|

市场调查报告书

商品编码

1445473

渗透测试 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Penetration Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

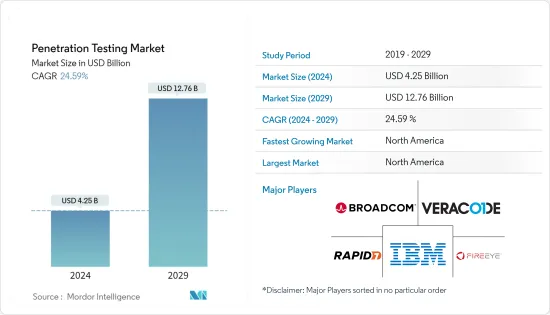

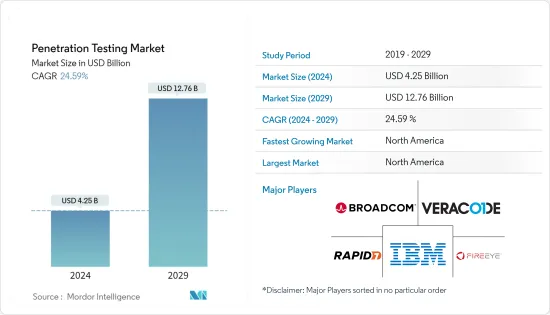

渗透测试市场规模预计到 2024 年为 42.5 亿美元,预计到 2029 年将达到 127.6 亿美元,在预测期内(2024-2029 年)CAGR为 24.59%。

主要亮点

- 网路攻击数量的增加,加上满足合规措施的需求不断增长,预计将成为预测期内全球渗透测试市场的成长动力。

- 对行动和网路应用程式等基于软体的财产保护的需求不断增长,预计将推动全球渗透测试市场的成长。此外,越来越多地使用基于云端的安全解决方案预计将刺激渗透测试的需求。预计这将促进全球渗透测试市场的成长。此外,发展中国家日益数位化预计将增加基于物联网(IoT)的连接设备的趋势。这反过来又推动了渗透测试的需求。

- 全球互联网活动的不断增长,加上安全要求的增加,正在推动预测期内全球渗透测试市场的成长。

- 此外,越来越多的无线网路和越来越多的连接设备也产生了对各个垂直行业渗透测试的需求。然而,在预测期内,各个发展中国家和不发达国家缺乏技术人员和意识,可能会限制渗透测试市场的成长。

- 此外,在 Covid-19 期间,由于工作场所和其他设施普遍关闭,世界各地的企业在营运方面面临挑战。随着人们越来越多地使用技术来保持联繫并有效地经营公司,网路攻击的危险正在增加,特别是在大流行期间。因此,对尖端数位网路的需求急剧增加。

- 由于在家工作 (WFH) 的趋势不断增长,员工正在使用需要充分安全的设备存取业务网路和资料,这暴露了可利用的弱点,容易遭受网路攻击。此外,由于越来越多地采用数位转型来满足客户在线购物日益增长的需求,许多公司创建并更新了当前基于网路和行动的应用程序,从而为网路攻击提供了可能性。许多部门采用混合工作方法可能会在短期内增加对漏洞测试的需求。

渗透测试市场趋势

政府和国防部对渗透测试的需求不断增长

- 政府及其机构有权存取和管理大量敏感的公民资讯。此外,随着数位时代的到来,政府利用线上入口网站和行动应用程式来增强政府程序和流程。例如,印度政府已经启动了一项名为「数位印度」的数位运动,旨在将所有政府流程和支付数位化。

- 基础设施发展正在成为政府的优先事项之一,包括部署公共 Wi-Fi 和互联公共交通。因此,政府组织需要保护网路及其应用程式的安全,以大规模保护公民资讯的完整性。这给敏感资料带来了更大的脆弱性。

- 此外,联邦政府还使用商业现货 (COTS) 等技术来为政府应用程式提供广泛的功能。由于这些解决方案是为商业目的而开发的,因此政府系统容易受到某些必须解决的独特风险的影响。

- 因此,为政府开发技术的软体供应商被迫透过合规措施和指令来确保静态和动态应用程式的安全,例如美国国家标准与技术研究所 (NIST) 风险管理框架 (RMF) 和国防部资讯部保证认证和认可流程(DoD DIACAP)。这些要求要求供应商保证其应用程式的测试服务和验证。上述因素预计将推动预测期内研究的市场的成长。

