corporate legal teams to quickly automate the core processes of their working environment from triage through training outside counsel without any technical assistance. Corporate legal teams can access the platform for document automation, download the desired template, and within 30 minutes, the procedure is done.

- June 2022 - India based technology startup, Legalkart, took to digitalization by offering audio and video legal consultations. Lawyers can handle all their cases, clients, teams, and finances on this single platform. The other services on the forum will be property verification, online document verification, and legal advice. According to the startup, over 10,000 registered lawyers are in India, across nearly 900 cities, districts, and regions.

- April 2022 - The legal and regulatory firm Wolters Kluwer teamed up with Microsoft to embrace AI-driven legal research methods. They have developed a prototype for German clients that work in MS Word. Lawyers will get pertinent, high-quality content from several data sources without having to leave their regular workflows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

- 4.5 Technology Snapshot

- 4.6 By Practice Areas

- 4.6.1 Capital Market and Corporate Governance

- 4.6.2 Financial Documentation Services

- 4.6.3 Intellectual Property Management

- 4.6.4 Case Management

- 4.6.5 M & A and Environmental Laws

- 4.6.6 Other Areas

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Automation in Legal Analytics for Data-Driven Decision Making

- 5.1.2 Increase in Productivity and Revenue of Law Firms

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness Among Litigators and Law Schools

6 MARKET SEGMENTATION

- 6.1 Tools

- 6.1.1 Predictive

- 6.1.2 Descriptive

- 6.2 Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 Industry

- 6.3.1 Legal Firms

- 6.3.2 Corporate Firms

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of the Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wolters Kluwer N.V.

- 7.1.2 Thomson Reuters Corporation

- 7.1.3 Mindcrest Inc.

- 7.1.4 Lexisnexis ( RELX plc )

- 7.1.5 Abacus Data Systems

- 7.1.6 Everlaw Inc.

- 7.1.7 Proofpoint Inc.

- 7.1.8 CS Disco Inc.

- 7.1.9 Brainspace Corporation

- 7.1.10 IBM Corporation

- 7.1.11 Wipro Technologies

- 7.1.12 UnitedLex Corporation

- 7.1.13 Argopoint LLC

- 7.1.14 Premonition LLC

- 7.1.15 Analytics Consulting LLC

- 7.1.16 CPA Global