北美将持有主要份额

- 该地区是一个技术中心。因此,联邦政府对安全测试服务制定了严格的规定。此外,BFSI 等行业必须遵守合规性测试。

- 据国际电信联盟 (ITU) 称,北美是网路安全措施最积极、最坚定的地区。主要国家(美国 - 0.91 和加拿大 - 0.81)的 GCI 分数进一步强化了他们对建立强大的网路安全框架和增强的安全测试方法的承诺。该地区的企业期待安装渗透测试、安全性和漏洞管理解决方案,并拥有常规业务运营的最佳实践。

- 此外,由于在家工作 (WFH) 的趋势不断增长,员工正在使用不够安全的设备存取业务网路和资料,这暴露了可利用的弱点,容易遭受网路攻击。此外,由于越来越多地采用数位转型来满足客户在线购物日益增长的需求,许多北美公司已经创建并更新了其当前基于网路和行动的应用程序,从而为网路攻击提供了可能性。

- 预计该地区的公司将加倍投入必要的安全安排,例如防火墙分层防御、过滤 DNS、分段网路、安全客户端等。然而,员工意识和培训可能是为公司带来最高投资回报率的投资。

渗透测试产业概述

渗透测试市场竞争激烈,由几个主要参与者组成。就市场份额而言,目前很少有主要参与者占据市场主导地位。这些拥有显着市场份额的主要参与者正致力于扩大其在国外的客户群。这些公司正在利用策略创新和协作倡议来增加市场份额并提高获利能力。赛门铁克和 FireEye 等安全巨头多年来一直提供渗透测试,Bugcrowd 和 Synack 等其他漏洞赏金公司也进行众包渗透测试。

2022年5月,思科公司发布了网路安全评估工具,帮助亚太地区的中小企业(SMB)更了解其安全状况。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究成果

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素与限制简介

- 市场驱动因素

- 安全威胁日益增加

- 政府对资料安全的严格规定

- 政府和国防部对渗透测试的需求不断增长

- 市场限制

- 缺乏渗透测试意识

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 按类型

- 网路渗透测试

- Web应用程式渗透测试

- 行动应用渗透测试

- 社会工程渗透测试

- 无线网路渗透测试服务

- 其他类型

- 按部署

- 本地部署

- 云

- 按最终用户产业

- 政府和国防

- BFSI

- 资讯科技和电信

- 卫生保健

- 零售

- 地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 公司简介

- Synopsys Inc.

- Acunetix Ltd.

- Checkmarx Ltd.

- IBM Corporation

- Rapid7, Inc.

- FireEye Inc.

- VERACODE Inc,

- BreachLock Inc.

- Broadcom Inc. (Symantec Corporation)

- Clavax Technologies LLC

第 7 章:投资分析

第 8 章:市场机会与未来趋势

The Penetration Testing Market size is estimated at USD 4.25 billion in 2024, and is expected to reach USD 12.76 billion by 2029, growing at a CAGR of 24.59% during the forecast period (2024-2029).

Key Highlights

- The increasing number of cyber-attacks, coupled with the growing need to meet compliance measures, is anticipated to be a growth driver for the global penetration testing market during the forecast period.

- The increasing demand for the protection of software-based properties such as mobile and web applications is anticipated to boost the growth of the global penetration testing market. Additionally, the increasing use of cloud-based security solutions is expected to fuel the demand for penetration testing. This, in turn, is anticipated to foster the growth of the global penetration testing market. Moreover, the increasing digitization in developing countries is expected to increase the trend of Internet of Things (IoT)-based connected devices. This, in turn, drives the demand for penetration testing.

- The growing internet activities globally, coupled with the increased security compulsion, are driving the market growth of the global penetration testing market during the forecast period.

- Moreover, an increasing number of wireless networks and the growing number of connected devices are also generating demand for penetration testing across various industry verticals. However, the lack of skilled personnel and awareness in various developing and underdeveloped countries is likely to restrain the growth of the penetration testing market during the forecast period.

- Also, during Covid-19, businesses worldwide faced challenges in terms of carrying out operations due to the widespread closure of workplaces and other facilities. The danger of cyberattacks is growing as people use technology more and more to remain in touch and run their companies effectively, particularly during the pandemic. Due to this, the need for cutting-edge digital networks increased dramatically.

- Employees are accessing business networks and data using their devices that need to be adequately secure due to the growing trend of working from home (WFH), which exposes exploitable weaknesses to cyberattacks. Additionally, many companies have created and updated their current web- and mobile-based apps due to the increased adoption of digital transformation to meet the growing demand for customers to shop online, opening up possibilities for cyberattacks. The adoption of hybrid working methods by numerous sectors may increase the demand for vulnerability testing in the short term.

Penetration Testing Market Trends

Growing Requirement of Penetration Testing among Government and Defense

- The government and its agencies have the authority to access and manage large amounts of sensitive citizen information. Further, with the advent of the digital age, governments have leveraged online web portals and mobile applications to enhance government procedures and processes. For instance, the government of India has begun a digital movement, "Digital India," intending to digitize all government processes and payments.

- Infrastructure development is emerging as one of the priorities for governments, including deploying public Wi-Fi and connected public transport. As a result, there is a need for government organizations to secure the network and its applications to protect the integrity of citizen information on a large scale. This has created a greater vulnerability to sensitive data.

- Further, technologies, such as commercial off-the-shelf (COTS), are used by federal governments to enable broad functional capabilities for government applications. Since these solutions were developed for commercial purposes, government systems are vulnerable to certain unique risks that must be addressed.

- Thus, software vendors developing technology for the government have been pushed to ensure security for static and dynamic applications through compliance measures and mandates, such as the National Institute of Standards and Technology (NIST) risk management framework (RMF) and the Department of Defense Information Assurance Certification and Accreditation Process (DoD DIACAP). These mandates demand that vendors guarantee testing services and verification of their applications. The abovementioned factors are expected to propel the market's growth studied over the forecast period.

North America to Hold Major Share

- The region is a technology hub. Therefore, the Federal government has made stringent rules regarding security testing services. Moreover, it is made compulsory for industries like BFSI to adhere to compliance testing.

- According to International Telecommunication Union (ITU), North America is the most proactive and committed region regarding cyber security-based initiatives. The GCI score given to the major countries (United States - 0.91 and Canada - 0.81) further reinforces their commitment to building a robust cybersecurity framework and enhanced security testing methodologies. Businesses in the region look forward to installing penetration testing, security, and vulnerability management solutions and have the best practices for regular business operations.

- Moreover, employees are accessing business networks and data using their devices that are not adequately secure due to the growing trend of working from home (WFH), which exposes exploitable weaknesses to cyberattacks. Additionally, many North American companies have created and updated their current web- and mobile-based apps due to the increased adoption of digital transformation to meet the growing demand for customers to shop online, opening up possibilities for cyberattacks.

- Companies across the region are anticipated to double down on necessary security arrangements such as a layered defense with firewall, filtered DNS, segmented networks, security clients, etc. However, employee awareness and training might be the investment that brings the highest RoI for companies.

Penetration Testing Industry Overview

The penetration testing market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic innovations and collaborative initiatives to increase their market shares and increase their profitability. Security giants like Symantec and FireEye have offered pen testing for years, and other bug bounties players like Bugcrowd and Synack also conduct crowdsourced pen tests.

In May 2022, Cisco Inc. released a cybersecurity assessment tool to help small and medium-sized companies (SMBs) in the Asia Pacific area better understand their security posture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Security Threats

- 4.3.2 Stringent Government Regulations Regarding Data Security

- 4.3.3 Growing Requirement of Penetration Testing among Government and Defense

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness Regarding Penetration Testing

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Network Penetration Testing

- 5.1.2 Web Application Penetration Testing

- 5.1.3 Mobile Application Penetration Testing

- 5.1.4 Social Engineering Penetration Testing

- 5.1.5 Wireless Network Penetration Testing Services

- 5.1.6 Other Type

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Industry

- 5.3.1 Government and Defense

- 5.3.2 BFSI

- 5.3.3 IT and Telecom

- 5.3.4 Healthcare

- 5.3.5 Retail

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Synopsys Inc.

- 6.1.2 Acunetix Ltd.

- 6.1.3 Checkmarx Ltd.

- 6.1.4 IBM Corporation

- 6.1.5 Rapid7, Inc.

- 6.1.6 FireEye Inc.

- 6.1.7 VERACODE Inc,

- 6.1.8 BreachLock Inc.

- 6.1.9 Broadcom Inc. (Symantec Corporation)

- 6.1.10 Clavax Technologies LLC